Imagine waking up to discover that your investment has vanished overnight. This scenario became a painful reality for many following the JPEX collapse in Hong Kong, a case that starkly illustrates the growing threat of cryptocurrency fraud in Asia. With countless individuals facing severe financial setbacks, this incident underscores the urgent need for more robust regulatory frameworks to protect investors in an increasingly complex financial landscape.

Understanding the JPEX Debacle: A Case Study in Deception

Often referred to as “Hong Kong’s FTX,” the JPEX saga unfolded as a sophisticated and deceptive operation, ensnaring a multitude of investors in its web of fraud. Operating without the necessary licenses, JPEX utilized a range of manipulative tactics designed to entice unsuspecting individuals to invest significant sums of money. Misleading advertising, promises of unrealistic returns, and the strategic manipulation of trading platforms created a facade of profitability that ultimately crumbled, leaving many investors in financial ruins.

The aftermath of JPEX’s collapse was marked by a swift deterioration of trust within the cryptocurrency market. Withdrawals were frozen, and numerous arrests ensued, exposing a profound lack of transparency and accountability. The extent of the financial losses was staggering, affecting both retail investors and institutional players alike. This incident not only highlighted the inherent risks associated with unregulated cryptocurrency exchanges but also served as a cautionary tale about the importance of due diligence and investor awareness.

As the dust settled, a palpable sense of panic spread among the investors caught in the fallout. Many found themselves without any viable recourse, grappling with significant financial losses. The absence of established legal precedents in Hong Kong added another layer of complexity, making it increasingly difficult for victims to pursue justice. The sheer volume of affected individuals and the intricate nature of the fraudulent scheme further hindered recovery efforts, emphasizing the need for a more comprehensive legal framework to address cryptocurrency-related fraud.

Legal Developments: A Landmark Case in Hong Kong

The legal proceedings following the JPEX collapse marked a crucial turning point in Hong Kong’s regulatory approach to cryptocurrency. A successful civil suit filed by two investors against JPEX and its affiliates set an important legal precedent, demonstrating that victims of cryptocurrency fraud can indeed seek legal recourse and potentially reclaim their losses. The court’s ruling, which awarded a significant sum to the plaintiffs, provided a much-needed beacon of hope for others facing similar predicaments.

This landmark decision emphasized the importance of proactive legal action, challenging the prevailing notion that justice in cryptocurrency fraud cases is unattainable. The judge’s thorough reasoning and clear articulation of the legal arguments created a framework for future litigation, offering valuable guidance for legal professionals navigating the complexities of cryptocurrency-related cases.

However, significant challenges remain in asset recovery. The decentralized and borderless nature of cryptocurrencies complicates jurisdictional matters, making it difficult to trace and seize assets across international boundaries. Furthermore, the lack of specialized legal expertise in handling cryptocurrency fraud cases presents additional hurdles for victims seeking justice. The court’s decision, while monumental, highlighted the pressing need for enhanced international cooperation and the establishment of specialized legal frameworks to tackle the unique challenges posed by cryptocurrency fraud. The six-year statute of limitations for civil cases further complicates matters, underscoring the necessity for timely legal processes.

Regulatory Reforms: A Response to JPEX

The fallout from the JPEX collapse has acted as a catalyst for regulatory reform in Hong Kong and across various Asian jurisdictions. This incident illuminated the critical need for stricter licensing requirements for cryptocurrency exchanges, enhanced investor protection measures, and improved cross-border cooperation to combat cryptocurrency-related crimes. In response, Hong Kong’s regulatory framework has been strengthened, focusing on bolstering licensing protocols, implementing more stringent compliance measures, and increasing investor education initiatives. This balanced approach aims to foster innovation within the cryptocurrency sector while simultaneously safeguarding investors from fraudulent activities.

