In the ever-evolving landscape of the cryptocurrency market, financial institutions are facing a unique challenge: how to navigate the complexities and capitalize on the vast opportunities that this new frontier presents. As the crypto market continues to mature, the need for sophisticated trading tools and strategies has become increasingly apparent. Enter the world of algorithmic crypto trading software — a transformative technology that is redefining the way financial institutions approach the crypto space.

Embracing the Power of Automation

Imagine a trading platform that can process vast amounts of market data, identify lucrative opportunities, and execute trades with lightning-fast precision — all without the constraints of human error or response time. This is the power of algorithmic crypto trading software, a game-changing solution that is empowering financial institutions to achieve unparalleled levels of efficiency and performance.

By automating the core tasks of trading, these advanced platforms free up valuable time and resources for traders and analysts to focus on higher-level strategy and decision-making. Gone are the days of manually sifting through endless data streams and making split-second decisions; algorithmic trading software handles these tedious yet critical tasks with remarkable speed and accuracy, enabling financial institutions to capitalize on market movements that would be virtually impossible to capture through manual methods.

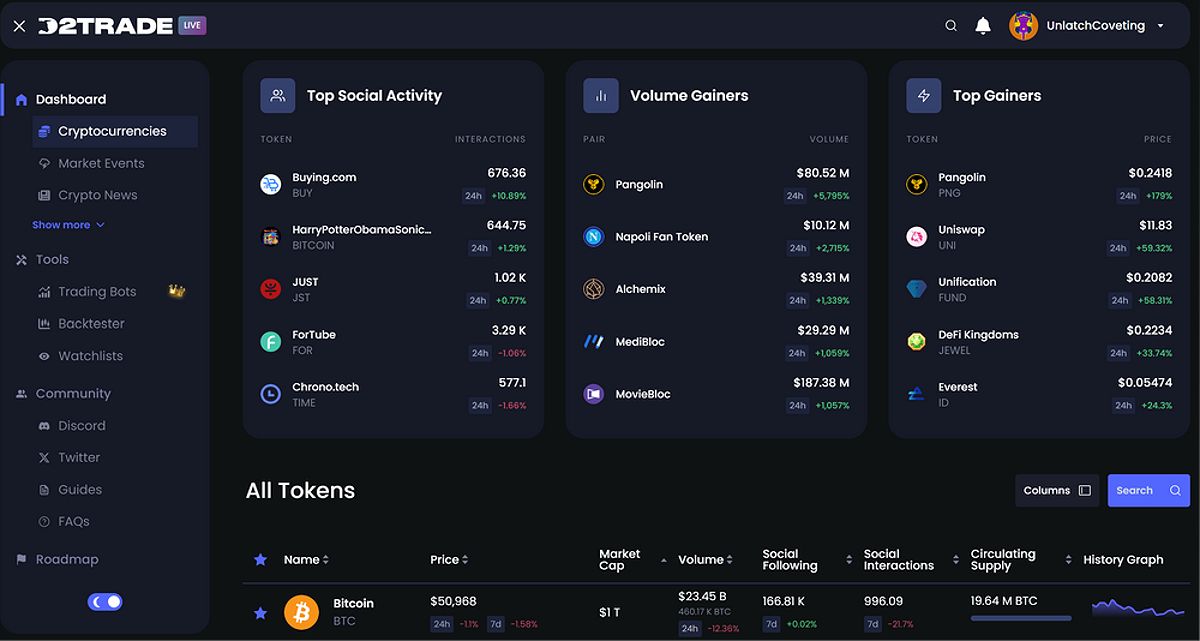

Dash2Trade Dashboard

Dash2Trade Dashboard

Mitigating Risks and Unlocking Opportunities

In the volatile and unpredictable crypto market, effective risk management is of the utmost importance. Algorithmic crypto trading software provides a robust and comprehensive solution, equipping financial institutions with advanced risk control tools that can help mitigate their exposure to market fluctuations.

Through features like stop-loss orders, trailing stops, and sophisticated position-sizing algorithms, these platforms ensure that trading activities are aligned with an institution’s risk appetite and investment objectives. By automating the implementation of these risk management protocols, financial professionals can navigate the crypto landscape with greater confidence and peace of mind, knowing that their trading strategies are backed by a robust risk management framework.

WienerAI bot

WienerAI bot

But the benefits of algorithmic trading extend far beyond risk mitigation. These sophisticated platforms also unlock a world of new trading opportunities that would be challenging, if not impossible, to capture through manual methods. By leveraging advanced quantitative analysis techniques, such as machine learning and artificial intelligence, algorithmic trading software can identify and exploit market inefficiencies and arbitrage opportunities that may elude even the most experienced human traders.

