As a passionate explorer of new technologies and their impact on our financial landscape, I”ve been fascinated by the rapid advancements in the realm of crypto trading bots. These sophisticated algorithms have the ability to process vast amounts of data, identify patterns, and make trading decisions at a pace that far surpasses human capabilities. In this guide, I”ll share my personal experiences and insights on how you can leverage the power of crypto trading bots to streamline your own trading strategies and potentially unlock new avenues for success.

Understanding The Allure Of Crypto Trading Bots

Cryptocurrency trading has always been a dynamic and fast-paced endeavor, requiring constant vigilance and quick decision-making. However, as the market continues to evolve, the sheer volume of data and the speed at which it changes can be overwhelming for even the most seasoned traders. This is where crypto trading bots come into play, providing a solution that can help level the playing field.

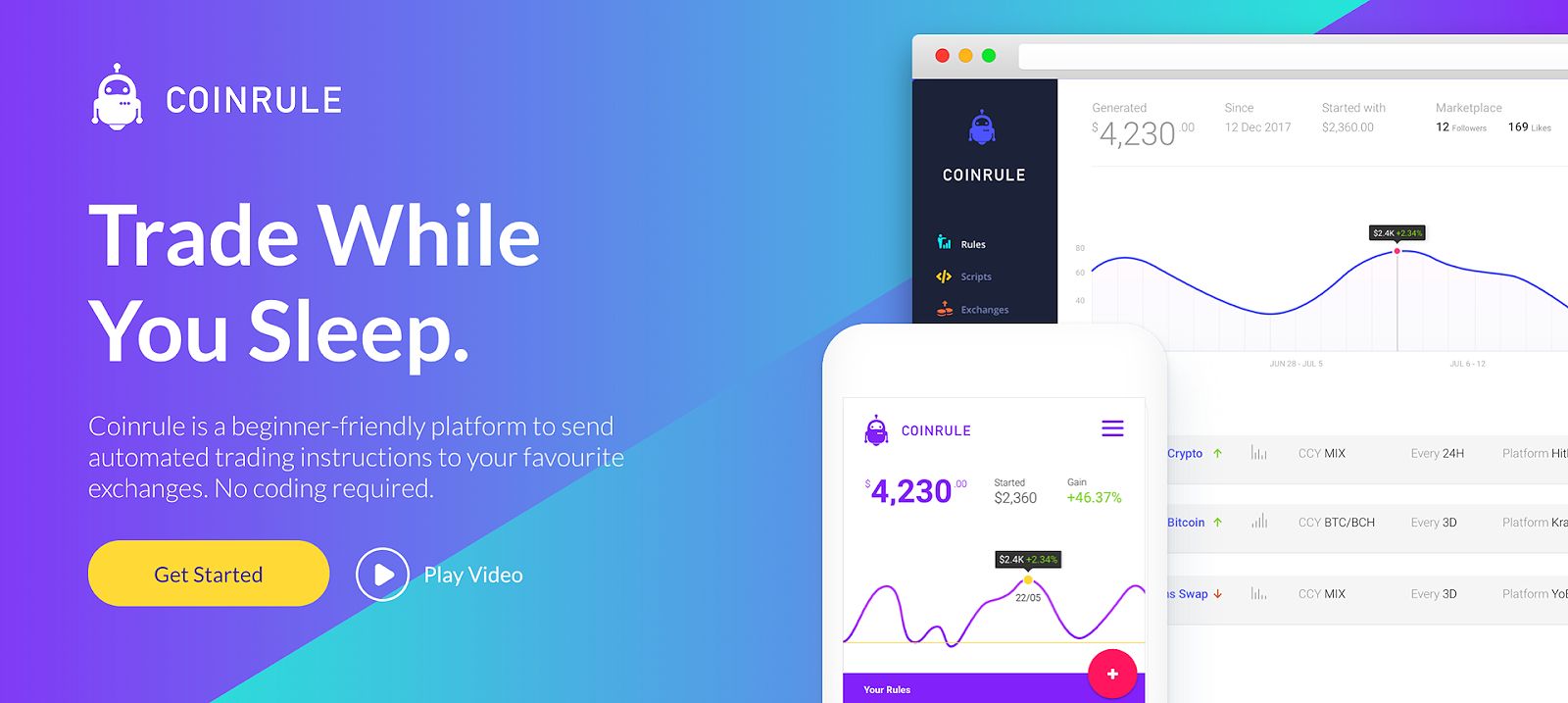

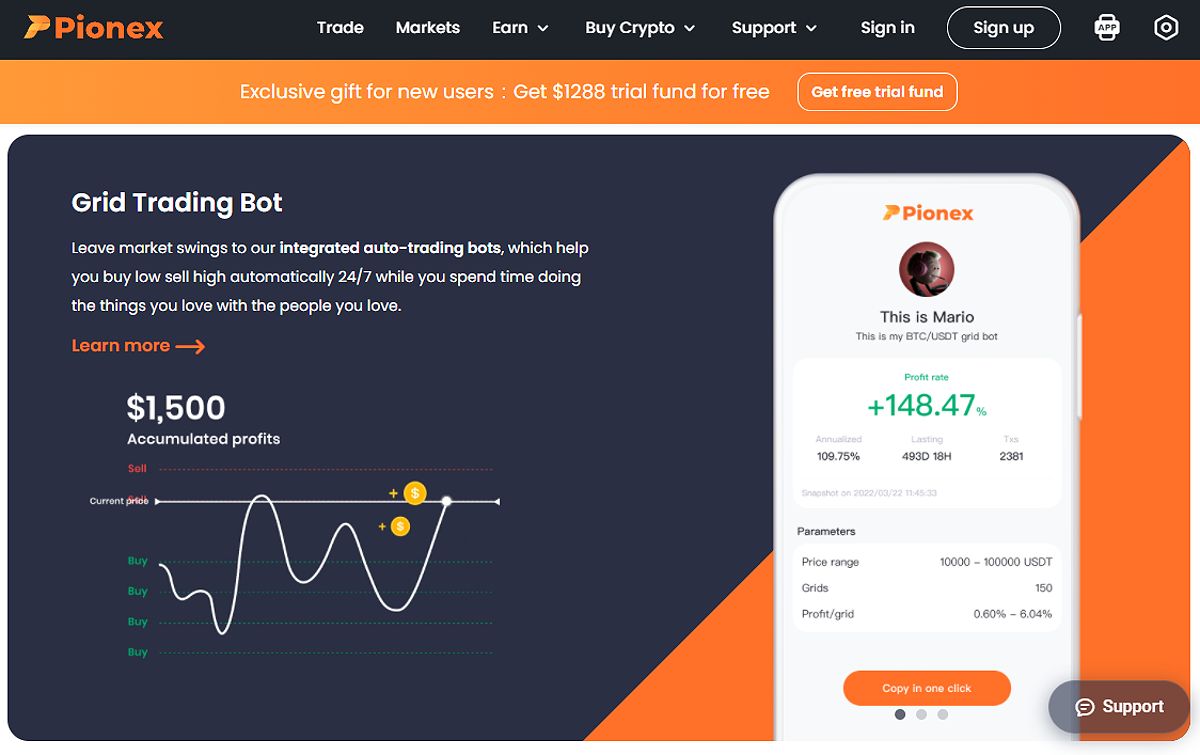

These automated programs are designed to execute trades in the cryptocurrency market based on predefined algorithms and strategies. By leveraging advanced technologies like artificial intelligence and machine learning, crypto trading bots can analyze market data, identify trading opportunities, and place buy and sell orders on your behalf — all without the need for constant manual monitoring.

Exploring The Diverse Landscape Of Crypto Trading Bots

The crypto trading bot ecosystem offers a wide range of options, each with its own unique strengths and specialized capabilities. As I’ve delved deeper into this space, I’ve encountered several captivating types of bots that can cater to a variety of trading styles and investment goals.

