In the ever-evolving world of cryptocurrency, short-term crypto trading has emerged as a thrilling frontier for savvy investors seeking quick profits. This dynamic and captivating endeavor offers the potential for substantial gains, but it also requires a strategic mindset to successfully navigate the market”s volatility. In this comprehensive guide, we will delve into the intricacies of short-term crypto trading, equipping you with the knowledge and tools to make informed decisions and potentially capitalize on the crypto market”s fluctuations.

Understanding The Allure And Risks Of Short Term Crypto Trading

Short-term crypto trading is the practice of buying and selling digital assets over a relatively short period, ranging from minutes to a few weeks. Unlike long-term investing, which focuses on holding cryptocurrencies for an extended period, short-term traders seek to profit from the market’s rapid price movements. This approach requires a keen understanding of technical analysis, market trends, and the ability to make quick, strategic decisions.

Short-term crypto trading

Short-term crypto trading

The allure of short-term crypto trading lies in its potential for high returns, but it also carries increased risk. Cryptocurrencies are notoriously volatile, with prices often fluctuating dramatically within a matter of hours or days. Effective short-term traders must be adept at navigating these turbulent waters, employing risk management strategies to mitigate potential losses.

Crafting Effective Short-term Crypto Trading Strategies

Successful short-term crypto trading requires a multifaceted approach. Let’s explore some strategies that can help you capitalize on the market’s fluctuations:

Technical Analysis: Leveraging Indicators And Patterns

Technical analysis is the cornerstone of short-term trading, as it allows you to identify potential entry and exit points based on historical price patterns and market behavior. By studying candlestick charts, moving averages, and various technical indicators, you can gain valuable insights into the market’s momentum and make informed trading decisions.

Crypto price charts

Crypto price charts

Fundamental Analysis: Understanding The Bigger Picture

While technical analysis focuses on price movements, fundamental analysis examines the underlying factors that may influence a cryptocurrency’s long-term value. By researching a project’s team, technology, adoption rates, and competitive landscape, you can make more informed decisions about the cryptocurrency’s potential for growth or decline.

Trading Strategies: Scalping, Day Trading, And Swing Trading

Short-term crypto trading encompasses several strategies, each with its own unique characteristics and risk profiles. Scalping, for instance, involves taking advantage of small, frequent price movements, while day trading focuses on capitalizing on intraday price fluctuations. Swing trading, on the other hand, aims to capture larger price swings over a few days to a couple of weeks.

Selecting The Right Cryptocurrencies For Short-term Trading

Not all cryptocurrencies are equally suited for short-term trading. When choosing the right digital assets, consider the following factors:

Factors To Consider

- Volatility: Embracing the Unpredictable Cryptocurrencies with high volatility are often the most attractive for short-term traders, as they offer the potential for significant price swings and quick profits. However, this volatility also brings increased risk, so it’s crucial to manage your exposure carefully.

- Liquidity: Ensuring Smooth Transactions Liquidity is a vital factor in short-term trading, as it determines how easily you can enter and exit positions. Cryptocurrencies with high trading volumes and active markets are generally more liquid, allowing you to execute trades quickly and efficiently.

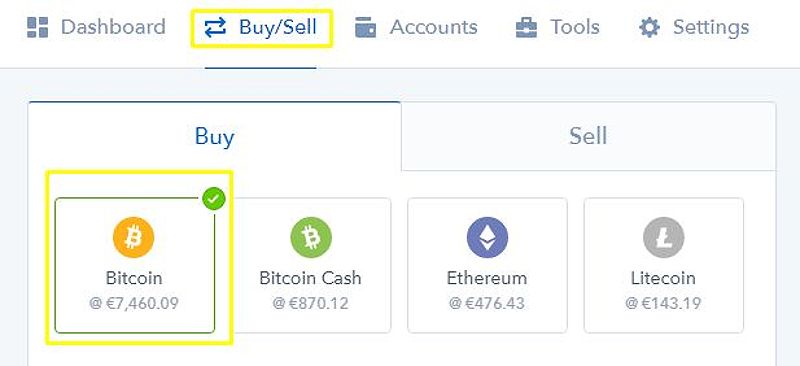

Crypto trading platform

Crypto trading platform

- Market Capitalization: Gauging Stability and Growth Potential The market capitalization of a cryptocurrency can provide insights into its stability and growth potential. While smaller market cap coins may offer more volatility, they also come with increased risk. Larger, more established cryptocurrencies can offer a balance of stability and potential for short-term gains.

Managing Risks In Short-term Crypto Trading

Short-term crypto trading is not without its risks, and effective risk management is crucial to your success. Consider the following strategies to mitigate potential losses:

Diversification: Spreading Your Bets

Diversifying your portfolio by investing in a range of cryptocurrencies can help reduce your overall risk exposure. This approach can protect your capital from the volatility of any single digital asset.

Stop-loss Orders: Limiting Potential Losses

Implementing stop-loss orders can help you minimize your downside risk by automatically closing your position when a cryptocurrency’s price reaches a predetermined level. This can prevent significant losses and give you the opportunity to reevaluate your trading strategy.

Emotional Control: Avoiding The Pitfalls Of Impulse Trading

The cryptocurrency market’s volatility can trigger strong emotional responses, leading to impulsive trading decisions. Developing a disciplined approach and sticking to your trading plan can help you avoid the pitfalls of emotional trading.

Best Practices For Short-term Crypto Trading

As you venture into the world of short-term crypto trading, consider the following best practices to enhance your chances of success:

Continuous Learning: Staying Ahead Of The Curve

The cryptocurrency market is constantly evolving, and successful traders must be committed to ongoing education. Stay informed about market trends, technological advancements, and regulatory changes that may impact your trading strategies.

Simulation And Practice: Honing Your Skills

Before risking real capital, consider practicing your trading strategies on a demo account. This allows you to refine your techniques, test your decision-making processes, and build confidence without exposing your funds to potential losses.

Discipline And Consistency: The Keys To Long-term Success

Short-term crypto trading requires unwavering discipline and a commitment to a well-defined trading plan. Consistency in your approach, risk management, and emotional control will be essential to navigating the volatile crypto market successfully.

Conclusion

Short-term crypto trading presents a thrilling opportunity for those willing to embrace the market’s volatility and develop a strategic mindset. By understanding the fundamentals, honing your trading strategies, and managing your risks, you can position yourself to capitalize on the dynamic nature of the cryptocurrency market. Remember, the crypto landscape is constantly in flux, so remain vigilant, adaptable, and committed to continuous learning. With the right approach, short-term crypto trading can be a rewarding endeavor, but always remember to invest only what you can afford to lose.

Faq

What are the most common mistakes made by short-term crypto traders? Some of the most common mistakes include: emotional trading, inadequate risk management, lack of diversification, and a failure to stay up-to-date with market trends and news.

How can I protect my profits from market volatility? Implement robust risk management strategies, such as stop-loss orders and diversification, to safeguard your profits. Additionally, maintain a disciplined and unemotional approach to trading.

What are the tax implications of short-term crypto trading? The tax implications of short-term crypto trading can vary depending on your location and specific circumstances. It’s recommended to consult with a tax professional to ensure you’re compliant with all relevant regulations.

How can I stay up-to-date with the latest trends and developments in short-term crypto trading? To stay informed, consider following industry experts on social media, reading reputable news sources, and attending conferences or webinars related to crypto trading.