As an avid crypto trader, I’ve always been fascinated by the potential of high-frequency trading (HFT) in the ever-evolving digital currency landscape. In the fast-paced world of cryptocurrency, where trillions of dollars in annual transactions are the norm, the ability to seize fleeting opportunities and capitalize on price fluctuations can mean the difference between success and stagnation.

In this in-depth exploration, I’ll delve into the intricacies of high-frequency crypto trading, revealing the top strategies, essential platform considerations, and valuable insights to help you navigate this thrilling, yet challenging, realm.

What is High Frequency Crypto Trading?

High-frequency crypto trading is a sophisticated trading approach that leverages advanced algorithms and cutting-edge technology to analyze market data and execute trades at lightning-fast speeds, often within milliseconds. By harnessing the power of these lightning-fast algorithms, traders can identify and act on even the smallest price discrepancies, generating substantial profits in the ever-changing crypto ecosystem.

The key advantages of high-frequency crypto trading include:

- Faster Order Execution: HFT algorithms can react to market changes and place trades much more quickly than manual traders, enabling them to seize fleeting opportunities.

- Lower Latency: HFT platforms are designed with low-latency infrastructure, ensuring that data and trade execution are processed with minimal delays.

- Exploiting Price Inefficiencies: HFT traders can identify and capitalize on small price differences across exchanges, generating profits from these market inefficiencies.

- Increased Trading Volume: By executing a high volume of trades rapidly, HFT traders can accumulate modest gains over time, resulting in substantial profits.

Best high frequency trading firms

Best high frequency trading firms

Top HFT Strategies for Crypto Traders

In the dynamic world of high-frequency crypto trading, several strategies have emerged as particularly effective. Let’s explore the most prominent HFT approaches:

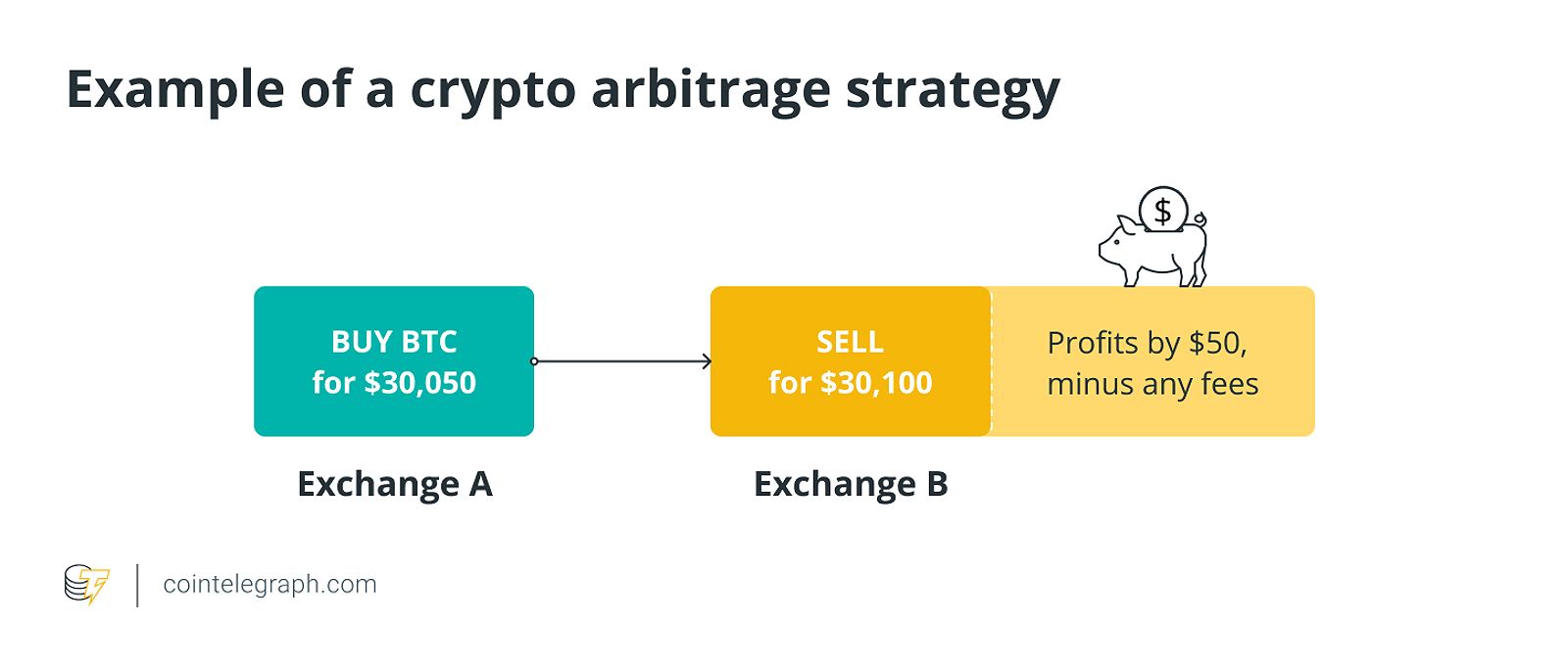

Arbitrage

Arbitrage is the practice of taking advantage of price differences for the same cryptocurrency across multiple exchanges. By rapidly identifying and executing trades to exploit these discrepancies, HFT traders can lock in small but consistent profits.

