In the ever-evolving world of cryptocurrency, seasoned traders have already conquered the initial learning curve and are now seeking to refine their strategies for greater efficiency and profitability. This comprehensive guide provides tips for crypto trading, equipping you with the advanced insights and techniques needed to thrive in the dynamic crypto market. Whether you’re looking to elevate your trading techniques, sharpen your risk management skills, or stay ahead of the curve, this guide will help you achieve your goals.

Elevating Your Trading Prowess

Experienced traders understand that continuously adapting and refining their strategies is the key to success. Let’s explore some advanced techniques that can help you maximize your returns in the crypto arena.

Mastering the Art of Scalping and High-Frequency Trading

Scalping and High-Frequency Trading

Scalping and High-Frequency Trading

For traders seeking to exploit short-term price fluctuations, scalping and high-frequency trading (HFT) can be powerful strategies. Scalping involves making multiple quick trades, often within minutes or even seconds, to capitalize on small price movements. By meticulously analyzing charts and market indicators, scalpers aim to generate consistent, albeit modest, profits from these rapid-fire transactions.

HFT, on the other hand, takes the concept of speed to the next level. Employing complex algorithms and powerful computing resources, HFT traders can execute trades at lightning-fast speeds, often outpacing the competition. The goal is to identify and exploit tiny price discrepancies across different exchanges, earning a small profit on each trade.

While these strategies can be lucrative, they also come with significant risks. The high-stress nature of these trading approaches, coupled with the need for split-second decision-making, can easily lead to emotional biases and impulsive trades. Successful implementation of scalping and HFT requires meticulous backtesting, extensive risk management protocols, and the ability to maintain unwavering discipline.

Unlocking the Potential of Arbitrage and Market Making

Cryptocurrency market

Cryptocurrency market

Another advanced technique in the crypto trading arsenal is arbitrage. This strategy involves identifying price discrepancies across different exchanges and capitalizing on them by simultaneously buying and selling the same asset. By taking advantage of these temporary imbalances, traders can potentially generate risk-free profits.

Market making is a closely related strategy that involves providing liquidity to the market. Traders who act as market makers place buy and sell orders at various price points, earning the spread (the difference between the bid and ask prices) as their profit. This approach can be particularly lucrative in highly volatile markets, where the need for liquidity is high.

Implementing arbitrage and market making strategies effectively requires deep market knowledge, significant capital, and the ability to execute trades rapidly. Additionally, traders must be vigilant in monitoring exchange fees, regulatory changes, and potential technological glitches that could impact their profitability.

Mastering the Art of Technical Analysis

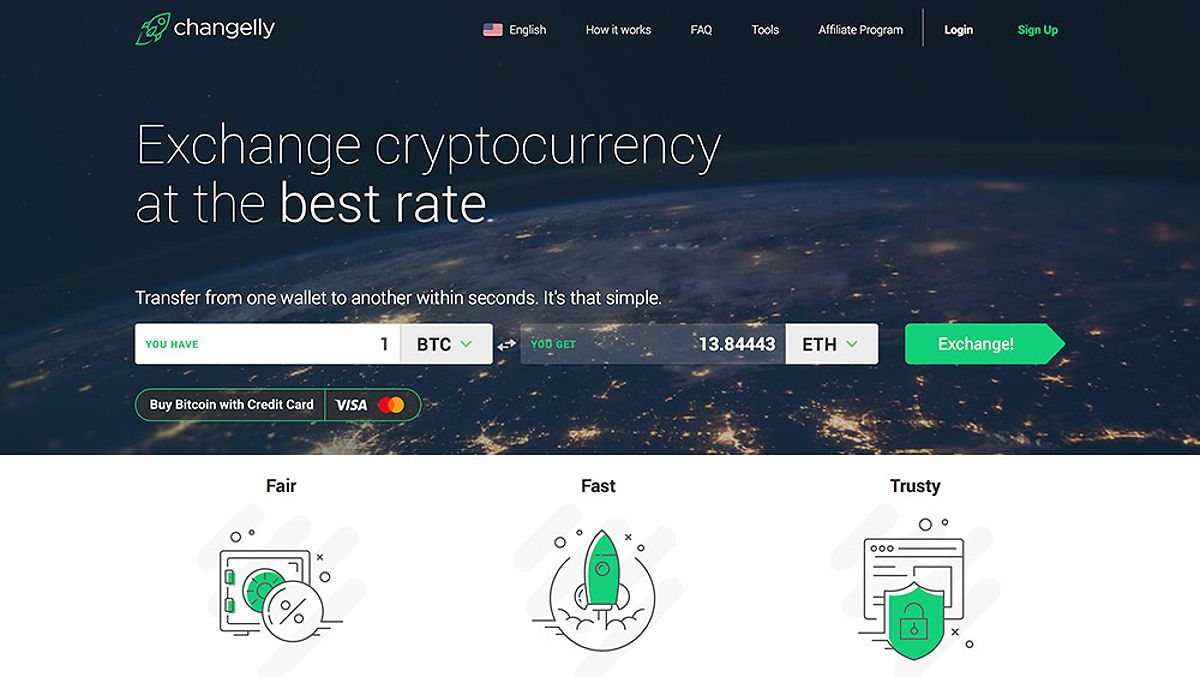

Changelly

Changelly

Experienced crypto traders often rely heavily on advanced technical analysis techniques to identify entry and exit points, as well as potential trends and patterns. Beyond the basic indicators, delving into complex tools like Elliott Wave Theory, candlestick patterns, and volume analysis can provide valuable insights into the market’s behavior.

