Optimizing Crypto Trading Fees: Strategies for Savvy Investors

Navigating the complex world of crypto trading fees can be a daunting task, even for seasoned investors. However, by understanding the nuances involved and implementing the right strategies, crypto enthusiasts can minimize the impact of these fees and maximize their investment returns.

This comprehensive guide delves into the intricacies of crypto trading fees, equipping readers with the knowledge and techniques necessary to become savvier and more efficient traders.

This comprehensive guide delves into the intricacies of crypto trading fees, equipping readers with the knowledge and techniques necessary to become savvier and more efficient traders.

Understanding Crypto Trading Fees

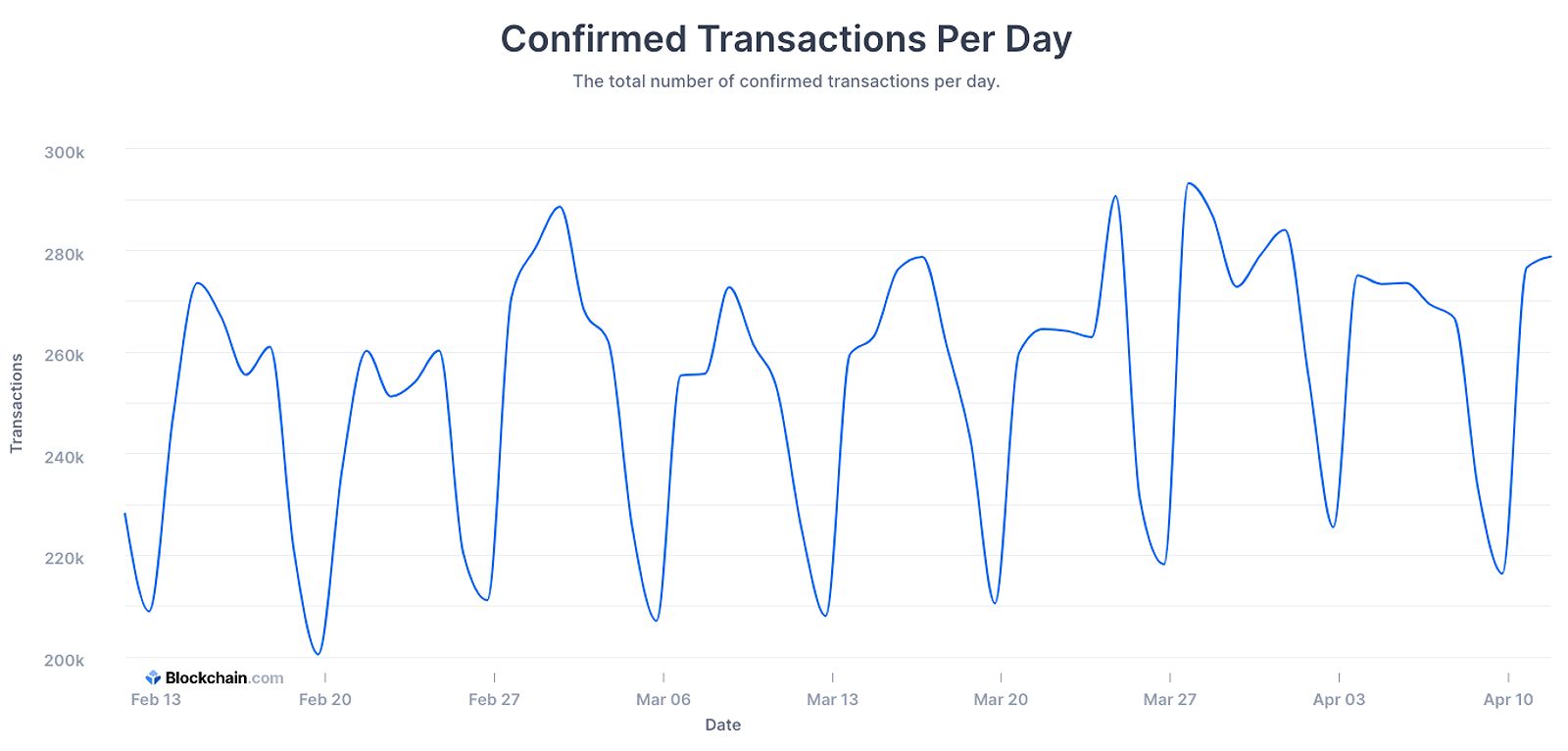

Cryptocurrency transactions involve a variety of fees that must be carefully considered. The first and most crucial of these is the network fee, which is paid to the miners or validators responsible for confirming and securing the transaction on the blockchain. These fees can fluctuate based on network congestion and the complexity of the transaction.

