As a self-proclaimed crypto enthusiast, I’ve been closely following the rapid evolution of the digital asset landscape. One strategy that has particularly piqued my interest is margin crypto trading — a powerful tool that allows savvy investors to amplify their gains in the volatile world of cryptocurrencies. In this comprehensive guide, I’ll share my personal insights and experiences on margin crypto trading USA, empowering you to navigate the thrilling world of margin trading.

Unlocking the Power of Leverage in Margin Crypto Trading USA

Picture this: You’ve been eyeing a promising cryptocurrency, and you’re confident it’s poised for a breakout. Rather than committing your entire savings, you can utilize margin trading to control a larger position with a fraction of the capital. This is the beauty of leverage — it enables you to magnify your potential profits, provided you manage the risks carefully.

Let me break down how this works. Margin trading involves borrowing funds from your broker or exchange to increase the size of your trades. For example, let’s say you have $1,000 to invest. By using 2x leverage, you can effectively control a $2,000 position. If the market moves in your favor, your gains are doubled. Of course, the flip side is that losses are also amplified, so it’s crucial to understand the inherent risks.

Navigating the Margin Trading Landscape

As with any investment strategy, margin trading has its fair share of complexities. It’s essential to familiarize yourself with the key concepts, such as initial margin, maintenance margin, and margin calls. Initial margin is the minimum collateral required to open a position, while maintenance margin is the amount you need to keep the trade active. If your position moves against you and your collateral falls below the maintenance level, a margin call will be triggered, requiring you to add more funds to your account.

Failure to meet a margin call can lead to the dreaded liquidation — the exchange closing your position to limit further losses. This is where risk management becomes paramount. Experienced traders often employ stop-loss orders to automatically close their positions when prices reach a certain threshold, protecting their capital.

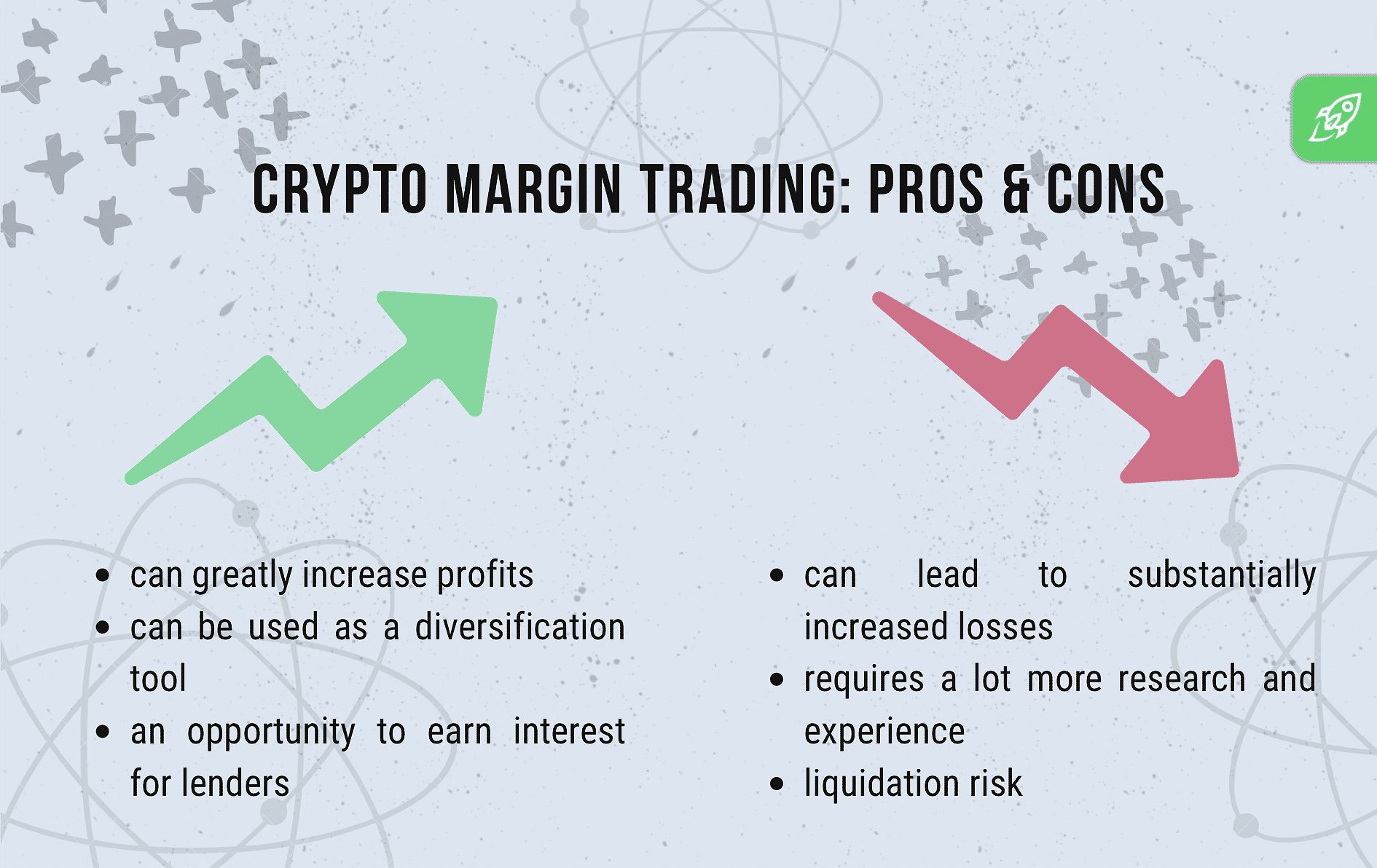

The pros and cons of crypto margin trading

The pros and cons of crypto margin trading

Exploring the Top Margin Trading Platforms in the USA

When it comes to margin crypto trading in the USA, there are several reputable platforms vying for your attention. As someone who has tested the waters myself, I can confidently recommend a few standout options:

Coinbase Pro

As the advanced trading platform of the renowned Coinbase exchange, Coinbase Pro offers a user-friendly interface and support for margin trading with up to 5x leverage on Bitcoin and Ethereum. The platform’s integration with the broader Coinbase ecosystem provides added security and transparency for US-based traders.

