The world of crypto trading is a dynamic and ever-evolving landscape, offering both opportunities and challenges for traders. With the right strategies and a disciplined approach, it is possible to navigate the complexities of the crypto market and achieve sustainable growth in your portfolio. In this article, we will explore the most prominent crypto trading strategies, highlighting their strengths, weaknesses, and the considerations you must keep in mind as you embark on your crypto trading journey.

Swing Trading: Crypto Trading Strategies For Riding Market Volatility

Swing trading in the crypto market has always intrigued me. The idea of capitalizing on the volatility of digital assets by taking positions that span multiple days or even weeks holds a certain allure. By leveraging technical analysis and identifying market trends, swing traders can seek to profit from both upward and downward price swings.

However, the crypto market is a fickle beast, and swing trading requires a delicate balance of patience, discipline, and risk management. One wrong move, and your hard-earned gains can vanish in the blink of an eye. As I’ve learned through my own experiences, the key to successful swing trading in the crypto space lies in your ability to read the market’s pulse, anticipate its sudden shifts, and execute your trades with surgical precision.

Golden Cross chart Image: Golden Cross chart – A chart showing the Golden Cross, a popular technical analysis indicator used in swing trading.

Golden Cross chart Image: Golden Cross chart – A chart showing the Golden Cross, a popular technical analysis indicator used in swing trading.

Day Trading: Mastering The Art Of Short-term Gains

The siren call of day trading in cryptocurrencies has seduced many, myself included. The prospect of capitalizing on the market’s intraday volatility and making quick profits is undoubtedly enticing. But, as with any high-stakes endeavor, day trading in the crypto space is not for the faint of heart.

To succeed as a day trader, you must possess a deep understanding of technical analysis, market sentiment, and the ability to make split-second decisions. The crypto market is known for its unpredictable and sudden price swings, and a single misstep can quickly erase your gains. As I’ve discovered, day trading requires a level of discipline, focus, and risk management that not everyone is equipped to handle.

