As an experienced investor navigating the ever-evolving cryptocurrency landscape, I’ve been on a constant search for ways to maximize my returns and diversify my portfolio. That’s when I discovered the power of the robinhood crypto trading bot — a game-changing tool that has revolutionized the way I approach the crypto market.

In June 2024, Robinhood, the renowned investment platform, unveiled their latest innovation — a powerful suite of crypto trading bots designed to streamline my investment strategies, reduce the emotional burden of manual trading, and potentially enhance my overall investment performance.

Unlocking the Power of Robinhood Crypto Trading Bot

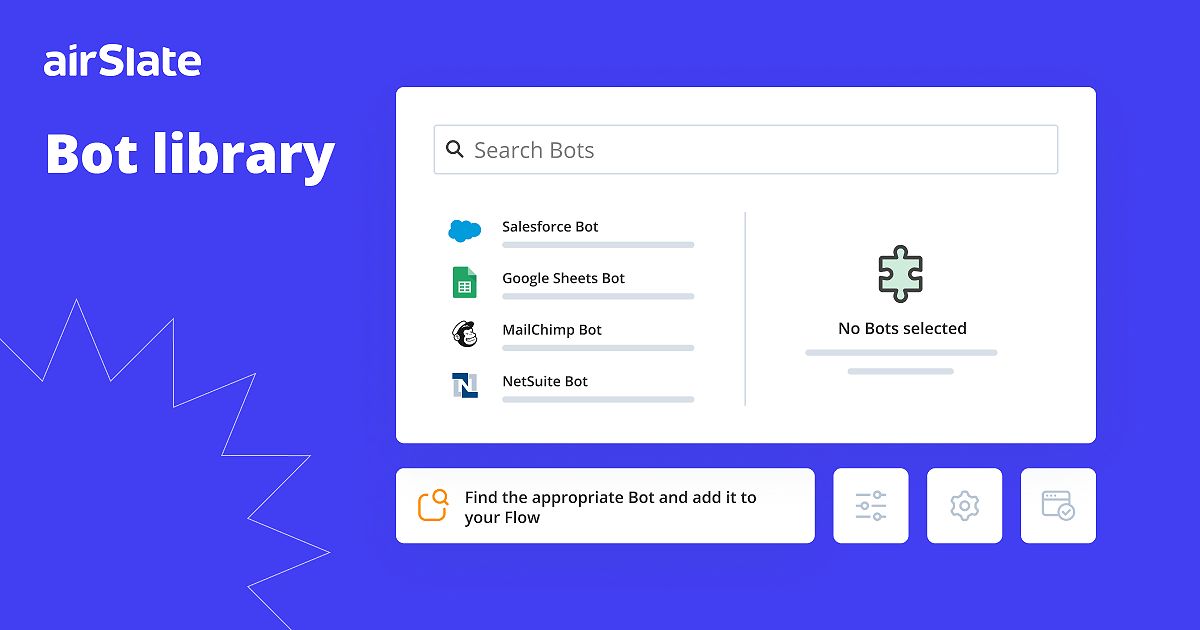

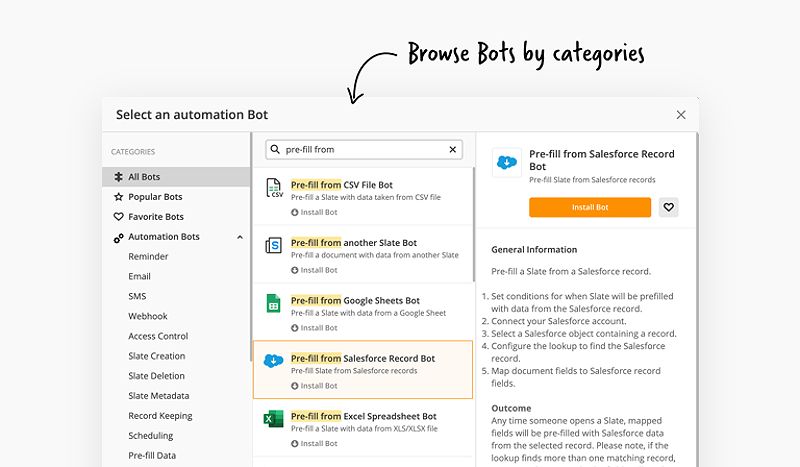

Cryptocurrency trading bots are essentially software programs that automate the buying and selling of digital assets based on predefined algorithms and market conditions. These bots can execute trades with lightning-fast speed, unparalleled consistency, and without the influence of human emotions — all of which are crucial advantages for savvy investors like myself.

Cryptocurrency Trading Bots

Cryptocurrency Trading Bots

Robinhood’s crypto trading bots leverage advanced algorithms to closely monitor the markets, identify lucrative trading opportunities, and execute transactions on my behalf. By automating this process, I’ve been able to achieve several key benefits:

- Consistent Returns: Robinhood’s bots can make trades with precision, potentially minimizing the impact of market volatility and maximizing my profits.

- Eliminating Emotional Bias: These bots make decisions based solely on data, removing the influence of fear, greed, and other emotional factors that can often lead to suboptimal trading decisions.

