In the rapidly expanding realm of digital assets, crypto options trading has emerged as a captivating frontier for those seeking to diversify their portfolios and capitalize on the unique opportunities presented by this burgeoning asset class. By leveraging the flexibility and versatility of options contracts, traders can now speculate on the future price movements of cryptocurrencies like Bitcoin and Ethereum, without the need to hold the underlying assets.

Exploring The Allure Of Crypto Options

At the heart of crypto options trading are two primary contract types: calls and puts. A call option grants the holder the right, but not the obligation, to purchase the underlying cryptocurrency at a predetermined price (the strike price) within a specified time frame. Conversely, a put option provides the holder the right, but not the obligation, to sell the cryptocurrency at the strike price.

The allure of crypto options trading lies in its ability to potentially profit from both rising and falling markets. Traders can utilize put options to speculate on downward price movements, while call options can be leveraged to capitalize on bullish trends. Furthermore, options can serve as a valuable hedging tool, allowing investors to protect their existing cryptocurrency holdings against potential price declines.

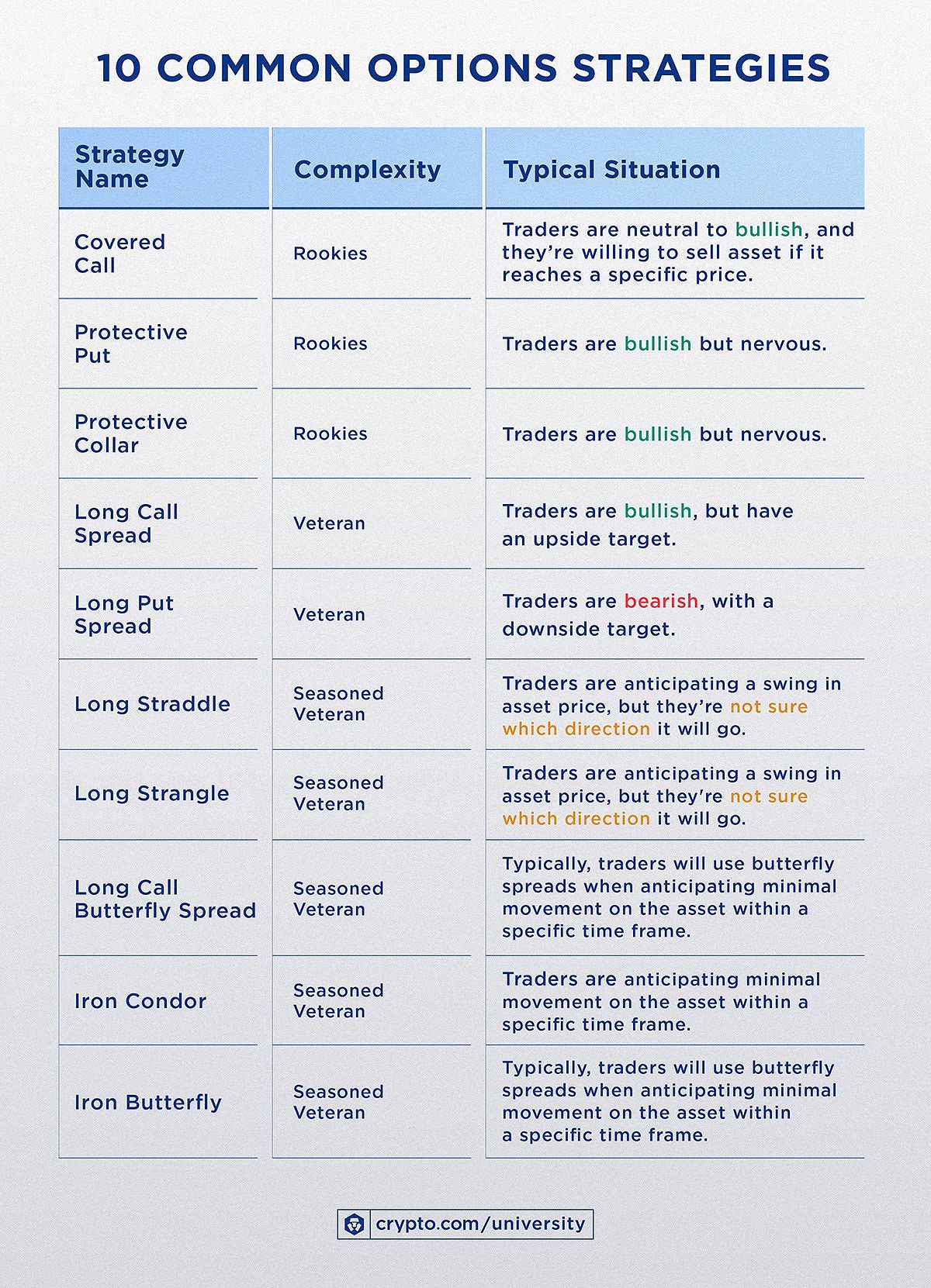

Defi Opt Trading 10strategies Image: A visual representation of 10 common strategies for decentralized finance (DeFi) options trading.

Defi Opt Trading 10strategies Image: A visual representation of 10 common strategies for decentralized finance (DeFi) options trading.

Navigating The Crypto Options Landscape In The Usa

As the crypto options market continues to mature, a growing number of reputable exchanges and platforms have emerged to cater to the needs of traders, both in the United States and globally. When selecting a crypto options trading platform, it’s essential to prioritize factors such as liquidity, fee structures, security measures, regulatory compliance, and the availability of advanced trading tools and analytics.

Some of the best crypto options trading platforms currently available in the USA include Binance, Bybit, and OKX, each offering a unique set of features and advantages to accommodate the diverse needs of traders. These platforms have established themselves as leaders in the crypto options space, providing the necessary infrastructure and resources for savvy investors to navigate the complexities of this dynamic market.

Deribit Options Image: A screenshot of a Deribit options trading interface showing various strike prices.

Deribit Options Image: A screenshot of a Deribit options trading interface showing various strike prices.

Crafting Winning Strategies

Success in the crypto options arena requires a solid understanding of various trading strategies and a disciplined approach to risk management. Let’s explore some of the top crypto options trading strategies that savvy investors are leveraging:

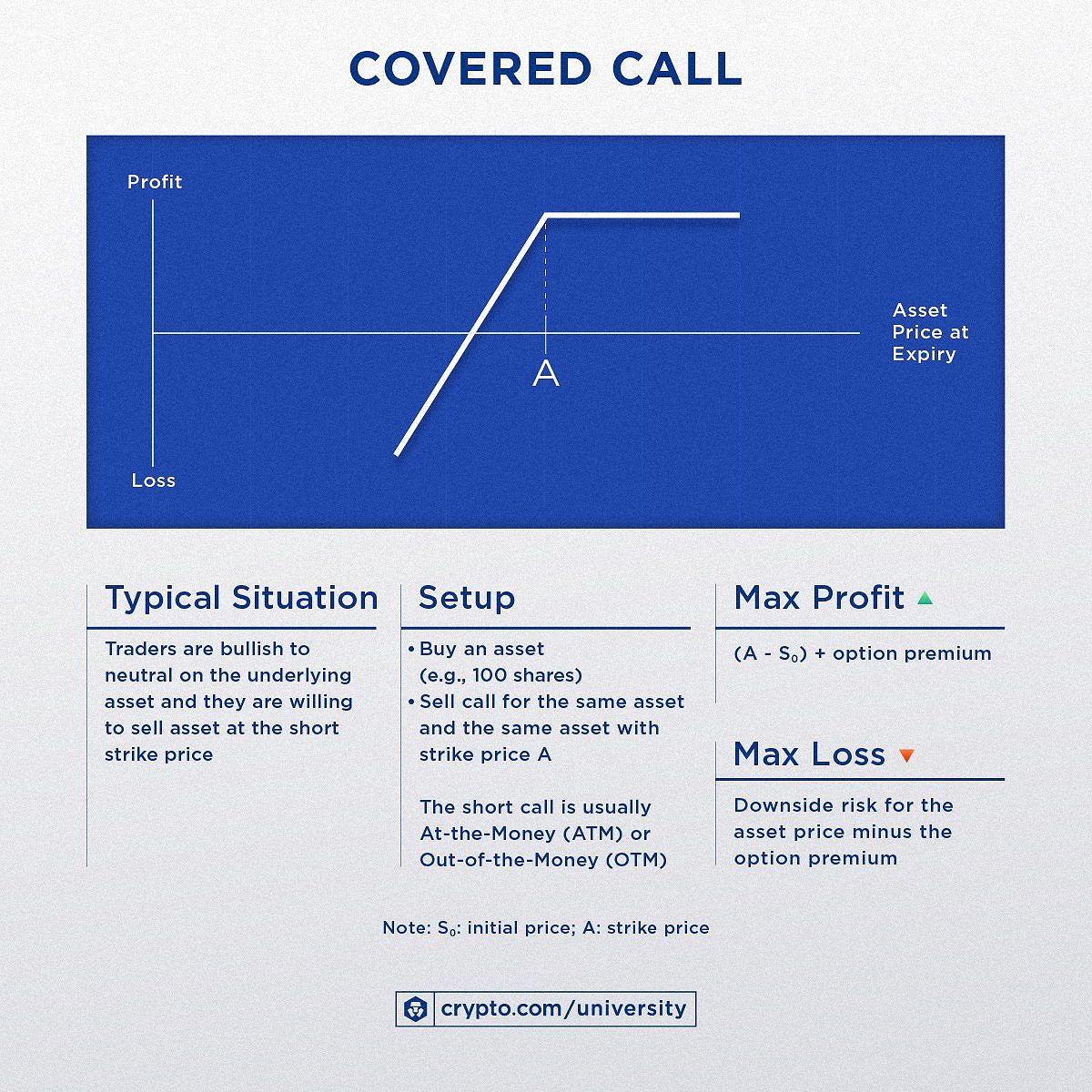

Covered Calls

The covered call strategy involves holding the underlying cryptocurrency and simultaneously selling call options on that same asset. By collecting the premium from selling the call options, traders can generate income while capping their upside potential if the cryptocurrency’s price rises above the strike price.

Defi Options Trading 10strategies C Image: An illustration of the covered call strategy in decentralized finance (DeFi) options trading.

Defi Options Trading 10strategies C Image: An illustration of the covered call strategy in decentralized finance (DeFi) options trading.

Protective Puts

This hedging strategy involves buying put options to safeguard an existing cryptocurrency position. If the asset’s price declines, the put option can be exercised to sell the cryptocurrency at the strike price, limiting potential losses.

Bull Call Spreads

Bullish traders can employ the bull call spread strategy, which involves purchasing a call option with a lower strike price and selling a call option with a higher strike price. This approach limits upside potential but also reduces the cost of the trade.

Long Straddles

For traders who anticipate a significant price move in a cryptocurrency, but are uncertain of the direction, the long straddle strategy can be a suitable choice. It involves simultaneously buying both a call and a put option with the same strike price and expiration date.

10 Common Strategiesapr 13 1 Image: An overview of 10 common strategies used in crypto options trading.

10 Common Strategiesapr 13 1 Image: An overview of 10 common strategies used in crypto options trading.

Mastering Risk Management

While the crypto options trading landscape presents exciting opportunities, it also carries inherent risks that must be carefully managed. Key considerations include the high volatility of cryptocurrencies, the impact of leverage and position sizing, and the effects of expiration and time decay on options contracts.

By developing a deep understanding of these factors and implementing robust risk management strategies, traders can navigate the crypto options market with confidence and potentially unlock new avenues for growth. This may involve diversifying their portfolio, employing stop-loss orders, and maintaining a disciplined approach to position sizing and trade execution.

Crypto Options Trading: The Next Frontier

As the crypto ecosystem continues to evolve, the importance of staying informed and adaptable cannot be overstated. By embracing the strategies and insights outlined in this guide, savvy investors can embark on their crypto options trading journey with confidence and the potential to unlock new levels of success in the ever-changing digital asset landscape.

Whether you’re a seasoned trader or a newcomer to the crypto options world, the time is ripe to explore this captivating frontier. By leveraging the power of options, you can potentially amplify your returns, manage risk more effectively, and position yourself at the forefront of the crypto revolution.