Coinbase crypto exchange

Coinbase crypto exchange

Kraken

Kraken is a long-standing player in the crypto space, and it’s also a go-to destination for margin trading. With up to 50x leverage for international users and 3x for US traders, Kraken caters to both beginners and seasoned professionals. The platform’s robust security features and diverse cryptocurrency offerings make it a compelling choice.

Kraken crypto exchange

Kraken crypto exchange

Phemex

Launched in 2019, Phemex has quickly established itself as a leading crypto margin trading platform. Offering up to 100x leverage on select cryptocurrencies, Phemex appeals to traders seeking the ultimate in trading power. While the high leverage may seem tempting, I always advise starting small and gradually increasing as you gain experience.

Maximizing Your Margin Trading Journey

As you embark on your margin trading adventure, I’d like to share a few tips that have served me well:

- Start Small, Grow Gradually: Don’t be lured into the trap of over-leveraging your positions. Begin with modest leverage and increase it incrementally as you become more comfortable with the mechanics and risks.

- Implement Robust Risk Management: Utilize stop-loss orders to limit potential losses and protect your hard-earned capital. Diversify your portfolio across multiple cryptocurrencies to mitigate overall risk.

- Educate Yourself Continuously: Margin trading requires a deep understanding of the underlying concepts. Regularly review educational resources, attend webinars, and connect with experienced traders to enhance your knowledge.

- Practice in a Sandbox Environment: Before putting real money on the line, consider opening a demo account to test your strategies and familiarize yourself with the trading platform.

- Seek Professional Guidance: If you’re unsure about any aspect of margin trading, don’t hesitate to consult with a qualified financial advisor. Their expertise can prove invaluable in navigating this complex landscape.

The Future of Crypto Margin Trading in the USA

As I look ahead to the future of margin crypto trading in the USA, I’m filled with a sense of excitement and optimism. The continuous advancements in the digital asset ecosystem, coupled with the growing mainstream adoption of cryptocurrencies, suggest that the opportunities for savvy traders will only continue to expand.

In fact, according to a recent industry report, the global crypto margin trading market is expected to reach $90 billion by 2024, representing a compound annual growth rate of over 25% from 2019. This surge in popularity is driven by the increasing sophistication of retail investors and the growing recognition of the potential benefits of leverage in cryptocurrency markets.

Moreover, the regulatory landscape for crypto margin trading in the USA is also evolving. In June 2024, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) issued new guidelines aimed at providing clearer oversight and investor protection in this space. This move is expected to foster greater confidence and participation from both individual and institutional investors.

Embracing the Crypto Margin Trading Revolution

As I look ahead, I’m truly excited about the future of margin crypto trading in the USA. The combination of technological advancements, regulatory clarity, and the inherent volatility of the cryptocurrency markets presents a compelling opportunity for those willing to approach it with caution and diligence.

By arming yourself with the knowledge and tools outlined in this guide, you’ll be well-equipped to ride the wave of margin trading and potentially unlock new avenues for wealth creation. Remember, as with any investment strategy, it’s crucial to approach margin trading with caution, discipline, and a keen understanding of the risks involved.

So, my fellow crypto enthusiasts, let’s embark on this thrilling journey together. The potential rewards of margin trading are tantalizing, but the path forward requires diligence, patience, and a commitment to continuous learning. I’m here to support you every step of the way — let’s explore the future of margin crypto trading in the USA and see where it takes us.

FAQ

Q: Is margin crypto trading in the USA legal? A: Yes, margin crypto trading is legal in the USA, but it’s subject to regulations. It’s crucial to use reputable platforms that comply with US laws.

Q: Is margin trading risky? A: Yes, margin trading is inherently risky due to the leverage involved, which amplifies both gains and losses. It’s essential to understand the risks and manage them effectively.

Q: How much leverage should I use? A: Start with low leverage and gradually increase it as you gain experience. Higher leverage can lead to larger profits but also greater losses, so it’s essential to find the right balance for your risk tolerance.

Q: What is a margin call? A: A margin call is a request from the exchange to add more funds to your account to cover potential losses. Failure to meet a margin call can lead to the forced liquidation of your position.

Conclusion

As we wrap up this journey through the world of margin crypto trading in the USA, I hope you’ve gained a deeper understanding of the power and complexities of this strategy. Remember, the path to successful margin trading is paved with careful planning, risk management, and a commitment to continuous learning.

By leveraging the insights and tips shared in this guide, you’ll be well on your way to navigating the exciting world of margin trading. Keep in mind that the crypto markets can be volatile, and margin trading amplifies both the potential rewards and risks. Tread carefully, start small, and never risk more than you can afford to lose.

I’m excited to see where your margin trading journey takes you. As you explore the frontiers of this dynamic field, I encourage you to stay curious, embrace the learning process, and don’t hesitate to reach out if you need any guidance along the way. Together, let’s continue to push the boundaries of what’s possible in the ever-evolving world of cryptocurrency trading.