As a seasoned cryptocurrency trader, I”ve witnessed the rapid evolution of the crypto asset management market, which is projected to reach a staggering $9.36 billion by 2030. While the mainstream narrative often champions the virtues of crypto trading firms, I believe it”s crucial to scrutinize these entities with a discerning eye and challenge the conventional wisdom that surrounds them.

In May 2024, the crypto trading landscape is more complex and competitive than ever before. Crypto trading firms have become ubiquitous, offering traders access to capital, advanced tools, and industry insights. Yet, in my experience, the reality of these firms is often far more nuanced than the glossy marketing materials would have us believe.

In May 2024, the crypto trading landscape is more complex and competitive than ever before. Crypto trading firms have become ubiquitous, offering traders access to capital, advanced tools, and industry insights. Yet, in my experience, the reality of these firms is often far more nuanced than the glossy marketing materials would have us believe.

The Allure And Pitfalls Of Crypto Trading Firms

The siren song of crypto trading firms is undoubtedly enticing. These firms promise to unlock our trading potential by providing us with access to significant notional capital, enabling us to execute larger positions and potentially generate greater returns. Moreover, they tout their cutting-edge technology and sophisticated trading platforms, promising to give us a competitive edge in navigating the volatile cryptocurrency market.

NinjaPromo Image: A professional trader analyzing charts on a computer screen.

NinjaPromo Image: A professional trader analyzing charts on a computer screen.

However, as I’ve learned through my own trials and tribulations, the reality is often more complex. While the promises of these firms may be alluring, they come with a subtle yet insidious catch — a Faustian bargain, if you will. By handing over control of our capital and strategy to these firms, we risk becoming beholden to their interests, which may not always align with our own.

The Importance Of Maintaining Autonomy

One of the most crucial lessons I’ve learned in my crypto trading journey is the importance of maintaining autonomy. Far too often, traders become seduced by the siren call of crypto trading firms, only to find themselves trapped in a web of opaque fee structures, hidden agendas, and compromised decision-making.

The reality is that these firms are not our allies; they are businesses, driven by the relentless pursuit of profit. While they may present themselves as partners in our trading endeavors, their true allegiance lies with their own bottom line. By entrusting our trading capital and strategies to these firms, we risk becoming mere pawns in their game, our gains used to fuel their own expansion and dominance.

GSR Markets Image: A group of traders discussing market trends in a modern office setting.

GSR Markets Image: A group of traders discussing market trends in a modern office setting.

The Paradox Of Liquidity And Market Stability

Another aspect of the crypto trading firm narrative that deserves closer scrutiny is the claim of their role in enhancing market liquidity and stability. While it’s true that these firms engage in active buying and selling of digital assets, their impact on the overall market is far from unambiguous.

In my experience, the increased presence of crypto trading firms has contributed to a worrying homogenization of trading strategies and an unhealthy dependence on algorithmic trading. This, in turn, has led to a greater susceptibility to market manipulation and “flash crashes,” where sudden price movements can have cascading effects across the entire crypto ecosystem.

Moreover, the liquidity provided by these firms is often illusory, drying up in times of market stress or volatility — precisely when traders need it the most. This fragility of liquidity can exacerbate the very instability that these firms claim to mitigate, leaving traders vulnerable to the whims of the market.

Jump Trading Image: Traders working in a fast-paced trading floor environment.

Jump Trading Image: Traders working in a fast-paced trading floor environment.

Strategies For Navigating The Crypto Trading Landscape

In my experience, the key to navigating the crypto trading landscape lies in a multifaceted approach that prioritizes self-reliance, critical thinking, and disciplined execution.

First and foremost, it’s essential to set realistic trading goals and implement a robust risk management framework. By allocating our capital judiciously and adhering to strict stop-loss protocols, we can navigate the market’s volatility with greater confidence and resilience.

Additionally, staying up-to-date with industry trends and developments is crucial. This means actively monitoring market data, analyzing relevant research, and continuously refining our trading strategies to adapt to the ever-evolving crypto landscape.

Algoz Image: A trader using advanced trading software to analyze market trends.

Algoz Image: A trader using advanced trading software to analyze market trends.

