Navigating the Crypto Trading Landscape in India: Unlocking the Potential of a Digital Revolution

As the world of finance continues to evolve, crypto trading has emerged as a transformative force in India. This comprehensive guide will provide you with the knowledge and insights you need to navigate the crypto trading india landscape, exploring the vast potential for growth and innovation that this digital revolution presents for investors and traders alike.

Choosing The Right Cryptocurrency Exchange In India

The foundation of successful crypto trading begins with selecting a reputable and reliable exchange. In my exploration, I’ve discovered that leading platforms like WazirX, CoinDCX, and ZebPay have emerged as trusted hubs for crypto enthusiasts in India. These exchanges offer a diverse range of digital assets, robust security measures, and user-friendly interfaces, catering to the diverse needs of investors.

When choosing a crypto exchange, it’s crucial to consider factors such as security, fees, and the selection of available cryptocurrencies. Look for exchanges with a proven track record of safeguarding user funds, offering competitive trading fees, and providing a wide range of digital assets to diversify your portfolio.

Security

One of the key considerations when selecting a crypto exchange in India is the level of security they provide. Look for platforms that utilize multi-factor authentication, cold storage solutions, and regularly conduct security audits to ensure the safety of your digital assets. Additionally, research the exchange’s reputation, customer reviews, and any reported incidents of hacking or security breaches to make an informed decision.

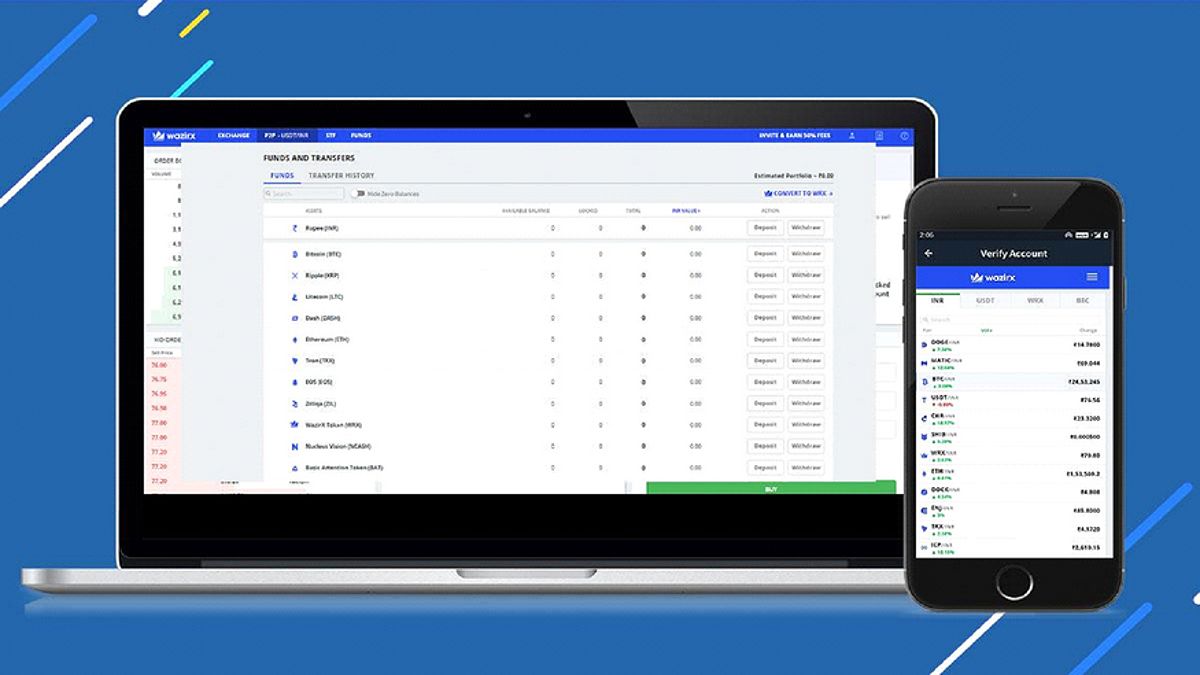

WazirX India crypto exchange

WazirX India crypto exchange

Fees

Fees are another important factor to consider when choosing a crypto exchange. Compare the trading fees, withdrawal fees, and any other associated costs across different platforms to ensure you’re getting the best value for your trading activities. Some exchanges may also offer tiered fee structures or discounts based on your trading volume, so be sure to explore these options as well.

CoinDCX India crypto exchange

CoinDCX India crypto exchange

Selection Of Cryptocurrencies

The selection of cryptocurrencies available on the exchange is also crucial. If you’re looking to diversify your portfolio, choose a platform that offers a wide range of digital assets, including popular cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins. This will give you more flexibility to build a well-rounded investment strategy.

