Robinhood Crypto Trading Fees: An In-Depth Look at the True Cost of Cryptocurrency Trading on the Platform

As an investigative crypto journalist, I”ve closely followed the evolving landscape of cryptocurrency trading platforms. One name that has consistently piqued my interest is Robinhood, a brokerage firm that has carved out a unique niche in the crypto space by offering commission-free trading. However, the true cost of trading on Robinhood isn”t always as straightforward as it may seem. In this report, I”ll provide a balanced and analytical perspective on the nuances of Robinhood”s crypto trading fees to help you make informed decisions about your cryptocurrency investments.

Robinhood – S Crypto Trading Fees: Uncovering The Details

At the core of Robinhood’s offering is its commission-free trading model, which extends to cryptocurrencies as well. This approach has undoubtedly made the platform appealing to many beginner investors looking to dip their toes into the crypto market without incurring hefty per-trade fees. However, as I’ve discovered through my research, there are other fees associated with crypto transactions on Robinhood that are important to understand.

Robinhood vs Coinbase

Robinhood vs Coinbase

The most significant of these fees is the spread fee, which is the difference between the bid price and the ask price of a cryptocurrency. Robinhood charges this fee on all crypto trades, and the amount can vary depending on the cryptocurrency and market conditions. This means that while you may not be paying a direct commission, the spread fee can still impact the overall cost of your trades. As a savvy investor, it’s crucial to keep a close eye on the current spread when making trades to ensure you’re getting the best possible price.

In addition to the spread fee, Robinhood also charges a fee for transferring funds in and out of your account. While ACH transfers are free, wire transfers come with a $25 fee for outgoing transfers. This is an important consideration if you plan to frequently move your funds between Robinhood and an external wallet or bank account.

Robinhood Vs- The Competition: Evaluating Crypto Trading Fees

To truly understand the value proposition of Robinhood’s crypto trading fees, it’s essential to compare them to other popular platforms in the market. This analysis paints a more nuanced picture of the overall cost of trading on Robinhood.

Take Coinbase, for example. This well-known cryptocurrency exchange charges a variable fee based on the transaction amount and payment method, with fees ranging from 0.5% to 4.5%. Binance, another major player in the crypto space, has a tiered fee structure that depends on your trading volume and whether you’re a maker or taker. These fees can add up quickly, especially for frequent traders.

Coinbase fees

Coinbase fees

In comparison, Robinhood’s commission-free trading model can be a significant advantage, particularly for beginner investors or those with smaller transaction sizes. While Robinhood’s spread fee may be slightly higher than the fees charged by some exchanges, the overall cost of trading on Robinhood can be lower, making it an attractive option for those just starting their cryptocurrency investment journey.

Strategies For Minimizing Robinhood Crypto Trading Fees

As an experienced crypto investor, I’m always on the lookout for ways to optimize my trading costs and maximize my returns. When it comes to Robinhood’s crypto trading fees, there are a few strategies I’ve found to be particularly effective.

One of the key strategies I employ is the use of limit orders. Instead of relying on market orders, I make it a point to use limit orders when buying and selling cryptocurrencies on Robinhood. Limit orders allow me to set a specific price at which I’m willing to execute a trade, which can help me avoid paying the higher spread fee associated with market orders.

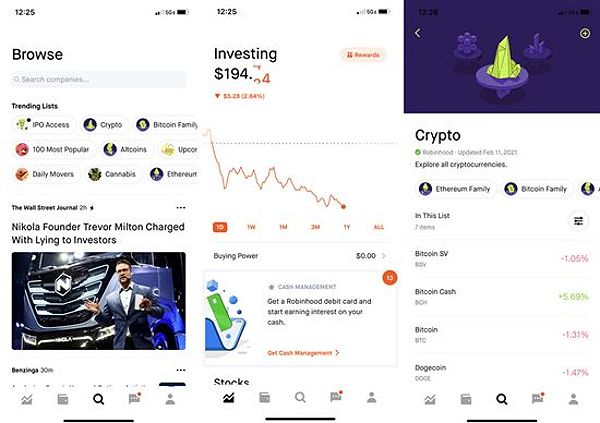

Screenshot of Robinhood

Screenshot of Robinhood

Another strategy I’ve found useful is considering Robinhood Gold, the platform’s premium subscription service. For a monthly fee of $5, Robinhood Gold offers additional features and benefits, including access to margin trading. By leveraging my funds through margin trading, I’ve been able to potentially lower my overall trading costs and optimize my investment returns.