Network fees

Network fees

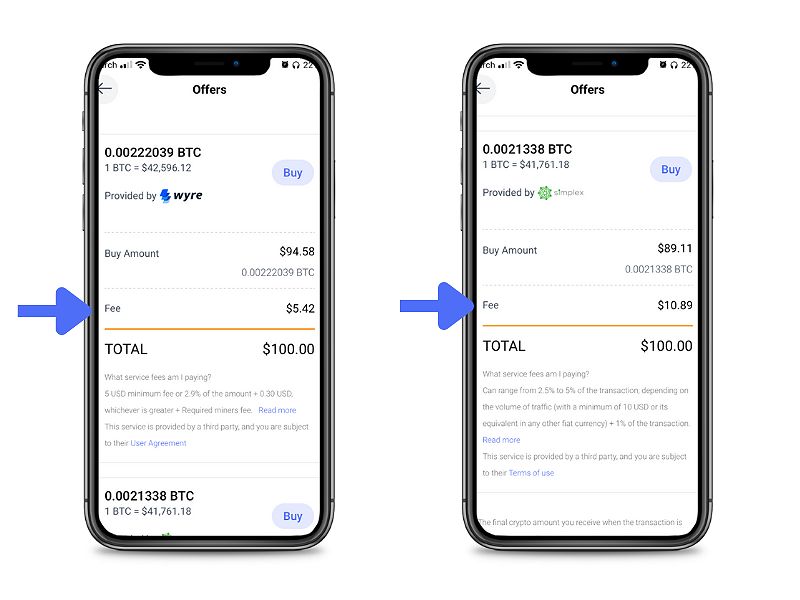

Another integral component is the service fee, charged by the cryptocurrency exchange or platform facilitating the trade. These fees can vary significantly, depending on the specific exchange and the type of transaction being conducted. For instance, Binance’s fees range from 0% to 0.1% for makers and 0.1% to 0.6% for takers, while Coinbase’s fees can reach as high as 0.6% for takers and 0.4% for makers.

Lastly, there are wallet fees, which are incurred when depositing or withdrawing funds from one’s digital wallet. Though typically small, these fees can add up over time, especially for high-volume traders.

Understanding the nuances of these different fee structures is crucial for minimizing their impact on investment returns.

Strategies For Reducing Crypto Trading Fees

As the crypto market continues to evolve, savvy investors can employ several effective strategies to mitigate the costs associated with trading activities.

Choosing The Right Cryptocurrency

Not all cryptocurrencies are created equal when it comes to transaction fees. Some, such as Bitcoin Cash and Litecoin, boast significantly lower fees compared to their more popular counterpart, Bitcoin. Bitcoin Cash transaction fees can be as low as $0.01, while Litecoin fees often hover around just a few cents. Additionally, newer blockchain networks like Solana and Cardano frequently offer lower fees and faster transaction times, making them attractive options for cost-conscious traders.

Lower fees cryptocurrencies

Lower fees cryptocurrencies

Timing Your Transactions Wisely

The timing of cryptocurrency transactions can have a substantial impact on the fees incurred. Blockchain networks tend to experience higher activity during peak hours, leading to increased transaction costs. By monitoring network activity and strategically executing trades during off-peak times, such as late at night or on weekends, traders can often secure lower transaction fees.

Leveraging Off-chain Protocols

Innovative solutions like the Lightning Network have revolutionized the way cryptocurrency transactions are processed. By handling transactions off the main blockchain, these protocols can dramatically reduce the fees paid by users, while still maintaining the security and decentralization of the underlying network. For example, Lightning Network transactions can be executed for a few cents or even fractions of a cent, compared to the $0.50 median Bitcoin transaction fee.

