As an experienced cryptocurrency trader in Australia, I”ve spent years navigating the ever-evolving digital asset markets. In my pursuit of consistent profits and staying ahead of the curve, I”ve come to embrace the power of crypto trading bots – automated systems that have revolutionized the way I approach the markets.

The Allure Of Crypto Trading Bots

The world of cryptocurrency trading can be a dizzying and volatile endeavor. The 24/7 nature of the markets, coupled with the breakneck pace of technological advancements, can be a daunting prospect for even the most seasoned traders. This is where crypto trading bots have emerged as a game-changer, offering a powerful tool to streamline my strategies and optimize my decision-making.

Crypto trading bot

Crypto trading bot

These automated systems, driven by advanced algorithms and data analysis, have the ability to execute trades at lightning speed, with unparalleled precision and consistency. By leveraging the power of these bots, I’ve been able to amplify my profits and gain a distinct edge in the volatile cryptocurrency markets.

Navigating The Crypto Trading Bot Ecosystem In Australia

As an experienced trader, I’ve had the opportunity to explore and evaluate a diverse range of crypto trading bot providers in the Australian market. While the choices can be overwhelming, I’ve found that certain platforms stand out for their reliability, flexibility, and advanced features.

One of the standout options I’ve come to rely on is 3Commas. This platform offers a comprehensive suite of 21 trading bots, allowing me to tap into the best of 18 major cryptocurrency exchanges. What I particularly appreciate about 3Commas is its depth of customization and the suite of sophisticated tools, including grid trading, dollar-cost averaging, and trailing stop-loss functionalities. These features have enabled me to fine-tune my strategies and maximize my trading efficiency.

