As someone deeply immersed in the ever-evolving crypto industry, I”ve witnessed firsthand the rising interest of financial institutions in cryptocurrencies as a new asset class. However, the complexities of securely storing and trading these digital assets can present unique challenges that require a meticulously crafted approach. In this article, I”ll share my insights on the BYOK (Bring Your Own Key) crypto trading platform, exploring the benefits, implementation strategies, and considerations that financial institutions must carefully navigate to ensure secure and compliant crypto trading operations.

What Is A Byok Crypto Trading Platform?

At the heart of the BYOK crypto trading platform lies a fundamental principle of security and control. Unlike traditional crypto trading platforms, where the platform provider manages the encryption keys, BYOK platforms empower financial institutions to generate, store, and manage their own encryption keys, known as Key Encryption Keys (KEKs). This separation of the “lock” (the encryption provided by the platform) and the “key” (the encryption key owned by the institution) is a critical differentiator, as it enhances security and compliance.

BYOK concept

BYOK concept

The key advantages of using a BYOK crypto trading platform for financial institutions are multifaceted. Firstly, by retaining control over their encryption keys, institutions can minimize the risk of data breaches and unauthorized access to their crypto assets, a particularly crucial consideration when handling sensitive financial information. Secondly, the BYOK approach enables financial institutions to demonstrate compliance more effectively, as they can directly manage and audit the encryption key lifecycle, a requirement stipulated by many regulations, such as PCI-DSS and GDPR. Finally, with the institution maintaining ownership of the encryption keys, the risk of vendor lock-in or data loss is significantly reduced, as they can easily migrate their data and assets to a different platform if necessary.

Implementing A Byok Crypto Trading Platform

Implementing a BYOK crypto trading platform is a strategic endeavor that requires a thoughtful and deliberate approach. As an experienced industry observer, I’ve identified several key steps that financial institutions should consider:

Selecting A Byok Platform Provider

The selection of the right BYOK platform provider is crucial. Institutions must carefully evaluate factors such as security, reliability, compliance, and integration capabilities with their existing systems to ensure a seamless and secure implementation.

