Day Trading Crypto vs Stocks: A Veteran Trader”s Perspective

As a seasoned stock trader, I”ve always been intrigued by the dynamic world of cryptocurrencies. The rapid rise of digital assets in recent years has sparked my curiosity, and I can”t help but wonder how my existing trading skills could translate to the day trading crypto vs stocks. In this comprehensive guide, I”ll share my insights on the key differences, advantages, and considerations for stock traders venturing into the thrilling realm of cryptocurrency trading.

Understanding The Crypto Market And Its Advantages And Disadvantages

Cryptocurrencies have emerged as a compelling investment opportunity, captivating the attention of investors worldwide. As a stock trader, I’ve been closely monitoring the crypto market, fascinated by its unique characteristics and the potential it holds. Unlike the traditional stock market, the crypto world operates 24/7, offering traders a level of flexibility and access that was once unimaginable.

The inherent volatility of the crypto market presents both opportunities and challenges. While the potential for rapid price movements can translate to higher returns, it also requires a heightened level of risk management and market understanding. As I venture into this new frontier, I’m excited to explore how my existing stock trading strategies can be adapted to capitalize on the crypto market’s unique dynamics.

Diving into the world of crypto day trading has its distinct advantages, but it also comes with its own set of unique challenges. As a stock trader, I’ve carefully evaluated the key differences between the two markets, weighing the potential benefits and risks.

Advantages of Day Trading Crypto:

- Higher Potential Returns: The crypto market’s volatility can provide opportunities for savvy day traders to generate substantial gains by capitalizing on rapid price movements.

- Flexibility and 24/7 Trading: The ability to trade cryptocurrencies around the clock, without the constraints of traditional stock market hours, offers more flexibility and a broader range of trading opportunities.

- Exposure to a Burgeoning Asset Class: Cryptocurrencies represent an innovative and rapidly evolving asset class, allowing diversification of portfolios and potential benefits from the market’s long-term growth.

Crypto day trading

Crypto day trading

Disadvantages of Day Trading Crypto:

- Heightened Risk: The crypto market’s volatility also means higher risk, with the potential for significant losses if trades are not managed effectively.

- Regulatory Uncertainty: Compared to the highly regulated stock market, the cryptocurrency space has a more varied regulatory landscape, which can introduce additional risks and uncertainties.

- Potential for Fraud: The decentralized nature of cryptocurrencies makes them a target for scams and fraudulent activities, requiring vigilance and a heightened focus on security.

As I navigate this new frontier, I’m acutely aware of the need to approach crypto day trading with a well-rounded strategy, a commitment to ongoing education, and a keen eye for risk management.

Adapting Strategies And Considerations For Day Trading Crypto Vs Stocks

While my experience in the stock market has provided a solid foundation, I recognize that successfully day trading cryptocurrencies requires a unique set of skills and strategies. I’ve been exploring various approaches to determine the best fit for my trading style and risk tolerance.

Scalping: This strategy involves executing numerous small trades to capitalize on minor price fluctuations, aiming to generate consistent, incremental profits. I’ve found that this approach can be particularly well-suited to the fast-paced and volatile nature of the crypto market.

