As an experienced cryptocurrency investor, I”ve witnessed the remarkable growth and evolution of the crypto trading fund landscape. In recent years, these specialized investment vehicles have become an increasingly attractive option for those seeking to diversify their portfolios and gain institutional-grade exposure to the dynamic cryptocurrency market.

In this comprehensive guide, I’ll share my insights and personal experiences navigating the intricacies of crypto trading funds, equipping you with the knowledge to make informed investment decisions.

In this comprehensive guide, I’ll share my insights and personal experiences navigating the intricacies of crypto trading funds, equipping you with the knowledge to make informed investment decisions.

Understanding The Rise Of Crypto Trading Funds

The crypto trading fund market has undergone a remarkable transformation, with assets under management (AUM) expected to reach an impressive $9.36 billion by 2030. This exponential growth is a testament to the increasing adoption of cryptocurrencies and the growing demand for specialized digital asset investment products.

As an early adopter, I’ve witnessed firsthand how crypto trading funds have become an integral part of the investment landscape, providing investors like myself with a convenient and diversified way to access the volatile yet promising crypto market. By pooling capital from multiple investors, these specialized funds employ a range of strategies, from active management to passive index-tracking, to navigate the ever-evolving cryptocurrency ecosystem.

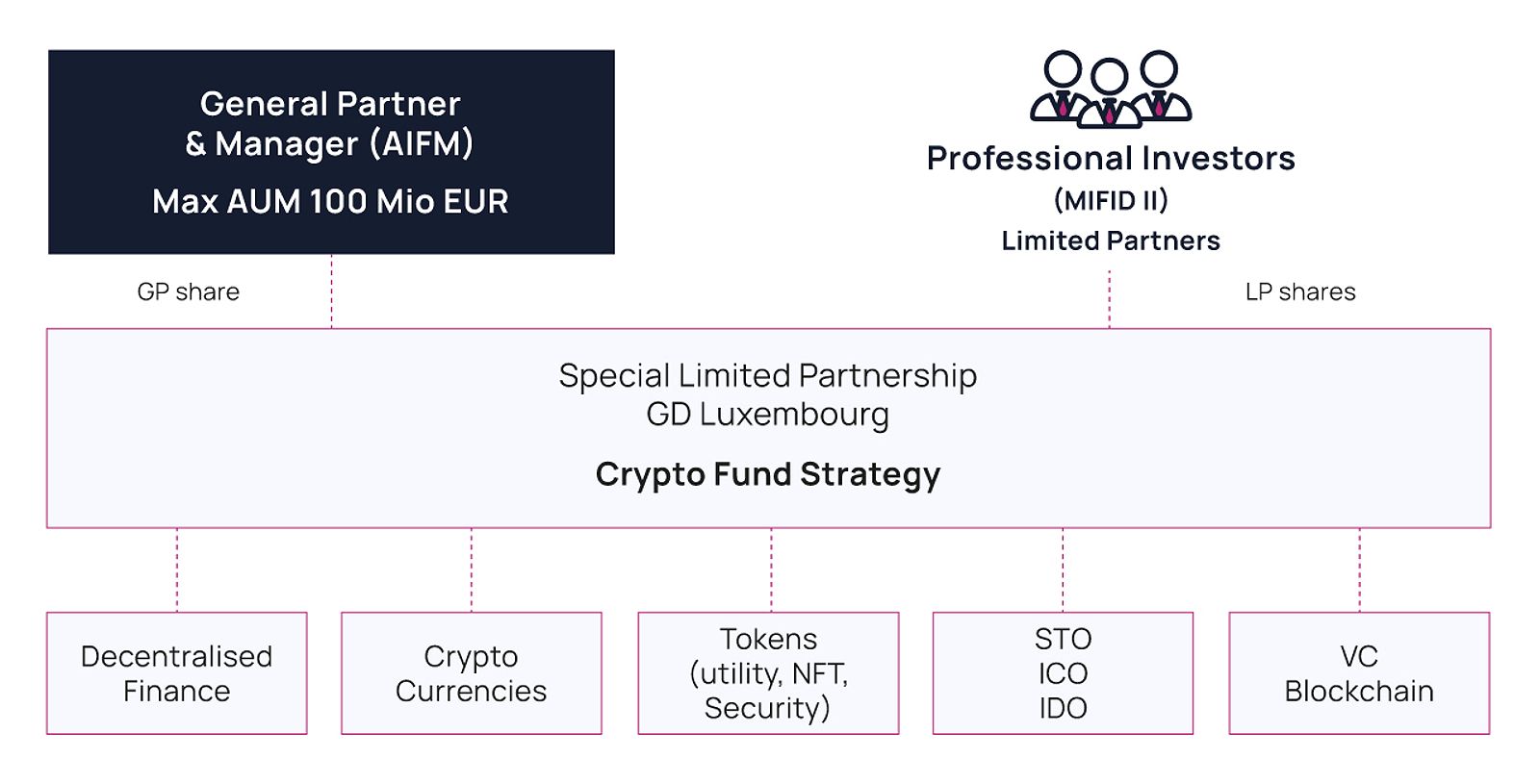

Crypto Funds

Crypto Funds

Evaluating Crypto Trading Funds: A Meticulous Approach

When it comes to investing in crypto trading funds, thorough due diligence is paramount. Over the years, I’ve developed a comprehensive framework for evaluating these investment vehicles, taking into account factors such as investment strategy, track record, management team, and fee structure.

