As an avid explorer of the ever-evolving crypto landscape, I”ve learned that navigating these uncharted waters can be both exhilarating and daunting, especially for those new to the game. However, I”ve discovered a secret weapon that has transformed my approach to crypto trading – TradingView”s paper trading feature. Allow me to share my journey and insights with you as we embark on a transformative experience together.

Unlocking The Power Of Paper Trading Crypto Tradingview

In the past, I too was hesitant to dive into the crypto markets, fearing the potential risks of losing my hard-earned capital. That all changed when I stumbled upon the incredible world of paper trading. This simulated trading environment, offered by the brilliant minds at TradingView, has become my playground for honing my skills and testing my strategies without the burden of real-world consequences.

Access TradingView Paper Trading

Access TradingView Paper Trading

The beauty of TradingView’s paper trading lies in its ability to replicate the real-time market conditions, allowing me to execute trades, analyze trends, and learn from my mistakes — all while using virtual funds. It’s the perfect training ground for aspiring crypto traders like myself, where we can explore the intricacies of the market without the fear of losing a single penny.

Mastering The Art Of Trade Execution

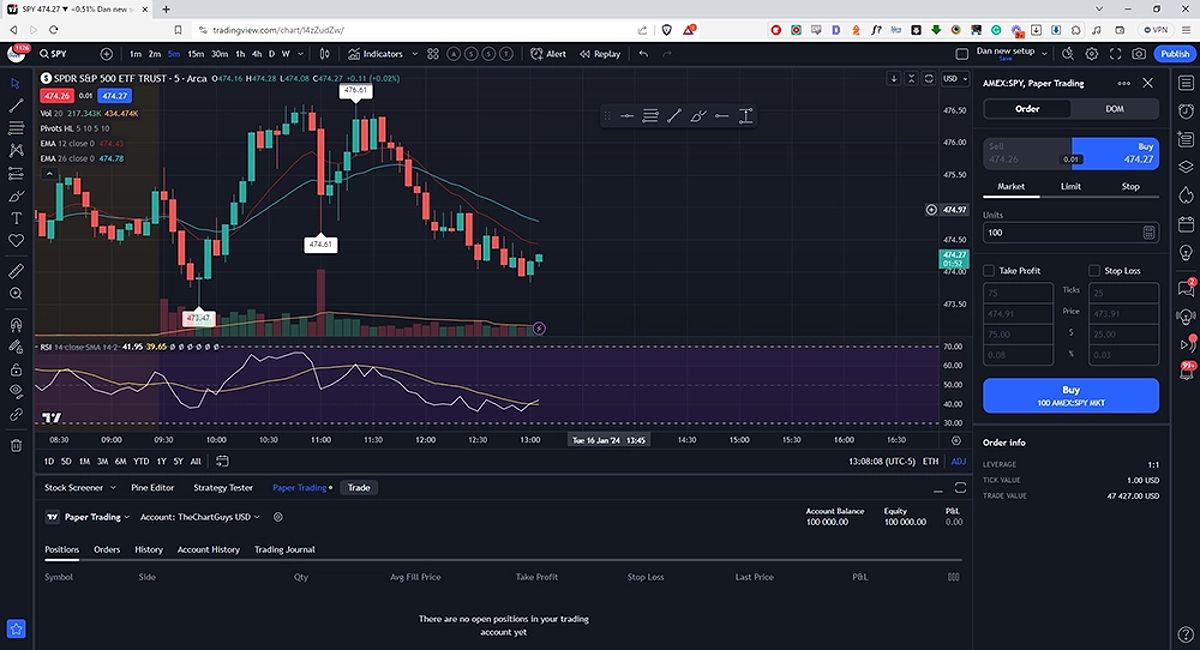

One of the most valuable lessons I’ve learned through paper trading is the art of trade execution. TradingView’s intuitive platform offers a wide array of order types, from market orders to limit orders and stop-loss orders, empowering me to tailor my trading approach to my specific needs and risk tolerance.

TradingView Paper Trading Order Entry

TradingView Paper Trading Order Entry

As I’ve delved deeper into the platform, I’ve discovered the true power of combining these order types to fine-tune my trading strategy. Whether it’s setting take-profit levels or implementing trailing stop-losses, TradingView’s tools have enabled me to develop a robust and disciplined approach to navigating the crypto markets.