The speed and precision of HFT algorithms are crucial in the fast-paced world of crypto arbitrage, as the window of opportunity can be fleeting. HFT platforms with low latency, advanced order types, and smart order routing capabilities are essential for traders seeking to maximize their arbitrage profits.

Example of a crypto arbitrage strategy

Example of a crypto arbitrage strategy

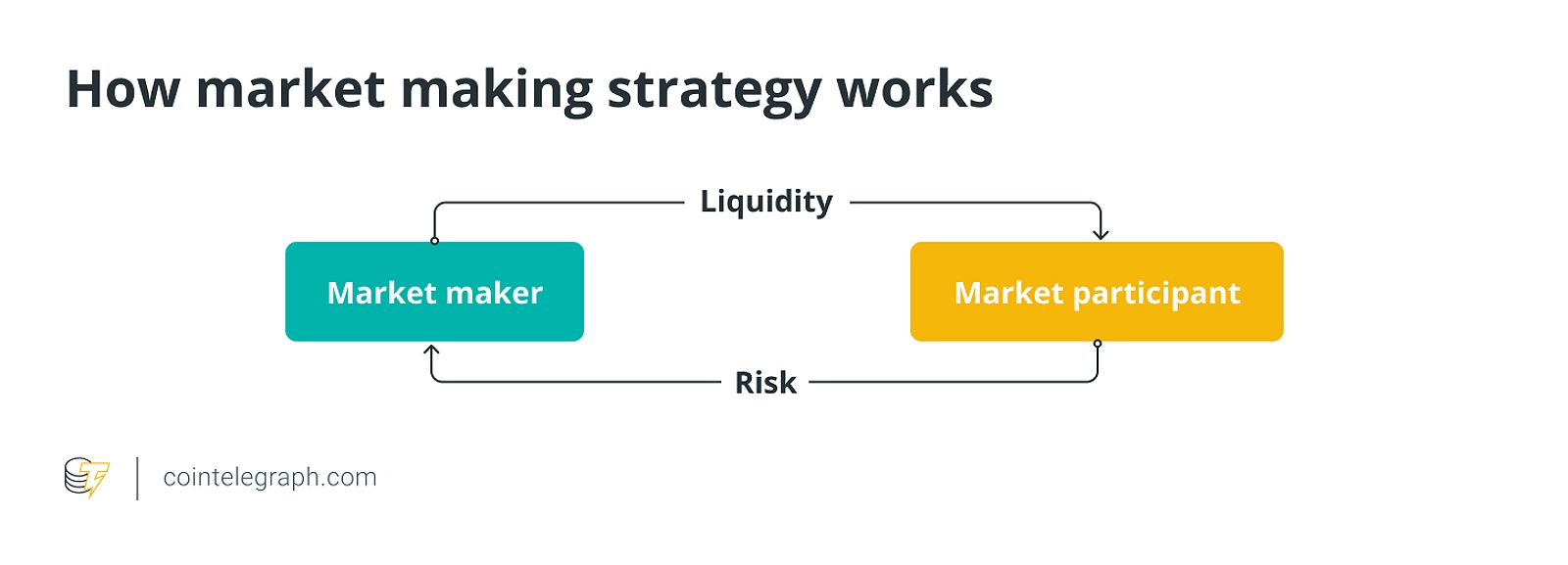

Market Making

Market makers play a vital role in providing liquidity to the crypto market. By consistently posting buy and sell orders at competitive prices, they ensure a steady flow of trading opportunities. High-frequency trading strategies can enhance market-making operations by rapidly adjusting bid-ask spreads in response to changing market conditions, allowing traders to capture profits from the bid-ask spread.

HFT platforms designed for market making often feature advanced order management tools, real-time data analytics, and smart order routing functionalities, empowering traders to optimize their market-making activities.

How market making strategy works

How market making strategy works

Volume Trading

Volume trading involves analyzing the trading volume of cryptocurrencies to identify market trends and opportunities. HFT strategies can be employed to capitalize on changes in liquidity, executing trades at optimal moments to maximize profits.

By leveraging real-time data and sophisticated algorithms, HFT traders can quickly respond to fluctuations in trading volume, enabling them to enter and exit positions with precision and efficiency.

Choosing the Right High-Frequency Crypto Trading Platform

As I’ve delved deeper into the world of high-frequency crypto trading, I’ve come to appreciate the critical importance of selecting the right platform. When evaluating potential HFT platforms, I focus on the following key factors:

- Execution Speed: The platform must offer low-latency execution, ensuring that my trades are processed in milliseconds or even microseconds.

- Order Types: Comprehensive support for advanced order types, such as limit orders, market orders, and algorithmic order types, is essential for implementing my trading strategies effectively.

- Data Feeds: Access to high-quality, real-time market data is a non-negotiable requirement, as it fuels the decision-making process of my HFT algorithms.

- Risk Management Tools: Effective risk management is paramount in the world of high-frequency trading. I prioritize platforms that provide robust risk management features, including stop-loss orders and position limits.