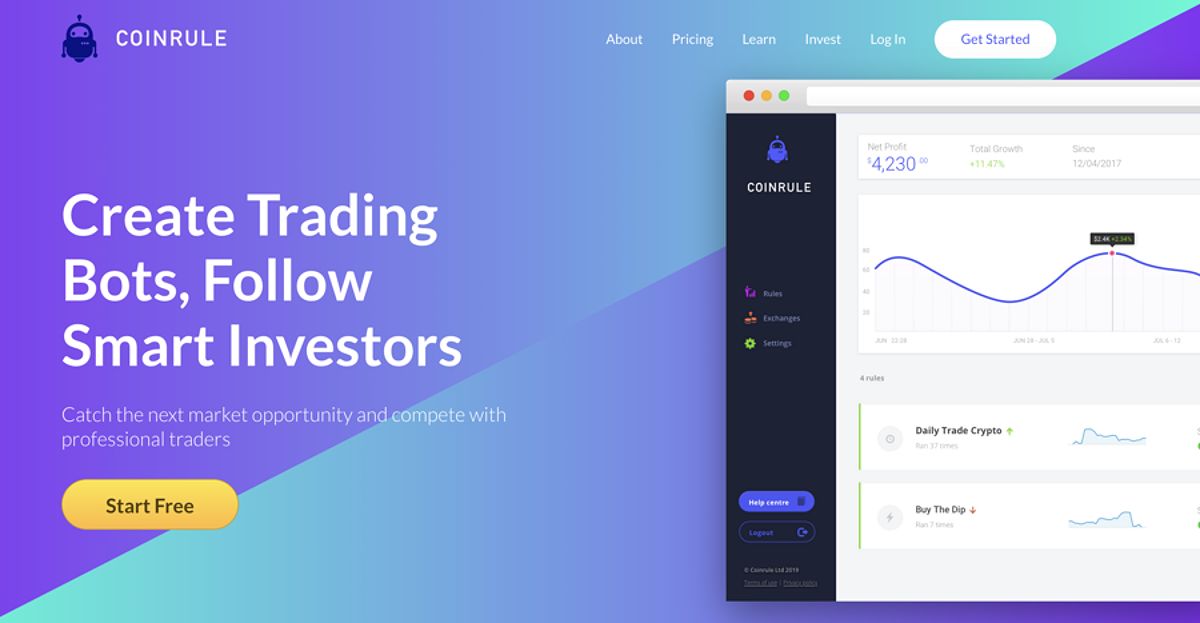

Coinrule

Coinrule

Driving Innovation and Competitive Edge

As the crypto market continues to evolve, financial institutions that embrace the power of algorithmic trading will be well-positioned to stay ahead of the curve. These cutting-edge platforms are not merely tools — they are strategic catalysts that can redefine an institution’s approach to the crypto space, enabling them to gain a significant competitive edge in this rapidly expanding market.

At the core of these transformative solutions lies a high-performance architecture that can handle the demands of the crypto market. From low-latency order execution to seamless integration with multiple exchanges and data sources, the best algorithmic crypto trading platforms are designed to provide financial institutions with the technological edge they need to thrive in the fast-paced crypto ecosystem.

Navigating the Complexities of Algorithmic Trading

Developing and implementing effective algorithmic trading strategies in the crypto market is a multifaceted process that requires a deep understanding of market dynamics, quantitative analysis, and technical expertise. Financial institutions seeking to harness the power of algorithmic trading must be prepared to invest in this process, conducting thorough research, testing, and optimization to ensure that their trading activities are aligned with their investment goals and risk tolerance.

By following a structured approach, which includes strategy development, rigorous testing, and gradual deployment, financial institutions can build a robust and resilient algorithmic trading framework that can adapt to the ever-changing crypto landscape. This meticulous process not only helps mitigate the inherent risks of algorithmic trading but also lays the foundation for long-term success in this dynamic and rapidly evolving market.

Choosing the Right Algorithmic Crypto Trading Solution

As financial institutions navigate the world of algorithmic crypto trading, they must carefully evaluate a range of factors to ensure they are selecting the right solution for their needs. Performance and scalability, security and reliability, and comprehensive support and integration are just a few of the key considerations that should guide their decision-making process.

Leading algorithmic crypto trading platforms in 2024 are designed to provide financial institutions with the technological edge they need to thrive in the crypto market. By prioritizing these critical features, forward-thinking institutions can confidently embrace the power of algorithmic trading and position themselves as leaders in this exciting and transformative space.