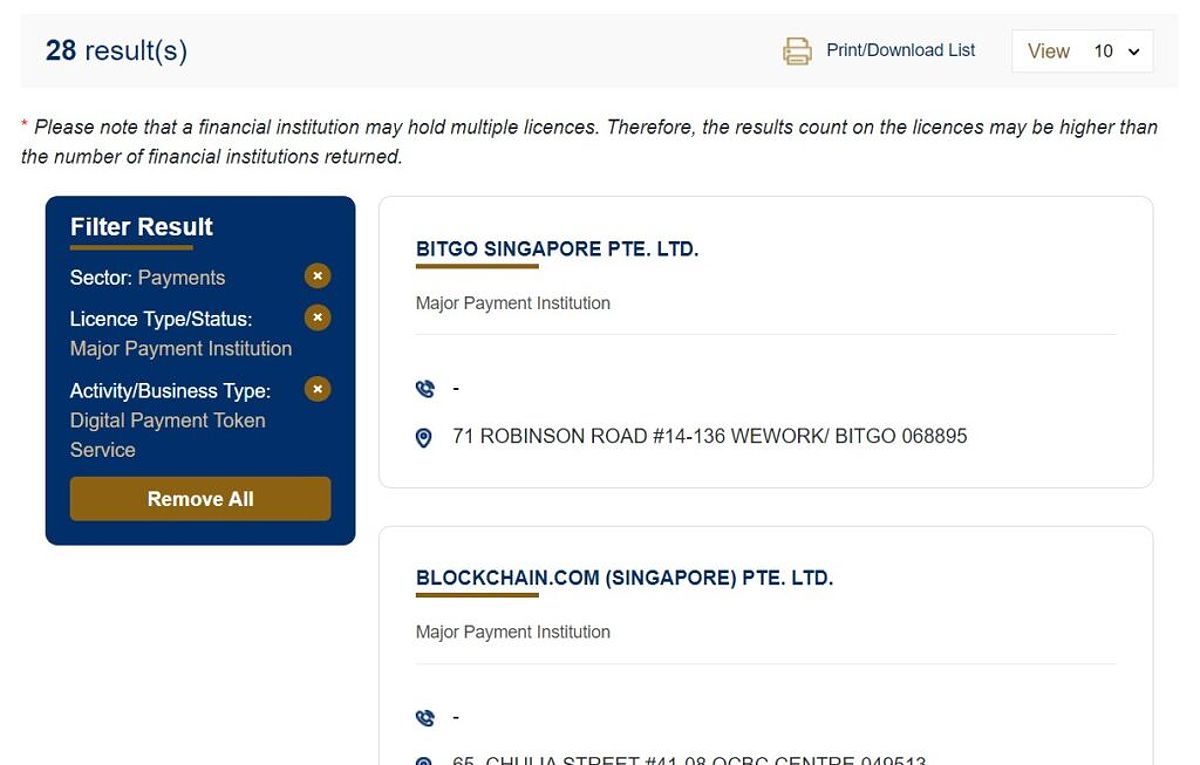

Other Asian nations, including Singapore, have also begun to recalibrate their regulatory landscapes in light of the JPEX incident. These jurisdictions have adopted various measures to enhance investor protection, improve market transparency, and reinforce regulatory oversight. Nonetheless, the challenge of creating a unified regulatory framework across different Asian nations remains persistent, highlighting the need for collaborative efforts to navigate the complexities of the cryptocurrency market. Furthermore, the development of Central Bank Digital Currencies (CBDCs) has emerged as a pivotal area of focus, with the potential to reshape regulatory landscapes and enhance transaction efficiency.

Implications for Financial Institutions: The Need for Diligence and Collaboration

The JPEX case serves as a crucial reminder of the importance of enhanced due diligence and robust compliance protocols for financial institutions engaged in cryptocurrency-related activities. Banks and other financial service providers must establish stringent procedures to assess and mitigate risks associated with cryptocurrency transactions, including identifying and preventing fraudulent activities. This entails the development of comprehensive know-your-customer (KYC) and anti-money laundering (AML) protocols tailored to the unique dynamics of the cryptocurrency market. Financial institutions must remain vigilant, adapting to regulatory changes and best practices in this rapidly evolving sector.

Moreover, international collaboration is essential for effectively combating cross-border cryptocurrency fraud. The borderless nature of cryptocurrencies necessitates a coordinated global approach to tracking and recovering stolen assets. This requires improved information sharing between law enforcement agencies, enhanced cooperation among regulatory bodies, and the establishment of standardized procedures for handling cryptocurrency-related investigations. Organizations such as Interpol play a vital role in facilitating these collaborative efforts, promoting the exchange of information and best practices while supporting cross-border investigations.

Conclusion

The JPEX collapse in Hong Kong stands as a significant chapter in the evolving legal and regulatory landscape of cryptocurrencies in Asia. It has revealed the vulnerabilities inherent within the cryptocurrency ecosystem and the urgent need for robust regulatory frameworks to protect investors. The legal precedent set by the civil suit against JPEX opens new avenues for victims seeking justice, offering a glimmer of hope amid a tumultuous landscape.

This case serves as a potent reminder of the necessity for ongoing vigilance, stringent regulatory oversight, and collaborative approaches to address the unique challenges posed by the cryptocurrency market. As the future of cryptocurrency regulation in Asia unfolds, it will depend on the capacity of governments, regulatory bodies, and financial institutions to adapt to a rapidly changing environment while effectively mitigating the risks associated with this transformative technology.