As an experienced crypto enthusiast, I”ve witnessed the rapid evolution of the industry, and one aspect that has particularly piqued my interest is the world of crypto futures trading. It”s a dynamic and complex field, but for those willing to navigate it, the potential rewards can be quite substantial. In this comprehensive guide, I”ll share my insights and personal experiences to help you, as a beginner, unlock the secrets of crypto futures trading.

Exploring Crypto Futures Trading For Beginners

When I first delved into crypto futures trading, I was captivated by the sheer possibilities it presented. Unlike traditional spot trading, where you simply buy and hold the underlying asset, crypto futures trading involves entering into a contract to buy or sell a specific cryptocurrency at a predetermined price on a future date. This unique approach opens up a world of opportunities for both speculative and hedging strategies.

At the heart of crypto futures trading are three key elements: contracts, leverage, and margin. Contracts define the details of the agreement, such as the cryptocurrency, the price, and the expiration date. Leverage allows you to control a larger position with a smaller amount of capital, while margin serves as the collateral you must maintain to keep your position open.

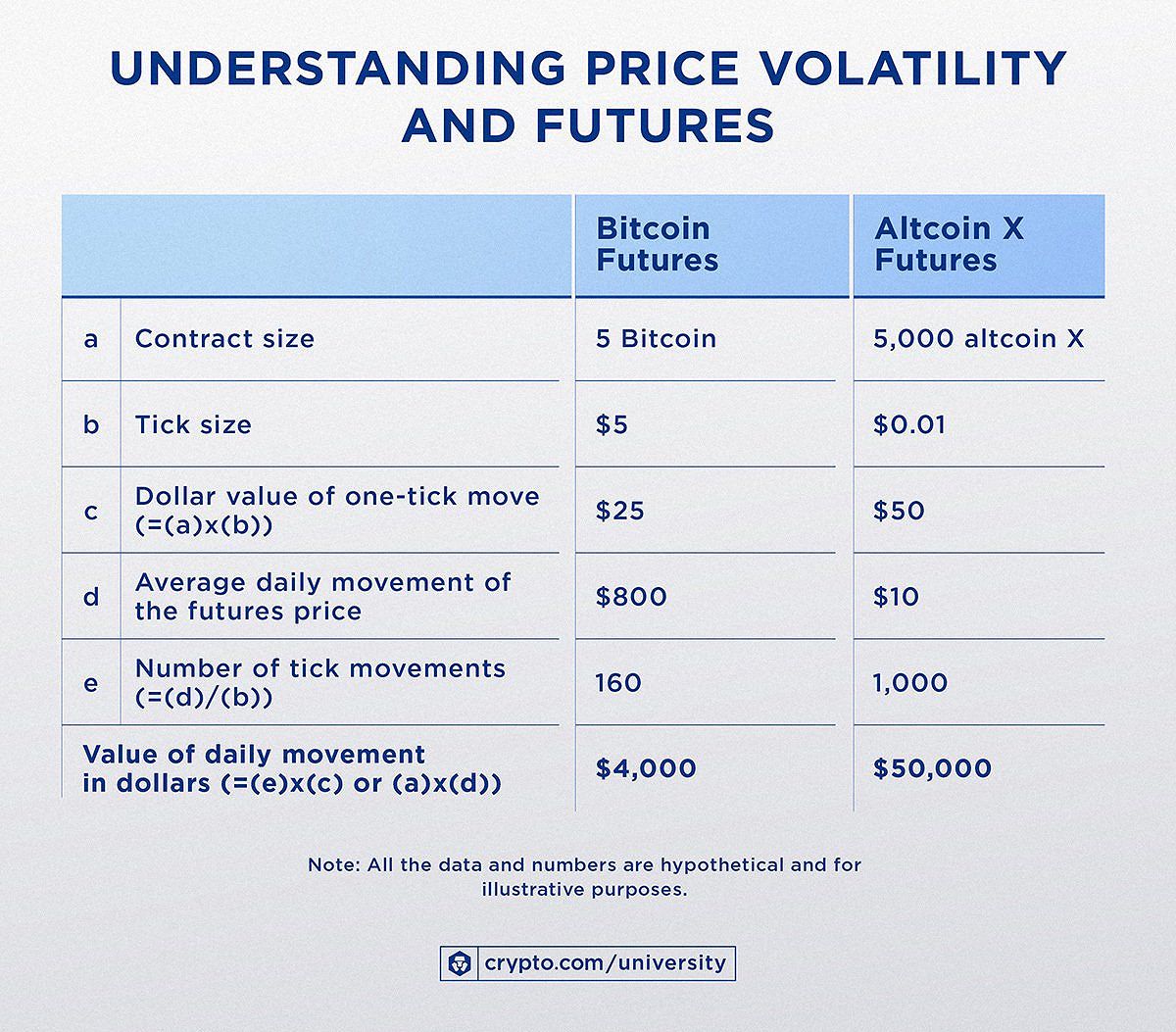

One of the significant advantages of crypto futures trading is the ability to hedge against market volatility. The unpredictable nature of the crypto market can be challenging, but by employing futures contracts, you can position yourself to capitalize on both upward and downward price movements. Additionally, crypto futures can offer portfolio diversification, as they provide exposure to the crypto market without the need to hold the underlying assets directly.

Crypto futures trading: contract

Crypto futures trading: contract

Navigating The Contract Landscape

The crypto futures market presents a diverse array of contract types, each with its own unique characteristics and applications. As I’ve explored this landscape, I’ve found that understanding these nuances is crucial for crafting effective trading strategies.

Perpetual Futures

One of the most common contract types is perpetual futures, which don’t have a predetermined expiration date. This flexibility makes them attractive for long-term strategies and market exposure.

Perpetual Futures

Perpetual Futures

Quarterly Futures

Quarterly futures, on the other hand, are designed to expire at the end of specific calendar quarters, allowing traders to align their positions with market cycles and seasonal trends.

Options

Another contract type that has caught my attention is options, which offer the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price within a specified timeframe. This added flexibility can be beneficial for risk management and advanced trading strategies.

