As an experienced crypto trader, I know all too well the importance of choosing the right trading platform. The crypto landscape is dynamic and ever-evolving, filled with both promising opportunities and potential pitfalls. That’s why I’m on a mission to share the insights I’ve gained over the years, empowering you to navigate this terrain with confidence and make informed decisions about the legit crypto trading platform you trust with your investments.

Essential Criteria for Selecting a Legitimate Crypto Trading Platform

Before we dive into specific platforms, let’s establish the key factors that define a truly legitimate and reliable crypto trading platform. These are the non-negotiables that should guide your search.

Security: The Bedrock of Trust

When it comes to crypto trading, security is the foundation upon which everything else is built. I’ve witnessed firsthand the devastating consequences of lax security measures – hacks, data breaches, and the loss of hard-earned funds. That’s why I prioritize platforms that demonstrate a steadfast commitment to protecting their users.

Look for features like two-factor authentication, cold storage, and robust regulatory compliance. Platforms with a proven track record of safeguarding assets and weathering the evolving threats in the crypto space are the ones worthy of your trust. According to industry data, crypto exchanges have been the target of numerous high-profile hacks, resulting in billions of dollars in lost funds. Prioritizing security is crucial to mitigate these risks and give you peace of mind.

Security

Security

Liquidity: The Lifeblood of Efficient Trading

Liquidity is the heartbeat of any successful trading platform. When you’re executing trades, you want to ensure seamless execution at your desired prices, without significant slippage. Platforms with deep order books and high trading volumes are more likely to provide this level of efficiency, allowing you to enter and exit positions swiftly.

By assessing a platform’s liquidity, you can gauge its ability to facilitate smooth, price-stable transactions. Platforms with robust liquidity tend to offer tighter spreads, faster execution times, and more stable market prices – all of which are essential for implementing your trading strategies effectively.

Trading Fees: Maximizing Your Profitability

The fee structure of a crypto trading platform can have a significant impact on your bottom line. As an experienced trader, I’m acutely aware of how trading fees can erode your profits if not carefully considered. That’s why I always scrutinize the cost of doing business on a platform before committing my capital.

Whether it’s maker/taker fees, flat fees, or tiered fee systems, understanding the nuances of each platform’s pricing model is crucial. Some may offer lower fees for high-volume traders, while others maintain a simple, fixed-fee structure. Identifying the approach that aligns best with your trading style and frequency can help you maximize your returns and minimize the impact of costs on your overall profitability.

Advanced Trading Features: Empowering Your Strategies

As a seasoned crypto trader, I’m always on the lookout for platforms that offer a robust suite of advanced features. These tools can significantly enhance my trading capabilities, allowing me to fine-tune my strategies, manage risk more effectively, and capitalize on market opportunities.

Features like margin trading, futures trading, and sophisticated charting and analysis tools are particularly appealing to me. They provide the flexibility and precision I need to execute my trading plan with confidence. Of course, it’s important to thoroughly understand the pros and cons of each advanced feature and ensure they align with your risk tolerance and trading approach.

Top Legit Crypto Trading Platforms for Experienced Traders

Now that we’ve established the key criteria, let’s explore some of the most reputable crypto trading platforms that cater to experienced investors like myself.

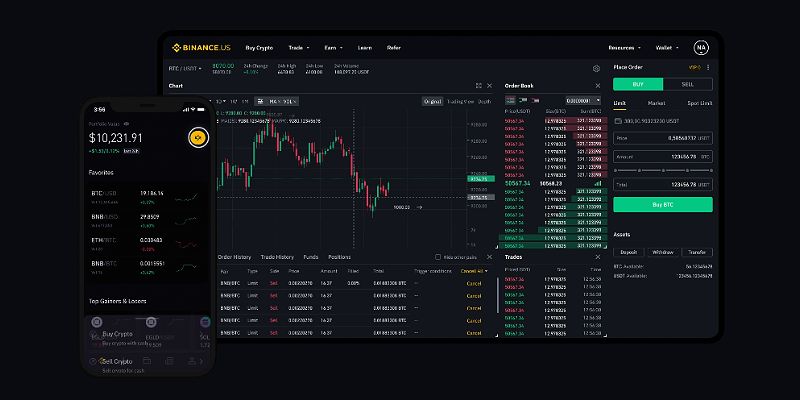

Binance: A Powerhouse with Global Reach

Binance is undoubtedly one of the giants in the crypto trading landscape. As one of the largest exchanges by trading volume, Binance boasts an impressive selection of cryptocurrency pairs, low trading fees, and a wealth of advanced features. Its global presence and massive user base are a testament to its liquidity and the depth of its order books.

However, Binance’s history has not been without its challenges. The platform has faced security concerns in the past and has encountered regulatory scrutiny in certain jurisdictions. While Binance has taken steps to bolster its security measures and compliance efforts, it’s crucial for seasoned traders like myself to closely monitor the platform’s track record and ongoing developments.