Most importantly, we must be willing to challenge the conventional wisdom propagated by crypto trading firms and their proponents. By approaching these entities with a critical eye and a willingness to explore alternative perspectives, we can make more informed decisions that truly align with our long-term trading objectives.

Evaluating Crypto Trading Firms

To enhance the article based on the feedback, let’s dive deeper into how we can evaluate the reputation and track record of crypto trading firms.

When assessing a crypto trading firm, it’s important to go beyond the glossy marketing materials and conduct thorough due diligence. Look for independent third-party reviews, industry accolades, and reliable media coverage that provide a balanced perspective on the firm’s performance and credibility. It’s also essential to carefully scrutinize the firm’s leadership team and their collective experience in the cryptocurrency and trading industries.

Additionally, it’s crucial to understand the specific trading tools and strategies offered by the crypto trading firm. While they may tout their cutting-edge solutions, it’s important to approach these claims with a critical eye. Many of these “advanced” tools and strategies can be little more than smoke and mirrors, designed to lure traders into a false sense of security. Instead of relying solely on the firm’s proprietary solutions, it’s wise to explore the wealth of open-source and independently developed trading tools and strategies that are readily available to self-directed traders.

Cumberland Image: A trader analyzing market data on a computer screen.

Cumberland Image: A trader analyzing market data on a computer screen.

