Imagine a world where the demand for wireless connectivity is met not through energy-intensive cellular towers but through a decentralized network that thrives on low power consumption. Helium mining is paving the way for this vision, merging ecological responsibility with the potential for financial gain. This article aims to dissect the viability of Helium mining as both a sustainable investment and a profitable venture.

Understanding Helium Mining: The Backbone of a Decentralized Network

At its core, Helium mining is anchored in a decentralized network that provides long-range wireless connectivity tailored for Internet of Things (IoT) devices. This innovative approach contrasts sharply with traditional cellular infrastructures, which require extensive, energy-draining setups. Instead, Helium employs a network of small, low-power hotspots, each operated by individual miners. This distributed model not only curtails the environmental repercussions typically associated with large-scale wireless networks but also enhances resilience by eliminating single points of failure.

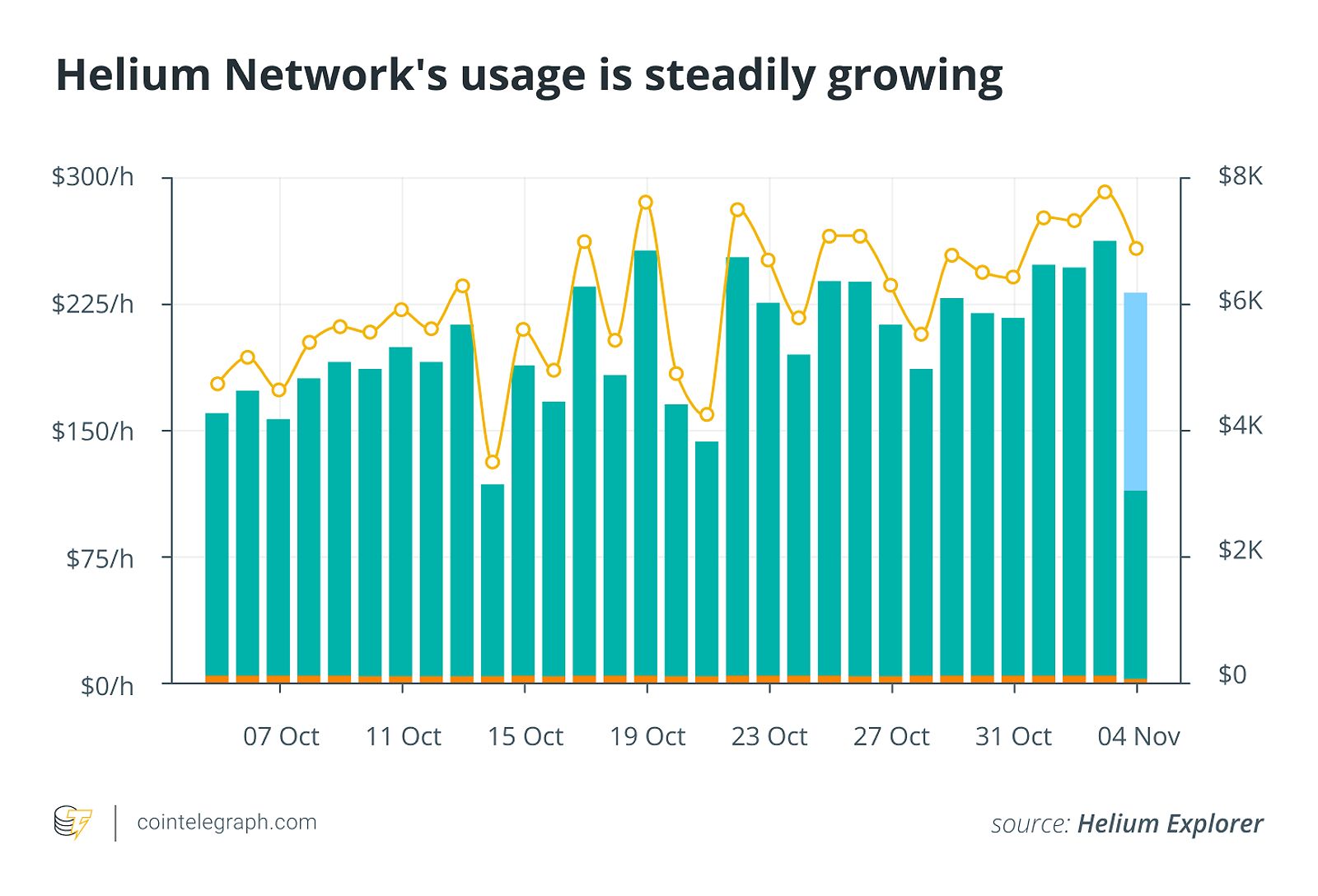

The key differentiator of Helium hotspots is their remarkably low energy consumption. Compared to traditional cell towers, these hotspots consume significantly less power, thereby producing a much smaller carbon footprint. In an era where climate change looms large, this reduction in energy usage is particularly critical. Furthermore, the Helium network dynamically adapts to varying demand, intelligently adjusting power consumption based on real-time network activity.

Financial Considerations and Environmental Accountability: A Dual Perspective

The financial framework of Helium mining revolves around the HNT token, a cryptocurrency that rewards miners for their contributions to network coverage. Like any cryptocurrency, the value of HNT is subject to fluctuations, introducing an element of market volatility that can impact profitability. Factors such as the density of IoT devices in a given area, the level of competition among miners, and the prevailing market price of HNT all play pivotal roles in determining earnings. In optimal conditions—high HNT prices, a dense network of IoT devices, and minimal competition—miners can reap substantial rewards. Conversely, unfavorable conditions can lead to little or no profit.