- Diversifying My Portfolio: Robinhood’s bots can manage multiple trading strategies simultaneously, allowing me to diversify my crypto investments and mitigate overall risk.

- Optimizing My Strategies: The platform’s backtesting capabilities enable me to refine my trading approaches using historical market data, ensuring my bots are configured for maximum efficiency.

Robinhood’s Crypto Trading Bots

Robinhood’s Crypto Trading Bots

Robinhoods Innovative Approach to Automated Crypto Trading

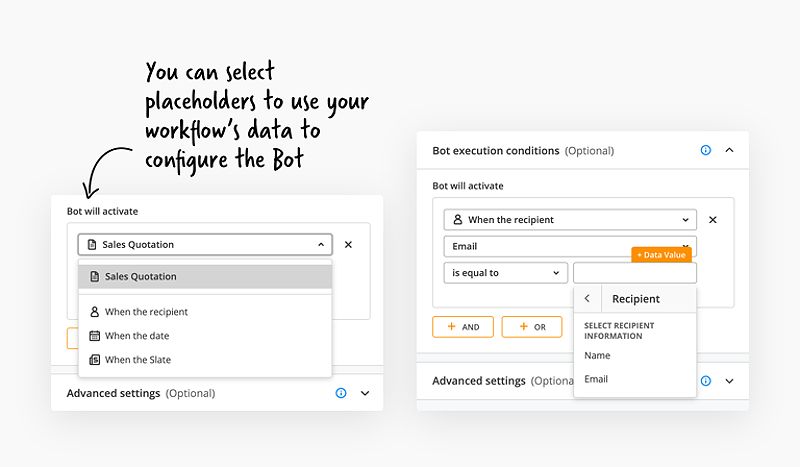

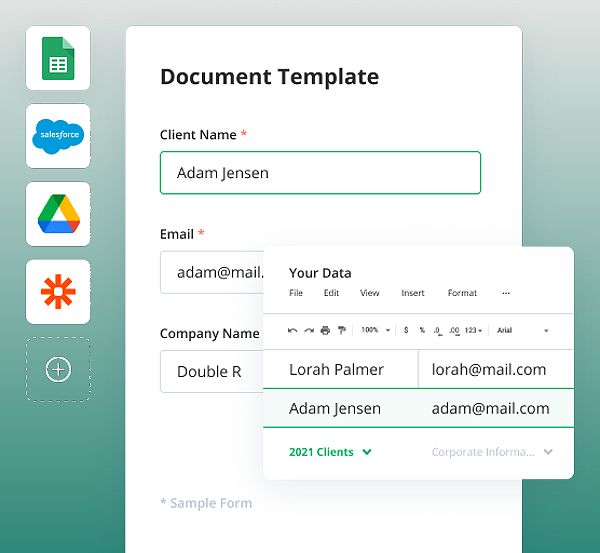

What sets Robinhood’s crypto trading bots apart is their commitment to user-friendly features and a streamlined investment experience. One of the standout features is the platform’s “recurring investment” option, which allows me to set up automatic, scheduled purchases of cryptocurrencies.

This “set it and forget it” approach to investing has been incredibly beneficial for implementing a dollar-cost averaging strategy. By investing a fixed amount at regular intervals, I’ve been able to reduce the impact of market volatility and steadily build my crypto portfolio over time.

Moreover, Robinhood’s bots use limit orders to execute trades, ensuring that my transactions are carried out at a specific price or better. This helps to minimize the risk of slippage and maintain precise control over my entry and exit points.

The platform currently supports a diverse range of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Dogecoin, giving me the flexibility to diversify my automated trading activities across multiple digital assets.

Unlocking the Full Potential of Robinhoods Crypto Trading Bots

As I’ve integrated Robinhood’s crypto trading bots into my investment strategies, I’ve been able to unlock a host of benefits that have helped me navigate the volatile cryptocurrency market with greater confidence and efficiency.

- Dollar-Cost Averaging: The recurring investment feature has allowed me to systematically invest a fixed amount at regular intervals, smoothing out the impact of market timing and potentially enhancing my long-term returns.

Dollar-Cost Averaging

Dollar-Cost Averaging

- Speed and Consistency: Robinhood’s bots have executed trades swiftly and consistently, minimizing the risk of missed opportunities and ensuring my orders are filled at the best possible prices.

Speed and Consistency

Speed and Consistency

- Risk Diversification: By implementing multiple trading strategies simultaneously, Robinhood’s bots have helped me diversify my crypto portfolio and manage my overall risk exposure.

Risk Diversification

Risk Diversification

- Backtesting Capabilities: The platform’s robust tools have enabled me to test and refine my trading strategies using historical market data, allowing me to optimize my bots before committing real capital.

Backtesting Capabilities

Backtesting Capabilities

- Emotionless Trading: Removing the emotional component from the trading process has led to more rational decision-making, potentially enhancing my long-term investment performance.

Navigating the Considerations and Best Practices

As I’ve delved deeper into the world of Robinhood’s crypto trading bots, I’ve learned that it’s essential to approach this investment tool with a keen eye on risk management and a willingness to continuously optimize my strategies.

