The rise of cryptocurrencies has captured the attention of investors, both seasoned and novice alike, as the crypto market gains mainstream traction. Platforms like Robinhood have emerged as accessible gateways for those eager to explore the world of digital assets. This guide provides knowledge and insights to navigate the intricacies of crypto trading on Robinhood.

Robinhood Crypto: Bridging the Gap

Accessing crypto

Accessing crypto

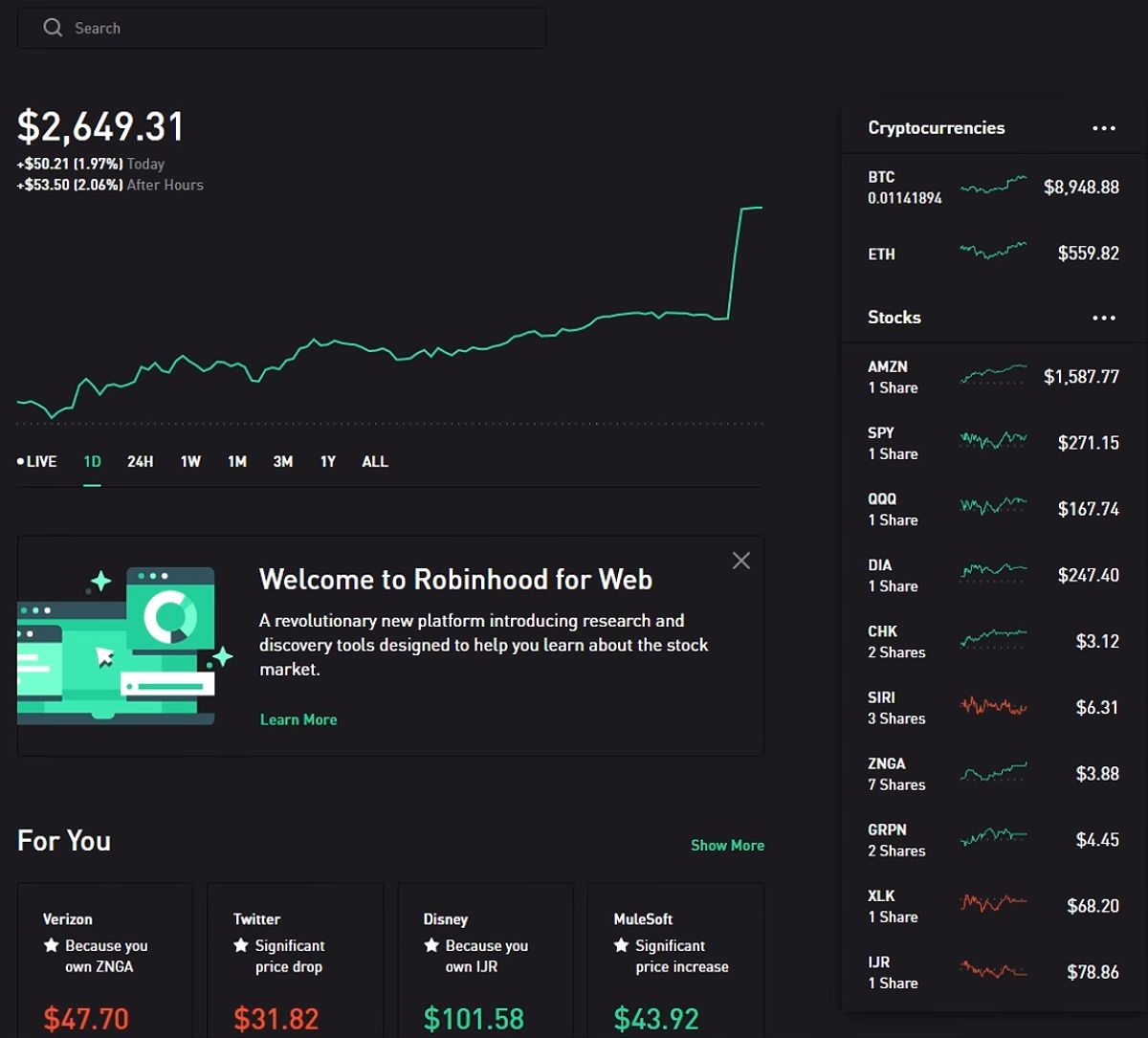

Robinhood, the popular online brokerage, has firmly established itself as a disruptive force in the financial industry. By offering commission-free trading in stocks, options, and exchange-traded funds (ETFs), Robinhood has democratized access to traditional markets. In recent years, the platform has expanded its offerings to include cryptocurrency trading through its Robinhood Crypto service.

Robinhood Crypto’s user-friendly interface and streamlined approach have made it an attractive choice for beginner investors dipping their toes into the crypto realm. The platform currently supports a curated selection of seven cryptocurrencies, including the industry heavyweights like Bitcoin, Ethereum, and Dogecoin, as well as alternative options such as Bitcoin Cash, Bitcoin SV, Litecoin, and Ethereum Classic. This focused selection aims to provide a more tailored and manageable experience for users, rather than overwhelming them with an extensive list of digital assets.

Is Crypto Trading Free on Robinhood?

One of the primary draws of Robinhood Crypto is its commission-free trading structure. Unlike traditional brokerages, Robinhood Crypto does not charge any trading commissions for buying and selling cryptocurrencies. This cost-effective approach makes it particularly appealing to beginner investors who are looking to explore the crypto market without the burden of high trading fees.

However, it’s important to note that Robinhood Crypto does implement an order flow fee, which is automatically included in the total cost of each transaction. This fee can vary based on the specific crypto asset and the market conditions at the time of the trade. Additionally, users who wish to transfer their crypto holdings off the Robinhood platform will incur a $75 withdrawal fee.