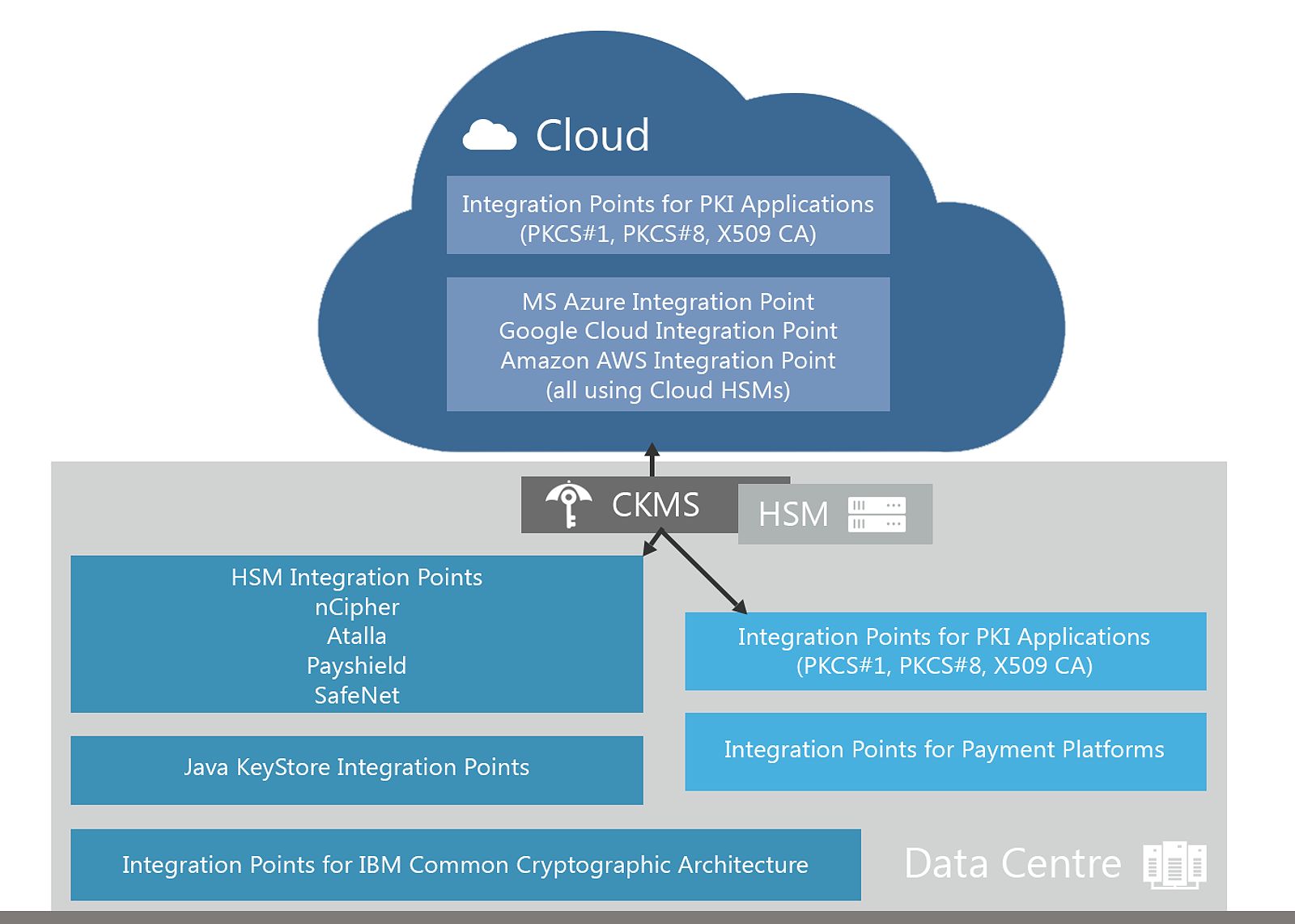

Seamless banking-grade key management

Seamless banking-grade key management

Integrating Encryption Key Management

Seamless integration between the institution’s encryption key management system and the BYOK platform is essential. This process involves ensuring the effective management of the key lifecycle, including key generation, rotation, and revocation.

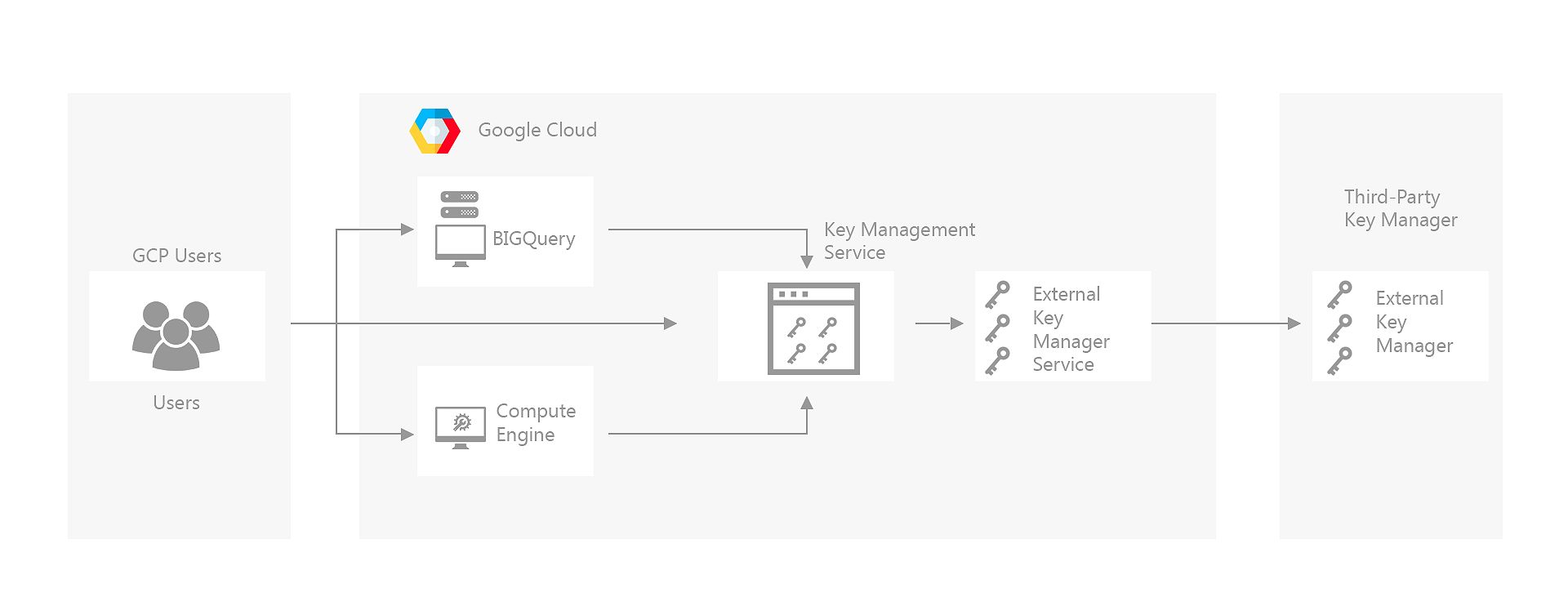

Cloud EKM providing bridge between KMS and External Key Manager

Cloud EKM providing bridge between KMS and External Key Manager

Establishing Secure Key Storage

Secure storage of the encryption keys is a fundamental requirement. Financial institutions can achieve this through the use of Hardware Security Modules (HSMs) or software-based Key Management Systems (KMS), both of which offer robust safeguards for the institution’s sensitive data.

