In the rapidly evolving world of cryptocurrency, the choice of a reliable and secure trading broker has become a critical decision for investors seeking to explore this dynamic market. With the proliferation of crypto trading platforms, discerning the best fit for one”s investment goals and risk tolerance can be a daunting task. This comprehensive guide aims to equip you with the necessary insights to navigate the crypto trading broker landscape and make an informed decision that aligns with your financial aspirations.

Understanding The Role Of Crypto Trading Brokers

Crypto trading brokers play a vital role in facilitating the buying, selling, and trading of digital assets. These brokers offer a range of services, including:

Crypto Trading

Enabling you to execute transactions in various cryptocurrencies, allowing you to capitalize on market movements.

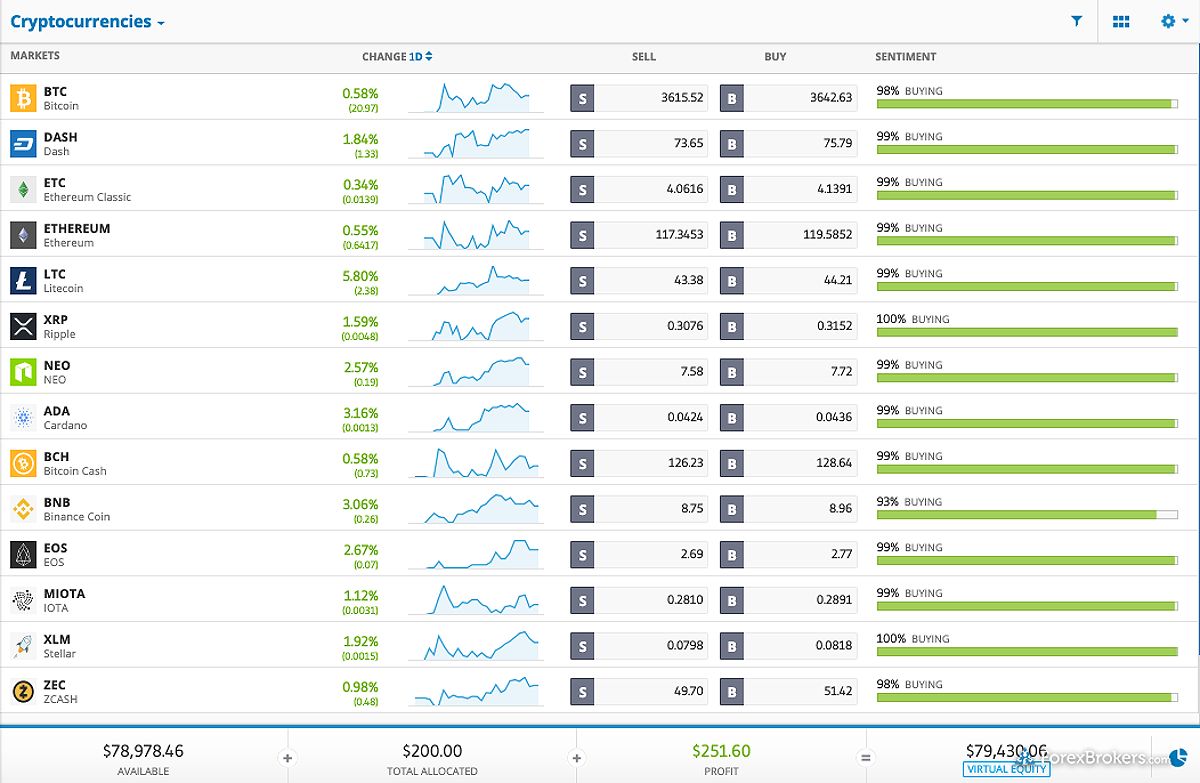

EToro cryptocurrencies Alt text: Image of different cryptocurrencies displayed on a trading platform.

EToro cryptocurrencies Alt text: Image of different cryptocurrencies displayed on a trading platform.

Cryptocurrency Custody

Providing secure storage and management of your crypto holdings, ensuring the safety of your digital assets.

Cryptocurrency Lending

Offering you the opportunity to earn interest by lending your crypto assets to other market participants.

Cryptocurrency Derivatives Trading

Granting access to advanced trading instruments, such as futures and options, for more sophisticated investment strategies.

By partnering with a reputable crypto trading broker, you can navigate the complexities of the cryptocurrency market with greater confidence and efficiency.

Key Factors To Consider When Choosing A Crypto Trading Broker

Choosing the right crypto trading broker is essential to ensure the security and profitability of your investments. Here are the key factors to consider:

Security And Safeguards

The security of your funds should be the primary concern when choosing a crypto trading broker. Look for platforms that employ industry-leading security measures, such as multi-factor authentication, cold storage for digital assets, and a proven track record of protecting customer funds. Robust security protocols are essential to mitigate the risks of cyber threats and safeguard your investments.

Fees And Transparency

Crypto trading brokers typically charge various fees, including trading fees, withdrawal fees, and deposit fees. Thoroughly research and compare the fee structures of different brokers to ensure you’re getting the best value for your trading activities. Prioritize platforms that offer transparent and competitive pricing to optimize your trading profitability.

Customer Support And Responsiveness

Reliable and responsive customer support is crucial, especially when navigating any issues or concerns that may arise. Assess the broker’s customer service channels, response times, and the overall quality of their assistance. Efficient and knowledgeable support can make a significant difference in your trading experience.

