As an experienced trader in the dynamic world of cryptocurrencies, I”ve been asked this question countless times: Is day trading crypto worth it? It”s a complex query that requires a nuanced response, and I”m eager to share my insights with you.

Fundamentals Of Day Trading Crypto

Let me start by unpacking the fundamentals of day trading crypto. In essence, it involves the rapid buying and selling of digital assets within a single trading day, with the aim of capitalizing on the inherent volatility of the crypto market. This fast-paced approach stands in contrast to long-term cryptocurrency investing, where one might hold onto a digital asset for an extended period.

Now, I know what you’re thinking — the potential for quick profits is undoubtedly enticing. And I won’t deny that I’ve witnessed traders achieve remarkable success in this arena. However, as with any high-risk, high-reward endeavor, day trading crypto also comes with its fair share of challenges and pitfalls.

Identifying Trading Opportunities

One of the key aspects to consider is the ability to identify trading opportunities. This involves a deep understanding of market dynamics, technical analysis, and fundamental factors that can influence the price movements of cryptocurrencies. It’s a skill that requires time, dedication, and a willingness to continuously learn and adapt.

I’ve found that combining various analytical techniques, such as studying candlestick patterns, moving averages, and recognizing support/resistance levels, can provide invaluable insights. Complementing this with an awareness of current news, events, and market sentiment can further enhance one’s ability to identify opportune moments to enter or exit trades.

Day trading price chart

Day trading price chart

Developing A Trading Strategy

Of course, having the right tools and information is only half the battle. Developing a well-defined trading strategy is crucial. Whether it’s scalping, range trading, or breakout trading, each approach requires a unique set of skills and a disciplined mindset. I’ve learned that it’s not enough to simply have a strategy — you need to meticulously align it with your risk tolerance and trading goals.

Risk Management In Day Trading Crypto

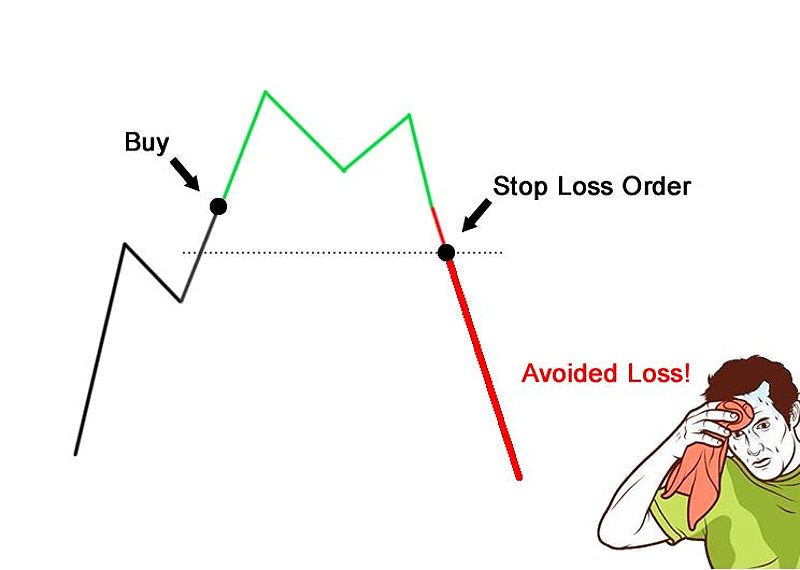

And let’s not forget the importance of risk management. As I mentioned, the crypto market can be highly volatile, and a single misstep can lead to devastating losses. This is where stop-loss orders and proper position sizing come into play. I’ve found that experienced traders typically risk no more than 1% of their total trading capital on a single trade, which helps to mitigate the impact of potential losses.

Challenges And Considerations For Beginners

Now, I know what you’re thinking — this all sounds like a lot of work, and you’re absolutely right. Day trading crypto is not a get-rich-quick scheme, and it requires a significant investment of time, effort, and discipline. It’s a journey that demands patience, resilience, and a willingness to learn from your mistakes.

One of the biggest challenges for beginners in day trading crypto is understanding market dynamics. The crypto market can be highly volatile and unpredictable, with sudden price swings that can catch even the most experienced traders off guard. Developing a deep understanding of the factors that drive these price movements, such as news events, regulatory changes, and investor sentiment, is crucial to identifying profitable trading opportunities.

Another key challenge is managing emotions. Day trading can be an emotional rollercoaster, with the thrill of successful trades quickly followed by the agony of losses. Developing a disciplined trading mindset and learning to control your emotions is essential to making rational, well-informed decisions.

Lastly, building a consistent trading strategy can be a significant hurdle for beginners. There are numerous trading approaches, each with its own set of rules and techniques. Finding the right strategy that aligns with your risk tolerance, trading style, and investment goals can take time and experimentation.

Instructions on how to do day trading

Instructions on how to do day trading

Is Day Trading Crypto Worth It For Beginners?

So, is day trading crypto worth it for beginners? In my experience, the answer isn’t a simple yes or no. It really depends on your individual circumstances, risk tolerance, and investment objectives. If you’re drawn to the excitement of the crypto market and are prepared to put in the hard work, it could be a rewarding venture. However, if you’re looking for a more passive, long-term approach, then a buy-and-hold strategy might be more suitable.

Ultimately, the decision is yours to make. But I can say with certainty that if you do decide to venture into the world of day trading crypto, it’s crucial to approach it with a well-informed and cautious mindset. Continuous education, diligent risk management, and the ability to adapt to market changes will be your key allies on this journey.

Frequently Asked Questions

Q: How much money do I need to start day trading crypto? A: There’s no one-size-fits-all answer to this question, as the amount of capital required can vary depending on your trading strategy and risk tolerance. However, it’s generally recommended to start with a small amount that you can afford to lose while you’re learning the ropes. As you gain experience and confidence, you can gradually increase your trading capital.

Q: Is day trading crypto a good way to make money? A: Day trading crypto can potentially be a lucrative endeavor, but it also carries significant risks. While I’ve witnessed some traders achieve remarkable success, the volatility of the crypto market can also lead to substantial losses. It’s crucial to approach day trading with caution and realistic expectations.

Q: What are the biggest challenges for beginners in day trading crypto? A: In my experience, some of the biggest challenges for beginners in day trading crypto include understanding market dynamics, managing emotions, and developing a consistent trading strategy. It’s essential to approach day trading with patience, diligence, and a willingness to learn from your mistakes.

Conclusion

As I reflect on my journey in the world of cryptocurrency day trading, I can confidently say that it’s a complex and multifaceted endeavor. While the potential rewards can be enticing, the inherent volatility and risks of the crypto market make it crucial to approach this pursuit with a well-informed and disciplined mindset.

Whether day trading crypto is worth it for you ultimately comes down to your personal circumstances, risk tolerance, and investment objectives. If you’re willing to put in the time, effort, and dedication required to develop the necessary skills and risk management strategies, it could be a rewarding journey. However, if you’re more inclined toward a passive, long-term approach, then a buy-and-hold cryptocurrency investment strategy may be a better fit.

Regardless of the path you choose, I encourage you to approach this decision with a clear understanding of the challenges and risks involved. Continuous education, diligent risk management, and the ability to adapt to market changes will be your greatest allies in navigating the dynamic world of cryptocurrency day trading.

Remember, there’s no one-size-fits-all approach, and the decision ultimately rests with you. Take the time to carefully consider your goals, resources, and risk tolerance, and don’t hesitate to seek guidance from experienced traders or industry professionals. With the right mindset and preparation, the world of day trading crypto could open up a world of possibilities.