- Stability and Security: Reliability and security are crucial, as I need to trust that my assets and trading activities are safeguarded.

- Scalability: As my trading volume and strategy complexity grow, I must ensure that the platform can seamlessly scale to accommodate my evolving needs.

By carefully evaluating these factors, I’ve been able to identify the HFT platform that best aligns with my trading goals and risk tolerance, empowering me to navigate the crypto markets with confidence and precision.

Risks and Considerations for High-Frequency Crypto Trading

While the potential rewards of high-frequency crypto trading are undeniable, it’s essential to recognize the inherent risks and challenges that come with this approach. As I’ve navigated this dynamic landscape, I’ve become acutely aware of the following key considerations:

- Market Volatility: The crypto market is renowned for its high volatility, which can pose significant challenges for HFT strategies that rely on small, consistent price movements.

- Regulatory Landscape: The regulatory environment surrounding HFT in the crypto space is continuously evolving, and I must remain vigilant to ensure my trading activities comply with any changes.

- Liquidity Concerns: Sudden changes in market liquidity can disrupt HFT strategies, leading to unexpected losses. Effective risk management is crucial to mitigate these risks.

- Technology Failures: Reliance on advanced technology means that any system failures or software glitches can have severe consequences for HFT traders.

- Potential for Market Manipulation: There are ongoing concerns that HFT strategies could be used to manipulate crypto markets, potentially drawing increased regulatory scrutiny.

To navigate these risks successfully, I’ve developed a comprehensive understanding of the crypto market, implemented robust risk management protocols, and partnered with reputable and reliable HFT platforms. Maintaining a vigilant and proactive approach is the key to thriving in this fast-paced, high-stakes environment.

Featured image

Featured image

Tips for Success in High-Frequency Crypto Trading

As I’ve honed my skills in the world of high-frequency crypto trading, I’ve learned invaluable lessons that have contributed to my success. Here are the top tips I would share with fellow traders seeking to excel in this dynamic field:

- Develop a Deep Understanding of the Crypto Market: Familiarizing myself with market trends, trading volumes, and the factors that drive price movements in the crypto ecosystem has been instrumental in informing my trading strategies.

- Implement Robust Risk Management Strategies: Establishing clear risk tolerance limits, utilizing stop-loss orders, and continuously monitoring my trading activities have been essential in mitigating potential losses.

- Choose the Right HFT Platform: Carefully researching and evaluating various HFT platforms has allowed me to find the one that best suits my trading needs, risk profile, and technological requirements.

- Stay Informed About Regulatory Changes: Staying up-to-date on the evolving regulatory landscape surrounding HFT in the crypto market has enabled me to adapt my strategies accordingly and ensure compliance.

- Continuously Refine Your Strategies: Regularly reviewing the performance of my HFT strategies, analyzing market data, and making adjustments has been key to optimizing my trading approach over time.

By following these best practices, I’ve been able to navigate the fast-paced world of high-frequency crypto trading with confidence, capitalizing on the opportunities this dynamic market presents.

FAQ

Q: Is high-frequency trading legal in the crypto market? A: While HFT is generally legal, there are regulatory considerations, particularly regarding market manipulation and insider trading. Traders must stay informed about the evolving regulatory landscape and ensure their strategies comply with applicable laws and regulations.

Q: What are the best high-frequency crypto trading platforms? A: Some popular HFT platforms for the crypto market include Autowhale, Virtu Financial, Tower Research Capital, and Hudson River Trading. However, it’s crucial to research and choose a platform that suits your specific trading needs and risk tolerance.

Q: How fast are high-frequency trading algorithms? A: HFT algorithms can execute trades in milliseconds or even microseconds, depending on the platform and technology used. The speed of these algorithms is a key factor in their ability to capitalize on fleeting market opportunities.

Q: Is high-frequency trading suitable for all traders? A: High-frequency trading requires significant technical expertise, financial resources, and a deep understanding of the crypto market. It may not be suitable for all traders, especially those with limited experience or risk tolerance. Careful evaluation of your trading goals and capabilities is essential before pursuing HFT strategies.

Conclusion

As I’ve immersed myself in the world of high-frequency crypto trading, I’ve come to appreciate the power and potential of this sophisticated approach. By leveraging advanced algorithms, cutting-edge technology, and lightning-fast execution, I’ve been able to navigate the ever-changing crypto landscape with greater agility and precision, capitalizing on even the smallest price discrepancies to generate consistent profits.

However, this journey has not been without its challenges. The inherent risks and regulatory considerations associated with high-frequency trading demand a steadfast commitment to risk management, technological prowess, and a deep understanding of the crypto market. By carefully selecting the right HFT platform, implementing robust strategies, and staying vigilant about the evolving landscape, I’ve been able to navigate these obstacles and thrive in this fast-paced, high-stakes environment.

As you embark on your own high-frequency crypto trading journey, I encourage you to approach it with a combination of diligence, adaptability, and an unwavering commitment to your goals. By doing so, you’ll be well-positioned to seize the opportunities that this dynamic market has to offer and achieve the success you’ve been seeking.