Harnessing Tradingviews Analytical Arsenal

But paper trading on TradingView is not just about executing trades — it’s about leveraging the platform’s comprehensive analytical tools to gain a deeper understanding of the market. From customizable charts and technical indicators to advanced scripting capabilities, TradingView has become my command center for unraveling the complexities of the crypto landscape.

TradingView Trading Panel

TradingView Trading Panel

I’ve spent countless hours experimenting with different indicators, testing various trading strategies, and even creating my own custom scripts to identify potential opportunities. This hands-on experience has been invaluable, as it has allowed me to develop a keen eye for market trends and the confidence to make informed trading decisions.

Crafting A Winning Trading Plan

As I’ve progressed in my paper trading journey, I’ve come to realize that success in the crypto markets is not just about executing trades — it’s about developing a comprehensive trading plan that aligns with my investment objectives and risk management strategies.

TradingView’s paper trading feature has been instrumental in this process, allowing me to track my trades, analyze my performance, and make adjustments to my plan as needed. By maintaining a detailed trading journal, I’ve been able to document my thought process, identify areas for improvement, and refine my approach over time.

Integrating With Real-world Trading

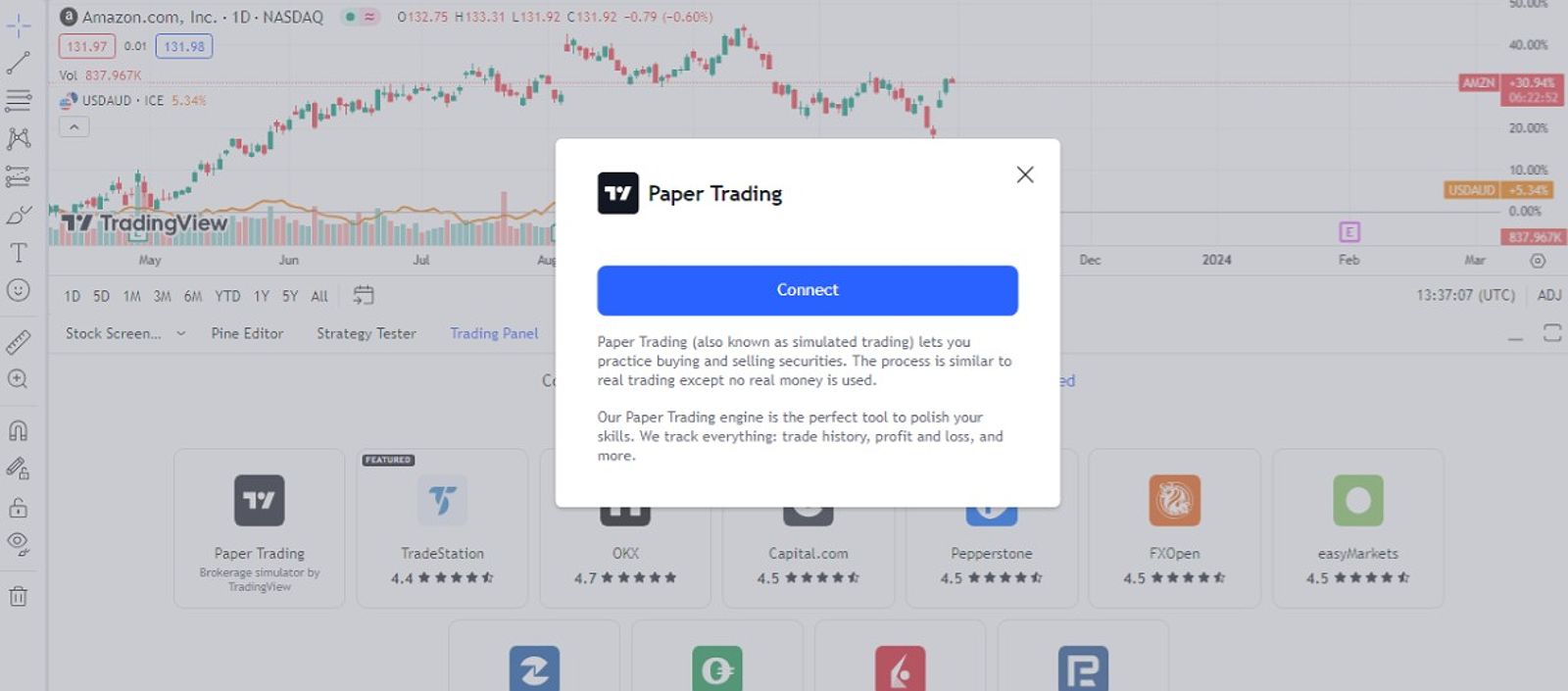

While the thrill of paper trading has been immensely rewarding, I know that the ultimate goal is to transition from the virtual world to the live crypto markets. Fortunately, TradingView has made this transition seamless by offering the ability to integrate my paper trading account with a real brokerage.

Connect Paper Trading Account

Connect Paper Trading Account

By connecting my brokerage account to TradingView, I can now leverage the platform’s powerful tools and analytical capabilities directly within my live trading environment. This integration has allowed me to maintain a consistent workflow and build upon the skills I’ve developed through my paper trading practice.

Embracing Risk Management Strategies

As I’ve gained confidence in my trading abilities through paper trading, I’ve also come to understand the critical importance of effective risk management. TradingView’s platform has provided me with the tools and resources to experiment with various risk management techniques, such as position sizing and stop-loss strategies.

By practicing these techniques in the paper trading environment, I’ve been able to develop a deeper understanding of how to protect my capital and manage my exposure to the inherent volatility of the crypto markets. This knowledge has been invaluable as I’ve transitioned to live trading, giving me the confidence to navigate the ups and downs with a clear and focused mindset.

Mastering Emotional Control