Arbitrage Bots

These bots are designed to capitalize on price discrepancies across different cryptocurrency exchanges. By identifying and exploiting these market inefficiencies, they can execute trades that generate profits from the price differences.

Arbitrage Bot Example

Arbitrage Bot Example

Market Making Bots

These bots play a crucial role in providing liquidity to the cryptocurrency market. By placing buy and sell orders at specific price levels, they earn a small spread on each trade, effectively contributing to the overall stability and healthy functioning of the market.

Market Making Bot Example

Market Making Bot Example

Trend-following Bots

Equipped with the ability to analyze technical indicators, these bots aim to identify and ride the waves of market trends. By detecting emerging patterns and price movements, they can execute trades that align with the prevailing market sentiment.

Trend-Following Bot Example

Trend-Following Bot Example

Algorithmic Bots

Embracing the power of complex mathematical models and machine learning algorithms, these bots dive deep into market data to uncover trading opportunities that may not be readily apparent to the human eye. Their ability to process and analyze vast amounts of information can give them a distinct edge in the ever-evolving crypto landscape.

Algorithmic Bot Example

Algorithmic Bot Example

As I’ve experimented with these various bot types, I’ve come to appreciate the importance of aligning the right bot with my own trading experience, investment goals, and risk tolerance. Novice traders may find solace in user-friendly bots with pre-built strategies, while more seasoned individuals may opt for customizable bots that allow them to create and test their own unique trading algorithms.

Getting Started With Crypto Trading Bots: My Personal Journey

When I first decided to venture into the world of crypto trading bots, I’ll admit that I was a bit overwhelmed by the sheer number of options available. However, as I delved deeper into the research and evaluation process, I discovered that the key to success lies in finding the right bot platform that aligns with my specific needs and preferences.

My personal journey began with carefully reviewing and comparing various crypto trading bot providers, considering factors such as their features, pricing structures, exchange integrations, and the quality of their customer support. This extensive due diligence helped me identify a few standout platforms that I felt confident in exploring further.

Once I had selected a reputable bot provider, the next step was to seamlessly connect my cryptocurrency exchange account to the bot platform. This integration process was straightforward and enabled the bot to execute trades on my behalf, all while maintaining the security of my exchange credentials.

With the technical setup complete, I then delved into the process of configuring my trading strategy. Depending on the bot’s capabilities, I had the option to either utilize pre-built strategies or create my own custom rules based on technical indicators, market conditions, and my investment objectives. This customization process allowed me to tailor the bot’s behavior to my specific trading style and risk tolerance.

Maximizing The Efficiency Of My Crypto Trading Bot

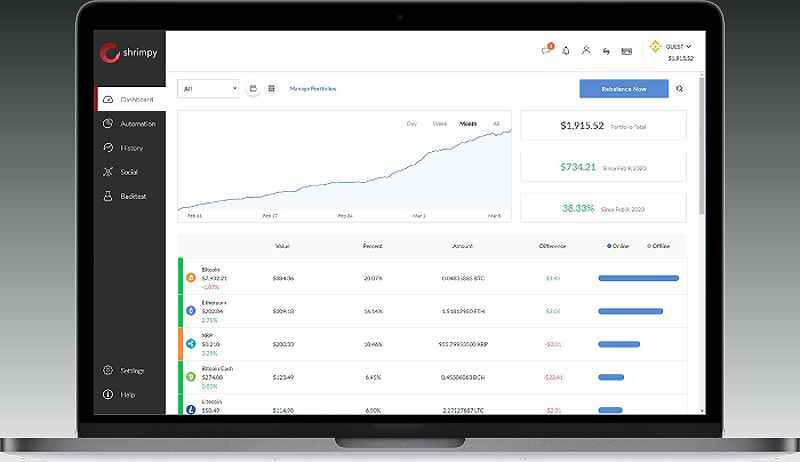

As I’ve continued to work with my crypto trading bot, I’ve discovered that the key to unlocking its full potential lies in a combination of consistent monitoring, continuous optimization, and a willingness to adapt to the ever-changing market conditions.

