In the rapidly evolving world of digital assets, crypto trading has emerged as a thrilling frontier, offering both opportunities and challenges for those eager to venture into this dynamic market. As a seasoned crypto enthusiast, I”ve witnessed firsthand the remarkable growth and potential of cryptocurrencies, and I”m excited to share my insights and guide you on your journey as a beginner in crypto trading.

Embracing The Crypto Trading Landscape

The crypto trading realm offers a captivating frontier, where the potential for growth and profitability is matched only by the inherent challenges and volatility. Unlike traditional stock trading, the crypto market operates 24/7 and is largely decentralized, free from the constraints of a central authority. This unique structure presents both opportunities and obstacles for those new to the game.

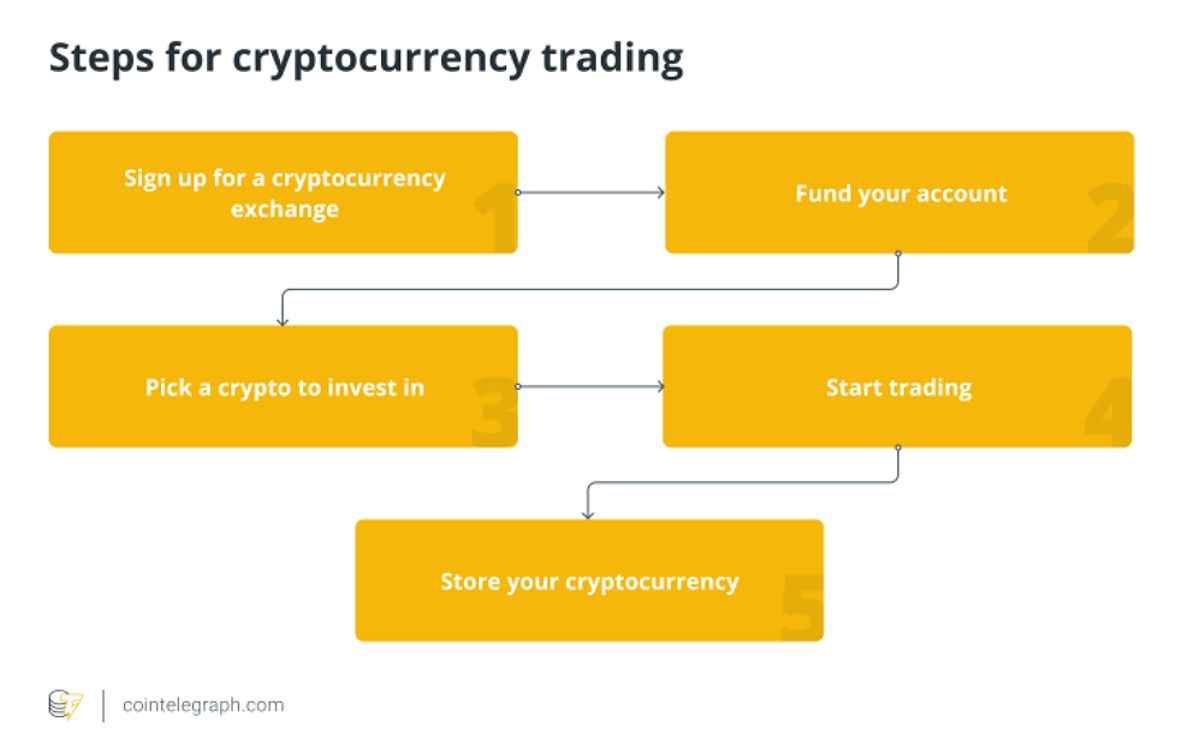

Cryptocurrency trading steps

Cryptocurrency trading steps

As a beginner, it’s essential to understand the core principles of crypto trading, including the various order types, market dynamics, and the importance of a well-crafted trading strategy. By mastering these foundational elements, you’ll be better equipped to make informed decisions and manage the risks associated with this dynamic market.

Choosing A Reliable Crypto Broker

The first step in your crypto trading journey is selecting a reputable cryptocurrency exchange or broker. This decision will have a significant impact on your overall trading experience, so it’s crucial to conduct thorough research and consider factors such as security, fees, the range of supported cryptocurrencies, and the user-friendliness of the platform.