ZebPay India crypto exchange

ZebPay India crypto exchange

Diversifying Your Crypto Portfolio: Strategies For Success

The cryptocurrency market is a vast and dynamic landscape, with a myriad of digital assets, each with its unique characteristics and growth potential. From the flagship Bitcoin to the innovative Ethereum and a plethora of altcoins, the options can be overwhelming. However, by understanding the fundamentals of different cryptocurrencies, you can make informed decisions and build a diversified portfolio that aligns with your investment goals and risk tolerance.

When constructing your crypto portfolio, consider factors like market capitalization, use cases, and the long-term potential of the underlying technology. Diversifying across various cryptocurrencies can help mitigate the risk of volatility and capitalize on the growth opportunities presented by this exciting asset class.

Asset Allocation Strategy

One effective strategy for diversifying your crypto portfolio is to allocate your investments across different asset types, such as digital currencies, decentralized finance (DeFi) protocols, and blockchain-based projects. This can help you capture the potential upside of various sectors within the crypto ecosystem and reduce your overall risk exposure.

Risk Management

Additionally, consider adjusting your portfolio allocation based on your risk appetite and investment timeline. For instance, you might allocate a larger portion of your portfolio to more established cryptocurrencies like Bitcoin and Ethereum for long-term growth, while reserving a smaller percentage for higher-risk, higher-potential altcoins.

Regularly monitoring your portfolio and rebalancing it as needed can also help you maintain a well-diversified and optimized crypto investment strategy. This may involve selling some assets to reinvest in others or adjusting your allocation percentages to align with your evolving investment objectives.

Navigating The Regulatory Landscape: Staying Compliant In India

As the Indian government’s stance on cryptocurrency has evolved over time, staying informed about the latest regulatory developments is crucial. While crypto trading is legal in India, it’s important to be mindful of the tax implications and compliance requirements to ensure you operate within the legal framework.

In 2024, the Indian government introduced a 30% tax on crypto gains and a 1% TDS (Tax Deducted at Source) on all crypto transactions. Familiarizing yourself with these tax regulations and seeking professional guidance can help you manage your crypto investments effectively and avoid any potential legal complications.

It’s also essential to stay up-to-date with any changes or new regulations introduced by the government. The crypto landscape in India is constantly evolving, and being proactive in understanding and adhering to the latest rules can help you navigate the market confidently and avoid any legal pitfalls.

Staying Informed

One effective way to stay informed about regulatory updates is to follow reputable news sources, industry publications, and official government announcements. Additionally, consider joining online communities or forums dedicated to crypto trading in India, where you can engage with other investors and stay informed about the latest developments.

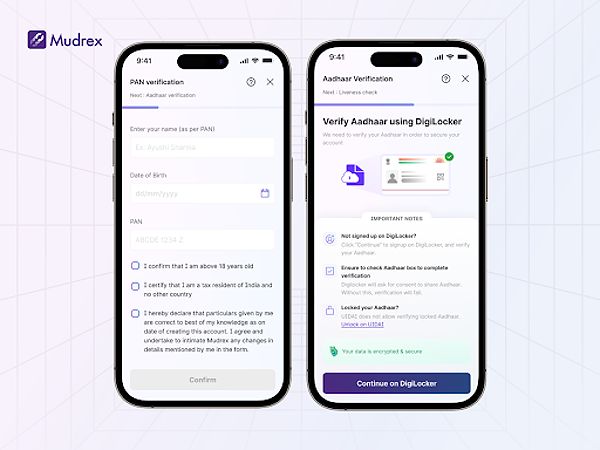

Register and Verify Your Account on a Crypto Exchange

Register and Verify Your Account on a Crypto Exchange

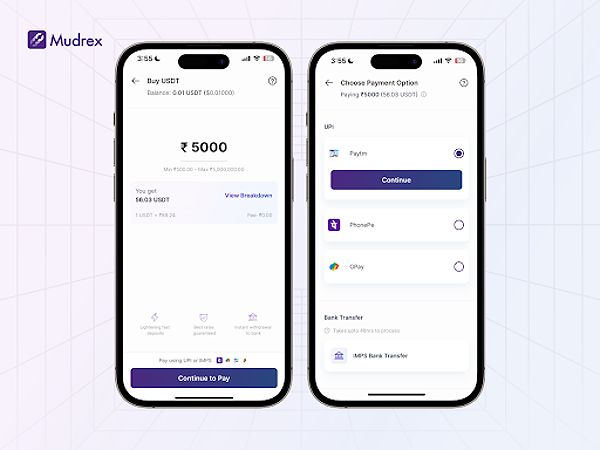

Add Funds to Your Wallet

Add Funds to Your Wallet

Leveraging Trading Strategies: Maximizing Your Returns In Crypto Trading India

Successful crypto trading often involves the strategic application of various trading techniques. From short-term day trading to long-term investment strategies, understanding the nuances of technical analysis, market trends, and risk management can be key to navigating the volatility of the crypto markets.

Explore different trading strategies, such as scalping, swing trading, and position trading, to determine which approach aligns best with your investment style and risk appetite. Additionally, staying up-to-date with market news, analyzing trends, and implementing effective risk management practices can enhance your chances of success in the crypto trading arena.

