The cryptocurrency landscape is constantly changing, and finding consistent profits requires the right strategies. This comprehensive guide provides a wealth of insights and actionable techniques for effective crypto trading, empowering traders of all levels. Presented in a downloadable PDF format, this resource serves as an invaluable tool for navigating the crypto markets and achieving financial success. It includes a detailed exploration of crypto trading strategies pdf and is designed to be your indispensable companion on your journey.

Mastering the Fundamentals of Crypto Trading

Understanding the Cryptocurrency Ecosystem

Cryptocurrencies have revolutionized the global financial landscape, providing a decentralized and secure alternative to traditional financial systems. By exploring the foundational principles of blockchain technology and familiarizing oneself with the diverse array of crypto assets, traders can gain a deeper understanding of the dynamic cryptocurrency market. Additionally, keeping a pulse on the regulatory landscape surrounding cryptocurrencies is crucial, as it can significantly impact the value and adoption of these digital assets.

The rise of decentralized finance (DeFi) has further expanded the crypto ecosystem, introducing a range of innovative financial services and applications built on blockchain technology. Comprehending the advantages and inherent risks associated with DeFi can empower traders to make informed investment decisions and capitalize on the evolving opportunities within the crypto sphere.

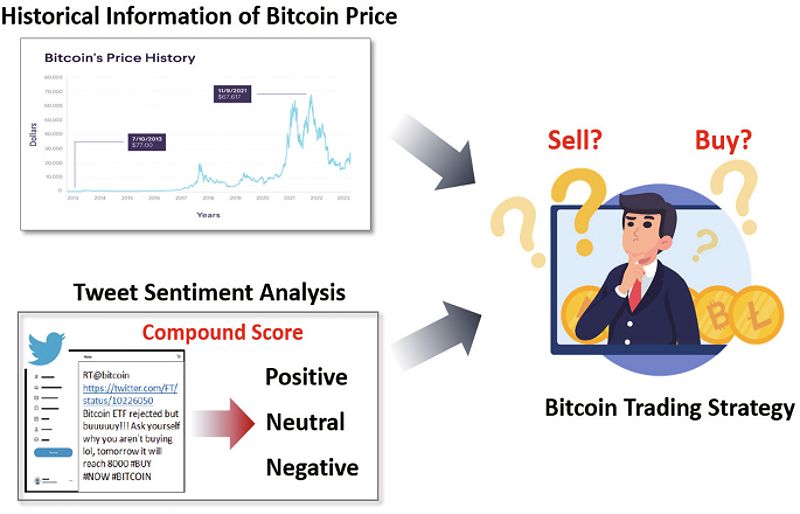

Figure 1

Figure 1

Navigating Crypto Trading Terminology

To effectively engage in crypto trading, it is essential to master the essential terminology and concepts. From the distinction between spot trading and futures trading to the understanding of technical indicators like moving averages, RSI, and MACD, this section equips traders with the necessary knowledge to make informed and strategic trading decisions.

Familiarizing oneself with the nuances of market capitalization, trading volume, and order books is crucial for analyzing the overall health and liquidity of the crypto market. Moreover, grasping the role of leverage in amplifying both profits and risks can help traders navigate the market with a heightened level of awareness and risk management.

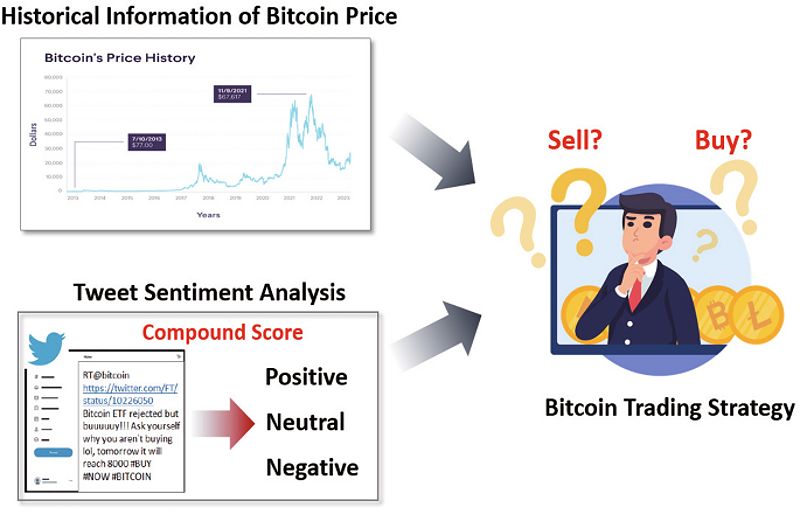

Figure 2

Figure 2

Choosing the Right Crypto Exchange

The selection of a crypto exchange is a critical step in the trading journey. Factors such as trading fees, security features, and the availability of trading pairs can significantly impact the overall trading experience. By conducting a comparative analysis of popular exchanges like Binance, Coinbase, and Kraken, traders can identify the platform that best suits their specific trading needs and preferences.