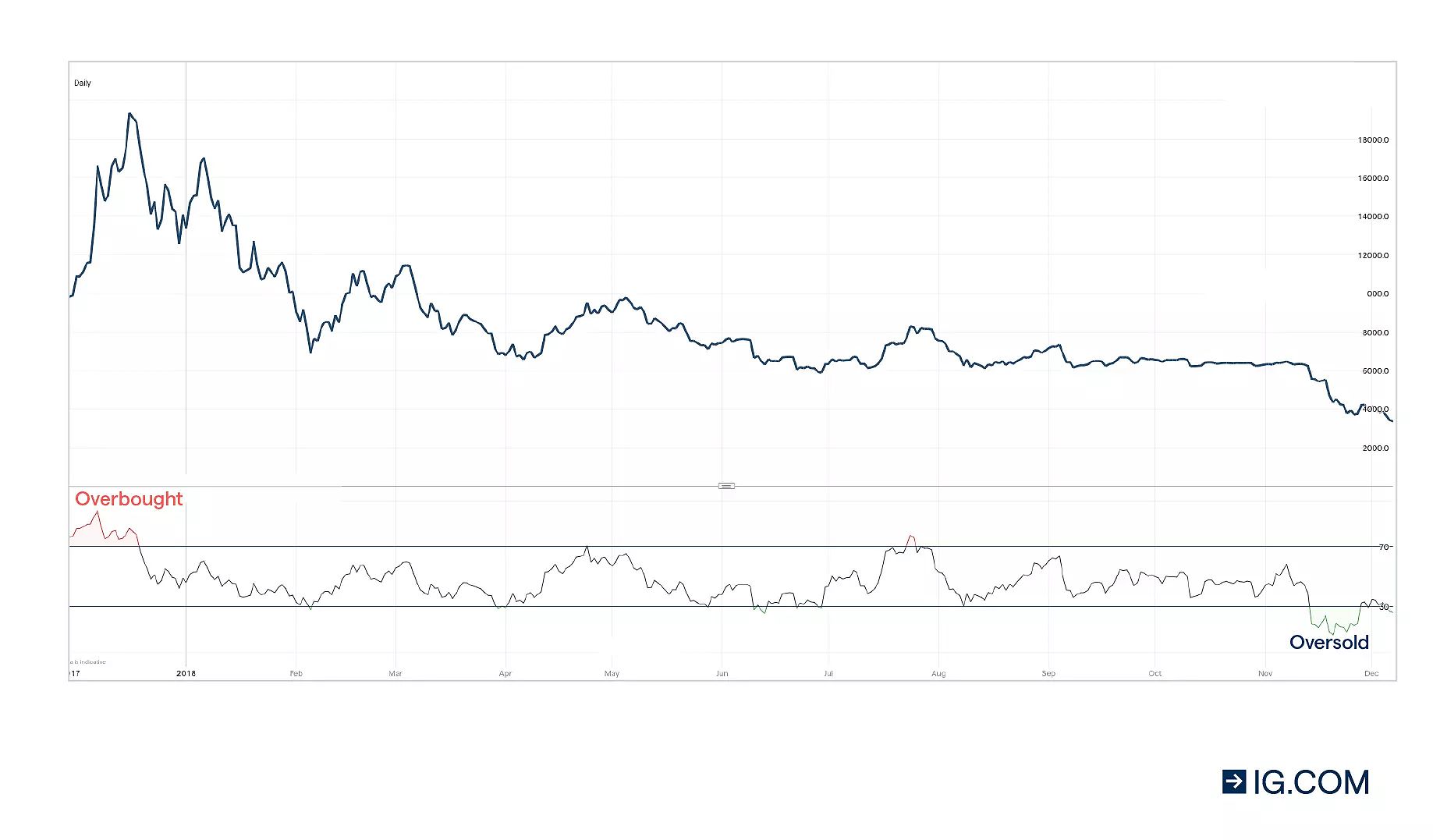

RSI chart Image: RSI chart – A chart showing the Relative Strength Index (RSI), a commonly used technical indicator in day trading.

RSI chart Image: RSI chart – A chart showing the Relative Strength Index (RSI), a commonly used technical indicator in day trading.

Position Trading: Embracing The Long-term

In contrast to the frenetic pace of day trading and swing trading, position trading in cryptocurrencies offers a more measured and patient approach. By focusing on identifying and capitalizing on prevailing market trends, position traders can seek to benefit from the broader market’s upward or downward trajectory.

This strategy is often favored by investors who are more risk-averse and seek stability in their crypto portfolios. As I’ve observed, position traders typically conduct in-depth fundamental analysis, examining factors such as project roadmaps, team dynamics, and industry developments to make informed investment decisions.

Dollar-cost Averaging: Minimizing Volatility

In the unpredictable world of crypto trading, one strategy that has consistently caught my attention is Dollar-Cost Averaging (DCA). This approach involves investing a fixed amount of capital at regular intervals, regardless of the current market price. By averaging out the purchase prices over time, DCA helps traders reduce the risk of buying at the market’s peak and potentially selling at a loss.

While DCA may not maximize short-term gains, I’ve found it to be an effective way for beginners and long-term investors to build their crypto portfolios while minimizing their exposure to market fluctuations. The beauty of this strategy lies in its simplicity and its ability to provide a more systematic and disciplined approach to crypto investing.

Scalping: Capitalizing On Momentum

The world of scalping in the crypto market is a high-stakes game, where traders seek to capitalize on small, yet frequent, price movements. As I’ve delved into this strategy, I’ve come to appreciate the level of technical expertise and risk management required to succeed.

Scalpers must possess a deep understanding of market microstructure, the ability to execute trades rapidly, and a strong emotional control to navigate the fast-paced market conditions. While scalping can be particularly effective in highly liquid crypto markets, a single unexpected event can quickly erode the gains from multiple successful trades.

As I’ve discovered, effective scalping requires a level of discipline and precision that not everyone is willing or able to maintain. It’s a strategy that demands a relentless focus and a willingness to embrace the inherent risks of the crypto market.

Key Considerations In Navigating The Crypto Landscape

Regardless of the crypto trading strategy you choose to pursue, there are several key considerations that you must keep in mind:

- Risk Management: Effective risk management is the cornerstone of any successful crypto trading endeavor. This includes setting stop-loss orders, diversifying your portfolio, and allocating capital based on your risk tolerance.

- Education and Research: The crypto market is a constantly evolving landscape, and staying up-to-date with industry news, technical analysis, and fundamental analysis is crucial to making informed trading decisions.

- Emotional Control: Emotions can be the downfall of even the most seasoned crypto traders. Developing the discipline to make rational, data-driven decisions and avoiding impulse-driven trades is essential.

- Regulatory Landscape: The ever-changing regulatory landscape surrounding cryptocurrencies can significantly impact market conditions, and it’s vital to stay informed about the latest developments.

- Trading Platform Selection: Choosing a reputable and secure crypto trading platform that aligns with your trading strategy and provides the necessary tools and features is a critical step in your crypto trading journey.

Frequently Asked Questions

What is the best crypto trading strategy for beginners? For beginners, the dollar-cost averaging (DCA) strategy is often recommended as it provides a systematic and disciplined approach to investing in cryptocurrencies, minimizing the impact of market volatility.

How much capital do I need to start crypto trading? The amount of capital required to start crypto trading can vary, but many platforms allow traders to start with as little as $100. However, it’s essential to only invest what you can afford to lose, as the crypto market can be highly volatile.

What are the risks associated with crypto trading? Crypto trading carries significant risks, including price volatility, hacking, and regulatory uncertainty. Proper risk management, thorough research, and a well-defined trading strategy are crucial to mitigate these risks.

Conclusion

In conclusion, the path to success in crypto trading is not a one-size-fits-all approach. By understanding the various trading strategies outlined in this article, you will be better equipped to navigate the complexities of the crypto market and potentially achieve sustainable growth in your portfolio. Remember, the key to success lies in a disciplined approach, effective risk management, and a willingness to continuously learn and adapt to the ever-changing landscape of the crypto trading world.