As a seasoned cryptocurrency enthusiast and trader, I”m excited to share my insights on the transformative world of crypto margin trading. In today”s rapidly evolving financial landscape, investors are constantly seeking innovative strategies to amplify their returns, and margin trading has emerged as a powerful tool in the crypto arena.

Unlocking The Potential Of Crypto Margin Trading

At the heart of crypto margin trading lies the ability to borrow funds, which allows traders to take on larger positions and potentially magnify their profits. By leveraging their capital, even the smallest price movements in the market can translate into sizable gains. This is particularly advantageous in the highly volatile cryptocurrency market, where sudden price fluctuations are a common occurrence.

How margin trading works in crypto

How margin trading works in crypto

As I’ve delved deeper into this realm, I’ve come to appreciate the nuanced relationship between risk and reward. Margin trading is a double-edged sword — it can amplify returns, but it also introduces unique risks that must be carefully navigated. The key is to strike a delicate balance, employing strategies that harness the power of leverage while mitigating the potential for significant losses.

Managing The Risks With Discipline

One of the most critical aspects of crypto margin trading is understanding the inherent risks involved. The dreaded “margin call” is a constant concern, as it can occur when the value of a trader’s collateral falls below the minimum requirement set by the exchange. In such scenarios, traders will be compelled to add more funds to their account to maintain their position, or risk having their position liquidated entirely.

Liquidation, however, is the most formidable risk faced in the crypto margin trading arena. If the market moves against a trader’s position and their collateral is insufficient to cover the losses, the exchange may automatically close the position, selling the assets to recoup the borrowed funds. This can result in devastating financial setbacks, potentially wiping out a trader’s entire account.

Risk and reward from margin trading

Risk and reward from margin trading

To mitigate these risks, I’ve dedicated countless hours to understanding the intricacies of leverage, margin requirements, and effective risk management strategies. Stop-loss orders, portfolio diversification, and disciplined position sizing have become the cornerstones of my approach, ensuring that I never risk more than I can afford to lose. By providing specific examples of how I’ve implemented these strategies, I can help readers better visualize how to apply them in their own trading.

Navigating The Crypto Margin Trading Landscape

As I’ve navigated the crypto margin trading landscape, I’ve had the opportunity to explore some of the leading platforms catering to US-based investors. Among these, Kraken and Coinbase Pro have emerged as standout options, each offering unique features and benefits.

Kraken

Kraken, a well-established cryptocurrency exchange, has long been a favorite among US traders. Its user-friendly interface, diverse trading pairs, and the ability to leverage positions up to 5x have made it a compelling choice for those seeking to venture into the world of crypto margin trading. Kraken’s commitment to robust security measures and regulatory compliance has also instilled a sense of trust and confidence in its platform.

Coinbase Pro

Coinbase Pro, the advanced trading platform offered by the popular Coinbase exchange, has also caught my attention. Catering to both novice and experienced traders, Coinbase Pro offers margin trading with up to 3x leverage, providing a gateway for those looking to explore the potential of this investment strategy. The platform’s comprehensive educational resources and advanced order types have been invaluable in my journey to navigate the complexities of crypto margin trading.

Embracing A Thoughtful Approach

As I’ve delved deeper into the realm of crypto margin trading, I’ve learned that a thoughtful and disciplined approach is essential for long-term success. I’ve adopted a mindset of steady progress, where I start small, diversify my portfolio, and continuously educate myself on the latest market trends and regulatory changes.

