The cryptocurrency market is rapidly growing and attracting a wider audience. However, the volatility and complexity of crypto trading can be overwhelming, particularly for newcomers. This guide provides essential knowledge and strategies to help beginners navigate the world of crypto trading with confidence. It focuses on crypto trading strategies for beginners, offering a comprehensive resource for those starting their trading journey.

Understanding the Fundamentals

Before delving into the intricacies of crypto trading, it is crucial to grasp the underlying concepts and key terminology. Cryptocurrency trading refers to the practice of buying and selling digital assets with the objective of profiting from price fluctuations. Unlike traditional investing, where the focus is on long-term asset appreciation, crypto trading involves actively monitoring the market and executing trades to capitalize on short-term price movements.

The crypto market is known for its high volatility, which can lead to significant price swings. Factors such as supply and demand dynamics, media presence, regulatory changes, and major events can all impact the value of cryptocurrencies, making it essential for traders to have a well-developed trading strategy.

To navigate the crypto trading landscape, it is vital to familiarize oneself with essential terminology, including:

- Buy Order: An order to purchase a cryptocurrency at a specific price.

- Sell Order: An order to sell a cryptocurrency at a specific price.

- Market Order: An order to buy or sell immediately at the best available price.

- Limit Order: An order to buy or sell at a specific price or better.

- Stop-Loss Order: An order to automatically sell a cryptocurrency if its price falls below a predetermined level, limiting potential losses.

- Take-Profit Order: An order to automatically sell a cryptocurrency if its price reaches a predetermined level, securing profits.

Selecting the right trading platform

Selecting the right trading platform is another crucial step in the crypto trading journey. Aspiring traders should look for a reputable and user-friendly platform that offers features such as robust security measures, reasonable fees, advanced trading tools, and responsive customer support. Some popular beginner-friendly platforms include Coinbase, Binance, and Kraken, each with its own strengths and weaknesses.

Beginner-Friendly Crypto Trading Strategies for Beginners

Now that the groundwork has been laid, let’s explore some of the most beginner-friendly crypto trading strategies.

Dollar-Cost Averaging (DCA)

The Dollar-Cost Averaging (DCA) strategy involves investing a fixed amount of money into a cryptocurrency at regular intervals, regardless of market conditions. This approach helps to smooth out the impact of market volatility, as the trader will be buying the asset at both high and low prices.

To implement a DCA strategy, the trader simply needs to decide on a fixed investment amount and a schedule (e.g., weekly or monthly) for making their purchases. By consistently investing over time, the trader can reduce the risk of buying at the wrong time and potentially mitigate the emotional impact of market fluctuations.

The primary advantages of the DCA strategy include its simplicity, reduced risk, and suitability for long-term investing. However, it’s important to note that this approach may not yield the highest returns during bull markets, and it requires consistent discipline and commitment from the trader.

HODL (Buy and Hold)

The HODL (hold on for dear life) strategy is a long-term investment approach that involves buying cryptocurrencies and holding them for an extended period. The rationale behind this strategy is the belief that the value of certain cryptocurrencies, particularly the top ones like Bitcoin, will continue to appreciate over time.

By adopting a HODL strategy, traders can avoid the constant monitoring and emotional decision-making required for more active trading. This approach is suitable for investors with a long-term outlook and strong conviction in the potential of the cryptocurrencies they’ve chosen.

The key benefits of the HODL strategy include its simplicity, suitability for long-term investing, and the ability to avoid the stress of constant market monitoring. However, it’s crucial to note that this strategy may cause traders to miss out on potential short-term gains, and it requires a high level of patience and confidence in the chosen cryptocurrencies.

Trend Following

The trend following strategy involves identifying and capitalizing on the overall direction of the crypto market. By using technical indicators like moving averages, traders can identify the dominant market trend and make trading decisions accordingly.

For example, if the price of a cryptocurrency is consistently rising and the moving average is pointing upward, a trend following trader might consider opening a long position to potentially profit from the upward trend. Conversely, if the price is consistently declining and the moving average is pointing downward, a trend following trader might consider opening a short position.

The advantages of the trend following strategy include its ability to capitalize on long-term market trends, reduced need for frequent trading, and suitability for beginners who prefer a less active approach. However, this strategy can also result in missed short-term opportunities, and it can be challenging to accurately predict trend reversals.

Setting Up Your Crypto Trading Environment

To enhance the chances of success in the crypto trading arena, it is essential to set up a proper trading environment. This includes selecting the right trading tools and implementing effective risk management strategies.