Binance

Binance

Kraken: A Veteran’s Choice for Security and Compliance

Kraken is a veteran in the crypto trading arena, known for its unwavering commitment to security and regulatory compliance. As a platform trusted by institutional investors and individual traders alike, Kraken offers a robust set of trading tools, advanced order types, and in-depth market analysis capabilities.

Although Kraken’s interface may be more complex compared to some other exchanges, its focus on safeguarding user assets and maintaining a strong compliance record makes it a popular choice among experienced crypto traders. The platform’s dedication to security and its institutional-grade features cater perfectly to the needs of sophisticated investors like myself.

Bybit: Specializing in Margin and Futures Trading

For traders who prioritize advanced trading features, Bybit stands out as a compelling option. Bybit’s specialization in margin trading and futures trading makes it an attractive platform for seasoned crypto investors seeking to leverage their positions and fine-tune their strategies.

Bybit’s user-friendly interface, high-performance trading engine, and competitive fee structure have earned it a loyal following among experienced traders. While the platform may not offer the same breadth of cryptocurrency pairs as some of its competitors, its focus on catering to the needs of sophisticated investors like myself is a major draw.

Bybit

Bybit

Personalized Guidance for Selecting the Right Crypto Trading Platform

Choosing the ideal crypto trading platform is a highly personal decision, one that must be tailored to your individual trading style, risk tolerance, and investment goals. Here are some tips to help you navigate this process:

Assess Your Trading Preferences

Take the time to honestly evaluate your trading habits, preferred strategies, and risk profile. Are you an active trader seeking platforms with high liquidity and low fees? Or are you a more risk-averse investor who prioritizes robust security features? Understanding your unique needs will be the guiding light in your platform selection journey.

Consider Your Financial Constraints

Carefully scrutinize the fee structures of the platforms you’re evaluating. Evaluate trading fees, deposit/withdrawal charges, and any minimum trade requirements. These costs can have a significant impact on your trading profitability, so it’s essential to find a platform that aligns with your budget and financial goals.

Prioritize Security and Compliance

In the volatile and rapidly evolving crypto landscape, security should be a non-negotiable priority. Research the platforms’ track records, security measures, and regulatory compliance to ensure your assets are safeguarded. Remember, the security of your investments should never be compromised for the sake of convenience or cost savings.

Seek Responsive Customer Support

When navigating the complexities of crypto trading, having access to reliable and responsive customer support can make all the difference. Assess the platforms’ customer service channels, response times, and the breadth of their support offerings. This can prove invaluable in the event of technical issues or market volatility.

Learn from the Experiences of Others

Don’t underestimate the power of reading reviews and testimonials from other traders. Their firsthand experiences can provide invaluable insights into the user experience, security, and overall reputation of the platforms you’re considering. Leverage this collective wisdom to make a more informed decision.

FAQ

Q: What are the primary risks associated with using crypto trading platforms?

A: The primary risks associated with crypto trading platforms include security breaches, fraud, and the highly volatile nature of the cryptocurrency market. Crypto exchanges have been targeted by sophisticated cyber-attacks, resulting in the loss of billions of dollars in user funds. Additionally, the unpredictable price swings in the crypto market can expose traders to significant potential losses.

Q: How can I verify the legitimacy of a crypto trading platform?

A: To verify the legitimacy of a crypto trading platform, look for clear indicators of regulatory compliance, such as licenses and certifications. Additionally, research the platform’s security measures, including its use of advanced encryption, offline storage, and regular security audits. Transparency and a proven track record of safeguarding user assets are crucial in identifying reputable platforms.

Q: What steps can I take to protect myself from scams and fraud?

A: To protect yourself from scams and fraud, be wary of any platform or opportunity that makes unrealistic promises, employs high-pressure sales tactics, or lacks transparency. Conduct thorough research on the platform’s team, history, and online reputation. Legitimate platforms will have a clear and accessible process for verifying your identity and securing your funds.

Conclusion

As an experienced crypto trader, I understand the importance of selecting a legit trading platform that meets your specific needs and preferences. By prioritizing security, liquidity, trading fees, and advanced features, you can navigate the crypto landscape with confidence and maximize your trading success.

The platforms I’ve highlighted in this guide – Binance, Kraken, and Bybit – each offer unique strengths and cater to the diverse needs of seasoned investors. However, your personal trading style, risk tolerance, and financial constraints should be the guiding factors in your platform selection process.

Remember, the crypto market is dynamic and ever-evolving, so it’s crucial to stay vigilant, conduct ongoing research, and adapt your strategies as necessary. By following the criteria and tips outlined in this guide, you’ll be well on your way to finding the most legitimate and reliable crypto trading platform to support your investment goals.

Happy and secure trading!