By mastering these technical analysis techniques, traders can gain a deeper understanding of the market’s dynamics and make more informed trading decisions. However, it’s crucial to remember that technical analysis is not a foolproof method, and traders should always complement it with fundamental research and risk management strategies.

Sharpening Your Risk Management Acumen: Tips for Crypto Trading

In the volatile and unpredictable world of cryptocurrency, effective risk management is paramount for long-term success. Let’s explore some advanced techniques that can help experienced traders mitigate potential losses.

Dynamically Adapting Your Stop-Loss Orders

Implementing stop-loss orders is a fundamental risk management tool, but experienced traders often take it a step further by employing dynamic stop-loss strategies. These orders adjust based on market volatility and trend changes, allowing traders to protect their profits while maintaining exposure to potential upside.

For example, a trailing stop-loss order can automatically move the stop-loss level higher as the price of an asset increases, locking in gains while limiting downside risk. This dynamic approach can be particularly effective in the highly volatile crypto market, where sudden price movements can quickly erode profits if not properly managed.

Optimizing Your Position Sizing and Portfolio Allocation

Determining the optimal position size and managing your portfolio allocation are critical aspects of risk management. Experienced traders often use advanced techniques, such as calculating risk-reward ratios and implementing position-sizing formulas, to ensure that their exposure to any single trade or asset is within their risk tolerance.

Moreover, diversifying your portfolio across different cryptocurrencies and asset classes can help mitigate overall risk. By allocating your capital strategically, you can reduce the impact of adverse market movements on your trading account.

Leveraging with Prudence

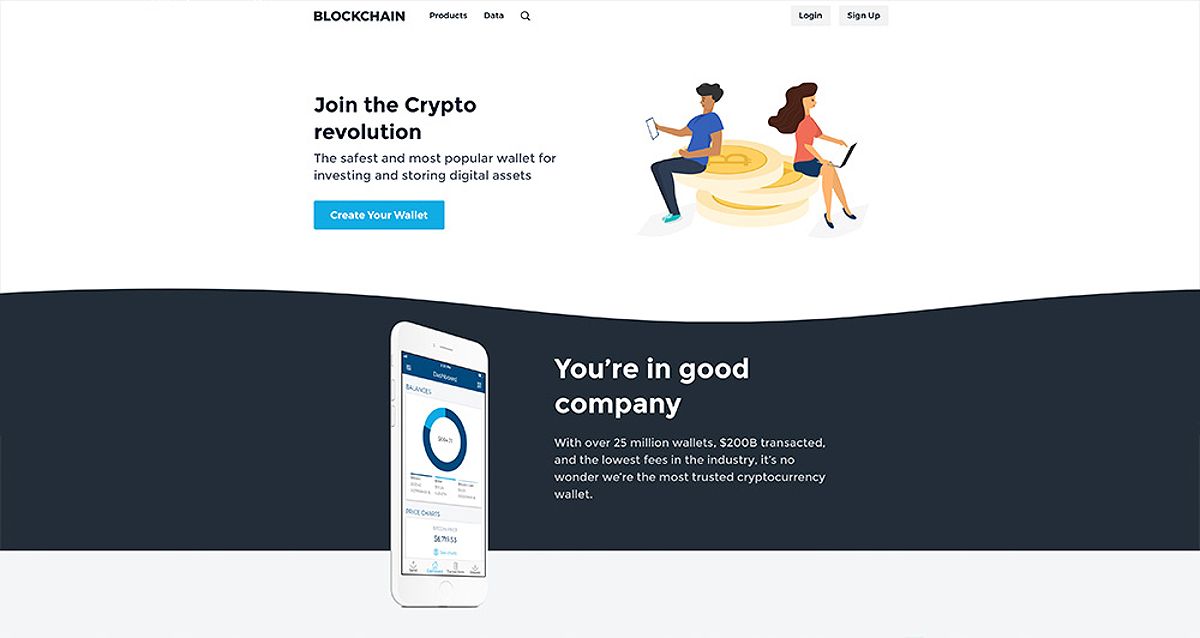

Blockchain

Blockchain

Leverage can be a powerful tool for amplifying profits, but it also carries the risk of amplifying losses. Experienced traders understand the importance of using leverage responsibly and setting appropriate limits to manage their exposure.

