The allure of quick profits in the ever-evolving cryptocurrency landscape has lured many unsuspecting investors into the clutches of sophisticated scammers. As the crypto market continues to capture global attention, it is crucial to approach this domain with vigilance and a healthy dose of skepticism, especially when it comes to crypto trading scams.

Identifying The Traps: Common Crypto Trading Scams Exposed

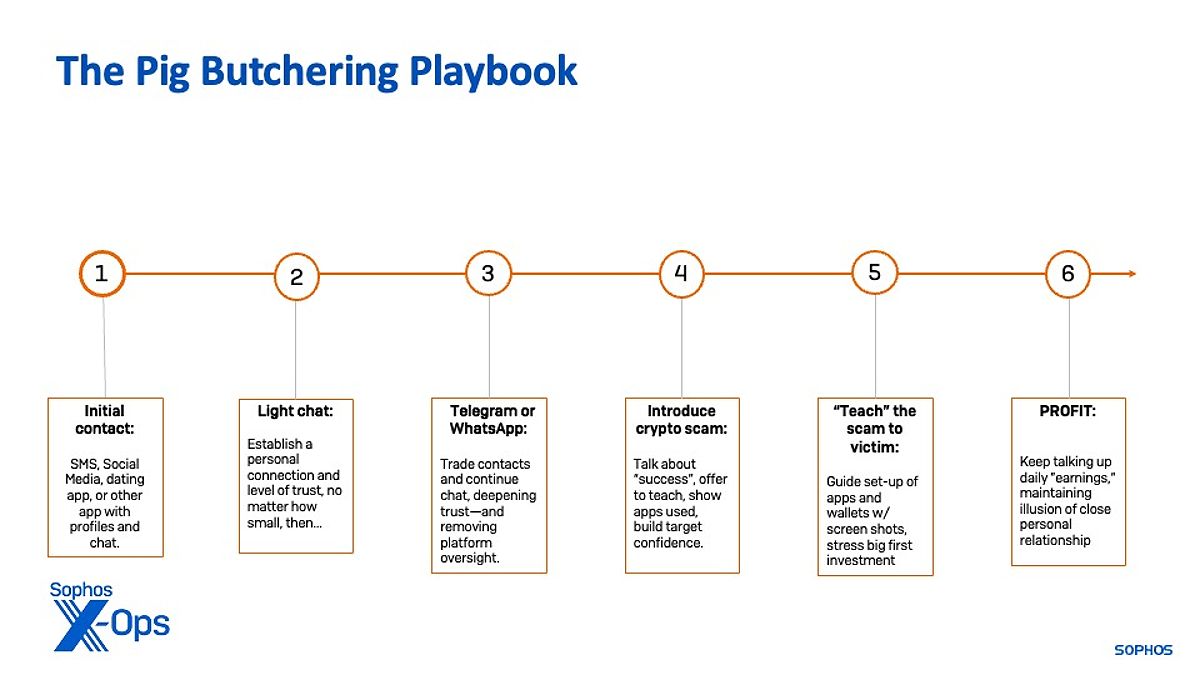

The world of crypto trading is rife with sophisticated traps, meticulously designed to separate the unwary from their hard-earned funds. From phishing platforms masquerading as legitimate exchanges to pump-and-dump schemes that prey on the fear of missing out, the arsenal of the crypto scammer is both diverse and deceptive.