Finally, I’ve learned to minimize the number of times I transfer funds in and out of my Robinhood account. Given the $25 fee for wire transfers, I try to limit these transactions and instead opt for larger, less frequent transfers. This helps me avoid these fees and keep my trading costs down.

The Impact Of Robinhood – S Crypto Trading Fees On My Investment Strategies

As an experienced crypto investor, I’ve found that Robinhood’s crypto trading fees have had a significant impact on my investment strategies. While the commission-free trading model is certainly appealing, the spread fee and other associated costs have required me to approach my trades with a more nuanced and analytical mindset.

One of the key ways Robinhood’s fees have influenced my strategies is in my use of limit orders. By taking the time to carefully analyze the current spread and setting limit orders accordingly, I’ve been able to minimize the impact of the spread fee on my trades. This has allowed me to capture more favorable prices and optimize my returns.

Additionally, the potential cost savings offered by Robinhood Gold’s margin trading feature has led me to reevaluate my portfolio allocation and leverage strategies. By strategically using margin to amplify my positions, I’ve been able to potentially generate higher returns while keeping my overall trading costs in check.

At the same time, I’ve had to be more mindful of my fund transfer activities. Avoiding frequent wire transfers and consolidating my movements in and out of Robinhood has helped me avoid the $25 fee and further optimize my investment returns.

Risks Associated With Robinhood Crypto Trading

While Robinhood’s commission-free crypto trading model can be attractive, it’s important to be aware of the potential risks involved. One key risk is the platform’s reliance on payment for order flow (PFOF), which means Robinhood generates revenue by routing customer orders to market makers, who may execute the trades at prices that are slightly less favorable than the best available prices. This practice has been the subject of controversy and regulatory scrutiny, and it’s important for investors to understand how it may impact their trades.

Another risk to consider is the limited selection of cryptocurrencies available on Robinhood. The platform only offers a handful of the most popular digital assets, which means investors may miss out on opportunities in emerging or niche cryptocurrencies. Additionally, Robinhood’s platform does not provide the same level of control and customization as dedicated crypto exchanges, which may limit the flexibility and advanced trading options available to more experienced investors.

Faq

What is the spread fee on Robinhood? The spread fee on Robinhood is the difference between the bid price and the ask price of a cryptocurrency. This fee is charged on all crypto trades, and the amount can vary depending on the cryptocurrency and market conditions.

What is the ACH transfer fee on Robinhood? Robinhood does not charge any fees for ACH transfers, which are the most common method of funding your Robinhood account. However, they do charge a $25 fee for wire transfers out of your account.

Conclusion

As the cryptocurrency market continues to evolve, platforms like Robinhood have emerged as popular options for beginner investors. However, as an investigative crypto journalist, I’ve found that navigating the nuances of Robinhood’s crypto trading fees is crucial for maximizing your investment returns.

While Robinhood’s commission-free trading model is undoubtedly appealing, it’s essential to understand the spread fee and other associated costs. By utilizing strategies like limit orders, considering Robinhood Gold, and minimizing frequent transfers, you can effectively minimize your crypto trading costs and focus on building a diversified portfolio that aligns with your financial goals.

At the same time, it’s important to be aware of the potential risks associated with Robinhood’s crypto trading, such as the platform’s reliance on payment for order flow and the limited selection of cryptocurrencies available. By carefully weighing the pros and cons, you can make informed decisions that align with your investment objectives and risk tolerance.

As you embark on your cryptocurrency investment journey, I encourage you to stay informed, think critically, and prioritize your financial well-being. With the right approach and a keen understanding of the fees and risks involved, you can navigate the exciting world of crypto trading with confidence. Happy trading!