Implementing Robust Processes

To maintain the integrity and traceability of crypto trading activities, financial institutions must develop and implement rigorous processes for key management, access control, and audit logging. These processes ensure the institution’s crypto trading operations adhere to the highest standards of security and compliance.

Training And Continuous Monitoring

Empowering the employees responsible for managing the BYOK platform with comprehensive training is essential. Furthermore, the institution should continuously monitor the platform for any security incidents or compliance issues, proactively addressing them to ensure the ongoing integrity of their crypto trading operations.

Challenges Of Using A Byok Crypto Trading Platform

While the BYOK crypto trading platform offers significant benefits, financial institutions may also encounter certain challenges during its implementation and ongoing management. As an objective observer, I’ve identified three primary areas of concern:

Complexity

Integrating a BYOK platform with existing systems and managing the encryption key lifecycle can be more complex than using a traditional crypto trading platform, requiring specialized expertise and dedicated resources.

Cost

Implementing and maintaining a BYOK platform, including the necessary hardware and software components, may require a higher upfront investment compared to traditional crypto trading platforms.

Operational Overhead

The additional responsibilities of key management and maintenance can increase the operational overhead for the institution, necessitating the allocation of dedicated resources and expertise.

To mitigate these challenges, financial institutions should work closely with their BYOK platform provider, leverage external expertise when necessary, and prioritize the automation and streamlining of key management processes.

Tips For Using A Byok Crypto Trading Platform

Drawing from my in-depth industry knowledge, I’d like to share some practical tips to help financial institutions make the most of their BYOK crypto trading platform:

Develop A Comprehensive Key Management Strategy

Establish clear policies and procedures for key generation, distribution, rotation, backup, and revocation to ensure the security and integrity of the institution’s crypto assets.

Implement Strong Access Controls

Implement robust access controls, multi-factor authentication, and role-based permissions to limit access to the encryption keys and trading platform, effectively mitigating the risk of unauthorized access.

Automate Key Lifecycle Management

Leverage the platform’s automation features to streamline key management tasks, such as scheduled key rotations and backups, reducing the burden on IT and security teams and improving efficiency.

Regularly Review And Update Policies

Continuously review and update the institution’s key management and crypto trading policies to adapt to changes in regulations, security best practices, and the evolving crypto landscape, ensuring the institution remains agile and compliant.

Collaborate With The Byok Platform Provider

Maintain a close working relationship with the BYOK platform provider to stay informed of new features, security updates, and any changes that may impact the institution’s trading operations, facilitating proactive risk management.

Frequently Asked Questions

Q: What are the key benefits of using a BYOK crypto trading platform?

A: The primary benefits of using a BYOK crypto trading platform include increased security, improved compliance, and reduced risk of vendor lock-in or data loss. By retaining control over their encryption keys, financial institutions can minimize the risk of data breaches and unauthorized access to their crypto assets, while also demonstrating compliance more effectively.

Q: How do I choose the right BYOK crypto trading platform provider?

A: When selecting a BYOK platform provider, financial institutions should carefully evaluate factors such as security, reliability, compliance, integration capabilities, and the provider’s track record in the financial services industry. Ensuring a seamless integration with the institution’s existing systems and processes is crucial.

Q: What are the main challenges of implementing a BYOK crypto trading platform?

A: The key challenges of implementing a BYOK crypto trading platform include complexity in integrating the platform with existing systems, the higher upfront investment, and the operational overhead of managing encryption keys and maintaining compliance. Institutions must be prepared to dedicate specialized resources and expertise to address these challenges.

Conclusion

As the crypto industry continues to evolve at a rapid pace, the adoption of BYOK crypto trading platforms has emerged as a critical solution for financial institutions seeking to navigate the complexities of the digital asset market. By maintaining control over their encryption keys, institutions can bolster security, enhance compliance, and mitigate the risks associated with vendor lock-in and data loss.

Through my in-depth reporting and analysis, I’ve provided a comprehensive guide to the BYOK crypto trading platform, highlighting the benefits, implementation strategies, and considerations that financial institutions must carefully weigh. By developing a robust key management strategy, implementing strong access controls, and collaborating closely with their BYOK platform provider, institutions can leverage the power of this innovative technology to strengthen their position in the dynamic crypto trading landscape.

As the crypto industry continues to mature and regulatory frameworks evolve, the importance of BYOK crypto trading platforms will only grow, presenting financial institutions with a strategic opportunity to capitalize on the transformative potential of digital assets while prioritizing security, compliance, and risk management. By navigating this landscape with a thoughtful and proactive approach, institutions can position themselves for long-term success in the rapidly evolving world of crypto trading.