Phantom Platforms And Counterfeit Wallets

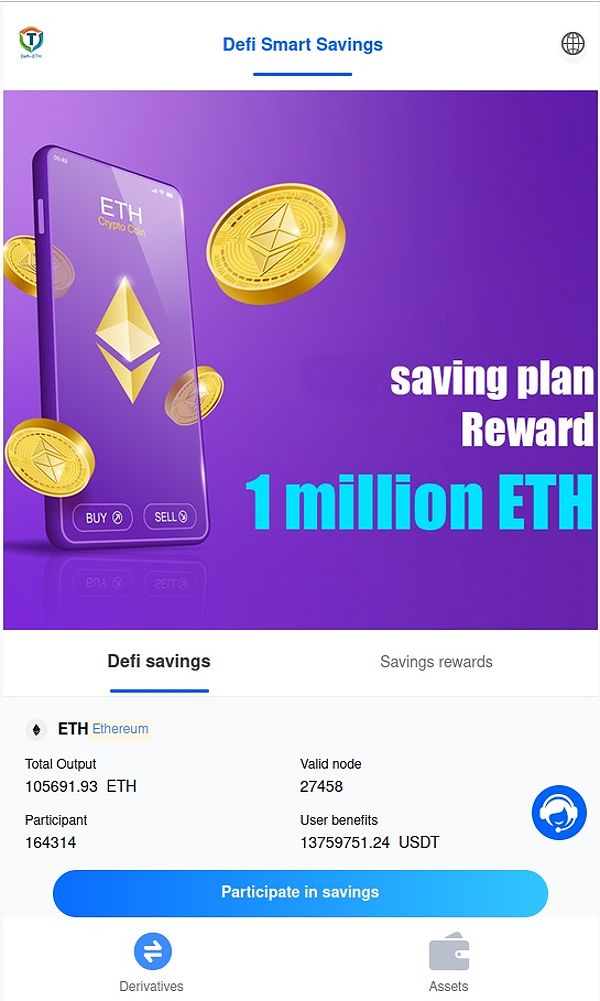

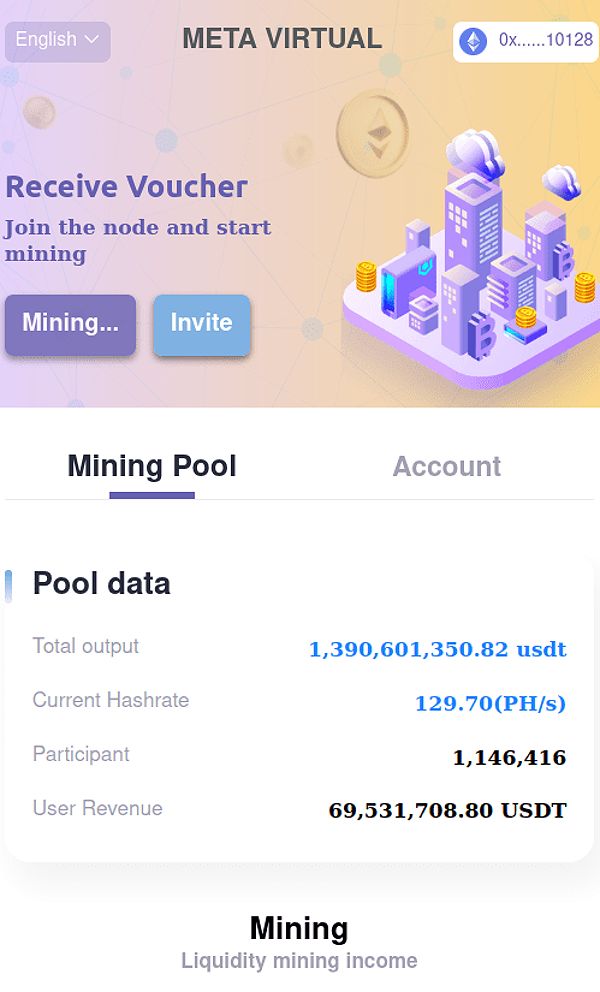

One of the most prevalent tactics employed by these modern-day swindlers is the creation of fake trading platforms and digital wallets. Scammers invest considerable effort in replicating the look and feel of well-known crypto exchanges and storage solutions, often using similar domain names to lure unsuspecting victims. Once you’ve entrusted them with your login credentials or transferred your funds, the scammers have free rein to drain your crypto holdings, leaving you helpless and financially devastated.

These scams can be particularly difficult to detect, as the fraudulent platforms may even allow for small withdrawals, further reinforcing the illusion of legitimacy. However, when the time comes to make a larger withdrawal, the platform mysteriously vanishes, and your funds disappear along with it.

The Pump-and-dump Deception

Another common tactic employed by crypto scammers is the infamous “pump-and-dump” scheme. In these manipulative ploys, fraudsters artificially inflate the price of a cryptocurrency through aggressive marketing, social media hype, and false promises of astronomical returns. Once the price has been driven up, the scammers quickly sell off their holdings, causing the value to plummet and leaving investors with significant losses.