- Risk Management: While bots can enhance my trading efficiency, I’ve maintained a vigilant approach to risk management. I’ve set appropriate stop-loss orders and diligently monitor my bot’s performance to ensure I’m well-prepared for any market fluctuations.

- Research and Due Diligence: Thoroughly researching the cryptocurrencies I plan to trade and understanding the inherent risks has been a crucial part of my approach. Staying up-to-date with industry news and trends has also helped me make more informed decisions.

- Monitoring and Adjustment: Regularly monitoring my bot’s performance and adjusting my trading strategies as market conditions evolve has been key to maintaining the effectiveness of my automated trading system.

- Technical Expertise: Effectively configuring and managing Robinhood’s crypto trading bots has required a basic understanding of trading strategies, market analysis, and bot programming. I’ve continuously sought out educational resources and collaborated with experienced traders to enhance my skills in this area.

Remember, while Robinhood’s crypto trading bots can be a powerful tool for experienced investors like myself, they are not a one-size-fits-all solution. It’s essential to carefully evaluate your investment goals, risk tolerance, and trading expertise before integrating these bots into your overall investment strategy.

Comparing Robinhoods Crypto Trading Bots with Other Platforms

In the world of automated cryptocurrency trading, Robinhood isn’t the only platform offering this service. However, the company’s approach to crypto trading bots sets it apart from some of its competitors.

Robinhood vs. Coinbase

Coinbase, another prominent cryptocurrency exchange, offers its own automated trading feature called Coinbase Pro. While Coinbase Pro provides a more comprehensive set of trading tools, I’ve found Robinhood’s crypto trading bots to offer a more user-friendly and streamlined experience, especially as an investor who is already familiar with the Robinhood platform.

Robinhood vs. Binance

Binance, one of the largest cryptocurrency exchanges globally, has a robust ecosystem of trading bots and automation tools. However, Robinhood’s crypto trading bots have appealed to me as a U.S.-based investor who values a platform with a strong regulatory presence and a focus on user-friendliness.

Robinhood vs. TradingView

TradingView is a popular platform for technical analysis and trading, and it also offers a range of automation and bot-building tools. While TradingView may provide more advanced customization options, Robinhood’s crypto trading bots have offered me a more streamlined and user-friendly experience, which is a key priority for my investment strategy.

Embracing the Future of Automated Crypto Trading with Robinhood

As an experienced investor, I’ve been continuously searching for new and innovative ways to maximize my returns and diversify my crypto portfolio. Robinhood’s crypto trading bots have emerged as a game-changing solution that has helped me streamline my investment strategies, reduce the emotional burden of manual trading, and unlock new opportunities for growth.

By leveraging the power of automation, I’ve been able to enhance my investment performance, minimize the impact of market volatility, and diversify my portfolio with greater efficiency. While I’ve maintained a keen focus on risk management and continuous optimization, Robinhood’s crypto trading bots have become an invaluable tool in my investment arsenal.

As I look towards the future, I’m excited to see how Robinhood’s crypto trading bots will continue to evolve and unlock new possibilities for experienced investors like myself. With the right mindset, a solid understanding of the market, and a willingness to adapt, I’m confident that I can continue to ride the wave of innovation and take my cryptocurrency investments to new heights.

FAQ

Q1: Is Robinhood’s crypto trading bot suitable for beginners?

A: While Robinhood’s bot is designed to be user-friendly, it’s generally recommended for investors with some experience in cryptocurrency trading. Beginners may find it more beneficial to start with simpler investment strategies and gradually build their expertise before exploring automated trading solutions.

Q2: What are the fees associated with using Robinhood’s crypto trading bot?

A: Robinhood’s crypto trading bot is commission-free, meaning I don’t incur any trading fees for my automated transactions. However, I may still be subject to other fees related to cryptocurrency trading, such as network fees or withdrawal charges, so it’s essential to familiarize myself with Robinhood’s fee structure.

Q3: Can I use multiple bots simultaneously on Robinhood?

A: As of now, Robinhood’s platform allows for one recurring investment per cryptocurrency. However, this may change in the future, and the platform may introduce more advanced options for managing multiple bots within a single account.

Q4: Is it safe to use Robinhood’s crypto trading bot?

A: Robinhood implements industry-standard security measures to protect its users’ accounts and funds. This includes features like two-factor authentication, encryption, and secure storage of sensitive information. While no platform can guarantee absolute safety, Robinhood’s commitment to security has provided me with a level of assurance as an experienced crypto investor.

Conclusion

In the ever-evolving world of cryptocurrency, Robinhood’s crypto trading bots have emerged as a powerful tool that has transformed the way I approach my investment strategies. By automating the trading process, these bots have helped me achieve consistent returns, diversify my portfolio, and minimize the emotional challenges of manual trading.

As I continue to explore the benefits of Robinhood’s crypto trading bots, I remain committed to maintaining a thorough understanding of the market, a disciplined risk management strategy, and a willingness to continuously optimize my trading approaches. With the right mindset and the right tools, I’m confident that I can unlock new opportunities for growth and take my cryptocurrency investments to new heights.