By carefully calculating their risk-to-reward ratio and maintaining strict stop-loss orders, traders can leverage their capital while minimizing the potential for catastrophic losses. However, it’s crucial to remember that even small market fluctuations can have outsized effects when leverage is involved, so caution and discipline are paramount.

Staying Ahead of the Curve

The cryptocurrency market is constantly evolving, and staying informed is essential for experienced traders to maintain their edge. Let’s explore strategies for keeping up with the latest trends and developments.

Staying Informed Through Diligent Research and News Monitoring

Staying up-to-date with the latest news, regulations, and emerging technologies in the crypto space is crucial. Religiously following reputable industry publications, newsletters, and social media channels can help you identify new opportunities and potential risks before they become widely known.

However, it’s essential to approach market information with a critical eye, avoiding the temptation of FOMO-driven decision-making. Thoroughly research and analyze the data to validate its reliability and relevance to your trading strategy.

Embracing the Evolving Crypto Trading Landscape

The crypto trading landscape is constantly expanding, with the emergence of advanced platforms and tools that can enhance your trading experience. Platforms like TradingView, Binance, and BitMEX offer features such as real-time data, sophisticated charting tools, and automated trading bots, allowing you to refine your strategies and gain a competitive edge.

Continuously exploring and testing new platforms can help you identify the one that best suits your trading style and needs. By staying adaptable and embracing technological advancements, you can optimize your workflow and decision-making processes.

Understanding the Psychological Factors Driving the Crypto Market

Experienced traders understand that the crypto market is not solely driven by fundamentals; psychological factors also play a significant role. Recognizing and managing the impact of emotions like fear, greed, and herd behavior can help you make more objective trading decisions and avoid common pitfalls.

By developing a deeper understanding of market psychology, you can learn to identify and mitigate the influence of these biases on your trading strategy. This can involve techniques like setting clear trading rules, maintaining emotional discipline, and avoiding impulsive trades.

Remember, the crypto market is a constantly evolving landscape, and staying ahead of the curve requires a combination of advanced strategies, risk management acumen, and a commitment to continuous learning and adaptation. By implementing the tips and techniques outlined in this guide, you can position yourself for long-term success as an experienced crypto trader.

FAQ

How can I improve my technical analysis skills?

To enhance your technical analysis skills, consider enrolling in online courses or tutorials that cover advanced techniques like Elliott Wave Theory, candlestick pattern recognition, and volume analysis. Additionally, practice consistently by analyzing historical crypto market data and backtesting your strategies to refine your approach.

What are the best resources for learning about advanced crypto trading strategies?

Some of the top resources for learning about advanced crypto trading strategies include industry-leading websites like CoinDesk, Cointelegraph, and The Block, as well as specialized trading forums and communities like r/CryptoTrader on Reddit. Additionally, following experienced crypto traders on social media and attending online webinars or workshops can provide valuable insights and practical guidance.

How do I manage risk effectively when using leverage?

When using leverage in crypto trading, it’s crucial to implement strict risk management protocols. This includes calculating your leverage-adjusted position sizes, setting appropriate stop-loss orders, and closely monitoring your exposure. Avoid overleveraging, and be prepared to reduce your position size or close trades quickly in response to market volatility.

What are the latest trends in the crypto market that I should be aware of?

Some of the latest trends in the crypto market include the rise of decentralized finance (DeFi) applications, the increasing institutional adoption of cryptocurrencies, and the emergence of new asset classes like non-fungible tokens (NFTs). Staying informed about these developments and their potential impact on the market can help you identify new trading opportunities and adjust your strategies accordingly.

How can I stay disciplined and avoid emotional trading?

Maintaining emotional discipline is essential for successful crypto trading. Some strategies to avoid emotional biases include setting clear trading rules and sticking to them, using automated trading tools to eliminate impulsive decisions, and regularly reviewing your trading journal to identify and address any patterns of emotional decision-making. Additionally, practicing mindfulness and stress management techniques can help you stay calm and focused during volatile market conditions.

Conclusion

In the dynamic and ever-evolving world of cryptocurrency, experienced traders understand the importance of continuously refining their strategies, managing risk effectively, and staying ahead of the curve. By mastering advanced techniques like scalping, high-frequency trading, arbitrage, and technical analysis, they can elevate their trading performance and generate consistent profits.

At the same time, sharpening their risk management skills through the use of dynamic stop-loss orders, strategic position sizing, and responsible leverage management is crucial for long-term success. Finally, maintaining a keen awareness of the latest market trends, cutting-edge trading tools, and the psychology behind market behavior can help them adapt and thrive in the rapidly changing crypto landscape.

As experienced crypto traders, their commitment to learning, adapting, and executing with precision will be the keys to their continued success. By embracing these advanced tips, staying disciplined, and continuously exploring the vast opportunities the crypto market has to offer, they can position themselves at the forefront of this dynamic and ever-evolving industry.