The cryptocurrency market continues to be a source of fascination and challenge for investors. Its potential for significant returns and its role at the forefront of financial innovation are undeniable. However, as a beginner, I soon realized that navigating this volatile market can be intimidating, with risks that can quickly erode hard-earned gains.

This changed when I learned about the crucial role of stop-loss orders in how to use stop loss in crypto trading. This powerful tool has revolutionized my approach to crypto trading, allowing me to manage risk, safeguard my investments, and ultimately, gain greater confidence and success in this dynamic market.

Understanding the Essence of Stop Loss

At its core, a stop-loss order is a simple yet effective mechanism that automatically executes a trade when an asset reaches a specific price level. In the context of crypto trading, this means that I can set a predetermined point at which my position will be closed, limiting my potential losses if the market turns against me.

Imagine the crypto market as a turbulent ocean, and your investment as a delicate ship. Without a stop-loss in place, you’re essentially sailing without a life jacket, at the mercy of the unpredictable waves. But with a stop-loss, it’s as if you’ve equipped your vessel with a powerful safety net, allowing you to navigate the choppy waters with a greater sense of security and control.

What is Stop-Loss in Crypto Trading

What is Stop-Loss in Crypto Trading

How to Use Stop Loss in Crypto Trading for Beginners

As a newcomer to the crypto world, I quickly realized that the market’s notorious volatility was a double-edged sword. The potential for rapid and substantial gains was enticing, but it also meant that I was constantly at risk of suffering devastating losses. This emotional rollercoaster can lead to impulsive decision-making, further exacerbating the problem.

That’s where stop-loss orders have become an invaluable ally. By setting these protective measures, I’ve been able to take the guesswork out of risk management, freeing up my mental bandwidth to focus on the long-term growth of my portfolio. Rather than being consumed by the fear of losing it all, I can approach each trade with a clear head, knowing that my downside is capped and my capital is safeguarded.