These schemes thrive on the fear of missing out (FOMO) and the promise of easy money, luring in unsuspecting victims through the use of fake celebrity endorsements, elaborate websites, and coordinated social media campaigns. By the time the scam is executed, the value of the crypto asset can plummet, leaving investors with nothing but the bitter taste of regret.

Fabricated Crypto Products And Job Opportunities

Scammers have also found new ways to exploit the crypto-curious, creating fictitious cryptocurrency products, such as tokens or investment opportunities, as well as fraudulent job postings related to crypto trading. These scams often involve elaborate backstories, phony whitepapers, and the promise of effortless riches, all designed to lure in the unsuspecting.

In some cases, scammers may even create fake mobile apps that appear to be legitimate crypto trading platforms or wallets, distributing them through official app stores to further enhance their credibility and make them harder to detect.

Armor Up: Strategies For Protecting Yourself From Crypto Trading Scams

Cultivate A Healthy Skepticism

In the high-stakes world of crypto trading, a healthy dose of skepticism is your greatest ally. Approach any investment opportunity with a critical eye, and be wary of high-pressure tactics, promises of guaranteed returns, or claims of “free money.” Trust your instincts, and don’t let emotion-driven decisions cloud your judgment.

If an investment opportunity seems too good to be true, it likely is. Scammers often rely on the allure of easy money and the fear of missing out to ensnare their victims. By maintaining a vigilant and discerning mindset, you can significantly reduce your risk of falling prey to these sophisticated scams.

Diligent Research And Due Diligence

Thorough research and due diligence are the cornerstones of navigating the crypto trading landscape safely. Before investing in any cryptocurrency or platform, take the time to thoroughly vet the project. Carefully review the whitepaper, understand the team behind the venture, and search for reviews and testimonials from other users. Avoid any investment opportunities that lack clear, transparent information or seem to be operating in a legal gray area.

It’s also essential to verify the legitimacy of any crypto exchange or wallet provider before entrusting them with your funds. Look for established, reputable platforms that have a proven track record and a strong reputation within the crypto community.

Secure Your Digital Assets

Protecting your cryptocurrency holdings is of paramount importance. Always use a reputable and secure digital wallet to store your assets, and never share your private keys or recovery phrases with anyone, including investment platforms. Enable two-factor authentication and consider storing your private keys offline in a hardware wallet for added security.

Regularly monitor your wallet balances and transactions, and be vigilant for any unexpected tokens or assets appearing in your account. If you encounter anything suspicious, act swiftly to secure your funds and report the incident to the relevant authorities.

FAQs

Q: How can I tell if a cryptocurrency exchange is legitimate? A: Look for a professional-looking website, a clear and detailed whitepaper, and a team of experienced professionals. Check for positive online reviews and ratings from reputable sources. Ensure the exchange is registered with the appropriate financial authorities in your jurisdiction.

Q: What are some red flags to look out for when investing in cryptocurrency? A: Be wary of promises of guaranteed returns, “free money,” or high-pressure sales tactics. Avoid investments that lack a clear explanation or have a poorly written whitepaper. Thoroughly research the project, its team, and its roadmap before committing any funds.

Q: What should I do if I think I’ve been scammed? A: Contact your bank or financial institution immediately. Report the scam to the relevant authorities, such as the FTC or your local law enforcement. Document all the details of the incident, including any communication with the scammers, and provide this information to the authorities to aid in their investigation.

Conclusion: Navigating The Crypto Minefield With Vigilance

The allure of the cryptocurrency market is undeniable, but it is also a breeding ground for sophisticated scams that prey on the uninformed and the unwary. By arming yourself with the knowledge to identify the common crypto trading scams, practicing diligent research and due diligence, and securing your digital assets, you can navigate this ever-evolving landscape with a renewed sense of confidence and control.

Remember, in the world of crypto trading, the only person you can truly trust is yourself. Cultivate a healthy skepticism, trust your instincts, and never let the promise of easy money cloud your judgment. By doing so, you can minimize the risk of falling victim to the cunning schemes of the crypto scammers and safeguard your financial future.