3Commas Trading Bot

3Commas Trading Bot

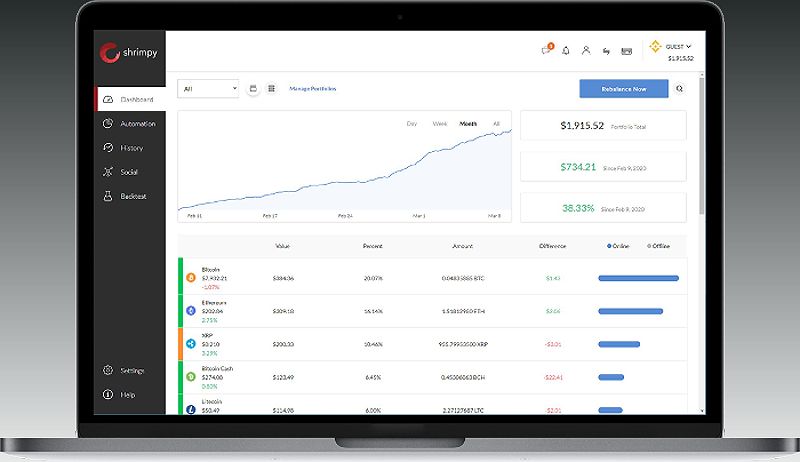

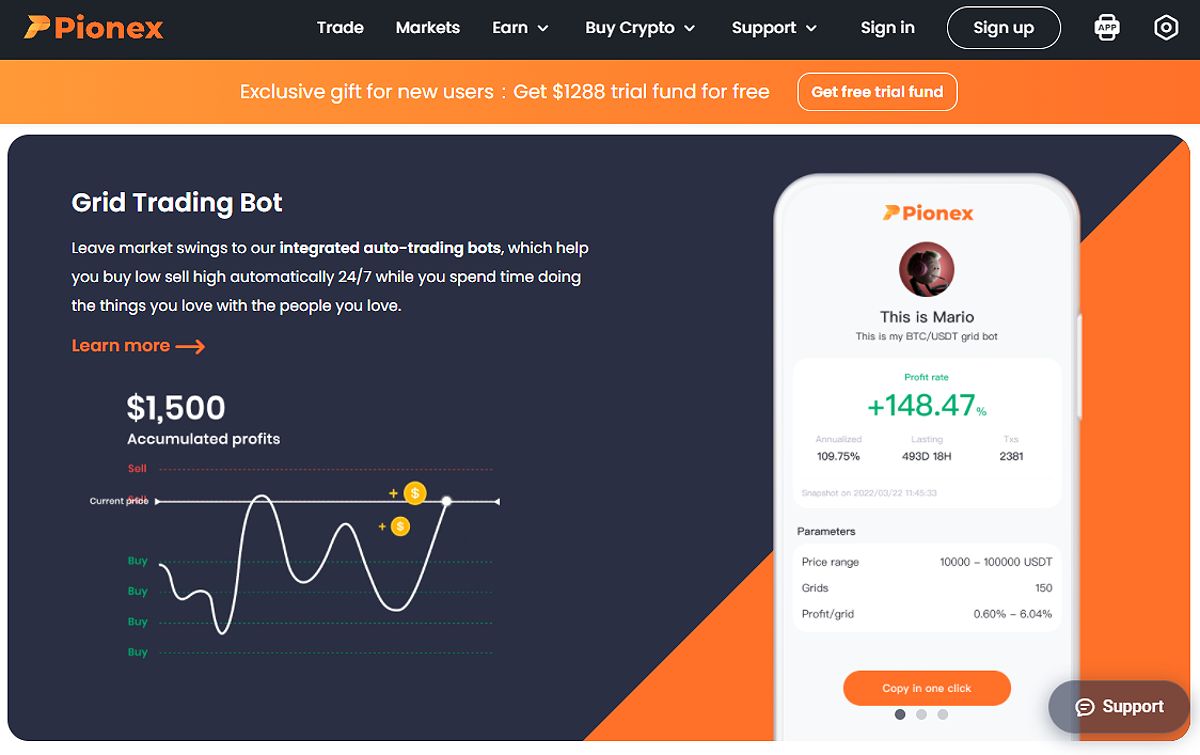

Another notable option that has caught my attention is Pionex. This exchange-integrated platform provides 16 free trading bots, each tailored to a specific trading strategy. From grid trading and leveraged grid trading to spot-futures arbitrage, the sheer breadth of options has allowed me to diversify my approach and explore new avenues for generating profits.

Pionex Trading Bot

Pionex Trading Bot

Unleashing The Power Of Advanced Trading Strategies With Crypto Trading Bots Australia

The true value of crypto trading bots lies in their ability to execute complex trading strategies with precision and efficiency. By leveraging advanced features such as backtesting and AI-driven decision-making, these bots have become an indispensable tool in my arsenal.

One particular strategy that has piqued my interest is the use of AI-powered trading bots, such as those offered by Growlonix. These bots utilize machine learning algorithms to analyze market data and make informed trading decisions, often outperforming traditional rule-based strategies in volatile market conditions. By harnessing the power of artificial intelligence, I’ve been able to gain a deeper understanding of market dynamics and make more informed trading choices.

Another advanced strategy that I’ve explored is arbitrage, facilitated by platforms like Bitsgap. These bots scan multiple exchanges for price discrepancies, executing trades to capitalize on these opportunities and generate profits. As an experienced trader with a strong grasp of market mechanics, I’ve found these arbitrage bots to be a valuable addition to my trading toolkit.

The Art Of Bot Management

While crypto trading bots have undoubtedly revolutionized my approach to the cryptocurrency markets, their successful implementation requires diligent monitoring and management. As an experienced trader, I’ve developed a keen eye for fine-tuning my bots’ performance, adjusting parameters, and adapting my strategies to changing market conditions.

A critical aspect of my bot management strategy is setting appropriate risk management parameters, such as stop-loss orders and position sizing. I’ve also made it a habit to closely monitor my bots’ execution and make timely adjustments as needed, ensuring that their underlying logic and strategies remain aligned with my overall investment objectives and risk tolerance.

Tapping Into The Crypto Trading Bot Community

One of the key advantages I’ve leveraged as an experienced trader in Australia is the thriving community of fellow enthusiasts and developers in the crypto trading bot ecosystem. By engaging with online forums, educational resources, and social trading platforms, I’ve been able to stay informed about the latest trends, strategies, and best practices in the world of automated cryptocurrency trading.