Mastering the Stop Loss Setup

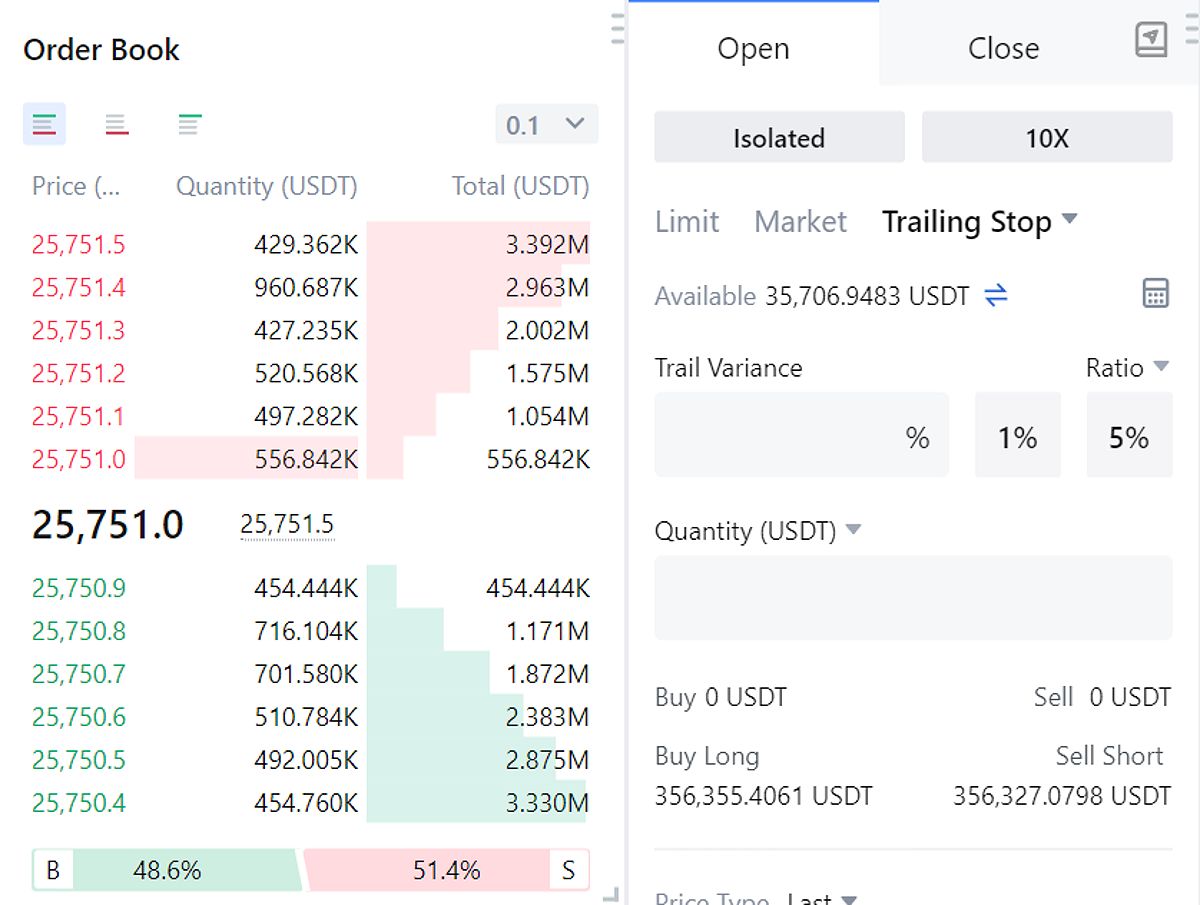

Getting started with stop-loss orders is a straightforward process, and most leading cryptocurrency exchanges, such as Binance, Coinbase, and PrimeXBT, offer this feature as part of their trading platforms.

When placing a buy or sell order, you’ll typically find an option to set a stop-loss price. This is the level at which your position will be automatically closed, effectively limiting your potential losses. You can choose between a market order, which will execute the trade at the current market price, or a limit order, which will only execute at your specified stop-loss price or better.

As a beginner, I found it helpful to start with a stop-loss set at around 5-10% below my entry price. This provided a reasonable buffer to account for normal market fluctuations while still protecting my capital. Of course, as I gained more experience, I began to fine-tune my stop-loss levels based on factors such as the cryptocurrency’s volatility, my risk tolerance, and my overall trading strategy.

Avoiding Common Pitfalls

In my early days of crypto trading, I made my fair share of mistakes when it came to utilizing stop-loss orders. One common pitfall was setting the stop-loss too tight, resulting in premature exits from potentially profitable trades. Conversely, I also learned the hard way about the dangers of setting the stop-loss too wide, exposing myself to far greater losses than necessary.

Another critical mistake I made was the temptation to ignore the stop-loss altogether, succumbing to the allure of potential gains and disregarding the risks. This proved to be a costly lesson, as I witnessed my portfolio dwindle due to unexpected market swings.

Harnessing the Power of Stop Loss Best Practices

As I’ve grown more proficient in crypto trading, I’ve discovered a range of best practices to optimize the effectiveness of my stop-loss strategy:

- Regularly Review and Adjust: I make it a habit to closely monitor market conditions and adjust my stop-loss levels accordingly. As the crypto landscape evolves, my stop-loss may need to be updated to maintain optimal protection.