Reputation, user-friendliness, and the breadth of supported cryptocurrencies are also essential considerations when choosing a crypto exchange. Thorough research and reading reviews can help traders make an informed decision and ensure the security of their assets.

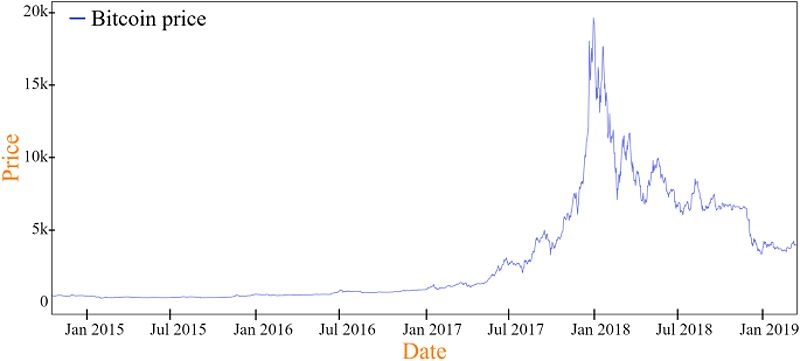

Figure 3

Figure 3

Effective Crypto Trading Strategies

Technical Analysis

Analyzing price charts and identifying patterns using technical indicators is a powerful tool in the crypto trader’s arsenal. This section delves into the different types of charts, the application of various technical indicators, and the importance of support and resistance levels. By mastering technical analysis, traders can gain valuable insights into potential future price movements.

Understanding the nuances of candlestick patterns, trend lines, and oscillators can provide traders with a competitive edge in the crypto market. Combining multiple technical indicators can also help confirm trading signals and minimize the risk of false breakouts.

Figure 4

Figure 4

Fundamental Analysis

Alongside technical analysis, comprehending the underlying fundamentals of cryptocurrencies is crucial. Researching the technology, the project’s team, and market adoption can provide a deeper understanding of a cryptocurrency’s true value proposition and long-term potential. Analyzing factors such as market capitalization, trading volume, and community engagement can give traders an edge in the crypto trading landscape.

By incorporating fundamental analysis into their trading strategies, traders can identify undervalued or overvalued cryptocurrencies and make more informed investment decisions. Staying up-to-date with the latest news and developments in the crypto space can also help traders anticipate potential market shifts and adjust their trading strategies accordingly.

Arbitrage Trading

Profiting from price discrepancies between different exchanges is a strategy known as arbitrage trading. This section explores the various types of arbitrage, highlighting the importance of speed and efficiency in executing these trades. While arbitrage can be a lucrative strategy, it is essential to be aware of the potential risks associated with market volatility and transaction fees.

Effective arbitrage trading requires a keen eye for market movements, a deep understanding of the crypto ecosystem, and the ability to execute trades swiftly. Maintaining a diversified portfolio and carefully managing risk can help mitigate the inherent challenges of this strategy.

Figure 6

Figure 6

Scalping

Scalping involves capitalizing on small price fluctuations by entering and exiting trades quickly. This strategy requires the use of technical indicators, high-frequency trading software, and a keen eye for market trends. Scalping demands precision, speed, and effective risk management, as it carries the potential for both significant rewards and substantial losses.

Developing a disciplined approach to scalping, with well-defined entry and exit points, is crucial for success. Constantly monitoring market conditions and adapting the strategy accordingly can help traders navigate the volatile crypto market and capitalize on short-term opportunities.

Figure 7

Figure 7

Essential Tools for Crypto Trading

Trading Platforms and Software

Choosing the right trading platform is essential for success in the crypto market. This section explores the features, fees, and user interfaces of popular crypto trading platforms, highlighting the importance of advanced charting tools, order types, and robust security measures. Additionally, it introduces trading software like TradingView and MetaTrader 5, which can enhance the trading experience.

Familiarity with various order types, such as market orders, limit orders, and stop-loss orders, can help traders execute trades more effectively and manage their risk more efficiently. Exploring the customization options and analytical tools offered by trading platforms can further optimize the trading workflow.

Crypto Trading Bots

Automated trading bots can streamline crypto trading strategies, executing trades even when the trader is not actively monitoring the market. This section delves into the different types of trading bots, such as scalping, arbitrage, and market-making, while emphasizing the importance of choosing a reputable and secure bot provider, as well as the need for careful backtesting and monitoring.

Incorporating trading bots into a strategy can provide a competitive advantage, as they can execute trades faster and more consistently than manual trading. However, it is crucial to thoroughly understand the bot’s underlying algorithm and ensure that it aligns with the trader’s trading objectives and risk tolerance.

