In the ever-evolving world of cryptocurrency, the ability to seamlessly exchange one digital asset for another has become increasingly essential. Crypto to crypto trading, often referred to as alt-coin trading, presents a unique opportunity for investors and enthusiasts to diversify their portfolios, access a wider range of digital currencies, and potentially capitalize on lucrative arbitrage opportunities. This comprehensive guide will walk you through the fundamentals of navigating the crypto-to-crypto trading landscape. From understanding the core concepts to choosing the right trading platform and strategies, we’ll equip you with the knowledge and tools to embark on your digital asset swapping journey with confidence.

Exploring the World of Crypto to Crypto Trading

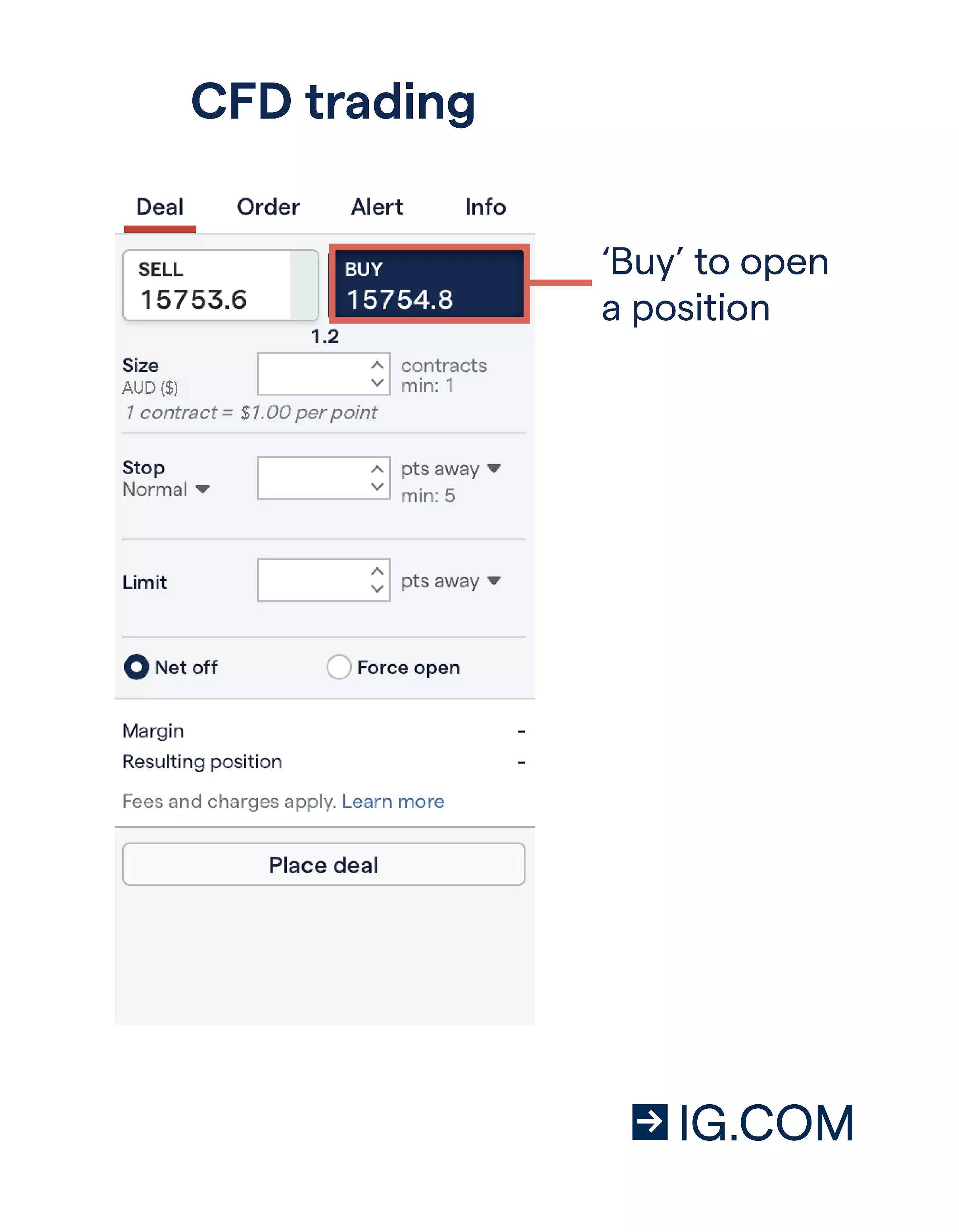

CFD trading deal ticket – going long

CFD trading deal ticket – going long

Imagine a financial landscape where you can directly exchange one cryptocurrency for another, similar to how traditional currency exchange markets operate. This is the essence of crypto-to-crypto trading. Unlike traditional trading, where investors must purchase an asset with fiat currency (such as USD or EUR), this innovative approach enables direct swaps between digital assets, granting you greater flexibility and access to a broader range of investment options.

One of the primary advantages of crypto-to-crypto trading is the ability to diversify your cryptocurrency portfolio. By exchanging one digital asset for another, you can spread your investment across various coins and tokens, potentially mitigating the risks associated with market volatility. Additionally, this approach grants you access to a wider variety of cryptocurrencies, including emerging projects and altcoins, which may present unique opportunities for growth and profit.

Navigating the Crypto-to-Crypto Trading Landscape

As the cryptocurrency market continues to evolve, the number of trading platforms offering crypto-to-crypto exchange services has grown exponentially. When selecting a platform, it’s crucial to consider several key factors to ensure a secure and seamless trading experience.

Factors to Consider

- Supported Cryptocurrencies: Ensure the platform supports the specific cryptocurrencies you wish to trade, as the available options can vary among different providers.

- Fees and Commissions: Thoroughly review the platform’s fee structure, including any charges for trading, deposits, and withdrawals. Comparing costs across multiple platforms can help you identify the most cost-effective option.

- Security: Look for platforms that prioritize the safety of your digital assets, with robust security measures such as multi-factor authentication, cold storage, and insurance coverage.

- User Interface: Consider the platform’s ease of use and overall user experience, as this can significantly impact your trading efficiency and overall satisfaction.

- Customer Support: Evaluate the platform’s customer support responsiveness and their ability to address any issues or concerns you may have.

