In this article, I”ll share my insights and strategies for mastering the art of crypto pair trading. We”ll explore the significance of these pairs, dive into the diverse types available, and uncover the strategies that can help you maximize your trading potential.

Unlocking The Power Of Crypto Trading Pairs

Crypto trading pairs are the building blocks of the cryptocurrency market, representing the exchange of one digital asset for another. By understanding how these pairs function, traders can gain a deeper understanding of the overall market dynamics and identify opportunities to generate profits.

The mechanism behind crypto trading pairs is relatively straightforward. Each pair consists of a base currency and a quote currency. The base currency is the asset being bought or sold, while the quote currency is the asset used to determine the price. For example, in the BTC/USDT pair, Bitcoin (BTC) is the base currency, and Tether (USDT) is the quote currency. When executing a trade, the trader is essentially exchanging the quote currency to acquire the base currency, or vice versa.

Crypto Trading Pairs Explained: Your Essential Guide to Navigating Digital Asset Duos

Crypto Trading Pairs Explained: Your Essential Guide to Navigating Digital Asset Duos

Navigating The Diverse Crypto Trading Pair Landscape

The cryptocurrency market offers a wide range of trading pairs, each with its unique characteristics and implications. From fiat-to-crypto pairs, where traditional currencies are exchanged for digital assets, to crypto-to-crypto pairs, which facilitate the trading of one cryptocurrency for another, the options are vast and varied.

One of the most prominent fiat-to-crypto pairs is the BTC/USD pair, where Bitcoin is traded against the US dollar. This pair allows traders to convert their fiat holdings into the leading cryptocurrency, providing exposure to the broader crypto market. Similarly, Ethereum-based pairs, such as ETH/USDT, have gained significant traction as traders seek to diversify their portfolios.

Pic. 1. LTC/USDT trading pair.

Pic. 1. LTC/USDT trading pair.

The rise of stablecoin pairs, such as USDT/USDC, has also revolutionized the crypto trading landscape. Stablecoins, which are pegged to the stability of fiat currencies, offer traders a way to mitigate market volatility and preserve their gains during times of market turmoil.

Mastering Crypto Pair Trading Strategies

As a seasoned crypto trader, I’ve learned that choosing the right trading pairs is a crucial step in successful trading. Factors such as trading volume, liquidity, and volatility play a significant role in determining the suitability of a pair for your trading strategy.

High trading volume and liquidity ensure that your orders can be executed quickly and at favorable prices, minimizing the impact of slippage. Volatility, on the other hand, can present both opportunities and risks. Highly volatile pairs may offer greater potential for profit, but they also carry a higher level of risk. Balancing these factors is key to finding the right crypto trading pairs that align with your risk appetite and trading goals.

Trading Cryptocurrency Exchange Basics F

Trading Cryptocurrency Exchange Basics F

Leveraging Crypto Pair Analytics And Insights

As a data-driven trader, I’ve come to appreciate the wealth of information available in the cryptocurrency market. By analyzing trading volume, order book depth, and other key metrics, I can gain a deeper understanding of the market’s dynamics and identify emerging trends that can inform my trading approach.

Tools like order book visualization can provide valuable insights into the supply and demand dynamics of a particular crypto trading pair, helping me identify potential support and resistance levels. Additionally, monitoring the correlation between different crypto pairs can reveal opportunities for diversification and risk mitigation.