Crypto News and Analysis Resources

Staying informed about the latest news and developments in the cryptocurrency market is essential for making informed trading decisions. This section provides a comprehensive list of reputable crypto news sources and analysis websites, underscoring the importance of filtering information and verifying the reliability of sources.

Leveraging social media platforms like Twitter and online forums can also be valuable for gathering real-time market sentiment and staying up-to-date with the latest trends and discussions in the crypto space. However, it is important to maintain a critical eye and cross-reference information from multiple reliable sources.

Risk Management and Trading Psychology

Risk Management Strategies

Effective risk management is a cornerstone of successful crypto trading. This section discusses the importance of defining risk tolerance, setting stop-loss orders, and diversifying the portfolio. Understanding the concept of risk-reward ratio and the role of position sizing in managing risk will help traders navigate the volatile crypto market with confidence.

Implementing a well-structured risk management plan can help protect trading capital and minimize potential losses. Continuously monitoring open positions and adjusting risk exposure accordingly can also contribute to the long-term sustainability of trading strategies.

Trading Psychology and Emotional Control

Emotional biases, such as confirmation bias, herd mentality, and fear of missing out (FOMO), can significantly impact trading decisions. This section highlights the importance of developing a disciplined and objective approach to trading, emphasizing the need for emotional control and patience in the trading process.

Cultivating self-awareness and learning to recognize personal psychological tendencies can help traders avoid common pitfalls and make more rational, data-driven decisions. Incorporating techniques like journaling, mindfulness, and regular breaks can also enhance emotional resilience and decision-making abilities in the crypto market.

Advanced Crypto Trading Strategies

Day Trading

Day trading involves profiting from short-term price fluctuations by entering and exiting trades within a single trading day. This strategy requires the use of technical analysis, scalping, and high-frequency trading techniques. Successful day traders must maintain a high level of speed, precision, and risk management to navigate the volatile crypto market effectively.

While day trading can be a lucrative strategy, it also carries significant risks, such as market volatility and emotional fatigue. Developing a disciplined approach and setting strict trading parameters can help mitigate these challenges and improve the chances of consistent profitability.

Swing Trading

Swing trading focuses on capturing medium-term price swings, typically holding trades for a few days or weeks. This strategy combines technical analysis and fundamental analysis to identify potential trend reversals and support/resistance levels. Patience and discipline are key in swing trading, as it requires the ability to hold positions for a more extended period compared to day trading.

By understanding the underlying factors that drive price movements, swing traders can position themselves to capitalize on broader market trends. However, it is crucial to manage risk effectively and be prepared to adapt the strategy to changing market conditions.

Position Trading

Position trading involves profiting from long-term price trends, holding trades for months or even years. This strategy relies heavily on fundamental analysis, as it seeks to identify cryptocurrencies with strong underlying value propositions and growth potential. Macro-economic factors and regulatory developments can also play a significant role in position trading decisions.

Successful position traders must possess a deep understanding of the cryptocurrency market, patience, and the ability to manage risk over an extended period. While position trading may require a more significant time commitment, it can potentially yield higher returns compared to shorter-term strategies, provided the trades are executed with discipline and sound risk management practices.

Crypto Trading Strategies PDF Free Download

This comprehensive guide has provided you with a deep dive into effective crypto trading strategies, empowering you with the knowledge and tools to navigate the dynamic cryptocurrency market with confidence. By mastering these strategies and prioritizing disciplined risk management, you can position yourself for sustainable success in the world of crypto trading. Download your free copy of this guide today and embark on your journey to unlocking profitable opportunities in the crypto realm.

FAQ

Q: What are the best crypto trading strategies for beginners? A: For beginners, it is recommended to focus on learning the fundamentals of crypto trading, including understanding technical analysis and fundamental analysis. Start with smaller trades and gradually increase your investment as you gain experience and confidence in the market.

Q: How can I learn more about crypto trading? A: There are numerous resources available to learn about crypto trading, including online courses, books, and educational YouTube channels. Additionally, joining online communities and forums can be a great way to connect with other traders, share knowledge, and learn from their experiences.

Q: Is crypto trading profitable? A: Crypto trading can be profitable, but it is essential to understand the inherent risks involved. Proper risk management, the development of a sound trading strategy, and continuous learning and adaptation are key factors in achieving consistent profitability in the crypto market.

Conclusion

This comprehensive guide has provided you with a deep dive into the world of effective crypto trading strategies, equipping you with the knowledge and tools to navigate the dynamic cryptocurrency market with confidence. By mastering the fundamentals, leveraging proven trading techniques, and prioritizing disciplined risk management, you can position yourself for sustainable success in the ever-evolving world of crypto trading.

Download your free copy of this guide today and embark on your journey to unlocking profitable opportunities in the crypto realm. With the right strategies and a commitment to continuous learning, you can unlock the true potential of the cryptocurrency market and achieve your financial goals.