Popular Crypto-to-Crypto Trading Platforms

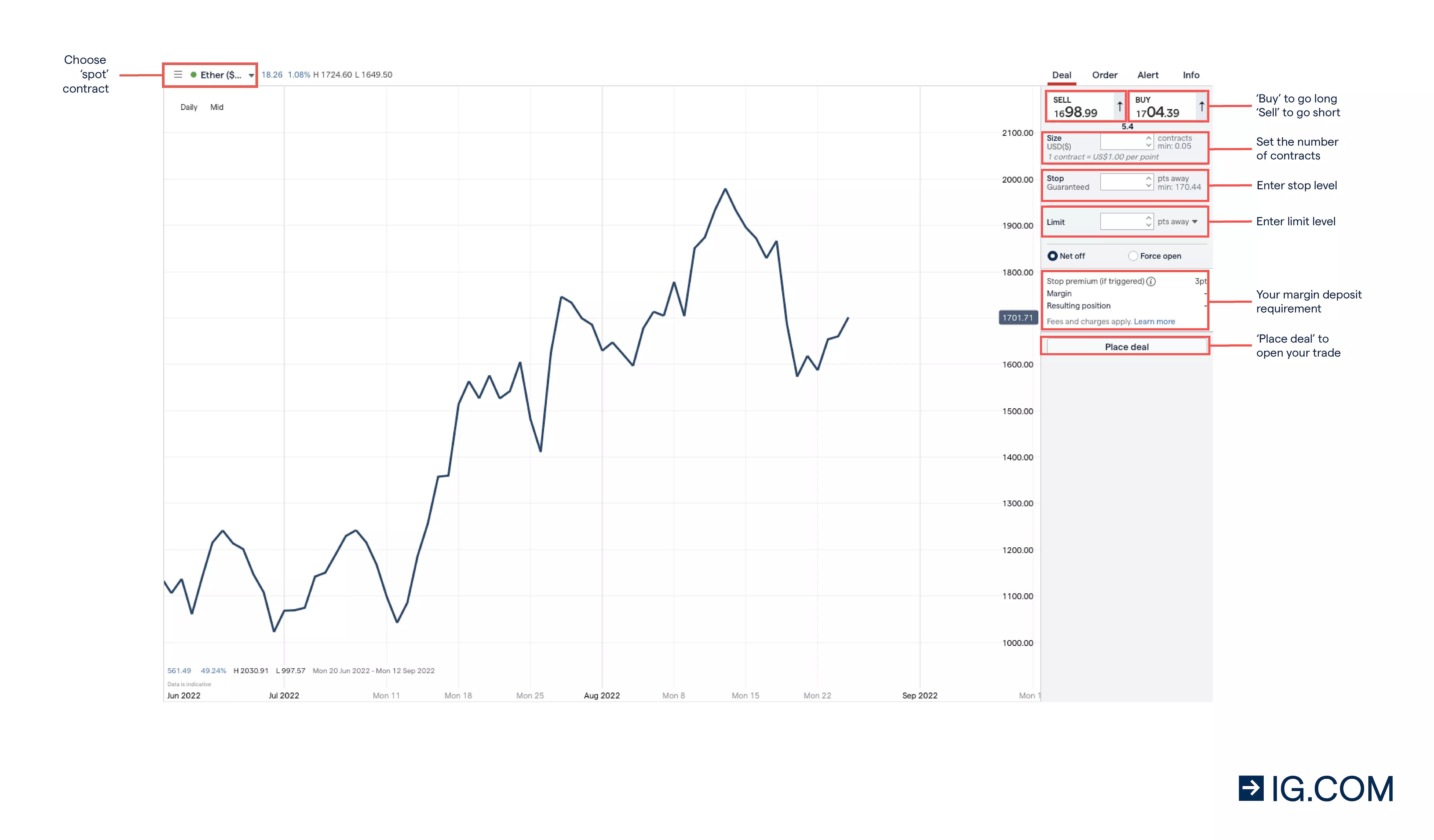

Ether deal ticket

Ether deal ticket

As you explore the crypto-to-crypto trading landscape, several platforms have gained prominence for their diverse offerings and reliable services. Let’s take a closer look at some of the most popular options:

Binance: As one of the largest and most well-known cryptocurrency exchanges, Binance offers a wide range of trading pairs and low fees, making it a popular choice for crypto-to-crypto trading. With its user-friendly interface and robust security measures, Binance caters to both novice and experienced traders.

Kraken: Known for its focus on security and advanced trading features, Kraken is a platform that appeals to both beginner and seasoned crypto enthusiasts. Its comprehensive suite of tools and resources can help you navigate the complexities of digital asset swaps with confidence.

Uniswap: As a decentralized exchange (DEX), Uniswap allows for direct peer-to-peer trading, providing users with greater control and privacy over their crypto-to-crypto transactions. This platform is particularly attractive for those seeking an alternative to traditional centralized exchanges.

KuCoin: This platform has gained popularity for its extensive selection of altcoins and crypto-to-crypto trading pairs, catering to investors seeking exposure to a diverse range of digital assets. With its user-friendly interface and competitive fees, KuCoin has become a go-to destination for those exploring the world of alt-coin trading.

As you evaluate these and other platforms, carefully consider the pros and cons of each, weighing factors such as fees, security, user experience, and the specific cryptocurrencies you wish to trade.

Setting Up Your Crypto-to-Crypto Trading Account

How to buy cryptocurrency.

How to buy cryptocurrency.

To begin your crypto-to-crypto trading journey, you’ll need to set up an account with a reputable exchange or platform. This process typically involves the following steps:

Account Creation

Start by creating an account on your chosen crypto-to-crypto trading platform. This usually involves providing personal information, such as your name, email address, and proof of identity, to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Funding Your Account

Once your account is established, you’ll need to fund it with the cryptocurrency(ies) you wish to trade. Most platforms offer a variety of deposit methods, including bank transfers, credit/debit cards, and direct cryptocurrency transfers. Be mindful of any fees associated with these deposit methods, as they can vary across platforms.

Choosing a Wallet

To securely store your cryptocurrencies, you’ll need to select a digital wallet. Wallets can be categorized as “hot” (online) or “cold” (offline) wallets, each offering different levels of convenience and security. It’s generally recommended to use a cold wallet, such as a hardware wallet, for long-term storage of your digital assets.