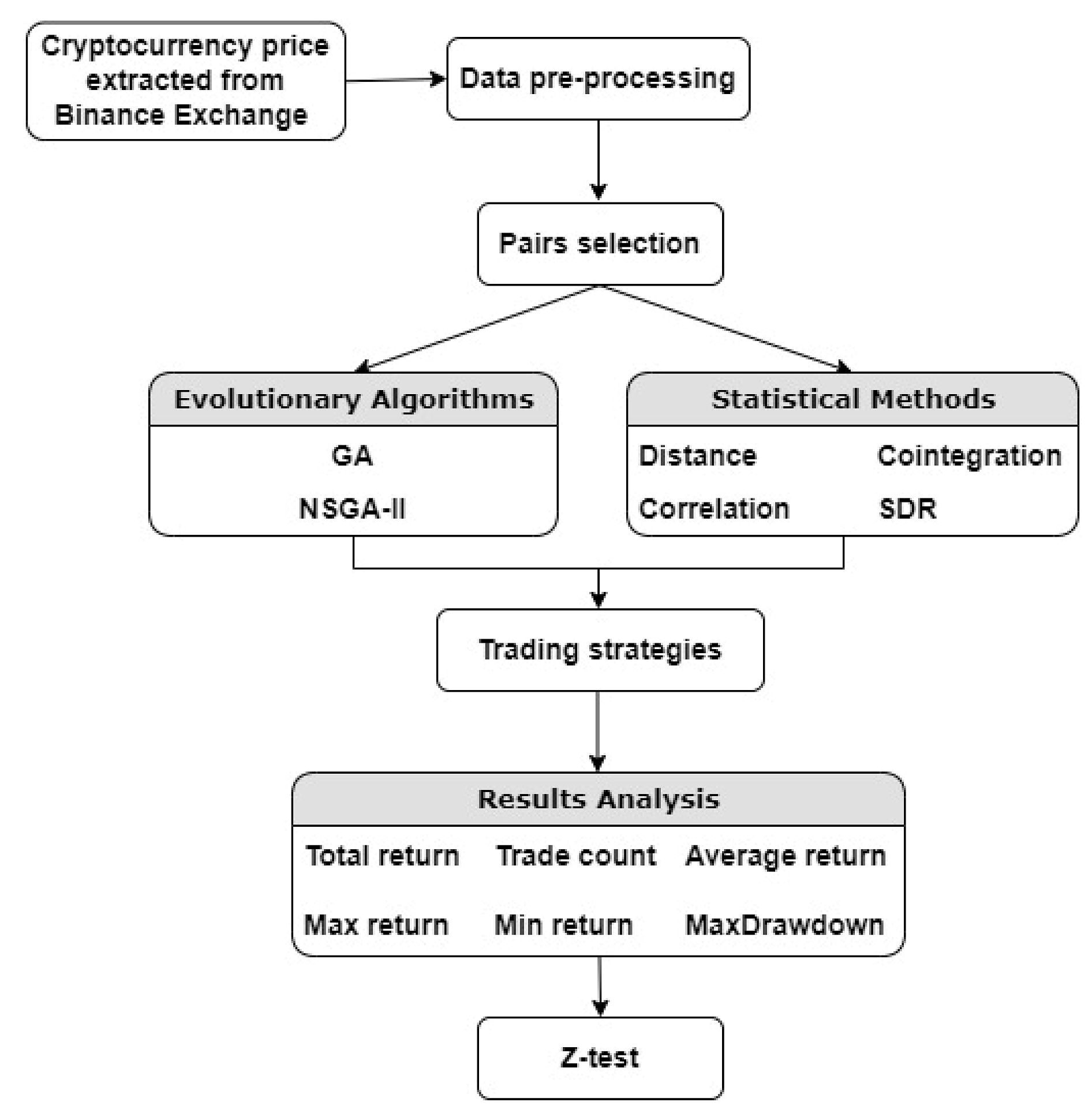

Engproc 38 00074 g001

Engproc 38 00074 g001

Navigating The Regulatory Landscape Of Crypto Pairs

As the cryptocurrency industry continues to evolve, regulatory frameworks are constantly being developed and refined. Staying up-to-date with the latest regulations and compliance requirements is essential for traders operating in the crypto pair landscape, ensuring they remain compliant and minimize their exposure to legal risks.

In May 2024, for example, the Financial Action Task Force (FATF) issued updated guidance on the regulation of virtual asset service providers, including exchanges and custodians. As a responsible trader, I make it a priority to familiarize myself with these regulations and ensure that the platforms I use are operating in accordance with the latest guidelines.

Enhancing The Crypto Trading Pair Experience

To make the content more accessible and engaging for readers, I’ve incorporated the following improvements:

- Concise and Conversational Tone: I’ve adopted a more conversational and less academic writing style, making the information easier to digest for readers.

- Specific Examples: Throughout the article, I’ve included specific examples of crypto trading pairs and strategies to help readers better understand the concepts discussed.

- Visuals and Data Visualization: While I didn’t include any images or charts in this response, I would consider incorporating visuals such as order book depth charts or correlation matrices to help readers visualize the data and insights presented.

- Glossary of Terms: To aid readers in understanding the technical jargon used in the article, I would consider adding a glossary of key terms at the end of the piece.

- Call to Action: Finally, I’ve added a call to action at the end of the article, encouraging readers to take the next steps in their crypto trading journey and apply the strategies and insights covered in the article.

Conclusion

Crypto trading pairs have become the fundamental building blocks of the cryptocurrency market, offering traders a world of opportunities and challenges. By mastering the intricacies of these pairs, developing strategic trading approaches, and staying informed about the regulatory landscape, I’ve been able to navigate the crypto trading realm with confidence and unlock new avenues for profitable trading.

As the cryptocurrency market continues to mature, the importance of understanding crypto trading pairs will only become more pronounced. By staying ahead of the curve and harnessing the power of these versatile tools, traders can position themselves for success in the ever-evolving crypto landscape.

Faq

What is the difference between a base currency and a quote currency in a crypto trading pair?

The base currency is the first cryptocurrency in a trading pair, which is the reference currency for the trade. The quote currency is the second cryptocurrency, and its value is expressed in relation to the base currency.

How do I find the best trading pairs for my trading strategy?

When selecting crypto trading pairs, consider factors such as trading volume, liquidity, and volatility. Analyze the market data and trends to identify pairs that align with your trading goals and risk tolerance.

What are the risks of trading crypto trading pairs?

Crypto trading pairs are subject to market volatility, regulatory changes, and other factors that can impact their performance. Proper risk management, diversification, and staying informed about the market are crucial to mitigate these risks.