As an avid observer of the rapidly evolving cryptocurrency landscape, I’m excited to share everything you need to know about crypto trading. Whether you’re intrigued by the potential for substantial returns or simply fascinated by the revolutionary technology behind digital assets, this comprehensive guide will equip you with the essential knowledge to confidently navigate the dynamic crypto trading ecosystem.

Understanding the Fundamentals of Cryptocurrency Trading

At its core, cryptocurrency trading involves the buying and selling of digital currencies like Bitcoin, Ethereum, and a multitude of altcoins on specialized exchanges. These decentralized platforms facilitate the exchange of cryptocurrencies, allowing traders like you and me to speculate on their price movements and potentially generate profits.

But what sets cryptocurrency trading apart from traditional financial markets? The key differentiator lies in the underlying technology – the blockchain. Unlike centralized systems, the cryptocurrency network operates through a peer-to-peer model, utilizing blockchain technology to verify and record transactions. This unique structure offers several potential benefits, including faster transaction times, lower fees, and greater accessibility for individuals worldwide.

However, it’s important to recognize that the cryptocurrency market is also known for its inherent volatility, with prices often experiencing sudden and significant fluctuations. Additionally, the lack of comprehensive regulatory oversight in some regions can introduce additional risks, such as potential scams or hacks. As an aspiring crypto trader, it’s crucial to understand these potential pitfalls and develop effective risk management strategies to navigate this dynamic landscape.

A rendering of a crypto coin with a lock on it.

A rendering of a crypto coin with a lock on it.

Exploring Everything You Need to Know About Crypto Trading

At the heart of the cryptocurrency trading ecosystem lies the delicate interplay of supply and demand. The total number of coins in circulation, as well as the rate at which new coins are introduced or removed from the market, can significantly impact the prices of various cryptocurrencies. This market dynamic is further influenced by factors such as market capitalization, which represents the total value of all the coins in existence.

As I dive deeper into this captivating crypto market, I’ve come to appreciate how external events and news can also have a profound effect on cryptocurrency prices. Regulatory announcements, security breaches, and advancements in blockchain technology are just a few examples of the factors that can sway investor sentiment and lead to volatile price movements.

Understanding these market drivers is essential for any aspiring cryptocurrency trader, as it allows you to make more informed decisions and potentially capitalize on the market’s dynamism. By staying attuned to the latest developments and trends, you can gain a deeper understanding of the market and identify emerging opportunities.