One of the most significant challenges I’ve faced in my crypto trading journey has been the management of my emotions. The rollercoaster ride of the markets can be a powerful force, and it’s easy to let our emotions cloud our judgment and lead us astray.

However, paper trading on TradingView has been a game-changer in this regard. By simulating real-market conditions without the risk of real money, I’ve been able to observe and analyze my own emotional responses to winning and losing trades, market fluctuations, and other triggers. This has allowed me to develop strategies for maintaining a calm and disciplined mindset, which I’ve found to be essential in the high-stakes world of crypto trading.

Conclusion

As I reflect on my journey with TradingView’s paper trading feature, I’m filled with a sense of appreciation and excitement. What started as a tentative exploration of the crypto markets has blossomed into a transformative experience, empowering me to develop the skills, confidence, and discipline required to navigate the ever-changing landscape of digital currencies.

Through the power of simulation and the wealth of analytical tools at my fingertips, I’ve been able to hone my trading strategies, manage risk effectively, and cultivate a calm and focused mindset — all without the burden of real-world consequences. And as I prepare to take the leap into live trading, I know that the lessons I’ve learned through paper trading will be my guiding light, helping me navigate the challenges and seize the opportunities that lie ahead.

Frequently Asked Questions

What is paper trading? Paper trading is a simulated trading environment where you can practice trading without using real money. It allows you to test your strategies, learn from your mistakes, and build confidence before risking actual capital.

How do I set up a TradingView paper trading account? To set up a TradingView paper trading account, simply create a free TradingView account and navigate to the “Paper Trading” section. From there, you can customize your virtual trading account, including the initial balance and commission settings.

What are the benefits of using TradingView paper trading? Some of the key benefits of using TradingView paper trading include the ability to practice trading without risk, access to real-time market data and advanced analytical tools, the opportunity to develop and test trading strategies, and the chance to build confidence and discipline as a trader.

How can I use TradingView paper trading to practice trading cryptocurrencies? TradingView’s paper trading feature allows you to simulate trades on a wide range of cryptocurrency pairs. You can use the platform’s charting tools and technical indicators to analyze market trends, execute trades, and track your performance, all without risking real money.

Can I integrate my TradingView paper trading account with a real broker? Yes, TradingView offers the ability to integrate your paper trading account with a variety of brokers. This allows you to seamlessly transition from paper trading to live trading while leveraging the same analysis and trading tools you’ve become familiar with on the TradingView platform.