While the allure of financial gain is evident, it is essential for investors to remain cognizant of the risks inherent in the cryptocurrency landscape. Profitability in Helium mining is far from assured; market fluctuations can dramatically influence returns. A thorough risk assessment that encompasses initial investments, ongoing operating costs, and the unpredictable nature of crypto markets is imperative. By juxtaposing Helium mining with other environmentally sound investment avenues, such as renewable energy projects, investors can better navigate the potential risks and rewards. Calculating the expected return on investment (ROI) involves a careful examination of all costs and revenue possibilities, which is crucial for informed decision-making.

Long-Term Sustainability of Helium Mining and Its Environmental Implications

The sustainability of Helium mining hinges on several pivotal factors. A critical element is the ongoing expansion of the IoT market. As the number of IoT devices requiring connectivity continues to surge, so too does the demand for Helium network coverage, which could drive up HNT prices and miner rewards. However, an overcrowded network in urban areas may pose challenges for new miners, necessitating strategic hotspot placement in less saturated regions. Additionally, advancements in hotspot technology and network protocols can further enhance efficiency and diminish energy consumption.

Helium mining holds considerable promise for contributing to sustainable development objectives. Its low-power operation and decentralized framework can mitigate the environmental effects of wireless communications. Beyond mere connectivity, Helium’s applications encompass vital areas such as environmental monitoring and smart agriculture, reinforcing its role in promoting sustainability. The scalability of the Helium network is a significant factor in its long-term viability. As demand escalates, the network can organically expand by adding more hotspots, avoiding the need for substantial investments in centralized infrastructure. Nevertheless, managing this growth is critical to prevent excessive energy use and ensure the network’s efficiency remains intact.