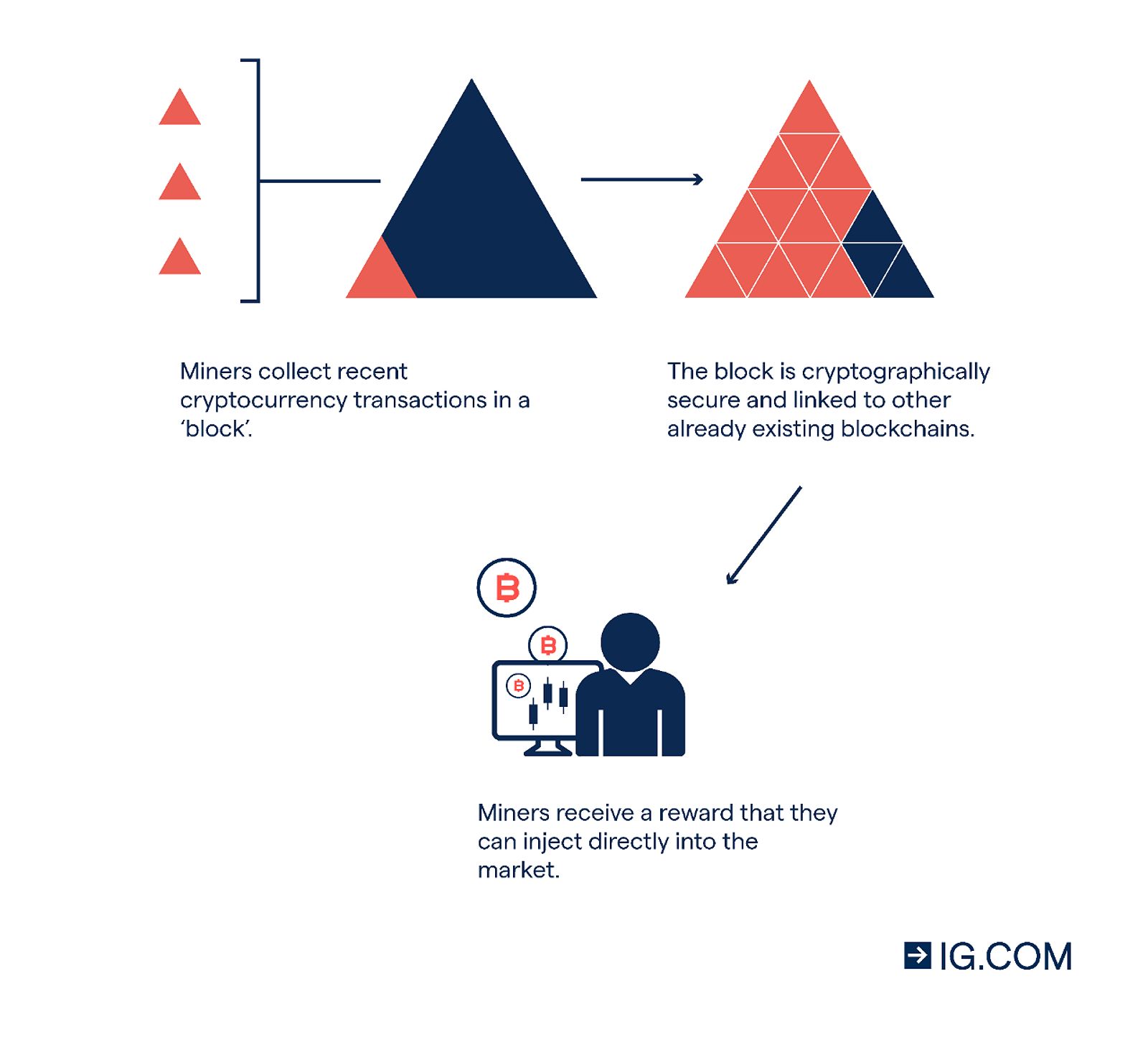

Artist rendering of blockchain

Artist rendering of blockchain

Selecting the Right Cryptocurrency Exchange

When it comes to cryptocurrency trading, the exchange you choose can have a significant impact on your experience and success. As I’ve explored the various options available, I’ve come to appreciate the importance of prioritizing security, regulation, fees, liquidity, user-friendliness, and the range of supported cryptocurrencies.

Reputable exchanges that maintain robust security measures, such as two-factor authentication and cold storage for digital assets, have become a top priority for me. Additionally, I’ve learned to evaluate the exchange’s compliance with relevant regulations in my jurisdiction, as this can provide an additional layer of trust and protection.

Fees and liquidity are also crucial considerations, as they can directly impact the efficiency of your trading activities. By comparing the trading fees, deposit and withdrawal charges, as well as the overall trading volume, I’ve been able to identify exchanges that offer competitive rates and ample liquidity to facilitate efficient order execution.

Finally, the user interface and available features have played a significant role in my exchange selection process. A user-friendly platform with mobile accessibility and advanced trading tools can greatly enhance the overall trading experience, allowing me to make more informed decisions and execute my strategies with greater efficiency.

