The crypto market, in its essence, is a cauldron of unpredictability, where fortunes can be made and lost in the blink of an eye. Yet, for the intrepid trader, this volatility presents a tantalizing challenge, a chance to outsmart the herd and carve out a path to financial success. But make no mistake, navigating this treacherous terrain requires a delicate balance of technical prowess, emotional fortitude, and an unwavering commitment to risk management.

Mastering The Metrics Of Crypto Volatility

The first step towards conquering the crypto volatility trading game is to develop a deep understanding of the tools used to measure and analyze market fluctuations. Standard deviation, average true range (ATR), and relative strength index (RSI) — these are the metrics that separates the wheat from the chaff.

Standard deviation, for instance, serves as a barometer of the degree of variation in cryptocurrency prices from their average. A high standard deviation signifies that the market is in a state of heightened turbulence, providing savvy traders with the opportunity to capitalize on the potential for trend reversals. Meanwhile, the ATR calculates the average daily price range, enabling traders to gauge the intensity of intraday volatility and compare market conditions across different cryptocurrency assets.

Standard deviation Image: A visual representation of standard deviation in crypto volatility

Standard deviation Image: A visual representation of standard deviation in crypto volatility

Furthermore, the RSI, a momentum oscillator, offers invaluable insights into the speed and direction of price movements. By identifying overbought or oversold conditions, this indicator can serve as a harbinger of impending price reversals — a critical piece of information for the crypto volatility trader who seeks to time the market with precision.

Strategies For Navigating The Volatility Maelstrom

Successful crypto volatility trading is not merely a matter of technical analysis; it is an art form that requires a multifaceted approach to risk management. Dollar-cost averaging, setting stop-loss and take-profit orders, and diversifying one’s portfolio are all essential strategies in the arsenal of the savvy crypto trader.

Dollar-cost averaging, for instance, instills a sense of discipline, encouraging traders to regularly invest a fixed amount of capital, regardless of the asset’s current price. This approach can help smooth out the effects of market volatility, as traders focus on long-term results rather than succumbing to the siren call of short-term price fluctuations. Similarly, setting stop-loss and take-profit orders can provide a safety net, limiting potential losses and locking in gains during periods of heightened market turbulence.

Dollar-cost averaging Image: A visual representation of dollar-cost averaging strategy in crypto volatility trading

Dollar-cost averaging Image: A visual representation of dollar-cost averaging strategy in crypto volatility trading

Diversification, however, is the true panacea for the crypto volatility trader. By allocating investments across a diverse array of cryptocurrencies and asset classes, one can effectively reduce their exposure to the risks associated with any single investment. This approach not only mitigates the impact of market swings but also preserves the overall portfolio value during times of heightened volatility.

Timing The Market: The Art Of Identifying Trends And Patterns

Mastering the art of crypto volatility trading often hinges on the ability to time the market effectively. By recognizing and interpreting market trends and patterns, the savvy trader can position themselves to capitalize on price movements and navigate the tumultuous waters of the crypto landscape.

Technical indicators, when combined with a keen understanding of market dynamics, can provide invaluable insights into the direction and pace of price changes, allowing traders to make more informed and strategic decisions. Monitoring the actions of large institutional investors, for instance, can offer valuable signals about future price movements, empowering traders to anticipate and respond to shifts in the market.

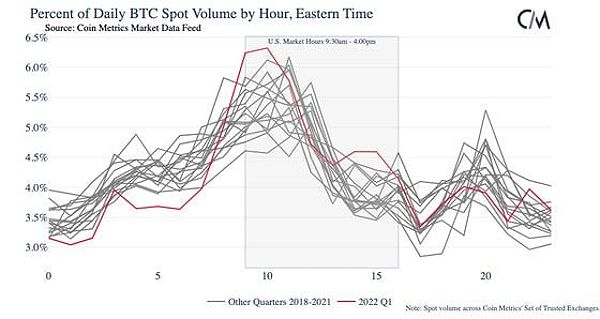

Bitcoin’s spot volume over three years Image: A graph showing Bitcoin’s spot volume over three years

Bitcoin’s spot volume over three years Image: A graph showing Bitcoin’s spot volume over three years

Furthermore, the ability to identify and interpret candlestick patterns, support and resistance levels, and other technical indicators can serve as a guiding light for the crypto volatility trader, illuminating potential entry and exit points during periods of heightened market turbulence.

Managing Risk In The Volatile Crypto Realm

Navigating the volatile crypto market requires a disciplined and unyielding approach to risk management. Setting realistic expectations, diversifying one’s portfolio, and utilizing stop-loss orders are not merely suggestions, but rather, the cornerstones of a successful crypto volatility trading strategy.

It is crucial to remember that the crypto market is inherently speculative, and even the most seasoned traders can face substantial losses if they fail to manage their risk effectively. By setting realistic goals, diversifying investments, and implementing robust risk management techniques, the crypto volatility trader can navigate the tumultuous market with greater confidence and resilience.

The Psychological Minefield Of Crypto Volatility Trading

Emotional control is a critical component of successful crypto volatility trading, separating the true masters from the pretenders. Avoiding impulsive decisions and maintaining a level-headed approach can mean the difference between profitable trades and costly mistakes. Developing a well-defined trading plan, sticking to one’s strategy, and controlling emotional responses are key factors in navigating the psychological challenges of this dynamic market.

The crypto market, with its dizzying highs and devastating lows, is a breeding ground for strong emotional reactions. Traders who can maintain their composure and adhere to their trading plan are more likely to weather the storms of volatility and capitalize on market opportunities, emerging as the true champions of the crypto volatility trading arena.

Specific Examples Of Crypto Volatility Trading Strategies

To provide more practical insights, let’s explore a few specific examples of crypto volatility trading strategies:

- Bollinger Bands Strategy: This strategy involves using Bollinger Bands, a technical indicator that measures market volatility. Traders can look for instances where the price touches the upper or lower Bollinger Band, indicating a potential reversal or breakout, and then enter trades accordingly.

- Fibonacci Retracement Strategy: By identifying key Fibonacci retracement levels, traders can pinpoint potential support and resistance levels, which can be used to time their entries and exits during periods of high volatility.

- Scalping Strategy: Scalping involves taking small, frequent profits by exploiting minor price movements in the market. This strategy is particularly well-suited for navigating the volatility of the crypto market, as traders can quickly enter and exit positions to capture small, consistent gains.

These are just a few examples of the many strategies that crypto volatility traders can utilize to navigate the turbulent waters of the crypto market. By incorporating these and other techniques into their trading arsenal, traders can enhance their chances of success in this dynamic and challenging environment.

Conclusion

In the captivating realm of cryptocurrency, the allure of volatility trading is both enticing and perilous. For the savvy trader, however, this dynamic landscape presents a unique opportunity to thrive, provided they possess the technical prowess, emotional fortitude, and risk management skills necessary to navigate the treacherous waters.

By understanding the metrics that measure and analyze market fluctuations, developing a well-rounded trading strategy, and maintaining a disciplined approach to risk management, the crypto volatility trader can position themselves to capitalize on the rapid price movements that characterize this burgeoning market. Yet, success in this arena is not merely a matter of technical analysis; it is a delicate balance of intellectual rigor, emotional control, and a willingness to challenge conventional wisdom.

As the crypto market continues to evolve, the demand for skilled and adaptable crypto volatility traders will only grow. Those who heed the lessons of the past, embrace the tools of the present, and possess the vision to anticipate the future will emerge as the true masters of this captivating and volatile domain.