As an experienced crypto day trader, I know firsthand how crucial timing can be in the ever-dynamic world of digital assets. The cryptocurrency market’s volatility presents both opportunities and challenges, and understanding the optimal time frames to execute your trades is key to maximizing your chances of success. In this comprehensive guide, I’ll share my insights and strategies to help you identify the most effective time frames for your day trading activities, answering the question what is the best time frame for crypto trading and empowering you to navigate the crypto landscape with greater confidence and profitability.

What is the Best Time Frame for Crypto Trading?

The cryptocurrency market operates 24/7, but not all hours are created equal for day traders. Different time frames, such as 1-minute, 5-minute, 15-minute, 1-hour, and 4-hour charts, reveal distinct market patterns and trends that can significantly impact your trading decisions.

A 1-minute chart, for instance, may showcase short-term fluctuations, while a 4-hour chart can uncover broader market movements. Recognizing the relationship between time frame and trading strategy is crucial for making informed choices and minimizing risk.

When selecting the right time frame for your crypto day trading, several factors come into play. Your personal trading style, risk tolerance, and the liquidity of the digital asset you’re targeting all play a role in determining the optimal time frame.

Scalpers, for example, may favor shorter time frames to capitalize on rapid price movements, while swing traders might prefer longer time frames to identify and ride broader trends. Finding the right balance between identifying trends and capturing short-term opportunities is key to your success.

Mastering Multi-Time Frame Analysis (MTFA)

One powerful tool I’ve leveraged in my crypto day trading journey is multi-time frame analysis (MTFA). By simultaneously examining multiple time frames, MTFA provides a comprehensive view of the market, enabling me to make more informed and reliable trading decisions.

The benefits of MTFA are numerous. First and foremost, it helps me identify the direction of the underlying trend with greater confidence. By confirming the trend across different time frames, MTFA reduces the risk of false signals and increases the reliability of my trading decisions.

MTFA also proves invaluable in finding suitable entry and exit points. By aligning the signals from various time frames, I can pinpoint the optimal moments to enter or exit a position, maximizing my chances of success.

Moreover, MTFA helps me manage risk more effectively. By filtering out noise and false signals, this approach allows me to focus on the most promising trading opportunities, minimizing the likelihood of costly mistakes.

To implement MTFA in my crypto day trading, I employ a variety of techniques, such as chart overlay, indicator comparison, and trend confirmation. By visually representing technical indicators and chart patterns across multiple time frames, I can identify the confluence of signals and confirm the overall market direction.

Comparing the readings of indicators, such as moving averages or the Relative Strength Index (RSI), across different time frames also provides valuable insights into the underlying market dynamics. Before entering a trade, I always use MTFA to validate the direction of the trend, ensuring that my entry aligns with the broader market sentiment.

Timing is Everything: The Best Hours for Crypto Day Trading

As I mentioned earlier, the cryptocurrency market operates 24/7, but there are certain hours that tend to be more favorable for day trading activities. Interestingly, the crypto market’s trading patterns often coincide with the opening and closing of the traditional stock market, the New York Stock Exchange (NYSE).

In my experience, the crypto market tends to experience increased trading activity and price movements during the hours when the stock market is open. As the NYSE opens in the morning, crypto prices often rise, driven by the influx of market participants. Conversely, when the stock market closes in the late afternoon, crypto prices often experience a dip due to a decline in trading volume.

The pre-market and post-market hours, when the stock market is closed but crypto trading continues, can also present opportunities for day traders like myself. These periods are generally characterized by lower liquidity and increased volatility, which can be capitalized on by skilled traders who are adept at managing risk.