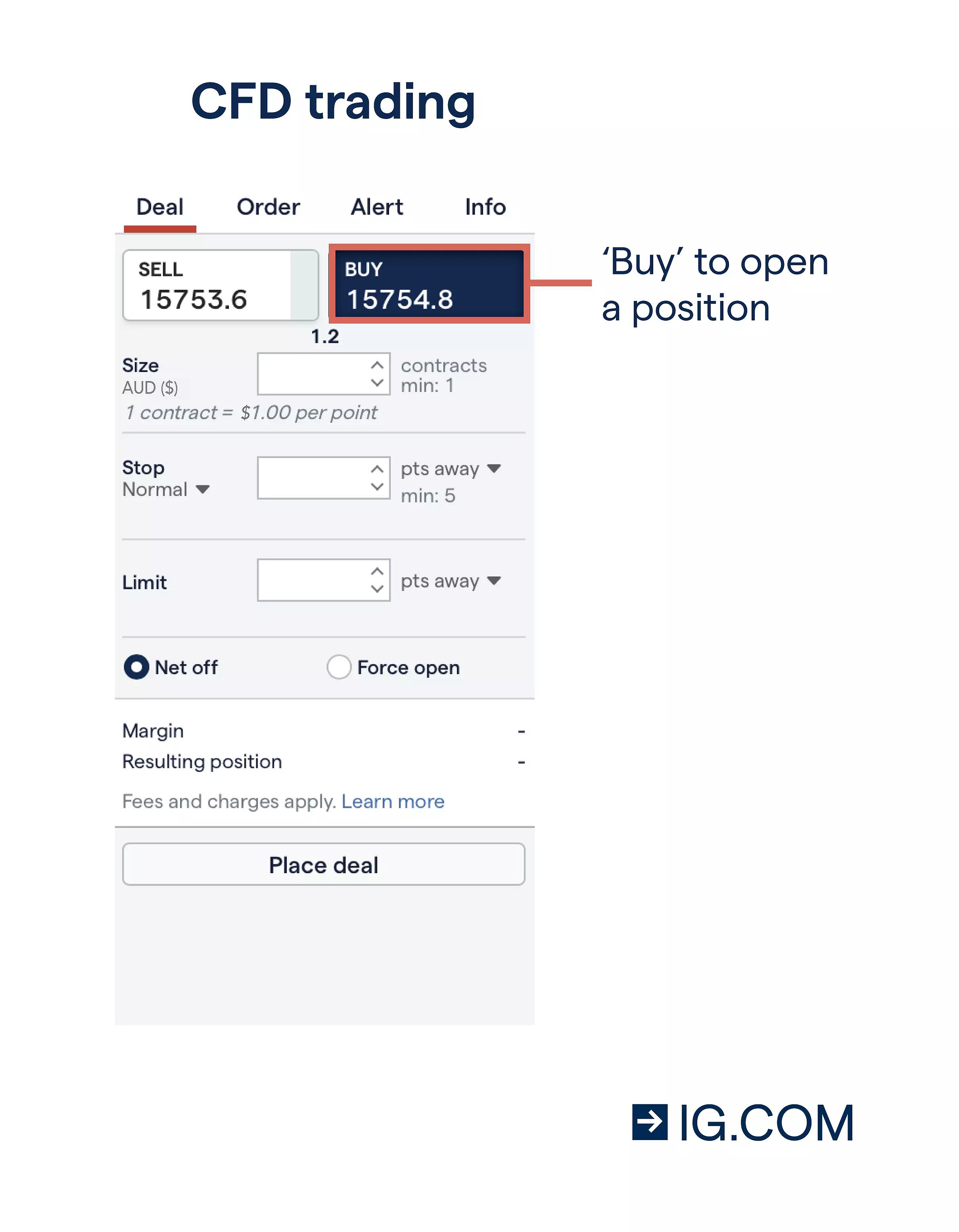

CFD trading deal ticket – going long

CFD trading deal ticket – going long

Taking the First Steps in Cryptocurrency Trading

As I’ve delved into the world of cryptocurrency trading, the process of getting started has become increasingly straightforward. The first step is to open an account with a reputable exchange, which typically involves providing personal identification documents and completing know-your-customer (KYC) verification.

Once your account is set up, you’ll need to fund it using various payment methods, such as bank transfers or credit/debit cards. This step is crucial, as it will give you the necessary liquidity to start trading.