Dollar-cost Averaging (dca)

One trading strategy that has gained popularity among crypto investors is dollar-cost averaging (DCA). This approach involves making regular, fixed-amount purchases of a cryptocurrency, regardless of the market price, over an extended period. By averaging out the purchase price, DCA can help mitigate the impact of market volatility and provide a more disciplined approach to long-term crypto investing.

Technical Analysis

Another effective strategy is to utilize technical analysis tools and indicators to identify market trends, support and resistance levels, and potential entry and exit points. This can help you make more informed trading decisions and improve your overall performance in the crypto markets.

Remember, as with any investment, it’s crucial to conduct thorough research, understand the risks involved, and seek professional guidance when necessary. Developing a well-rounded understanding of trading strategies and risk management principles can help you navigate the crypto trading landscape more effectively and maximize your returns.

Securing Your Crypto Assets: Protecting Your Digital Wealth

The safety and security of your cryptocurrency holdings should always be a top priority. Explore the benefits of hardware wallets and familiarize yourself with best practices for storing and managing your digital assets, ensuring they are safeguarded against potential threats.

While cryptocurrency exchanges offer built-in wallets for storage, transferring your long-term holdings to a non-custodial hardware wallet can provide an additional layer of security by keeping your private keys offline, reducing the risk of hacking or unauthorized access.

Hardware Wallets

When it comes to securing your crypto assets, one of the most important considerations is the storage method you choose. Hardware wallets, such as Ledger or Trezor, are widely regarded as the most secure way to store your digital assets, as they keep your private keys offline and away from potential online threats.

Best Practices

In addition to using a hardware wallet, it’s essential to follow best practices for managing your crypto holdings, such as regularly backing up your wallet, enabling two-factor authentication, and avoiding sharing your private keys or seed phrases with anyone. Staying vigilant and proactive about the security of your crypto assets can go a long way in protecting your digital wealth.

The Future Of Crypto Trading In India

As the global crypto ecosystem continues to evolve, India’s crypto market is poised for exponential growth. With the government’s increasing recognition of the potential of blockchain technology and the rising demand for digital assets, the future of crypto trading in India appears promising. By staying informed, adaptable, and diligent, you can position yourself to capitalize on the exciting opportunities that lie ahead.

The Indian government’s recent pilot launch of the Central Bank Digital Currency (CBDC) and the growing adoption of blockchain technology across various industries suggest a growing acceptance of cryptocurrencies. As the regulatory landscape continues to evolve, the opportunities for crypto traders and investors in India are expected to expand, paving the way for a more vibrant and innovative financial landscape.

Government – S Regulatory Approach

One of the key factors that will shape the future of crypto trading in India is the government’s regulatory approach. As the country continues to explore the potential of blockchain technology and digital assets, it’s likely that the regulatory framework will become more comprehensive and supportive of the crypto ecosystem. This could lead to increased institutional investment, improved market infrastructure, and greater mainstream adoption of cryptocurrencies in India.

Decentralized Finance (defi) And Non-fungible Tokens (nfts)

Moreover, the rise of decentralized finance (DeFi) and the growing popularity of non-fungible tokens (NFTs) are likely to have a significant impact on the Indian crypto market. As these emerging technologies gain traction, investors and traders in India may seek to diversify their portfolios and capitalize on the opportunities presented by these new asset classes.

Overall, the future of crypto trading in India appears promising, with the potential for continued growth, innovation, and regulatory development. By staying informed, adaptable, and proactive, crypto enthusiasts in India can position themselves to navigate this dynamic landscape and unlock the full potential of this digital revolution.

Faqs: Navigating The Crypto Trading Landscape

Is crypto trading legal in India? Yes, crypto trading is legal in India, although the regulatory landscape is still evolving. Investors should stay informed about the latest developments and comply with the applicable rules and regulations.

What is the best cryptocurrency exchange in India? The best cryptocurrency exchange in India depends on individual preferences and requirements. Some of the leading platforms include WazirX, CoinDCX, and ZebPay, each offering a range of features and services.

How do I pay taxes on my crypto trading profits? Crypto trading profits in India are subject to a 30% tax. Investors should maintain detailed records of their trades and consult with a tax professional to ensure compliance with the applicable tax laws.

What are the benefits of diversifying my crypto portfolio? Diversifying your crypto portfolio can help mitigate the risk of volatility and provide opportunities for potential gains. By investing in a variety of cryptocurrencies, you can balance your exposure and potentially enhance the overall performance of your investments.

How can I secure my cryptocurrency holdings? Securing your crypto assets is crucial. Consider using hardware wallets, which store your private keys offline, reducing the risk of hacking or unauthorized access. Additionally, enable two-factor authentication and follow best practices for managing your digital assets.

Conclusion

As the crypto trading landscape in India continues to evolve, it is essential to stay informed, adaptable, and diligent to capitalize on the opportunities that lie ahead. By embracing the knowledge and strategies outlined in this guide, you can position yourself to succeed in the exciting world of crypto trading in India.