In my experience, some of the most popular and reliable crypto brokers for beginners include Coinbase, Gemini, and Kraken. These platforms offer a diverse selection of cryptocurrencies, robust security measures, and user-friendly interfaces that cater to traders of all skill levels. By carefully evaluating the features and offerings of these brokers, you can find the one that best aligns with your investment goals and trading style.

Navigating The Crypto Trading Process

Once you’ve selected your crypto broker and set up your trading account, it’s time to dive into the intricacies of the trading process. Understanding the various order types, such as market orders, limit orders, and stop-loss orders, is essential for executing trades effectively and managing your risk exposure.

As a beginner, I recommend starting small and practicing with demo accounts or low-value trades to get a feel for the trading process before committing larger sums of money. The crypto market can be highly volatile, so it’s crucial to approach it with caution, discipline, and a well-defined trading strategy.

Developing A Winning Trading Strategy

Successful crypto trading often boils down to having a well-crafted strategy that aligns with your risk tolerance and investment objectives. This may involve analyzing market trends, monitoring news and events, and employing technical analysis tools to identify trading opportunities.

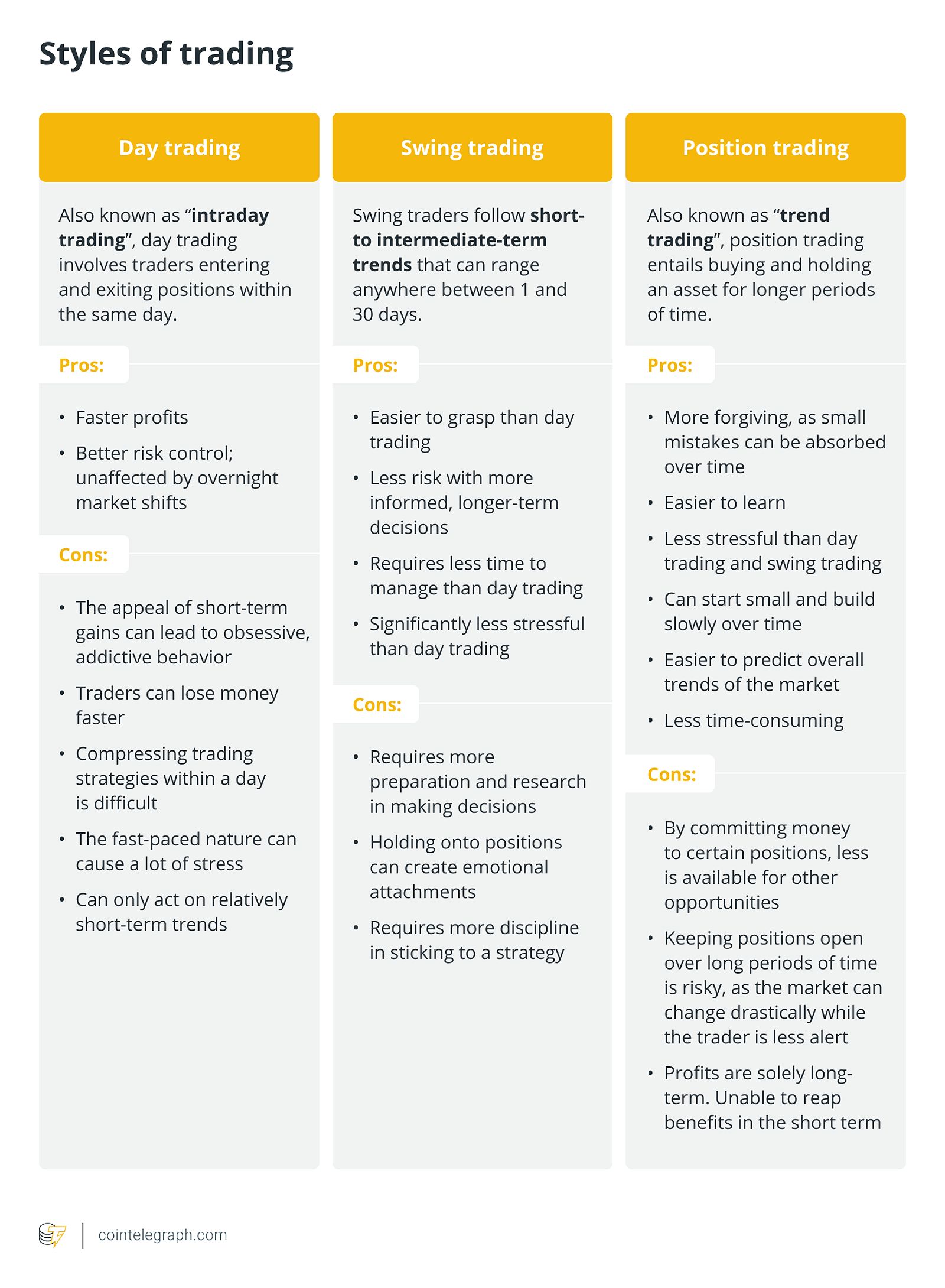

Styles of trading

Styles of trading