Leveraging Ethereums Gas Fees for Optimal Timing

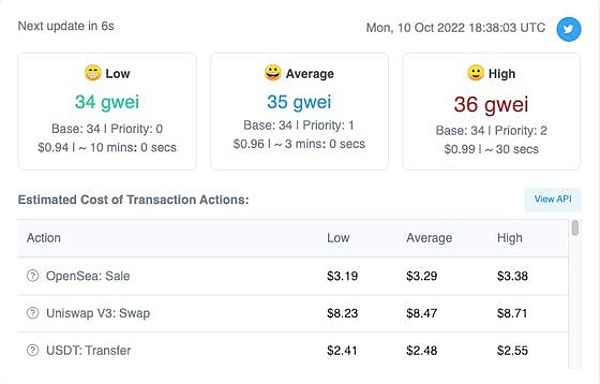

When it comes to day trading cryptocurrencies, Ethereum’s network fees, commonly known as “gas fees,” can have a significant impact on the timing of your trades. These fees fluctuate based on network congestion, and savvy traders like myself can use this information to our advantage.

Based on my observations, Ethereum gas fees tend to be lower during the late-night and early morning hours, as the network is less congested during these periods. Conversely, the fees spike during the hours when the U.S. stock market is open, as more traders are active on the Ethereum network.

By timing my trades to take advantage of lower gas fees, I can potentially save a significant amount on my transaction costs, especially for smaller portfolio sizes. This strategy has helped me maximize the profitability of my crypto day trading activities.

Additional Tips for Successful Crypto Day Trading

While identifying the right time frames and capitalizing on market patterns are crucial, there are several other factors I’ve incorporated into my day trading approach to enhance my success in the crypto market.

Risk Management

Effective risk management is paramount in the volatile cryptocurrency market. Implementing strategies such as stop-loss orders, position sizing, and diversification have been instrumental in mitigating the downside risks inherent in day trading.

Trading Psychology

The psychological aspects of day trading cannot be overlooked. Maintaining emotional discipline, avoiding impulsive decisions, and developing a well-structured trading plan have been essential for my long-term success in the crypto arena.

Technical Analysis

Mastering key technical indicators and chart patterns has provided valuable insights for my crypto day trading journey. Familiarizing myself with tools like moving averages, RSI, and trend lines has helped me identify high-probability trading opportunities.

Trading Tools and Resources

Leveraging the right trading platforms, charting software, and educational resources has significantly improved my day trading experience. Platforms that offer real-time market data, customizable charting, and advanced order execution have given me an edge in the crypto market.

FAQ

Q1: What is the best time frame for scalping crypto?

For scalping strategies in the crypto market, shorter time frames like 1-minute or 5-minute charts tend to be the most effective. These time frames allow scalpers to capitalize on rapid price movements and take advantage of small, frequent price fluctuations.

Q2: How do I know if I’m using the right time frame for my trading style?

The optimal time frame for your trading style depends on factors like your risk tolerance, market experience, and the specific cryptocurrency you’re trading. As a general guideline, aim for a ratio of 1:4 or 1:6 between your entry time frame and the trend identification time frame. For example, a 1-hour chart for entries and a 4-hour chart for identifying trends.

Q3: What are some common mistakes to avoid when using multi-time frame analysis?

One common mistake is relying too heavily on a single time frame and overlooking the broader market context. Another pitfall is overcomplicating your MTFA by incorporating too many time frames, which can lead to analysis paralysis. It’s best to start with two time frames and gradually expand to a maximum of three if necessary.

Q4: Are there any specific cryptocurrencies that are better suited for day trading than others?

The suitability of a cryptocurrency for day trading depends on factors like liquidity, volatility, and trading volume. Cryptocurrencies with higher market capitalization, such as Bitcoin, Ethereum, and Solana, tend to have more stable and liquid markets, making them generally more suitable for day trading activities.

Conclusion

In the dynamic world of cryptocurrency, finding the right time frame for your day trading activities can be the key to unlocking consistent profitability. By understanding the significance of time frames, leveraging the power of multi-time frame analysis, and capitalizing on the best hours for crypto trading, you can enhance your chances of success and navigate the volatile market with greater confidence.

Remember, day trading crypto is not without its risks, so always prioritize risk management, maintain emotional discipline, and continuously hone your technical analysis skills. With the right strategies and a well-informed approach, you can unlock the full potential of day trading in the crypto arena and achieve your financial goals.

If you’re ready to embark on your crypto day trading journey, I encourage you to put these insights into practice and stay up-to-date with the latest developments in the industry. By combining your dedication and my practical guidance, I’m confident you can become a successful crypto day trader in 2024 and beyond.