Investment Strategy: Aligning With Your Risk Appetite

One of the first things I consider is the fund’s investment strategy. Active funds that employ sophisticated trading techniques, such as arbitrage or quantitative strategies, often aim to capitalize on market opportunities and generate returns. In contrast, passive funds that track cryptocurrency indices or a basket of digital assets can provide a more stable and diversified exposure.

Assessing the fund’s strategy and its alignment with my own risk tolerance and investment objectives is a crucial step in the decision-making process.

Business person analyzing graph

Business person analyzing graph

Dissecting The Track Record: A Deeper Dive

Scrutinizing a crypto trading fund’s historical performance is another essential aspect of my due diligence. I meticulously analyze the fund’s returns, both in terms of absolute performance and risk-adjusted metrics, to gain insights into its ability to generate consistent and stable gains.

By delving into the fund’s long-term track record, I can better assess its potential to deliver on its stated objectives and manage the inherent risks of the crypto market.

Evaluating The Management Team: Expertise And Integrity

The expertise and experience of the crypto trading fund’s management team are also critical factors in my decision-making process. I carefully research the backgrounds and credentials of the key decision-makers, seeking out seasoned professionals with a proven track record in digital asset management.

Assessing the management team’s integrity, decision-making process, and alignment with investor interests is also a crucial part of my evaluation.

Multicoin Capital

Multicoin Capital

Evaluating The Fee Structure: Balancing Cost And Value

Lastly, I scrutinize the crypto trading fund’s fee structure, including any management fees and performance-based charges. As an experienced investor, I understand that high fees can erode the potential returns, so I carefully weigh the fund’s performance and value-add against the associated costs.

By taking a holistic approach to evaluating crypto trading funds, I’m able to make informed decisions that align with my investment goals and risk tolerance.

Navigating The Crypto Trading Fund Landscape

Accessing crypto trading funds can be done through various channels, such as brokerage accounts, financial advisors, and direct investment platforms. As I’ve navigated this landscape, I’ve learned the importance of understanding the minimum investment requirements and any tax implications associated with these investments.

One crucial factor I consider is the level of liquidity I require. Some crypto trading funds may have lock-up periods or redemption restrictions, which can impact my ability to access my investment on short notice. Evaluating my long-term investment horizon and risk tolerance helps me select funds that are well-suited to my overall financial goals.

Digital Currency Group

Digital Currency Group

Proactive Portfolio Management: Monitoring And Rebalancing

Maintaining an active role in managing my crypto trading fund investments is essential to ensuring they continue to align with my objectives. I routinely monitor the performance of my funds, comparing them to the broader cryptocurrency market and their stated investment goals. This vigilance allows me to make informed decisions about when to rebalance my portfolio and adjust my exposure to the crypto trading funds.

By staying attuned to market conditions and being prepared to adapt my investment strategy as needed, I’m able to navigate the inherent volatility of the crypto space and maximize the potential of my crypto trading fund investments.

Pantera

Pantera

Polychain Capital

Polychain Capital

Amber Group

Amber Group

Bitwise

Bitwise

Wave Digital Assets

Wave Digital Assets

Dragonfly

Dragonfly

Faq

Q: What are the key benefits of investing in crypto trading funds?

A: Investing in crypto trading funds can provide diversification, professional management, and access to specialized knowledge in the cryptocurrency market. These funds offer a convenient way for investors to gain exposure to the crypto space without the complexity of directly managing individual cryptocurrencies.

Q: What are the risks associated with crypto trading funds?

A: Crypto trading funds are subject to market volatility, regulatory uncertainty, and management fees, which can impact their overall performance. The cryptocurrency market is known for its high volatility, and funds may experience significant price fluctuations, even in the short term.

Q: How do I evaluate crypto trading funds?

A: When evaluating crypto trading funds, I consider the investment strategy, track record, management team, and fee structure to ensure alignment with my investment objectives and risk tolerance. Seeking the advice of a financial advisor can further strengthen the decision-making process.

Q: How do I invest in crypto trading funds?

A: Investors can access crypto trading funds through brokerage accounts, financial advisors, or direct investment platforms, depending on their preferred investment channel. It’s important to understand the minimum investment requirements and any associated tax implications.

Q: How do I manage my crypto trading fund investment?

A: As a seasoned investor, I actively monitor the performance of my crypto trading fund investments, rebalance my portfolio as needed, and consider exit strategies to maintain my desired risk exposure. Staying informed about market conditions and being prepared to adjust my allocation if the fund’s performance or risk profile changes significantly is crucial.

Conclusion

In the rapidly evolving world of cryptocurrency investing, crypto trading funds have emerged as a compelling option for those seeking diversified and institutional-grade exposure to this dynamic asset class. By leveraging my deep understanding of the crypto market and my commitment to proactive portfolio management, I’ve been able to navigate the crypto trading fund landscape with confidence and resilience.

As the crypto market continues to evolve, I’m confident that crypto trading funds will play an increasingly important role in providing investors like myself with the tools to capitalize on the promising opportunities in the digital asset space.