Lightning Network

Lightning Network

Shopping Around For The Best Rates

Just as savvy consumers compare prices when making any significant purchase, crypto traders must also be diligent in their research to find the best trading fee rates. Different exchanges and platforms often have varying fee structures, so it’s essential to take the time to explore and compare options to identify the most cost-effective solution that aligns with one’s trading volume and preferences. For instance, Binance and Coinbase have distinct fee schedules, so evaluating which platform best suits one’s needs is crucial.

Exchange fees comparison

Exchange fees comparison

The Impact Of Crypto Trading Fees On Investment Returns

Cryptocurrency trading fees can have a significant impact on an investor’s overall returns, especially for high-volume traders. Even a small difference in fees can add up quickly, eroding profits over time. For example, if an investor makes $100,000 worth of trades with a 0.5% fee, they would pay $500 in fees. However, by finding a platform with a 0.2% fee, the same investor would only pay $200 — a savings of $300 on that single trade.

By implementing the strategies outlined in this guide, crypto traders can minimize the toll of these fees and maximize the growth of their portfolios. Over the long run, these savings can compound, leading to significantly higher investment returns.

The Future Of Crypto Trading Fees

As the cryptocurrency market continues to evolve, it is likely that we will see ongoing changes and innovations in the way trading fees are structured and managed. Emerging technologies like layer-2 scaling solutions and decentralized exchanges may further drive down the cost of crypto transactions, making the market more accessible to a wider range of investors.

Additionally, regulatory changes and increased competition among crypto platforms could also influence the future of trading fees, potentially leading to more transparency and fairer pricing for users. As the industry matures, we may see a move towards more standardized and competitive fee structures, benefiting both novice and experienced crypto traders.

Faqs

What are the main factors that affect crypto trading fees? The primary factors that influence crypto trading fees include network congestion, transaction size, blockchain protocol, and the fees charged by the service provider being used.

How can I calculate the transaction fees for a specific crypto trade? To calculate the transaction fees for a specific crypto trade, traders can utilize online fee calculators or check the fee schedules provided by the exchange or platform they are using.

What are the benefits of using alternative coins with lower fees? Using cryptocurrencies with lower fees, such as Bitcoin Cash or Litecoin, can provide several advantages, including reduced transaction costs, faster transaction speeds, and increased scalability.

How do off-chain protocols like the Lightning Network help reduce fees? Off-chain protocols like the Lightning Network help reduce fees by processing transactions outside the main blockchain, eliminating the need for miners and reducing network congestion, which in turn lowers the overall transaction costs.

What are the potential risks associated with crypto trading fees? The primary risks associated with crypto trading fees include the potential for high fees to erode investment returns, impact trading strategies, and limit accessibility for smaller traders who may be priced out of the market.

The Importance Of Diversification In Crypto Trading

While reducing trading fees is an important strategy, it’s also crucial for crypto investors to diversify their portfolios. By investing in a range of cryptocurrencies, traders can mitigate the risk of relying too heavily on a single asset and potentially experiencing significant losses due to market volatility or other factors.

Diversification can also help investors take advantage of the varying fee structures and characteristics of different cryptocurrencies. For example, an investor might use Bitcoin for larger transactions due to its greater liquidity, while utilizing Litecoin or Ripple for smaller, more frequent trades to benefit from their lower transaction costs.

By adopting a diversified approach and carefully managing trading fees, crypto investors can position themselves for long-term success in the dynamic and rapidly evolving cryptocurrency market.

Conclusion

Mastering the complexities of crypto trading fees is a crucial step in becoming a successful investor in the digital asset market. By understanding the different types of fees, implementing effective strategies, and staying informed about industry trends, crypto enthusiasts can minimize costs and maximize their profits.

Remember, every penny saved on fees contributes to overall investment returns. By embracing the knowledge and techniques outlined in this guide, traders can navigate the crypto trading landscape with confidence and efficiency, ultimately achieving their financial goals.

As the cryptocurrency industry continues to mature, the importance of managing trading fees will only grow. By staying ahead of the curve and implementing the strategies discussed in this comprehensive guide, savvy crypto investors can position themselves for long-term success and reap the rewards of their diligence and expertise.