Institutional crypto trading is rapidly gaining traction as forward-thinking investors seek new avenues for diversification and growth. This article provides a comprehensive guide to institutional crypto trading, covering the key strategies, platforms, and trends that are shaping the future of this dynamic asset class.

Charting The Course Through The Crypto Ecosystem

The cryptocurrency market has undergone a remarkable evolution, captivating the attention of institutional investors seeking new opportunities for growth and diversification. From the pioneering Bitcoin to the innovative Ethereum and an expansive array of altcoins, this multifaceted ecosystem presents a world of possibilities for those willing to navigate its complexities.

Institutional investors approaching the crypto market must develop a deep understanding of the underlying market dynamics. Factors such as supply and demand, regulatory changes, and macroeconomic conditions all play a crucial role in shaping the volatility and liquidity of digital assets. By staying attuned to these market forces, institutions can position themselves to capitalize on the transformative potential of cryptocurrencies.

Crypto market statistics

Crypto market statistics

Mitigating Risks In The Crypto Frontier

The crypto landscape presents a unique set of challenges that institutional investors must address head-on. Heightened market volatility, security concerns, and regulatory uncertainty are just a few of the risks that require a well-structured risk management framework.

To navigate these challenges, institutional investors are implementing diversification strategies, leveraging advanced hedging techniques, and deploying robust security measures. By proactively addressing these risks, they are building resilient crypto trading portfolios that can withstand the dynamic nature of the market.

Charting The Regulatory Landscape

The global regulatory landscape for cryptocurrencies continues to evolve, with varied approaches across different jurisdictions. Institutional investors must stay vigilant and adapt their strategies to ensure compliance with the ever-changing regulatory frameworks.

From anti-money laundering (AML) to know-your-customer (KYC) regulations, institutional investors must navigate the complex legal landscape to maintain the integrity of their crypto trading activities. By collaborating closely with legal and compliance teams, these institutions are positioning themselves to capitalize on the opportunities while mitigating the risks associated with the regulatory environment.

Crypto regulation

Crypto regulation

Embracing The Transformative Potential Of Crypto

The crypto market is a rapidly evolving landscape, with new trends and innovative applications emerging at a dizzying pace. Institutional investors at the forefront of this revolution are exploring the potential of decentralized finance (DeFi) and the rise of non-fungible tokens (NFTs) to enhance their investment strategies and access new sources of yield.

By conducting thorough market research and due diligence, these forward-looking institutions are identifying promising opportunities that align with their investment objectives and risk profiles. From leveraging the power of DeFi platforms to tapping into the growing digital economy through NFTs, institutional investors are positioning themselves to capitalize on the transformative potential of the crypto ecosystem.

Institutional Crypto Trading Platforms: A Key To Unlocking The Market – S Potential

Selecting the right crypto trading platform is a crucial step for institutional investors navigating the crypto landscape. These platforms offer a range of features, including trading execution, liquidity, security, and regulatory compliance, all of which are essential for institutions seeking to execute their investment strategies effectively.

When evaluating potential crypto trading platforms, institutional investors must consider factors such as trading execution speed, order book depth, and the platform’s ability to handle large trade volumes. Security measures, including cold storage, multi-signature wallets, and robust cybersecurity protocols, are also crucial considerations. Regulatory compliance is another essential factor, as institutions must ensure the platform they choose operates within the applicable legal and regulatory frameworks.

By partnering with reputable and well-established crypto trading platforms, institutional investors can access the liquidity and trading capabilities they require to unlock the full potential of the crypto ecosystem. Additionally, these platforms may offer advanced features, such as algorithmic trading, portfolio management tools, and institutional-grade reporting, further enhancing the decision-making capabilities of these forward-thinking investors.

Gemini Exchange

Gemini Exchange

Crafting Tailored Investment Strategies

As the crypto market continues to evolve, institutional investors are leveraging a diverse array of investment strategies to capitalize on the opportunities. From passive indexing to active trading and algorithmic-driven approaches, each strategy offers unique advantages and considerations.

Passive indexing strategies, such as investing in crypto index funds, provide institutional investors with broad exposure to the crypto market while minimizing the risks associated with individual asset selection. Active trading strategies, on the other hand, require a deep understanding of market dynamics and the ability to make timely trading decisions. Algorithmic-driven approaches leverage sophisticated trading algorithms to capitalize on market inefficiencies and execute trades with precision.

By diversifying their crypto investment strategies, institutional investors can enhance their risk-adjusted returns and navigate the complexities of the rapidly evolving crypto landscape. As they explore these various approaches, they must carefully evaluate the risks and potential returns associated with each strategy, ensuring alignment with their investment objectives and risk profiles.