One of the strategies I’ve employed is to regularly review the bot’s performance, closely analyzing its execution, profitability, and overall effectiveness. This ongoing monitoring has enabled me to make timely adjustments to my trading rules, ensuring that my bot remains agile and responsive to the dynamic crypto market.

Moreover, I’ve found that diversifying my trading strategies has been crucial in maximizing the efficiency of my crypto trading bot. By experimenting with different techniques, I’ve been able to identify the approaches that work best for my trading style and market conditions.

Staying informed about the latest cryptocurrency news, trends, and developments has also played a vital role in my crypto trading bot journey. By keeping a pulse on the market, I’m able to make more informed decisions and ensure that my bot is making trades based on the most up-to-date information.

Unlocking The Potential Of Crypto Trading Bots In 2024

As I look ahead to the future, I’m truly excited about the boundless potential of crypto trading bots and their ability to transform the way we approach cryptocurrency trading. With the rapid advancements in artificial intelligence, machine learning, and data analytics, I believe that the capabilities of these automated trading tools will continue to evolve and become even more sophisticated.

In the year 2024, I envision a landscape where crypto trading bots will become even more accessible and user-friendly, catering to traders of all skill levels. The integration of these bots with exchanges and wallets will become seamless, allowing for a truly streamlined and efficient trading experience.

Furthermore, I anticipate the emergence of more specialized and niche-focused crypto trading bots, each tailored to address the unique needs and strategies of different market segments. Whether you’re a seasoned trader seeking to optimize your portfolio or a beginner looking to dip your toes into the crypto waters, there will be a bot solution that caters to your specific requirements.

As I continue my personal journey with crypto trading bots, I’m excited to see how the technology will continue to shape and transform the future of cryptocurrency trading. By embracing these powerful tools and leveraging their capabilities, I believe that traders like myself can unlock new levels of success and profitability in the ever-evolving crypto landscape.

Faqs

Can crypto trading bots really make me money? Absolutely! Crypto trading bots have the potential to generate profits, but their success ultimately depends on factors like the quality of the trading algorithms, market conditions, and your ability to configure and monitor the bot effectively. It’s important to start with a small investment and thoroughly test the bot’s performance before committing larger sums.

How much capital do I need to get started with a crypto trading bot? The minimum capital required can vary depending on the bot platform and the exchange you’re using. Many providers offer free trials or starter plans that allow you to get started with a relatively small investment, making it accessible for both novice and experienced traders.

Are crypto trading bots legal? Yes, the use of automated trading bots in the cryptocurrency market is generally legal, as long as they comply with applicable regulations and do not engage in any unlawful activities like market manipulation or insider trading. It’s important to familiarize yourself with the relevant laws and regulations in your jurisdiction.

Conclusion

As I look back on my personal journey with crypto trading bots, I can confidently say that they have become an invaluable tool in my trading arsenal. These automated programs have not only saved me time and reduced stress, but they’ve also played a significant role in enhancing my overall profitability.

By exploring the diverse landscape of crypto trading bots, from arbitrage and market making to trend-following and algorithmic strategies, I’ve been able to tailor my approach to my specific trading style and investment goals. The process of setting up and configuring my bot has been a rewarding learning experience, and the ongoing optimization and monitoring have allowed me to continuously refine my trading strategies.

As we move into the year 2024, I’m truly excited about the future of crypto trading bots and the boundless potential they hold. With advancements in artificial intelligence, machine learning, and data analytics, I believe these automated tools will become even more sophisticated and user-friendly, catering to traders of all skill levels and investment objectives.

By embracing the power of crypto trading bots and leveraging their capabilities, I’m confident that I can continue to navigate the dynamic cryptocurrency market with confidence and success. As I continue my personal journey, I encourage you to explore the world of crypto trading bots and unlock the opportunities that await in this exciting and ever-evolving financial landscape.