Next, you’ll need to decide which cryptocurrencies you want to trade. While the market is vast, I’ve found it generally advisable for beginners to start with well-established cryptocurrencies like Bitcoin and Ethereum, as they tend to have more stable price movements and higher liquidity.

When placing your first trade, you’ll have the option to either buy (go long) or sell (go short) the cryptocurrency, depending on your market outlook. It’s crucial to carefully research the cryptocurrency, analyze market trends, and set appropriate risk management measures, such as stop-loss orders, to protect your investment.

As you gain more experience, you can gradually expand your trading portfolio and explore more advanced trading strategies. However, it’s essential to always approach cryptocurrency trading with caution and a well-defined risk management plan.

Mitigating Risks in the Cryptocurrency Trading Sphere

Cryptocurrency trading, like any other financial market, carries inherent risks. Volatility, security breaches, and potential regulatory changes are just a few of the factors that can significantly impact your trading outcomes. To effectively manage these risks, I’ve adopted a multifaceted approach that prioritizes diversification, position sizing, and the utilization of stop-loss orders.

Diversification has become a cornerstone of my trading strategy, as it allows me to mitigate the impact of individual price fluctuations and potentially reduce my overall risk exposure. By allocating my investments across multiple digital assets, I’ve been able to create a more balanced portfolio that can withstand the market’s volatility.

Additionally, I’ve learned to carefully manage the size of my trading positions to ensure that no single trade can severely deplete my trading capital. Overexposure can be a risky proposition, so I’ve adopted a disciplined approach to position sizing based on my risk tolerance and trading plan.

The use of stop-loss orders has also become an integral part of my risk management strategy. By automating the closure of my positions when the market moves against me, I can limit my potential losses and protect my trading capital from significant drawdowns.

By prioritizing risk management and adopting a disciplined trading approach, I’ve been able to navigate the cryptocurrency market with greater confidence and potentially enhance my chances of long-term success.

Staying Informed and Adapting in the Evolving Crypto Landscape

As the cryptocurrency market continues to evolve, I’ve recognized the importance of staying up-to-date with the latest developments and trends. By consuming a diverse range of information sources, such as industry news, expert analyses, and social media discussions, I’ve been able to gain a deeper understanding of the market dynamics and identify emerging opportunities.

Moreover, I’ve learned to remain flexible and adaptable in my trading strategies. The cryptocurrency market is known for its rapid changes, and what works today may not be effective tomorrow. Regularly reviewing my trading plan, monitoring market conditions, and being willing to adjust my approach have become essential practices in my crypto trading journey.

FQAs

Is cryptocurrency trading legal? The legality of cryptocurrency trading varies by jurisdiction. It’s essential to research and understand the regulations in your local area before engaging in any cryptocurrency-related activities.

How much money do I need to start crypto trading? There is no set minimum amount required to start cryptocurrency trading. However, it’s generally advisable to start with a relatively small amount that you can afford to lose, as the cryptocurrency market is highly volatile.

What are the best cryptocurrencies to trade for beginners? Bitcoin and Ethereum are often considered good starting points for beginner cryptocurrency traders due to their established market presence and relatively higher liquidity.

How do I stay updated on the cryptocurrency market? To stay informed about the latest developments in the cryptocurrency market, you can follow reputable news sources, industry blogs, and social media groups focused on cryptocurrency and blockchain technology.

Embracing the Evolving Crypto Frontier

As I continue to navigate the captivating world of cryptocurrency trading, I’m constantly reminded of the exciting opportunities and challenges that lie ahead. The cryptocurrency market is a dynamic and rapidly evolving frontier, and by staying informed, adopting a disciplined approach, and embracing the inherent risks, I believe that aspiring traders like you can position yourselves for success.

Remember, the journey to becoming a confident and successful crypto trader is not without its twists and turns, but with the right mindset, knowledge, and risk management strategies, the potential rewards can be truly transformative. So, let’s embark on this thrilling adventure together, and discover the endless possibilities that the world of cryptocurrency trading has to offer.