The Future of Algorithmic Crypto Trading

As the cryptocurrency market continues to evolve, the role of algorithmic trading software in the financial industry will only become more prominent. Advancements in artificial intelligence (AI) and machine learning (ML) are poised to revolutionize the way algorithmic strategies are developed and deployed, while the growing adoption of decentralized finance (DeFi) protocols presents new opportunities for financial institutions to leverage algorithmic trading to capitalize on emerging market trends.

At the same time, the increasing regulatory landscape surrounding cryptocurrencies will require financial institutions to remain vigilant and ensure that their algorithmic trading activities comply with evolving compliance requirements. By staying ahead of these trends and investing in the right algorithmic crypto trading solutions, forward-thinking financial institutions can position themselves as innovators and trailblazers in this dynamic and rapidly evolving market.

The Rise of Algorithmic Trading in the Crypto Landscape

The rapid evolution of the cryptocurrency market has revolutionized the way financial institutions approach trading and investing. As the crypto landscape becomes increasingly complex, algorithmic trading software has emerged as a powerful tool for gaining a competitive edge. These sophisticated platforms are transforming the way financial institutions navigate the crypto markets, offering unparalleled efficiency, risk management, and access to new trading opportunities.

Maximizing Efficiency and Execution

One of the key advantages of algorithmic crypto trading software is its ability to streamline and automate numerous trading tasks. By processing vast amounts of market data and executing trades at lightning-fast speeds, these platforms can eliminate the human error and delays that often plague manual trading. This automation not only enhances the overall efficiency of the trading process but also allows financial institutions to capitalize on time-sensitive market movements that would be difficult to act upon manually.

Embracing Advanced Risk Management

Effective risk management is essential in the volatile crypto markets, and algorithmic trading software provides a robust solution. These platforms are equipped with advanced risk management tools, such as stop-loss orders, trailing stops, and position sizing algorithms, that help institutions mitigate their exposure to market fluctuations. By automating the implementation of these risk controls, financial institutions can ensure that their trading activities are well-aligned with their risk appetite and investment objectives.

Unlocking New Horizons for Traders

The power of algorithmic trading extends beyond efficiency and risk management; it also unlocks new trading opportunities that would be challenging or impossible to capture through manual methods. Algorithmic strategies can leverage sophisticated quantitative analysis techniques, such as machine learning and artificial intelligence, to identify and exploit market inefficiencies and arbitrage opportunities that may elude human traders. This enhanced market insight can translate into significant returns for financial institutions willing to embrace the power of algorithmic trading in the crypto space.

Investing in the Right Algorithmic Crypto Trading Solution

When selecting the right algorithmic crypto trading software for their institution, financial professionals must carefully evaluate a range of factors to ensure they are making an informed and strategic decision. Performance and scalability, security and reliability, and comprehensive support and integration are all critical considerations that can make or break the success of an institution’s algorithmic trading initiatives.

By prioritizing these key features and partnering with leading providers in the algorithmic crypto trading space, forward-thinking financial institutions can position themselves for long-term success in the rapidly evolving cryptocurrency market.

FAQ

Q: What are the risks associated with algorithmic crypto trading?

A: While algorithmic crypto trading offers significant advantages, it is not without risks. Some of the potential risks include flash crashes, market manipulation, and algorithm errors. Financial institutions must implement robust risk management protocols, including thorough testing and ongoing monitoring, to mitigate these risks and ensure the stability of their trading activities.

Q: How can financial institutions ensure the security of their algorithmic trading software?

A: Ensuring the security of algorithmic trading software is a critical concern for financial institutions. Key measures include robust data encryption, multi-factor authentication, and comprehensive access controls. Additionally, financial institutions should prioritize platforms that are compliant with relevant regulatory requirements and have a strong track record of reliability and stability.

Q: What are the best practices for developing and implementing algorithmic trading strategies?

A: Developing and implementing effective algorithmic trading strategies in the crypto market requires a structured and disciplined approach. Best practices include conducting thorough market research and analysis, creating well-defined trading objectives, rigorously testing strategies through backtesting and paper trading, and gradually deploying strategies in live market conditions while closely monitoring their performance and risk profiles.

Conclusion

In the fast-paced and ever-evolving world of cryptocurrency, financial institutions that embrace the power of algorithmic trading software will be poised to thrive. By harnessing the efficiency, risk management, and market insight offered by these cutting-edge platforms, forward-thinking institutions can gain a significant competitive edge and capitalize on the vast opportunities that the crypto market presents.

As the crypto landscape continues to transform, the importance of algorithmic trading solutions will only continue to grow. By investing in the right algorithmic crypto trading software and developing a well-rounded strategy, financial institutions can position themselves as leaders in this dynamic and rapidly expanding market, shaping the future of crypto trading and solidifying their position as innovators in the industry.