Understanding Crypto-to-Crypto Trading Orders

Cryptocurrency Trading Guide

Cryptocurrency Trading Guide

When engaging in crypto-to-crypto trading, you’ll encounter various order types that can be used to execute your transactions. Understanding these order types and their implications can help you make more informed trading decisions.

Market Orders

A market order is the simplest type of order, where you instruct the platform to execute the trade immediately at the current market price. While convenient, market orders may not always provide the best possible price, especially in volatile markets.

Limit Orders

With a limit order, you specify the maximum price you’re willing to pay to buy a cryptocurrency or the minimum price you’re willing to accept to sell. Limit orders allow for greater price control and can be particularly useful in identifying potential arbitrage opportunities.

Stop-Loss Orders

Stop-loss orders are designed to limit your potential losses by automatically executing a sell order when a cryptocurrency’s price reaches a predetermined level. This can be an effective risk management tool, although it’s important to carefully set the stop-loss level to avoid premature triggering.

Take-Profit Orders

Take-profit orders, on the other hand, are used to automatically sell a cryptocurrency when its price reaches a specific target level, helping you secure your gains and avoid missing out on potential upside.

Strategies for Successful Crypto-to-Crypto Trading

As you venture into the world of crypto-to-crypto trading, it’s essential to develop a well-rounded understanding of various trading strategies. Here are a few approaches to consider:

Dollar-Cost Averaging

This approach involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of the current market price. Dollar-cost averaging can help reduce the impact of market volatility and build a position over time.

Trend Trading

By identifying and following the overall trend of a cryptocurrency’s price, trend traders aim to capitalize on the momentum of the market. This strategy requires skill in recognizing trends and managing risk effectively.

Scalping

Scalping involves making quick profits from small price fluctuations, taking advantage of the high volatility in the crypto markets. This strategy requires a high level of skill, experience, and risk tolerance.

Arbitrage

Arbitrage trading takes advantage of price differences between various exchanges, allowing traders to capture risk-free profits by simultaneously buying and selling the same cryptocurrency across different platforms.

Tips for Navigating the Crypto-to-Crypto Trading Landscape

As you embark on your crypto-to-crypto trading journey, keep the following tips in mind:

- Start Small: Begin with a small amount of capital that you’re comfortable with potentially losing, as the crypto markets can be highly volatile.

- Educate Yourself: Continuously learn about the crypto market, trading strategies, and effective risk management techniques.

- Practice with a Demo Account: Before using real money, test your trading strategies and become familiar with the platform’s features using a demo account.

- Diversify Your Portfolio: Spread your investments across multiple cryptocurrencies to mitigate risk and enhance your long-term growth potential.

- Set Stop-Loss Orders: Utilize stop-loss orders to limit potential losses and protect your capital.

- Avoid Panic Selling: Resist the temptation to sell your cryptocurrencies in a panic when the market experiences a downturn.

- Stay Informed: Keep up-to-date with the latest news, regulations, and developments in the crypto industry to make informed trading decisions.

FQAs

What are the risks associated with crypto-to-crypto trading?

The cryptocurrency market is highly volatile, and crypto-to-crypto trading carries significant risks. Investors may potentially lose their entire investment due to market fluctuations, security breaches, or other unforeseen events. It’s essential to carefully manage your risk by diversifying your portfolio, setting stop-loss orders, and never investing more than you can afford to lose.

How can I protect myself from scams in crypto-to-crypto trading?

To protect yourself from scams, it’s crucial to choose a reputable and well-established crypto-to-crypto trading platform. Beware of promises of high returns or guaranteed profits, as these are often signs of a fraudulent scheme. Additionally, never share your personal information or private keys with anyone, and always verify the authenticity of any communication or offers before engaging.

Conclusion

The world of crypto-to-crypto trading presents an exciting opportunity for investors and enthusiasts to diversify their portfolios, access a wider range of digital assets, and potentially capitalize on lucrative arbitrage opportunities. By choosing a reputable trading platform, understanding the various order types, and implementing proven strategies, you can navigate this dynamic market with confidence.

Remember, the cryptocurrency market is inherently volatile, and it’s crucial to approach crypto-to-crypto trading with a well-informed and disciplined mindset. Start small, continue to educate yourself, and always prioritize risk management. With the right approach, you can unlock the potential of digital asset swaps and achieve your investment goals in the ever-evolving world of cryptocurrency.