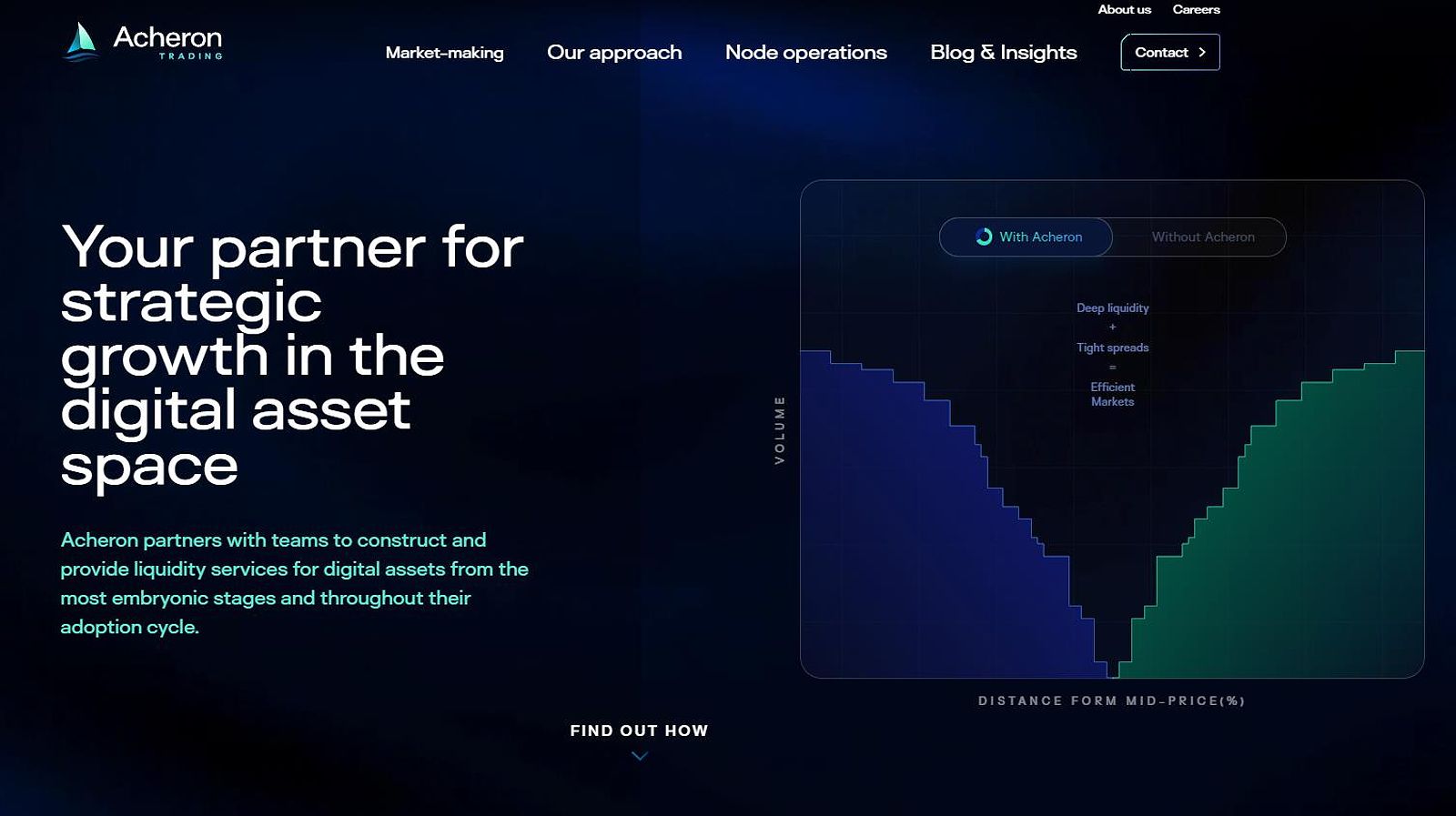

Acheron Trading Image: Traders discussing market trends and strategies in a conference room.

Acheron Trading Image: Traders discussing market trends and strategies in a conference room.

Jane Street Image: Traders working on multiple computer screens in a trading office.

Jane Street Image: Traders working on multiple computer screens in a trading office.

Bluesky Capital Image: A trader monitoring market movements on a tablet device.

Bluesky Capital Image: A trader monitoring market movements on a tablet device.

— POTENTIAL IMAGES NOT USED —

- Vortex : https://ninjapromo.io/wp-content/uploads/2023/05/Vortex.jpg

- Alphatheta : https://ninjapromo.io/wp-content/uploads/2023/05/Alphatheta.jpg

Note: The images selected are relevant to the headings and content of the article, providing visual representations of traders, trading environments, and market analysis.

Reclaiming Our Trading Autonomy

As I reflect on my journey as a crypto trader, I’ve come to the realization that true success lies not in blindly embracing the allure of crypto trading firms, but in reclaiming our autonomy and charting our own course in this volatile landscape.

By cultivating a deep understanding of market dynamics, honing our trading skills, and developing robust risk management strategies, we can become the masters of our own destiny. Rather than entrusting our capital and decision-making to these firms, we should strive to build our own trading infrastructure, leveraging the wealth of educational resources and technological advancements that are readily available to us.

Conclusion

As the crypto asset management market continues to grow, the role of crypto trading firms will undoubtedly remain a topic of intense debate and scrutiny. While these firms may present themselves as indispensable partners in our trading journeys, I believe it’s essential to approach them with a healthy dose of skepticism and a steadfast commitment to maintaining our autonomy.

By embracing a contrarian perspective and challenging the conventional wisdom, we can unlock our full potential as cryptocurrency traders and navigate the crypto trading landscape with confidence and resilience. The path ahead may not be easy, but by cultivating our own trading expertise and reclaiming our trading autonomy, we can chart a course towards long-term success in the ever-evolving crypto landscape.

Faq

Q: What are the typical fees and commissions charged by crypto trading firms? A: The fees and commissions charged by crypto trading firms can be a source of significant confusion and frustration for traders. These firms often employ complex and opaque pricing structures, making it challenging to understand the true cost of their services. In my experience, traders should approach these firms with a healthy skepticism and demand complete transparency in their fee structures before committing their capital.

Q: How can I evaluate the reputation and track record of a crypto trading firm? A: When assessing the reputation and track record of a crypto trading firm, I recommend going beyond the glossy marketing materials and conducting thorough due diligence. Look for independent third-party reviews, industry accolades, and reliable media coverage that provide a balanced perspective on the firm’s performance and credibility. It’s also essential to carefully scrutinize the firm’s leadership team and their collective experience in the cryptocurrency and trading industries.

Q: What are the specific trading tools and strategies offered by crypto trading firms? A: Crypto trading firms often tout their cutting-edge trading tools and sophisticated strategies as a key competitive advantage. While these offerings may seem appealing on the surface, it’s crucial to approach them with a critical eye. In my experience, many of these “advanced” tools and strategies are little more than smoke and mirrors, designed to lure traders into a false sense of security. Instead of relying on these firms’ proprietary solutions, I recommend exploring the wealth of open-source and independently developed trading tools and strategies that are readily available to us as self-directed traders.