— POTENTIAL IMAGES —

- Defi Opt Trading 10strategies : https://contenthub-static.crypto.com/wp_media/2023/05/DEFI_OPT_TRADING_10STRATEGIES.jpg

- 10 Common Strategiesapr 13 1 : https://contenthub-static.crypto.com/wp_media/2023/04/10-COMMON-STRATEGIESApr-13-1.jpg

- Defi Options Trading 10strategies C : https://contenthub-static.crypto.com/wp_media/2023/04/COVERED-CALL_Apr21.jpg

- Deribit Options : https://sp-ao.shortpixel.ai/client/to_auto,q_glossy,ret_img,w_1280,h_426/https://milkroad.com/wp-content/uploads/2023/06/options-2.jpeg

- A screenshot of Deribit’s strike prices : https://sp-ao.shortpixel.ai/client/to_auto,q_glossy,ret_img,w_1280,h_619/https://milkroad.com/wp-content/uploads/2023/06/Crypto-Options-Trading-2.jpeg

- Bit.com Options : https://sp-ao.shortpixel.ai/client/to_auto,q_glossy,ret_img,w_1280,h_478/https://milkroad.com/wp-content/uploads/2023/06/options-3.jpeg

- OKX Options : https://sp-ao.shortpixel.ai/client/to_auto,q_glossy,ret_img,w_1280,h_479/https://milkroad.com/wp-content/uploads/2023/06/okx-options.jpeg

- Defi Trading Introduction To Options F : https://contenthub-static.crypto.com/wp_media/2023/07/DeFi-Trading-Introduction-to-Options_F.jpg

- Example Of Option Moneynessaug 28 : https://contenthub-static.crypto.com/wp_media/2023/08/Example-of-Option-MoneynessAug-28.jpg

- Crypto options trading: volatile market. : https://assets.bitdegree.org/images/crypto-options-trading-volatile-market.jpg

TASK:

- Select between 3 and 10 images from POTENTIAL IMAGES that are most relevant headings and its content of SAMPLE BODY ARTICLE.

- From the selected images, insert the most relevant images after paragraphs for each heading to illustrate that section. If there are no relevant images for a particular heading, do not insert any images for that section.

- Do not insert duplicate images or alt text.

- Do not insert images to the “FAQ” sections.

- Use the format: . Write a short, relevant alt text description in English (Global) without mentioning specific websites or sources.

- Keep current headings/sub-headings markdown format (heading H2 (##) and sub-headings H3 (###)). Do not remove or modify any existing content, do not add more headings or change content structure in the SAMPLE BODY ARTICLE; only add images and alt text.

OUTPUT RULES:

- Output in language English (Global) and format with markdown.

- Do not include any instructions in the response, provide only the updated body article with inserted images.

Faq

Q: What are the main advantages of crypto options trading? A: The primary advantages of crypto options trading include the ability to potentially profit from both rising and falling markets, the potential for leveraged gains, and the opportunity to generate income through options premiums.

Q: Which crypto options trading strategy is best for beginners? A: For those new to crypto options trading, strategies like covered calls and protective puts are often considered good starting points, as they provide a relatively lower-risk approach to options trading.

Q: How can I effectively manage the risks associated with crypto options trading? A: Effective risk management in crypto options trading involves strategies such as diversifying your portfolio, using stop-loss orders, understanding the impact of volatility and time decay, and practicing disciplined position sizing.

Q: What are the most important factors to consider when choosing a crypto options trading platform in the USA? A: When selecting a crypto options trading platform in the USA, key factors to evaluate include liquidity, fees, security measures, regulatory compliance, and the availability of advanced trading tools and analytics.

Conclusion

As the crypto options trading landscape continues to evolve, savvy investors have the opportunity to navigate this captivating frontier and potentially unlock new avenues for growth. By understanding the fundamental concepts, exploring proven strategies, and selecting a reputable trading platform, traders can leverage the power of options to manage risk more effectively and amplify their returns in the ever-changing digital asset market.

Whether your goal is to profit from market volatility, hedge your existing cryptocurrency holdings, or generate a consistent stream of income, the world of crypto options trading presents a compelling and dynamic opportunity. By embracing the insights and strategies outlined in this guide, you can embark on your crypto options trading journey with confidence and the potential to stay ahead of the curve in the rapidly evolving world of digital assets.