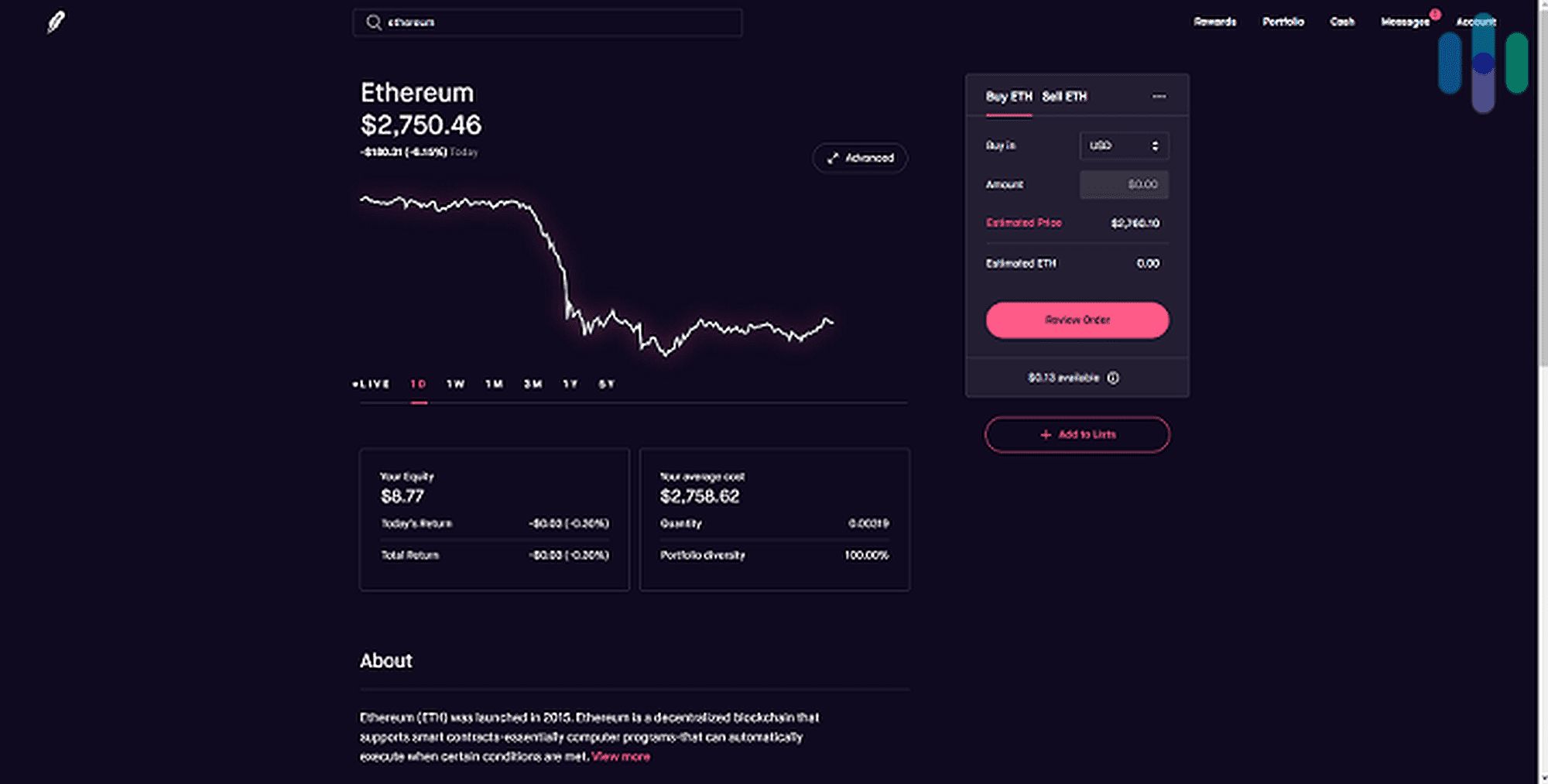

Robinhood Order Form

Robinhood Order Form

While the overall cost-effectiveness of Robinhood Crypto is a significant advantage, investors should be mindful of these potential fees and factor them into their trading strategies.

Robinhood Crypto Trading Limits

When it comes to trading cryptocurrencies on Robinhood, investors should be aware of certain limitations imposed by the platform. Robinhood Crypto has established minimum trade amounts for each supported cryptocurrency, with the exception of Dogecoin, which has a minimum requirement of 1 DOGE per transaction. These minimum trade requirements ensure that investors are not making insignificant trades, which could potentially impact the overall efficiency of the platform.

Notably, Robinhood Crypto does not impose daily or monthly trading limits, allowing investors to execute as many trades as they desire. However, one significant limitation is the platform’s inability to directly transfer cryptocurrencies to external wallets. Investors who wish to move their digital assets off the Robinhood platform will need to sell their holdings and withdraw the funds, which may be a concern for those seeking more control over their crypto assets.

Navigating the Robinhood Crypto Platform

Setting up a Robinhood Crypto account is a straightforward process. Investors will need to provide personal information, such as their name, address, and Social Security number, as well as upload a valid form of identification, like a driver’s license or passport. Once the account is established, users can begin exploring the platform’s crypto trading functionalities.

Within the Robinhood Crypto interface, investors can search for and view detailed information on the available cryptocurrencies. To execute a trade, users can select the desired cryptocurrency, choose between a buy or sell order, and specify the amount they wish to transact. The platform’s user-friendly design and mobile-first approach make it accessible for beginners to navigate the crypto trading experience.

Buying cryptocurrency on Robinhood – Login screen

Buying cryptocurrency on Robinhood – Login screen

Crypto Trading Rules and Regulations

As a licensed financial services provider, Robinhood Crypto operates within a regulatory framework to ensure compliance and integrity. The platform is registered with the Financial Crimes Enforcement Network (FinCEN) and adheres to the Bank Secrecy Act, which helps safeguard against illicit activities.