I’ve found that a diversified approach, where you allocate your investments across different cryptocurrencies, can help mitigate the risks associated with market volatility. Additionally, maintaining a disciplined, unemotional mindset and avoiding impulsive decisions based on fear or greed can significantly improve your chances of success in the crypto trading arena.

Crypto Trading For Beginners: Mastering The Art

As you delve deeper into the world of crypto trading, it’s essential to keep the following tips in mind:

- Start Small: Begin with a modest investment and gradually increase your position as you gain experience and confidence.

- Diversify Your Portfolio: Spread your investments across various cryptocurrencies to manage risk and potentially capitalize on the growth of emerging digital assets.

- Stay Informed: Keep up with the latest news, trends, and developments in the crypto industry to make well-informed trading decisions.

- Utilize Stop-Loss Orders: Protect your downside by setting stop-loss orders to limit potential losses on your trades.

- Practice Regularly: Use demo accounts or start with small trades to refine your skills and develop a trading strategy that works for you.

Remember, crypto trading carries inherent risks, and it’s crucial to only invest what you can afford to lose. Approach it with a well-informed, disciplined, and patient mindset to increase your chances of success in this dynamic market.

Understanding The Dynamics Of The Crypto Market

The crypto market is driven by a unique set of factors, including supply and demand, regulatory changes, and the overall sentiment surrounding the industry. By understanding these market dynamics, you can better anticipate potential price movements and adjust your trading strategy accordingly.

