Hong Kong has emerged as a thriving hub for crypto trading, offering a robust regulatory framework, a growing number of licensed exchanges, and a diverse range of digital assets for investment. This article provides a comprehensive guide to the Hong Kong crypto trading landscape, covering regulatory environment, exchange options, investment strategies, tax implications, and tips for success.

Hong Kong Crypto Trading: Regulatory Framework And Overview

The key advantage of the Hong Kong crypto market is its well-defined regulatory environment. The city’s financial watchdog, the Securities and Futures Commission (SFC), has implemented a comprehensive licensing regime for Virtual Asset Service Providers (VASPs), ensuring that licensed exchanges adhere to strict anti-money laundering and counter-financing of terrorism (AML/CFT) standards. This regulatory framework not only provides investors with a secure trading environment but also instills confidence in the long-term sustainability of the crypto industry in Hong Kong.

Hong Kong crypto regulation

Hong Kong crypto regulation

The SFC’s proactive approach to crypto regulation has set Hong Kong apart from other jurisdictions, as it aims to strike a balance between fostering innovation and protecting investors. By establishing clear guidelines and requirements for crypto exchanges, the SFC has created a conducive environment for the growth of the digital asset market, while also safeguarding the interests of retail and institutional investors.

As of May 2024, Hong Kong’s crypto landscape is thriving, with over 20 licensed exchanges catering to the needs of both seasoned traders and newcomers. This growth has been driven by the city’s forward-thinking approach to financial innovation, which has made it an attractive destination for crypto enthusiasts and investors alike.

Navigating The Crypto Exchange Landscape In Hong Kong

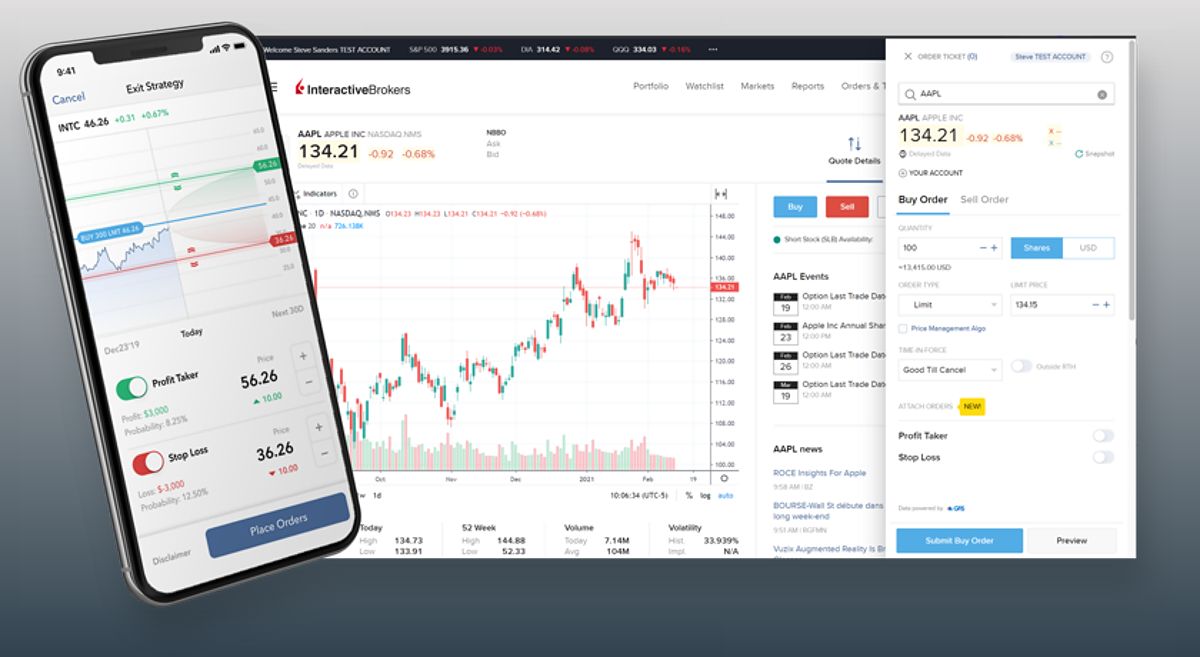

When it comes to choosing a crypto exchange in Hong Kong, investors have a range of licensed and reputable options to consider. Factors such as security, trading fees, customer support, and the breadth of digital assets offered are crucial in the decision-making process. Renowned exchanges like Crypto.com, Coinbase, and Huobi have established a strong presence in the Hong Kong market, providing investors with a secure and user-friendly trading experience.

Crypto.com exchange

Crypto.com exchange

In addition to the well-known global players, Hong Kong is also home to a number of locally-based crypto exchanges that have gained the trust of the investment community. These exchanges, such as TideBit and iBTC, offer a deep understanding of the local market dynamics and cater to the specific needs of Hong Kong-based investors.