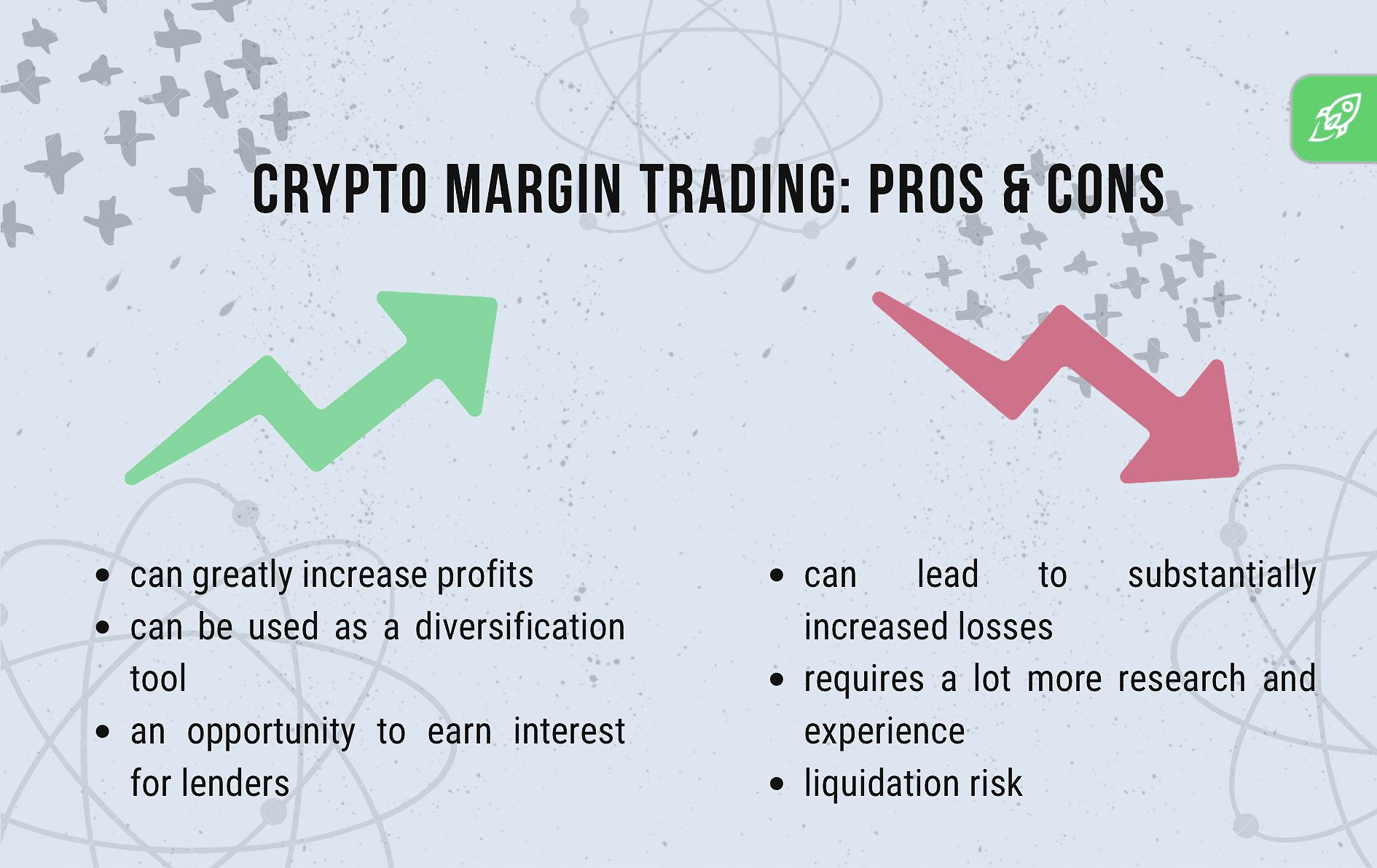

Pros and cons of crypto margin trading

Pros and cons of crypto margin trading

Leveraging the power of stop-loss orders has been a game-changer, as it allows me to limit my potential losses and prevent my positions from being liquidated. By regularly monitoring my margin levels and acting promptly to address any potential issues, I’ve been able to navigate the ever-changing crypto landscape with greater confidence and control.

To illustrate the effectiveness of this approach, I can provide a hypothetical example of how I’ve implemented stop-loss orders to manage my risk. Let’s say I’ve opened a long position on a cryptocurrency with a 3x leverage. I might set a stop-loss order at 5% below my entry price, which would automatically close my position if the market moves against me and my collateral falls below the required margin. This simple yet powerful risk management tool has been instrumental in preserving my trading capital.

Conclusion

The world of crypto margin trading is a captivating and rapidly evolving space, offering the potential for substantial gains while also presenting unique risks that must be carefully navigated. As an enthusiastic advocate for innovative financial technologies, I’m thrilled to have the opportunity to share my insights and strategies with you.

Whether you’re a seasoned trader or new to the cryptocurrency market, I encourage you to approach crypto margin trading with diligence, patience, and a commitment to effective risk management. By embracing a thoughtful and disciplined approach, you too can unlock the transformative potential of this exciting investment frontier.

Faq

Q: What is the minimum deposit required to start crypto margin trading in the US? A: The minimum deposit required to start crypto margin trading can vary across different platforms. Some exchanges may have no minimum deposit, while others may require a minimum of $100 or more to open a margin trading account.

Q: What is the maximum leverage available for crypto margin trading in the US? A: The maximum leverage available for crypto margin trading in the US can range from 2:1 to 5:1, depending on the platform. While some exchanges may offer higher leverage ratios, these tend to be more prevalent in non-US markets.

Q: Are there any specific regulations or restrictions for US-based crypto margin traders? A: Yes, the crypto margin trading landscape in the US is subject to regulatory oversight by authorities such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Traders must ensure they are using platforms that comply with these regulations and adhere to the applicable rules and guidelines.

Q: How can I minimize the risks associated with crypto margin trading? A: To minimize the risks of crypto margin trading, it’s crucial to implement sound risk management strategies. This includes setting stop-loss orders, diversifying your portfolio, and never investing more than you can afford to lose. Starting with small position sizes and gradually increasing your exposure as you gain experience can also help manage your risk effectively.