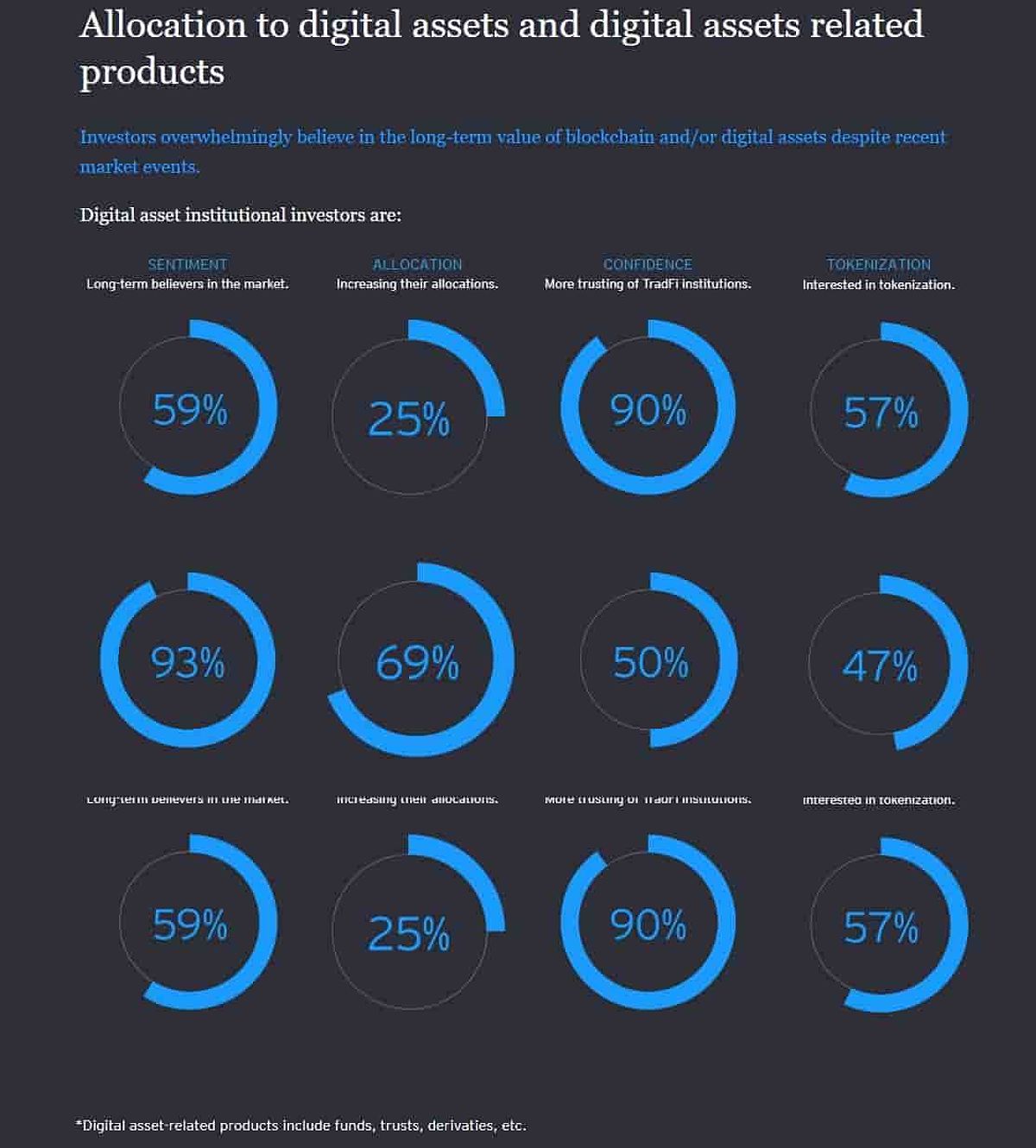

Crypto Institutional Interest

Crypto Institutional Interest

Faqs

What are the key risks to consider when trading cryptocurrencies? The key risks in crypto trading include market volatility, security breaches, and regulatory uncertainty. Institutional investors must implement robust risk management strategies to mitigate these risks and build resilient crypto trading portfolios.

How can institutional investors mitigate risks in crypto trading? Strategies for mitigating risks in crypto trading include diversification, hedging, leveraging advanced risk management tools, and ensuring compliance with regulatory requirements. By proactively addressing these challenges, institutional investors can navigate the crypto landscape with confidence.

What are the emerging trends and opportunities in the crypto market? Emerging trends in the crypto market include the growth of decentralized finance (DeFi) and the rise of non-fungible tokens (NFTs). Institutional investors are exploring these innovative applications to enhance their investment strategies and access new sources of yield.

How can institutional investors select a suitable crypto trading platform? When selecting a crypto trading platform, institutional investors should evaluate factors such as trading execution, liquidity, security, regulatory compliance, and the platform’s reputation and track record. By partnering with reputable and well-established platforms, institutions can unlock the full potential of the crypto ecosystem.

Embracing The Future Of Institutional Crypto Trading

Institutional crypto trading is a rapidly evolving landscape, with new opportunities and challenges emerging all the time. By staying informed, adaptable, and diligent, institutional investors can position themselves at the forefront of this digital revolution and capitalize on the vast potential of the crypto ecosystem.

As the world of finance continues to evolve, the institutional crypto trading landscape stands as a testament to the power of innovation and the boundless opportunities that lie ahead. By embracing this transformative asset class, institutional investors can shape the future of finance and unlock new avenues for growth and prosperity.