Scalping strategy

Scalping strategy

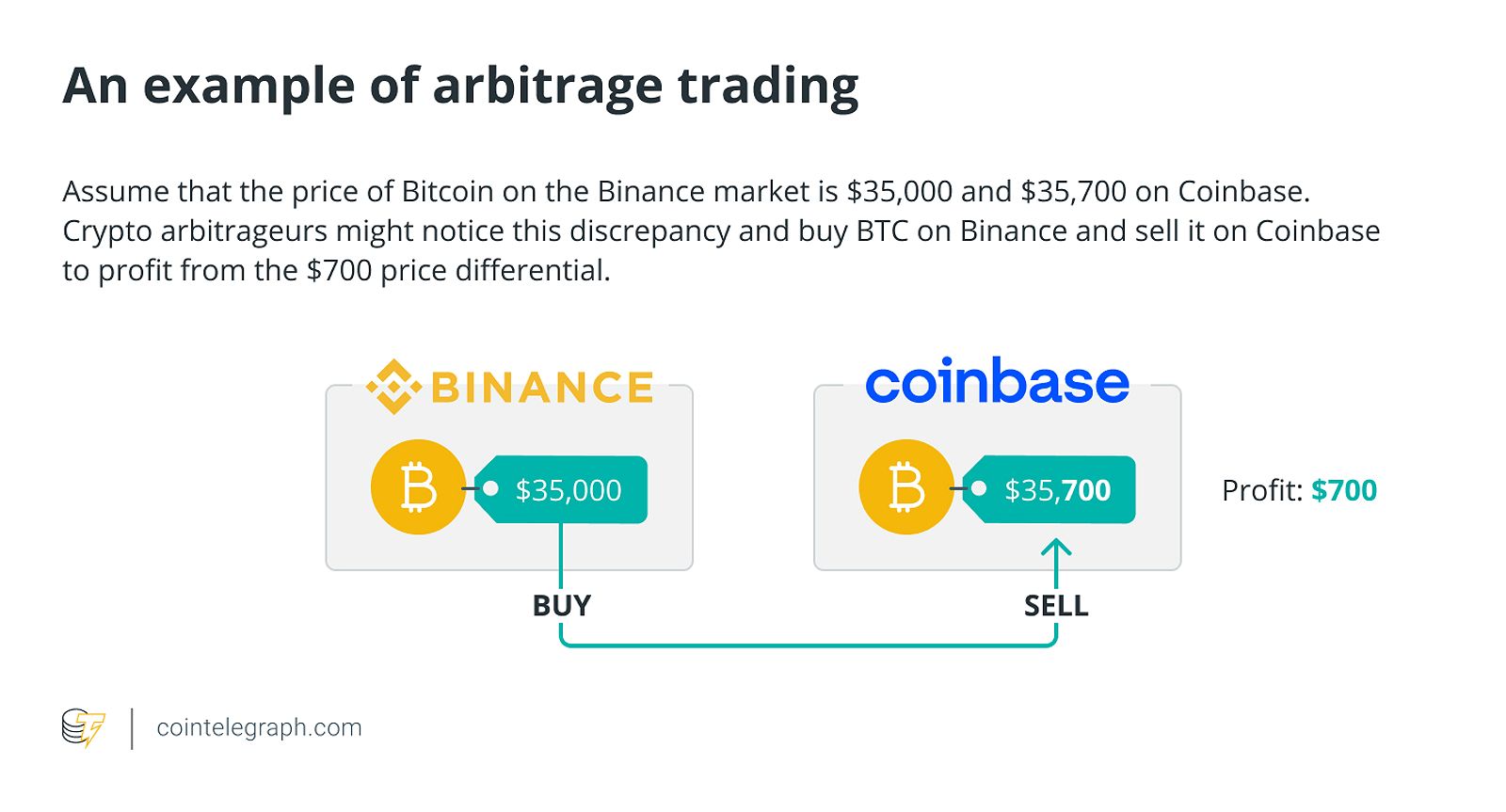

Arbitrage: By identifying and exploiting price discrepancies between different cryptocurrency exchanges, I’ve discovered opportunities to generate profits without significant market risk. This strategy requires a deep understanding of market dynamics and the ability to act quickly on opportunities.

Arbitrage trading

Arbitrage trading

High-Frequency Trading (HFT): While not accessible to individual traders like myself, I’ve observed the power of advanced algorithmic trading systems in the crypto market. These lightning-fast trading strategies take advantage of tiny price movements, showcasing the incredible potential of technology in this space.

As I continue to explore these and other crypto day trading strategies, I’m mindful of the need to adapt and refine my approach to account for the unique characteristics of the cryptocurrency market.

Making The Leap: Key Considerations For Stock Traders

Making the leap from the stock market to the world of cryptocurrency day trading is not without its challenges. As I embark on this journey, I’ve identified several key considerations that are crucial for stock traders like myself to keep in mind.

Understanding Crypto Market Dynamics: The cryptocurrency market operates very differently from the stock market, with its own unique characteristics, such as increased volatility, 24/7 trading, and the potential for significant price swings. Developing a deep understanding of these dynamics is essential for success.

Adapting Trading Strategies: While some existing stock trading strategies can be applied to the crypto market, it’s important to modify them to account for the unique challenges and opportunities presented by cryptocurrencies.

Managing Risk: Effective risk management is paramount when day trading crypto, as the market’s volatility can quickly lead to significant losses if not properly managed. Diligently refining risk management practices is essential to navigate this new frontier with confidence.

Continuous Education: Investing time in learning about cryptocurrencies, market trends, and best practices for day trading is crucial to success in this dynamic and rapidly evolving asset class. Committing to stay informed and adapting the approach as the landscape continues to evolve is essential.

Crypto trading technology

Crypto trading technology

Faq

Q: What are the biggest differences between day trading crypto and stocks?

The primary differences lie in the market dynamics, regulation, and trading hours. The crypto market is more volatile, operates 24/7, and has less regulatory oversight compared to the stock market.

Q: What are the key risks to consider when day trading crypto?

Key risks include high market volatility, potential for fraud, and the lack of comprehensive regulatory frameworks in the cryptocurrency space.

Q: How can stock traders adapt their existing strategies to day trade crypto?

Stock traders can apply strategies like scalping, arbitrage, and high-frequency trading to the crypto market, but must be prepared to modify them to account for the unique characteristics of cryptocurrencies.

Q: What are some common mistakes that stock traders make when day trading crypto?

Some common mistakes include not understanding the unique characteristics of the crypto market, overtrading, and not managing risk effectively.

Q: What are some resources that stock traders can use to learn more about day trading crypto?

There are many resources available online, including articles, books, and courses. Additionally, there are many online communities where stock traders can connect with others and learn from their experiences.

Conclusion

As a stock trader, venturing into the world of cryptocurrency day trading can be an exciting and potentially rewarding opportunity. However, it’s important to approach this new frontier with a well-rounded strategy, a commitment to continuous learning, and a focus on responsible risk management. By understanding the key differences between day trading crypto and stocks, adapting strategies accordingly, and managing risks effectively, you can increase your chances of success in this dynamic and rapidly evolving asset class.