Practical Insights for Eco-Conscious Investors

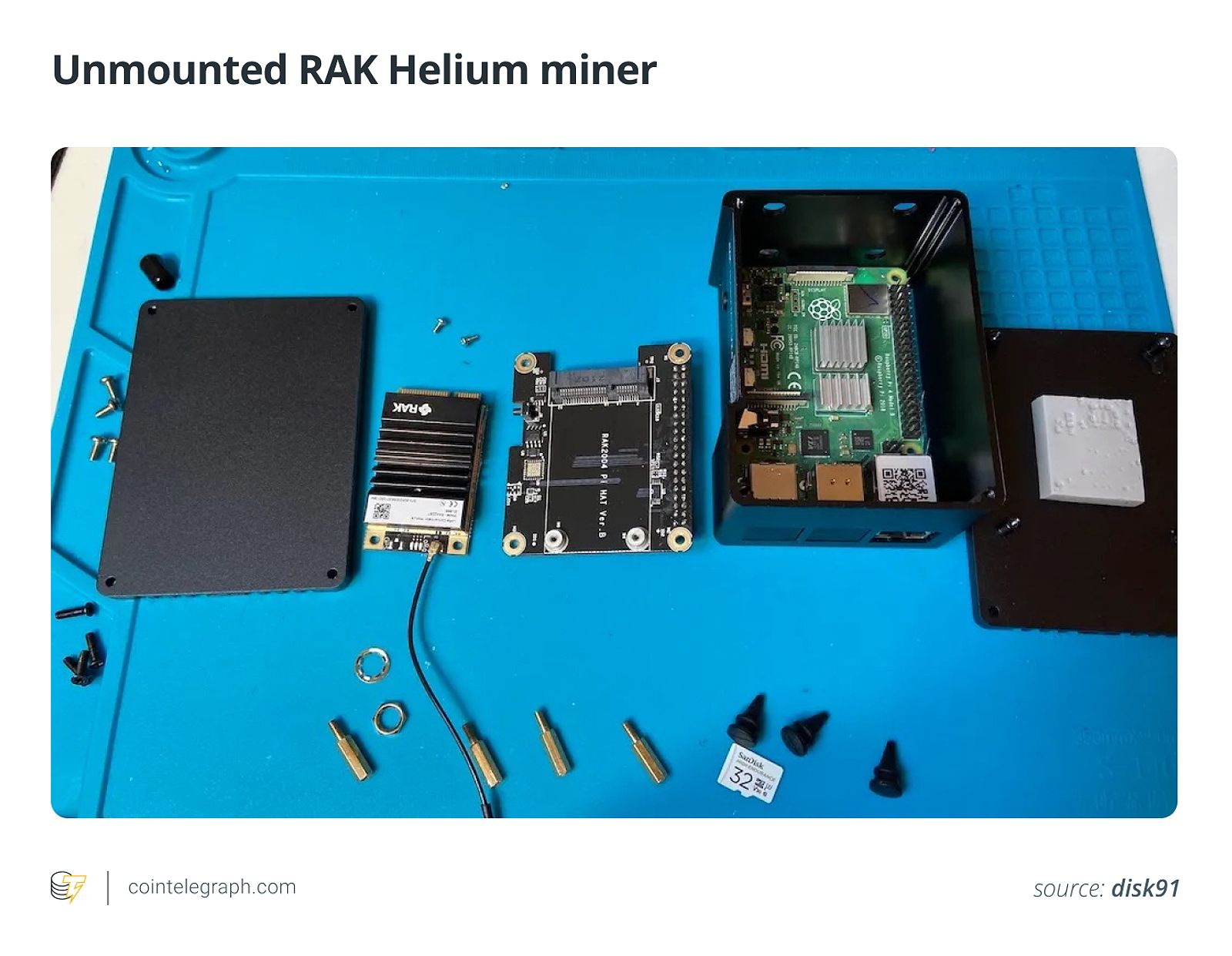

Selecting the right hardware is a vital consideration for those looking to engage in eco-friendly Helium mining. Different hotspot models exhibit varying energy efficiency levels, making it imperative to choose options with low power consumption ratings. Furthermore, optimizing hotspot placement can maximize profitability while minimizing energy waste. Strategic location choices, particularly in areas with high IoT device density and low competition, can enhance both efficiency and environmental sustainability.

Ongoing monitoring and management of energy usage are essential responsibilities for miners. Regularly assessing the energy consumption of your hotspots can uncover inefficiencies and guide efforts to reduce waste. This continuous process ensures that the environmental footprint of your Helium mining operations remains minimal. Additionally, staying informed about relevant regulations and environmental standards is crucial for responsible participation in the Helium network. Understanding the setup process—from hardware selection to hotspot placement and energy management—is vital for achieving success.

Conclusion

Helium mining represents a unique opportunity for investors who prioritize both financial returns and environmental responsibility. While the inherent volatility of cryptocurrency markets poses risks, the potential for profitability, combined with the low energy demands and decentralized nature of the Helium network, renders it a compelling investment choice. Successful participation hinges on meticulous planning, responsible operations, and a commitment to sustainable practices. Engaging in thorough research and maintaining a realistic perspective on risks and rewards will be essential for anyone looking to navigate this evolving landscape.