Types of options

Types of options

By familiarizing yourself with these contract types and their respective advantages, you’ll be better equipped to navigate the crypto futures market and tailor your approach to your specific trading goals and risk tolerance.

Crafting Winning Strategies

As I delved deeper into the world of crypto futures trading, I quickly realized that a well-rounded understanding of trading strategies is essential for success. From my personal experience, some of the most effective approaches include:

Long And Short Positions

The fundamental strategies of going long (buying) or going short (selling) allow traders to capitalize on both upward and downward market movements. This versatility has been crucial in my own trading journey, as it has enabled me to generate profits regardless of the market conditions.

Trend Following

By identifying and following established trends in the crypto market, I’ve been able to position myself to ride the waves of price movements, potentially generating consistent returns. This strategy requires a keen eye for market patterns and the discipline to execute trades at the right times.

Mean Reversion

This approach involves identifying assets that have deviated significantly from their historical averages and anticipating a return to those levels. It’s a strategy that has served me well, as I’ve been able to enter positions at opportune times and capitalize on the market’s tendency to correct itself.

Breakout Strategies

By closely monitoring resistance and support levels, I’ve been able to identify and capitalize on the sharp price movements that often occur when the market breaks through these key thresholds. This strategy has allowed me to potentially seize opportunities in the often volatile crypto futures market.

Breakout Strategies

Breakout Strategies

Mastering these strategies, along with effective risk management techniques, has been crucial in my crypto futures trading journey. It’s a continuous learning process, but one that has the potential to yield substantial rewards for those willing to put in the time and effort.

Choosing The Right Trading Platform

As I navigated the crypto futures landscape, I quickly realized that the choice of trading platform can make or break your success. When evaluating potential platforms, I’ve always prioritized factors such as security, liquidity, fees, user experience, and customer support.

Security

Security is of utmost importance, as you’ll be entrusting your hard-earned funds to the platform. Ensuring the platform has robust security measures in place, such as multi-factor authentication and cold storage for digital assets, has been a non-negotiable criterion for me.