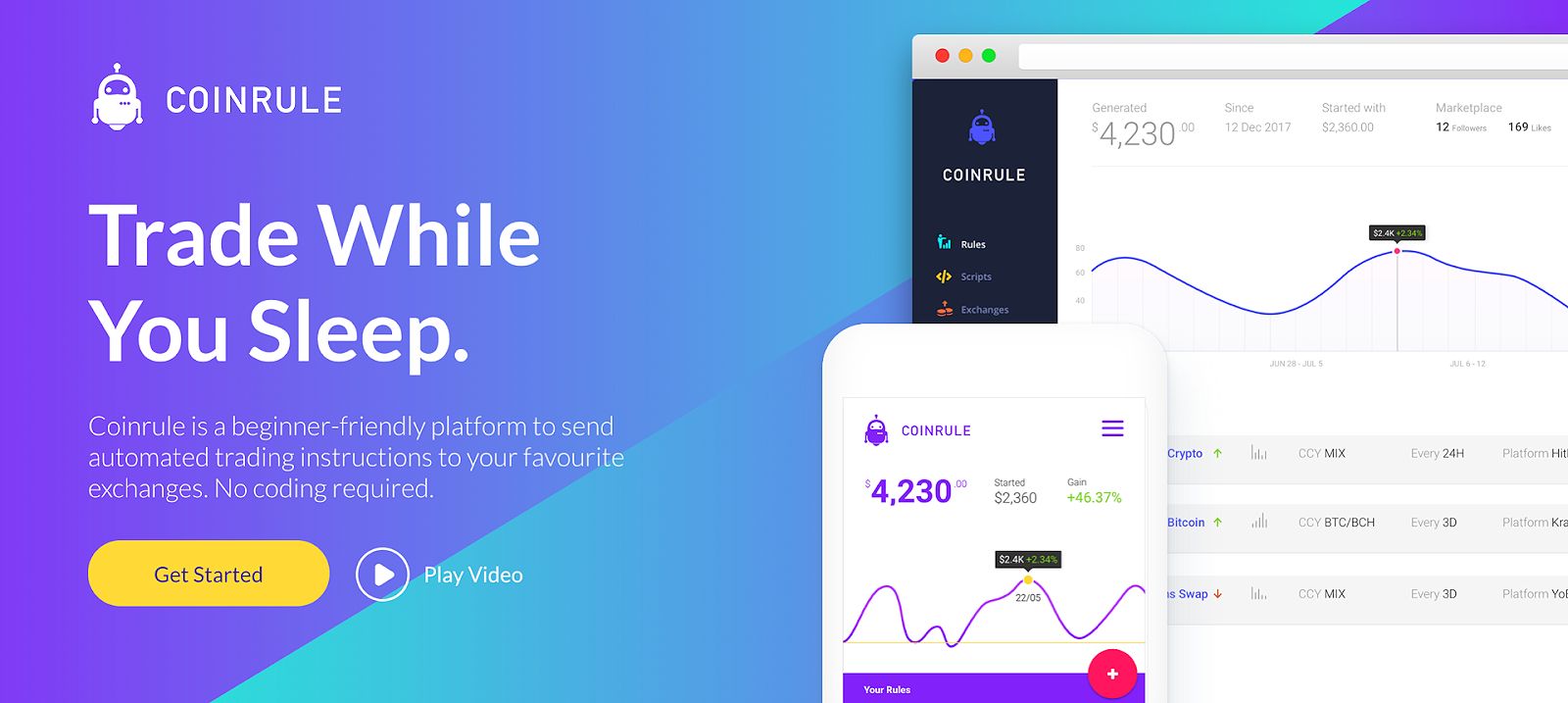

Platforms like Coinrule have provided me with a vibrant community where I can share my own strategies, collaborate on bot development, and learn from the experiences of my peers. This collective knowledge has been invaluable in refining my bot-based trading approaches and staying ahead of the curve.

Coinrule trading bot

Coinrule trading bot

Navigating The Regulatory Landscape

As an experienced trader in Australia, I’ve also had to navigate the evolving regulatory landscape surrounding crypto trading bots. While the use of these automated systems is generally legal in the country, it’s crucial to ensure compliance with relevant financial regulations and reporting requirements.

I’ve found it essential to consult with tax professionals to understand the specific implications of using crypto trading bots, as the tax treatment can vary depending on individual circumstances and jurisdictions. By staying informed and proactive about compliance, I’ve been able to leverage the power of these bots while mitigating potential risks and legal complications.

The Future Of Crypto Trading Bots In Australia

As I look ahead to the future of crypto trading bots in Australia, I see a landscape that is poised for continued growth and innovation. With the increasing adoption of digital assets and the ongoing advancements in technology, the role of these automated systems in the trading ecosystem is only set to become more prominent.

I’m excited to see how the crypto trading bot landscape will evolve, with the potential for even more sophisticated features, AI-driven decision-making, and seamless integration with the broader cryptocurrency ecosystem. As an experienced trader, I remain committed to staying at the forefront of these developments, constantly exploring new strategies and adapting my approach to capitalize on the ever-changing market dynamics.

Frequently Asked Questions

Q: Are Crypto Trading Bots Legal In Australia?

Yes, the use of crypto trading bots is legal in Australia, as long as they comply with relevant financial regulations and reporting requirements.

Q: What Are The Tax Implications Of Using Crypto Trading Bots?

Traders should consult with a tax professional to understand the specific tax implications of using crypto trading bots, as the treatment may vary depending on their individual circumstances and the jurisdiction in which they operate.

Q: Can I Create My Own Custom Crypto Trading Bot?

Absolutely. As an experienced trader with programming skills, I have the option to develop my own custom trading bots, allowing for a high degree of personalization and control over my trading strategies. This can be a particularly appealing option for those seeking to implement highly specialized or complex trading algorithms.

Q: What Are The Risks Associated With Using Crypto Trading Bots?

Like any trading tool, crypto trading bots come with inherent risks, including market volatility, technical glitches, and the potential for losses. As an experienced trader, I’ve implemented robust risk management strategies, such as setting appropriate stop-loss orders and diversifying my trading portfolio, to mitigate these risks and ensure the sustainable success of my bot-based trading endeavors.

Conclusion

As an experienced trader in Australia, I’ve embraced the power of crypto trading bots as a transformative tool in my quest for consistent profits and staying ahead of the curve. By carefully selecting the right platforms, implementing advanced strategies, and adhering to best practices in bot management, I’ve been able to unlock new levels of efficiency and profitability in my trading activities.

Looking ahead, I remain committed to staying at the forefront of the rapidly evolving crypto trading bot landscape. By tapping into the thriving community of fellow enthusiasts and continuously exploring new strategies and technologies, I’m confident in my ability to navigate the volatile cryptocurrency markets and achieve my investment goals.