Regulatory Compliance And Reputation

Investigate the broker’s regulatory standing and reputation within the cryptocurrency community. Look for brokers that are properly licensed and regulated in the jurisdictions where you reside, as this helps to mitigate the risk of encountering scams or unethical practices. Seek out reputable platforms with a proven track record of trustworthiness and customer satisfaction.

Breadth Of Offerings And Trading Tools

Consider the range of cryptocurrencies, trading pairs, and advanced features offered by the broker. A diverse selection of digital assets and sophisticated trading tools can provide you with the flexibility to adapt your investment strategies as the market evolves.

Once you have identified the key factors to consider when choosing a crypto trading broker, you can begin to evaluate the different brokers that are available.

Prominent Crypto Trading Brokers In 2024

As the cryptocurrency landscape continues to evolve, several brokers have emerged as standout options for traders and investors. Let’s explore some of the top crypto trading brokers to consider:

Etoro

eToro has established itself as a well-regarded and highly reputable crypto trading broker.

Best cryptocurrency broker: a man pointing at a tablet with some charts Alt text: Image of a man pointing at a tablet with cryptocurrency charts displayed.

Best cryptocurrency broker: a man pointing at a tablet with some charts Alt text: Image of a man pointing at a tablet with cryptocurrency charts displayed.

- Pros: User-friendly platform, extensive range of cryptocurrencies, both underlying cryptocurrency trading and cryptocurrency CFDs.

- Cons: Higher fees than some other brokers.

Coinbase

As one of the largest and most respected crypto trading brokers globally, Coinbase has earned a reputation for its intuitive interface, robust security measures, and a wide selection of cryptocurrencies.

Best cryptocurrency broker: jump-start your portfolio with Coinbase Alt text: Image of a person using a laptop with the Coinbase website displayed.

Best cryptocurrency broker: jump-start your portfolio with Coinbase Alt text: Image of a person using a laptop with the Coinbase website displayed.

- Pros: Intuitive interface, robust security measures, wide selection of cryptocurrencies.

- Cons: Limited trading tools compared to some other brokers.

Binance-us

As the US-based subsidiary of the global cryptocurrency exchange Binance, Binance.US offers a user-friendly trading platform and an extensive selection of digital assets.

- Pros: Low trading fees, advanced trading tools.

- Cons: Not as user-friendly as some other brokers.

Fidelity

Fidelity, a renowned financial services provider, has expanded its offerings to include cryptocurrency services.

- Pros: Emphasis on long-term investment strategies, secure custody solutions.

- Cons: Limited selection of cryptocurrencies compared to some other brokers.

Interactive Brokers

Interactive Brokers, a well-respected online broker, has recently integrated cryptocurrency trading into its robust trading platform.

- Pros: Competitive pricing, advanced trading tools, regulatory compliance.

- Cons: Not as user-friendly as some other brokers.

In addition to choosing the right crypto trading broker, there are a number of other things you can do to increase your chances of success in crypto trading.

Navigating The Crypto Trading Landscape: Tips For Success

- Conduct Thorough Research: Dedicating time to research the cryptocurrencies, market trends, and trading strategies can provide you with the necessary knowledge to make informed decisions. Understanding the underlying technology and dynamics of the crypto market can help you navigate the complexities with greater confidence.

- Start Small and Diversify: When you’re new to crypto trading, it’s prudent to begin with smaller investment amounts. This approach allows you to gain experience and test your trading strategies without risking significant capital. Additionally, diversifying your cryptocurrency holdings can help mitigate the risks associated with market volatility.

- Utilize Risk Management Strategies: Protect your profits and limit potential losses by setting stop-loss orders with your crypto trading broker. This feature can automatically execute the sale of your cryptocurrencies if the price falls below a specified level, helping to manage your risk exposure.

- Manage Your Emotions: Successful crypto trading requires discipline and the ability to make rational decisions. Avoid letting emotions like fear or greed influence your trading actions, as this can lead to impulsive and potentially detrimental decisions.

- Stay Informed and Adaptable: The cryptocurrency market is constantly evolving, so it’s crucial to stay up-to-date with the latest industry developments. Regularly review your trading strategies and be prepared to adapt them as the market landscape shifts to capitalize on emerging opportunities.

Frequently Asked Questions

What are the benefits of using a crypto trading broker?

- Security: Crypto trading brokers employ industry-leading security measures to protect your digital assets.

- Convenience: Brokers provide a user-friendly platform for buying, selling, and trading cryptocurrencies.

- Customer Support: Reputable brokers offer responsive customer service to assist you with any issues or concerns.

What are the risks associated with using a crypto trading broker?

- Fees: Brokers may charge various fees, such as trading fees, withdrawal fees, and deposit fees, which can impact your overall returns.

- Counterparty Risk: If the broker experiences financial difficulties or goes out of business, you may face the risk of losing your cryptocurrency holdings.

- Security Breaches: Even with robust security measures, there is always the potential for cyber attacks or hacking incidents that could compromise your digital assets.

Conclusion

The choice of a reliable and secure crypto trading broker is a critical decision for investors seeking to navigate the dynamic cryptocurrency market. By carefully evaluating the key factors outlined in this guide, you can identify the broker that aligns with your investment goals, risk tolerance, and personal preferences. Remember, the cryptocurrency landscape is constantly changing, so it’s essential to stay informed about the latest industry developments and continue refining your trading strategies. With the right crypto trading broker and a well-informed approach, you can embark on your crypto trading journey with confidence and potentially achieve your financial objectives.