Liquidity

Liquidity is another crucial consideration, as it determines the efficiency of your trades. High trading volumes and tight bid-ask spreads can make a significant difference in the execution of your orders, ultimately impacting your overall profitability.

Fees

Fees are also a key factor, as they can eat into your potential gains. I’ve carefully analyzed the fee structures of various platforms, taking into account not just the trading fees, but also any withdrawal fees or other applicable charges.

User Experience

The user experience has also been a top priority for me. As a beginner in the crypto futures world, I’ve found that a platform with a clean, intuitive interface and easy-to-navigate features can make a significant difference in my ability to execute trades and manage my positions effectively.

Customer Support

Finally, reliable and responsive customer support has proven invaluable when navigating any issues or seeking guidance on specific trading strategies or platform functionalities. I’ve made it a point to thoroughly research the customer support capabilities of any potential crypto futures trading platform before committing to it.

Mitigating Risks

As thrilling as the crypto futures market can be, it’s essential to approach it with a well-informed and disciplined mindset. Risk management has been a critical aspect of my trading journey, and I’ve found that strategies such as setting stop-loss orders, diversifying my portfolio, and maintaining a measured approach have been instrumental in protecting my capital.

One of the key challenges in crypto futures trading is the role of leverage. While leverage can amplify your gains, it can also magnify your losses if the market moves against your position. I’ve learned to use leverage cautiously and within my risk tolerance limits, ensuring that a single losing trade doesn’t significantly impact my overall portfolio.

Position sizing has also been a crucial tool in my risk management arsenal. By carefully determining the appropriate amount of capital to allocate to each trade, I’ve been able to limit my exposure and ensure that my trading decisions are made with a clear understanding of the potential risks involved.

Consistently monitoring market conditions, staying informed about regulatory changes, and adapting my strategies accordingly have also been essential in navigating the crypto futures landscape successfully. It’s a constantly evolving field, and maintaining a flexible and adaptable approach has been key to my continued growth and progress.

Faq

Q: What are the key differences between crypto futures and spot trading?

A: The main distinction lies in the nature of the transaction. Spot trading involves the direct purchase and sale of cryptocurrencies at their current market price, while crypto futures trading involves entering into a contract to buy or sell a cryptocurrency at a predetermined price on a future date.

Q: How does leverage work in crypto futures trading?

A: Leverage allows traders to control a larger position with a smaller amount of capital. For example, with 10x leverage, you can control a $10,000 position with just $1,000 of your own money. However, leverage also amplifies both profits and losses, so it’s crucial to use it cautiously and within your risk tolerance limits.

Q: What are some tips for beginners in crypto futures trading?

A: Start with a small amount of capital, use stop-loss orders to manage your risk, and choose a reputable trading platform. It’s also essential to continuously educate yourself about the market, trading strategies, and risk management techniques.

Q: How can I effectively manage risk in crypto futures trading?

A: Effective risk management strategies include setting stop-loss orders, diversifying your portfolio, and maintaining a disciplined approach. It’s also crucial to use leverage cautiously, carefully manage your position sizes, and continuously monitor market conditions to adapt your strategies as needed.

Conclusion

As I reflect on my crypto futures trading journey, I’m reminded of the countless lessons I’ve learned and the personal growth I’ve experienced along the way. This dynamic and complex field has presented both challenges and opportunities, but for those willing to navigate it with diligence and dedication, the potential rewards can be truly remarkable.

By understanding the fundamentals of the crypto futures market, exploring a range of effective trading strategies, and selecting a reliable trading platform, you too can unlock new possibilities in the crypto realm. Remember, it’s a continuous learning process, and the key to success lies in maintaining a well-informed and disciplined approach, coupled with effective risk management.

As we move forward, I’m excited to see what the future holds for the crypto futures market. With the industry’s rapid evolution and the emergence of new technologies, the opportunities for savvy traders like ourselves continue to expand. So, let’s embrace this journey, stay curious, and keep pushing the boundaries of what’s possible in the world of crypto futures trading.