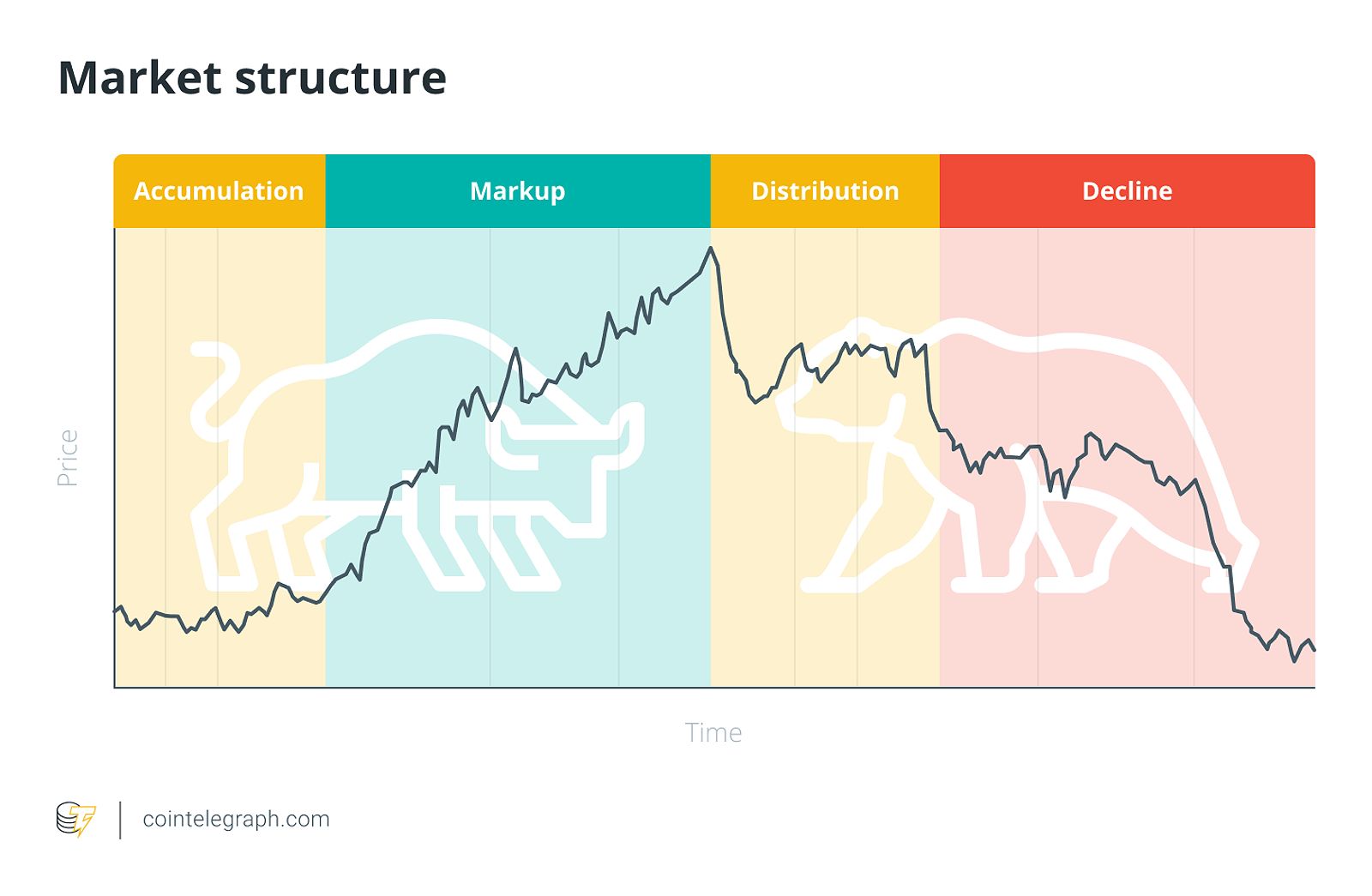

Market structure

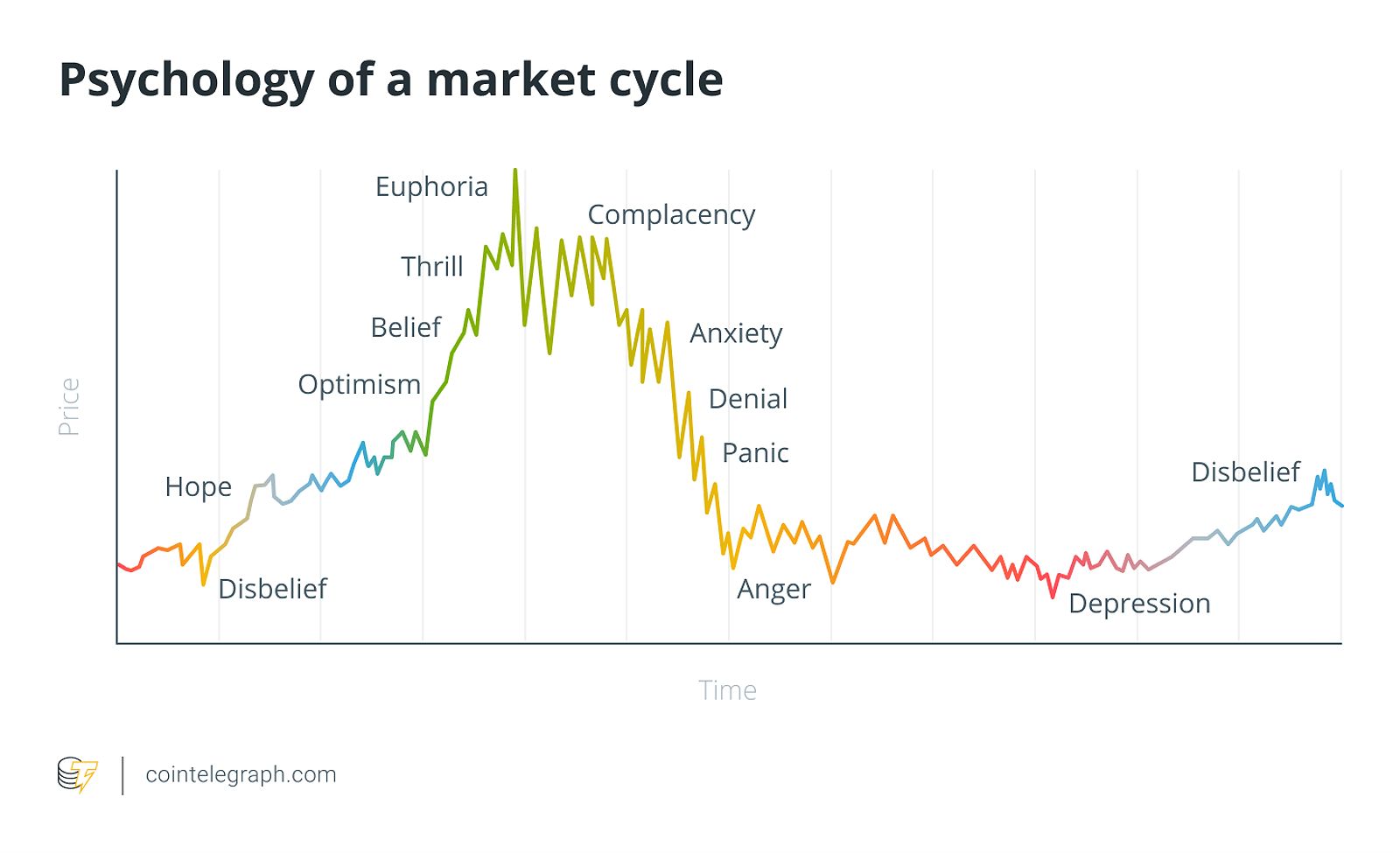

Market structure  Psychology of a market cycle

Psychology of a market cycle

One crucial factor to consider is the presence of “whales” — large investors or groups that hold significant amounts of a particular cryptocurrency. These whales can significantly influence market trends, and tracking their activities can provide valuable insights into the direction of the market.

Additionally, the psychological cycles of the crypto market, which can range from fear to euphoria, can also impact trading decisions. Maintaining a level-headed approach and avoiding emotional decision-making is crucial for navigating these market cycles successfully.

Faq

What is the best cryptocurrency to trade for beginners? There is no one-size-fits-all answer, as the “best” cryptocurrency to trade depends on your investment goals and risk tolerance. However, some of the most popular and liquid cryptocurrencies for beginners include Bitcoin, Ethereum, and Litecoin, as they tend to have lower volatility compared to smaller altcoins.

How much money do I need to start trading cryptocurrency? You can start trading cryptocurrency with a relatively small investment, such as $100. However, it’s important to remember that the crypto market can be highly volatile, and you should never invest more than you can afford to lose. It’s recommended to start with a modest investment and gradually increase your position as you gain experience and confidence.

How do I store my cryptocurrency? There are several options for storing your cryptocurrency, including hot wallets (online) and cold wallets (offline). Hot wallets, such as those provided by cryptocurrency exchanges, offer convenience but are generally less secure than cold wallets, which are physical devices that store your private keys offline. It’s essential to research the different wallet options and choose the one that best suits your security needs and trading strategy.

Conclusion

As a seasoned crypto enthusiast, I’ve witnessed the remarkable evolution of the digital asset landscape and the captivating opportunities it presents for those willing to venture into the world of crypto trading. By understanding the fundamentals, choosing a reliable broker, and developing a well-crafted trading strategy, you can navigate this dynamic market with confidence and potentially capitalize on the growth of cryptocurrencies.

Remember, crypto trading is not without its risks, so it’s crucial to approach it with a disciplined, patient, and well-informed mindset. Start small, diversify your investments, and continuously educate yourself on the latest market trends and developments. With the right approach, you can embark on an exciting and rewarding journey in the crypto trading frontier.