One of the key advantages of the Hong Kong crypto market is the wide range of digital assets available for trading, including the industry’s frontrunners, Bitcoin and Ethereum, as well as a diverse array of promising altcoins. This variety allows investors to build a well-diversified crypto portfolio that aligns with their risk appetite and investment objectives.

Cryptocurrencies

Cryptocurrencies

Investment Strategies And Opportunities In Hong Kongs Crypto Market

When it comes to investment strategies, Hong Kong-based traders can explore various approaches, including long-term holding, active trading, and even crypto-based lending and borrowing. The city’s regulatory framework and the presence of licensed exchanges provide investors with the necessary infrastructure to engage in these activities safely and compliantly.

For those seeking to capitalize on the growth potential of the crypto market, Hong Kong offers a range of opportunities. Investors can explore the potential of emerging blockchain-based projects, invest in decentralized finance (DeFi) protocols, or even participate in the thriving non-fungible token (NFT) ecosystem. However, it is crucial to thoroughly research and understand the risks associated with each investment before committing capital.

DeFi and NFT opportunities

DeFi and NFT opportunities

One popular strategy among Hong Kong-based investors is to build a diversified crypto portfolio that includes a mix of well-established cryptocurrencies and promising altcoins. This approach can help mitigate risk and potentially capitalize on the growth of the overall crypto market.

Tax Implications Of Crypto Trading In Hong Kong

One of the most attractive aspects of Hong Kong’s crypto landscape is the tax treatment of digital assets. Unlike many other jurisdictions, Hong Kong does not levy a capital gains tax on cryptocurrency investments. This favorable tax environment has made the city an appealing destination for crypto traders and investors seeking to maximize their returns.

However, it is important to note that profits derived from regular crypto trading activities are subject to income tax. Investors are responsible for accurately reporting their crypto-related earnings to the Inland Revenue Department (IRD) and ensuring compliance with the relevant tax regulations.

This favorable tax treatment, combined with the city’s robust regulatory framework and growing crypto ecosystem, has made Hong Kong a compelling destination for crypto investors looking to optimize their returns and minimize their tax liabilities.

Hong Kong crypto taxation

Hong Kong crypto taxation

Tips For Navigating The Hong Kong Crypto Market

Navigating the Hong Kong crypto market requires a cautious and informed approach. Investors are advised to thoroughly research the digital assets, understand the associated risks, and start with a manageable investment size. Diversifying one’s portfolio across different cryptocurrencies and maintaining a disciplined risk management strategy are also crucial to achieving long-term success.

Additionally, staying up-to-date with the latest regulatory developments and industry trends can help investors make informed decisions and capitalize on emerging opportunities in the Hong Kong crypto market. This may involve regularly monitoring news sources, attending industry events, and networking with other crypto enthusiasts in the Hong Kong community.

One key piece of advice for investors is to exercise patience and discipline when navigating the Hong Kong crypto market. The digital asset industry can be volatile, and it’s essential to avoid making impulsive decisions based on short-term market fluctuations. By taking a long-term, well-informed approach, investors can navigate the Hong Kong crypto landscape with greater confidence and achieve their investment goals.

Faq

Is crypto trading legal in Hong Kong? Yes, crypto trading is legal in Hong Kong, provided that it is conducted through licensed exchanges that comply with the regulatory framework established by the Securities and Futures Commission (SFC).

How do I choose a reputable crypto exchange in Hong Kong? When selecting a crypto exchange in Hong Kong, consider factors such as security, trading fees, customer support, the breadth of digital assets offered, and the exchange’s compliance with SFC licensing requirements. Reputation, transparency, and a track record of reliability are also important considerations.

What are the tax implications of crypto trading in Hong Kong? There is no capital gains tax on cryptocurrency investments in Hong Kong. However, profits from regular crypto trading activities are subject to income tax, and investors must report their earnings to the Inland Revenue Department (IRD).

Conclusion: Unlocking The Potential Of Hong Kongs Crypto Trading Ecosystem

In conclusion, Hong Kong’s crypto trading landscape offers a compelling opportunity for investors seeking to diversify their portfolios and capitalize on the growth of the digital asset market. With its well-defined regulatory framework, range of licensed exchanges, and favorable tax treatment, the city has established itself as a premier destination for crypto trading.

By understanding the market dynamics, navigating the regulatory landscape, and employing sound investment strategies, investors can unlock the full potential of Hong Kong’s crypto trading ecosystem. Whether seeking long-term growth or active trading opportunities, the city’s crypto market presents a wealth of possibilities for those willing to explore this exciting frontier of finance.

As the crypto industry continues to evolve and expand, Hong Kong’s position as a crypto hub is likely to strengthen, solidifying its status as a leading global center for digital asset investment and innovation. For those seeking to capitalize on the future of finance, Hong Kong’s thriving crypto landscape presents a compelling case for exploration and investment.