However, it’s crucial for investors to understand that cryptocurrencies, by nature, are highly volatile and speculative investments. Robinhood Crypto users should always conduct thorough research, exercise caution, and invest only what they can afford to lose. Responsible investment practices, such as diversifying one’s portfolio and setting realistic goals, are essential when navigating the crypto market.

Robinhood Crypto vs- The Competition

While Robinhood Crypto offers a user-friendly entry point into the world of digital assets, it is not the only platform available for crypto trading. Other popular options, such as Coinbase and Binance, provide a broader range of cryptocurrencies and more advanced trading features.

Coinbase, for instance, supports over 50 cryptocurrencies and offers a more comprehensive suite of research tools and market analysis. However, Coinbase’s fee structure is generally more complex and can be more expensive for smaller transactions compared to Robinhood Crypto’s commission-free trading.

Another key difference is the availability of crypto wallets. Coinbase offers its own crypto wallet, allowing users to store and manage their digital assets directly on the platform. Robinhood Crypto, on the other hand, does not currently provide this feature, which may be a concern for investors who prefer to have full control over their cryptocurrency holdings.

Ultimately, the choice between Robinhood Crypto and other platforms will depend on the individual investor’s needs, risk tolerance, and trading preferences. It’s advisable to explore and compare the features and costs of different crypto trading platforms to determine the best fit for your investment goals.

The Future of Robinhood Crypto

As the cryptocurrency market continues to evolve, Robinhood Crypto’s future plans will likely focus on expanding its offerings and addressing some of the limitations currently faced by its users. One highly anticipated development is the potential addition of a crypto wallet feature, which would allow Robinhood Crypto users to withdraw and transfer their digital assets to external wallets.

Additionally, Robinhood Crypto may consider expanding its supported cryptocurrency list to provide investors with a more diverse range of options. This could potentially include the addition of popular altcoins, such as Shiba Inu, which have gained significant traction among retail investors in recent years.

However, any future developments will be subject to regulatory scrutiny and compliance requirements. Robinhood Crypto must strike a balance between meeting the evolving needs of its user base and ensuring the necessary safeguards and oversight required in the rapidly changing cryptocurrency landscape.

FAQ

Q: Is Robinhood Crypto safe? A: Robinhood Crypto has implemented robust security measures, including two-factor authentication and cold storage for crypto assets. However, no platform is completely immune to risks, and users should always exercise caution when investing in cryptocurrencies.

Q: Can I transfer my crypto off Robinhood? A: Currently, Robinhood Crypto does not allow direct transfers of cryptocurrencies to external wallets. Investors who wish to move their digital assets off the platform will need to sell their holdings and withdraw the funds.

Q: What are the tax implications of crypto trading on Robinhood? A: Profits from cryptocurrency trading are generally considered taxable income in most jurisdictions. Investors should consult with a tax professional to ensure they understand the relevant tax implications and reporting requirements for their crypto trading activities on Robinhood.

Conclusion

In the ever-evolving world of finance, Robinhood Crypto has emerged as a compelling option for beginner investors seeking to explore the cryptocurrency market. With its commission-free trading, user-friendly interface, and curated selection of digital assets, the platform offers a streamlined entry point into the crypto ecosystem.

However, it’s crucial for investors to understand the platform’s limitations, such as the lack of direct crypto withdrawals and the potential for hidden costs in the form of order flow fees. Responsible investment practices, thorough research, and a clear understanding of the inherent risks associated with cryptocurrencies are essential when using Robinhood Crypto or any other crypto trading platform.

As the cryptocurrency market continues to mature, it will be interesting to see how Robinhood Crypto adapts and enhances its offerings to cater to the growing demands of its user base. By navigating the complexities of the crypto landscape with care and diligence, investors can unlock the potential of this exciting and rapidly evolving financial frontier.