Choosing the Right Trading Tools

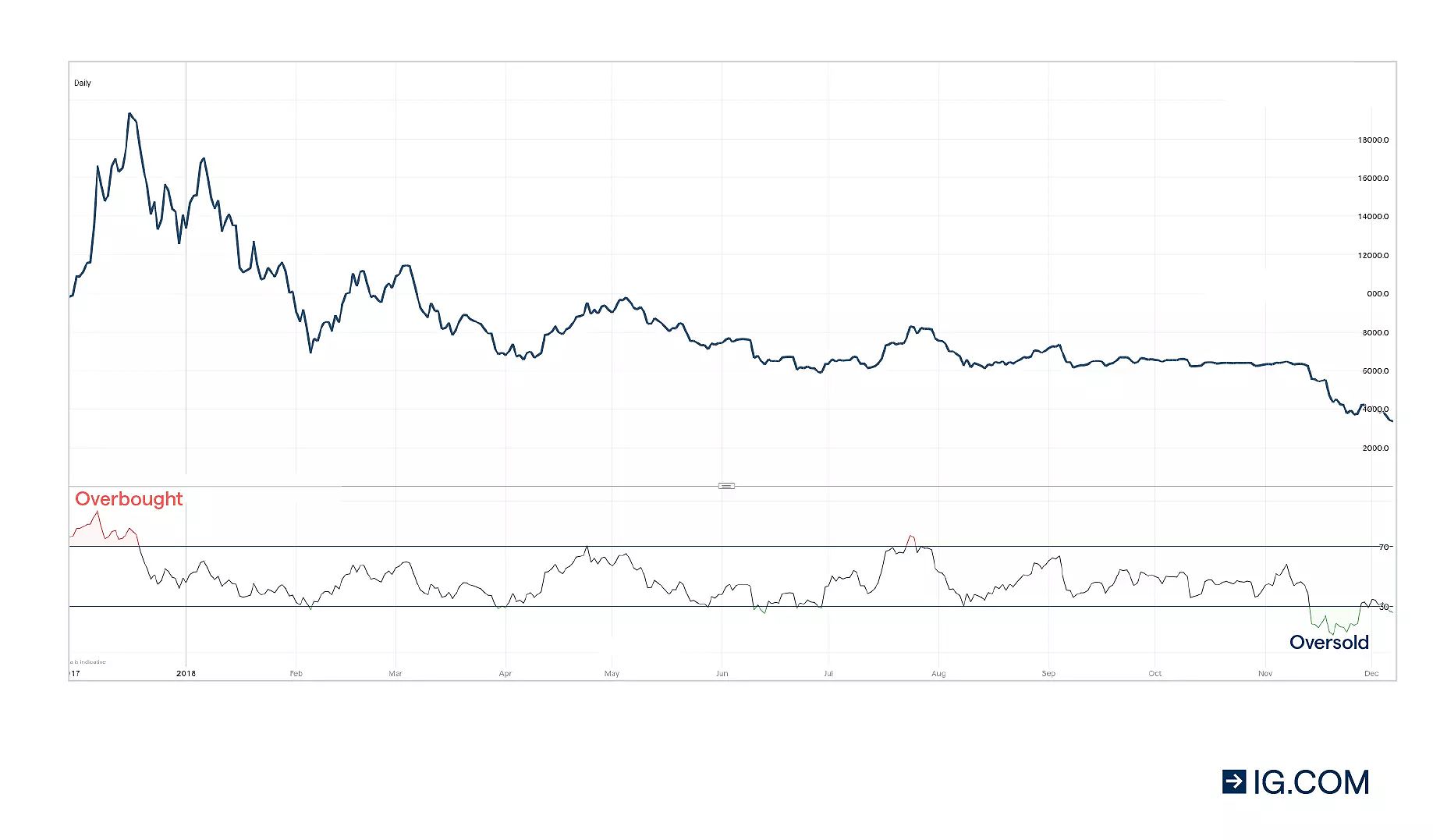

Effective crypto trading relies heavily on the use of charts and technical indicators. Aspiring traders should familiarize themselves with basic technical analysis tools, such as moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD).

These indicators can help traders identify potential entry and exit points, spot trends, and make more informed trading decisions. By understanding how to interpret and apply these tools, traders will be better equipped to navigate the volatile crypto market.

Managing Your Risk

Risk management is a crucial aspect of successful crypto trading, especially for beginners. Traders should implement strategies like stop-loss orders to protect against significant losses, and carefully consider their position sizing to ensure they are not overexposing their capital.

Additionally, diversifying investments across different cryptocurrencies can help mitigate the impact of market fluctuations. Traders should start with a small amount of capital and gradually increase their investments as they gain experience and confidence.

Essential Tips for Beginners

As aspiring crypto traders embark on their journey, they should keep the following tips in mind:

- Start with a Demo Account: Practice trading with virtual funds before risking real money. This will help traders become familiar with the trading platform, test their strategies, and build confidence without the pressure of actual financial losses.

- Learn from Educational Resources: Utilize online courses, tutorials, and articles to expand their knowledge and stay up-to-date with the latest developments in the crypto trading landscape.

- Join Crypto Communities: Connect with other traders to share ideas, learn from their experiences, and stay informed about market trends.

- Stay Informed: Keep up with news and events that may impact the crypto market, as these can significantly influence the prices of various digital assets.

- Be Patient and Disciplined: Avoid impulsive decisions and stick to their trading plan. Successful crypto trading requires patience, discipline, and a long-term perspective.

FAQ

Q: What is the best crypto trading strategy for beginners? A: There is no one-size-fits-all strategy. For beginners, Dollar-Cost Averaging (DCA) and HODL are generally recommended due to their simplicity and lower risk.

Q: How much money should I start with for crypto trading? A: Start with an amount you are comfortable losing. Begin with a small amount and gradually increase your investment as you gain experience and confidence.

Q: What are the biggest risks associated with crypto trading? A: The biggest risks include market volatility, scams and fraud, and security breaches. Be cautious of fraudulent schemes, protect your accounts and funds, and always do your own research (DYOR).

Conclusion

In the ever-evolving world of cryptocurrency, the potential for lucrative trading opportunities is undeniable. However, navigating the crypto market can be a daunting task, especially for those new to the field. This comprehensive guide has provided a thorough overview of the best crypto trading strategies for beginners, equipping aspiring traders with the knowledge and tools to embark on their trading journey with confidence.

By understanding the fundamentals, exploring beginner-friendly strategies, and setting up a proper trading environment, traders can position themselves for success in the exciting and dynamic crypto market. Remember to start with a demo account, learn from educational resources, and join the crypto community to gain valuable insights and support.

With dedication, patience, and a solid understanding of the market, beginner crypto traders can confidently take the first steps towards mastering the art of cryptocurrency trading. The future of finance is digital, and the time to explore the possibilities of crypto trading is now.