Best Stop Loss Strategy: 7 Proven Techniques for Crypto Success 2

Best Stop Loss Strategy: 7 Proven Techniques for Crypto Success 2

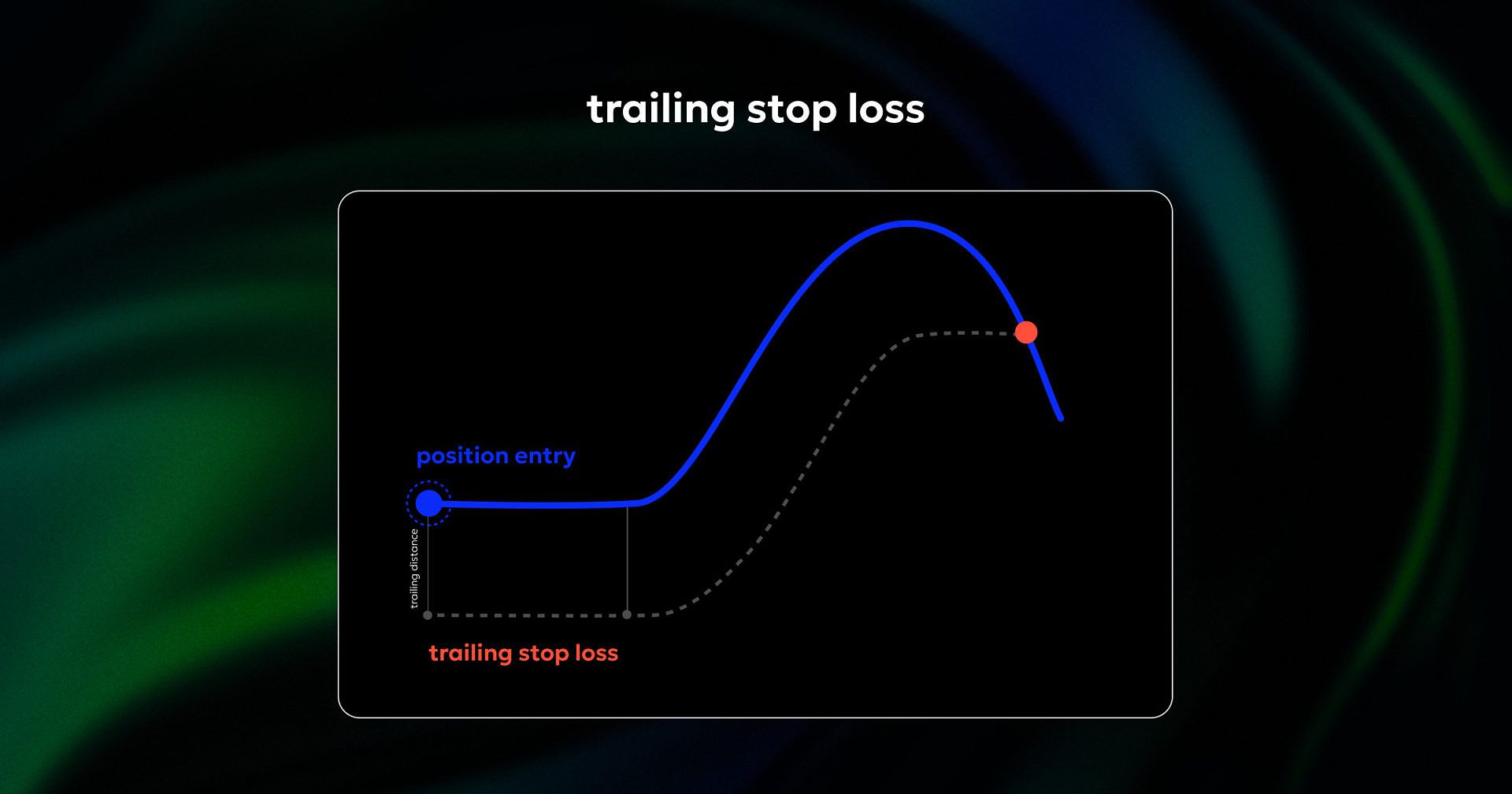

- Utilize Trailing Stop Loss: Some platforms offer a “trailing stop-loss” feature, which automatically adjusts the stop-loss level as the price moves in my favor. This allows me to capture more profits while still safeguarding my gains.

Trailing stop loss order

Trailing stop loss order

- Embrace Emotional Mastery: I’ve learned to recognize and manage the powerful emotions that can arise during volatile market conditions. By practicing mindfulness, sticking to my trading plan, and seeking support from like-minded traders, I’ve been able to make more informed and less impulsive decisions.

- Start Small, Experiment, and Grow: When testing my stop-loss strategies, I always begin with a small amount of capital. This allows me to refine my approach and build confidence without risking significant losses. As I become more experienced, I can gradually expand my position sizes and explore more advanced stop-loss techniques.

Unlocking the Next Level of Crypto Trading

As I’ve delved deeper into the world of crypto trading, I’ve discovered that the stop-loss order is just the beginning of a robust risk management arsenal. Seasoned traders often employ more sophisticated strategies, such as using multiple stop-loss levels for a single position or combining stop-loss with take-profit orders.

While I’m still on my journey to mastering these advanced techniques, I can confidently say that the stop-loss order has been a game-changer in my crypto trading journey. It has provided me with the confidence and the tools to navigate the volatile crypto market, allowing me to focus on long-term growth and the exciting potential of this rapidly evolving asset class.

FAQ

Q: What happens if the price gaps down and skips my stop-loss order?

A: While price gaps can occur in the crypto market, leading to orders being executed at a less favorable price, this is relatively less common compared to traditional financial markets. Crypto exchanges generally have mechanisms in place to mitigate the impact of sudden price movements, and I’ve found that the likelihood of a stop-loss being skipped is relatively low.

Q: Should I use a stop-loss for every trade?

A: Absolutely! As a crypto trader, I firmly believe that using a stop-loss order for every trade is crucial, especially when I’m unsure about the market’s direction. Stop-loss orders have become an integral part of my risk management strategy, helping me protect my capital and navigate the volatile crypto landscape with confidence.

Q: Can I set multiple stop-loss orders for the same trade?

A: Yes, many crypto trading platforms do allow you to set multiple stop-loss levels for a single trade. This can be a highly effective strategy, as it enables me to optimize my risk management by having different stop-loss triggers at various price points. It’s a technique I’ve explored and found to be quite useful in managing my exposure and capturing potential gains.

Unlocking the Potential of Crypto Trading

As I reflect on my journey in the crypto realm, I’m grateful for the transformative power of stop-loss orders. These simple yet powerful tools have been instrumental in helping me navigate the volatile and dynamic crypto market, allowing me to manage risk, protect my investments, and ultimately, achieve greater success in my trading endeavors.

Looking ahead to the future, I’m excited to continue exploring the vast potential of crypto trading and the ever-evolving strategies and techniques that can help me unlock even greater opportunities. With stop-loss orders as a cornerstone of my risk management approach, I feel empowered to embrace the challenges and seize the exciting possibilities that the crypto world has to offer.

So, whether you’re a seasoned crypto trader or a newcomer to this captivating space, I encourage you to embrace the power of stop-loss orders and make them an integral part of your trading toolkit. By doing so, you’ll not only safeguard your investments but also unlock the confidence and clarity needed to thrive in the ever-changing landscape of cryptocurrency.