As an avid cryptocurrency enthusiast and trader, I”ve witnessed the rapid evolution of the crypto landscape, where the emergence of crypto futures trading has become a game-changer. This dynamic market presents both exciting opportunities and significant risks, and I”m here to share my insights and strategies to help you navigate this volatile terrain.

Mastering The Crypto Futures Frontier

Crypto futures are essentially contracts that allow traders to speculate on the future price movements of cryptocurrencies without actually owning the underlying asset. These instruments offer the allure of leveraged exposure, enabling us to amplify our gains and losses based on the ever-shifting tides of the crypto markets.

Crypto futures trading

Crypto futures trading

However, this is not for the faint of heart. The very leverage that can propel us to dizzying heights can also plunge us into the depths of financial ruin if we’re not vigilant. It’s a double-edged sword that requires a deft touch and a robust risk management strategy.

Navigating The Risks And Rewards

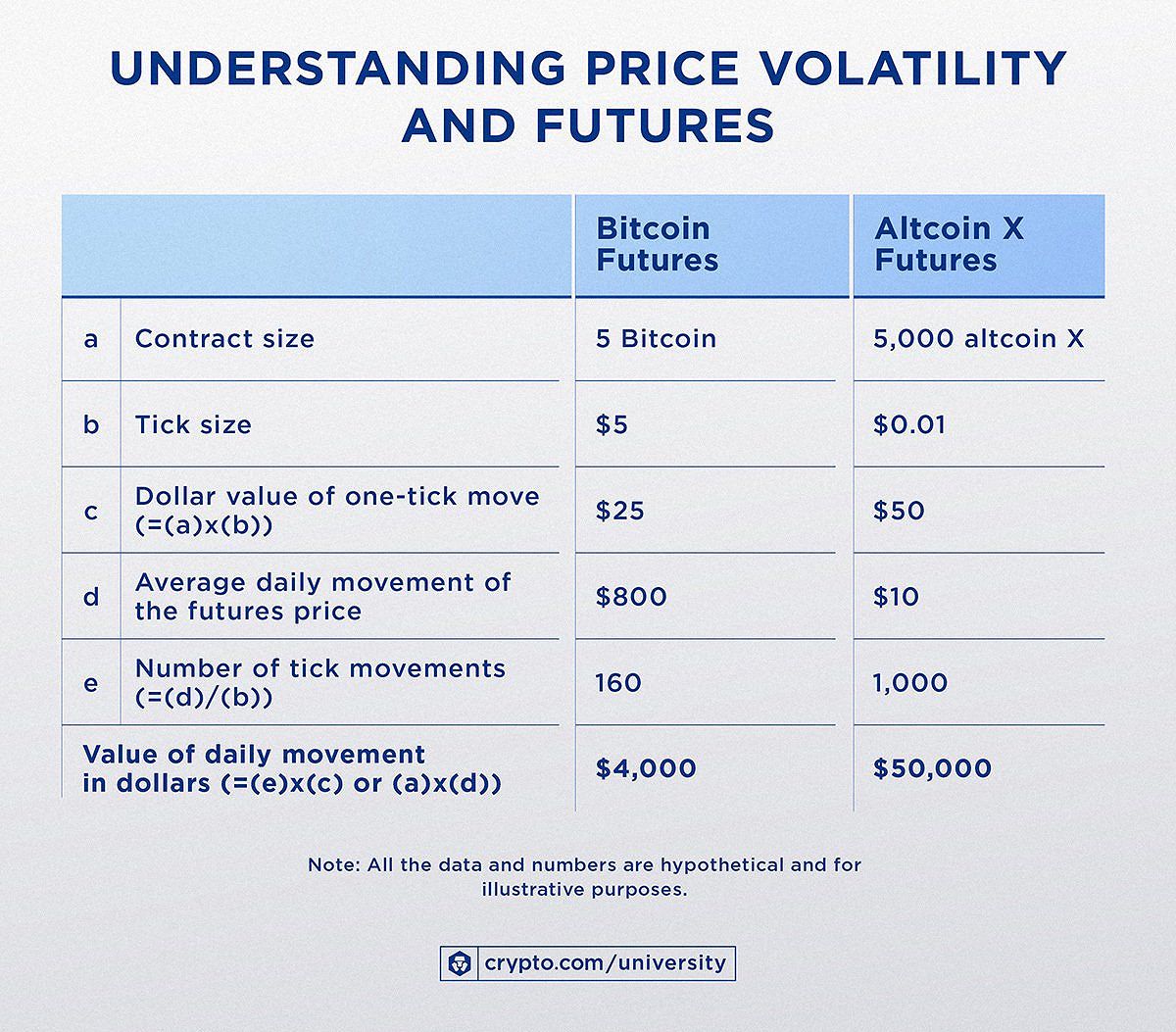

The crypto futures market is a wild ride, with volatility that can trigger sudden and dramatic price movements, leaving even the most seasoned traders grappling to keep up. It’s a high-stakes game where the potential for outsized returns is matched only by the risk of catastrophic losses.

Price volatility and futures

Price volatility and futures

Yet, for those willing to embrace the challenge, there are distinct advantages to be had. Crypto futures can serve as a powerful hedging tool, allowing us to offset the risks inherent in our spot cryptocurrency holdings. And for the more adventurous among us, the opportunity to speculate on the future direction of the market can be irresistible.

Navigating The Crypto Futures Landscape

Within the crypto futures realm, we’re presented with a diverse array of contract types, each with its own unique characteristics and trading dynamics. From perpetual futures with no expiry date to quarterly contracts settled in the underlying cryptocurrency, the choices can be overwhelming.

Crypto futures

Crypto futures

It’s essential to understand the nuances of these contract types and how they align with our individual trading strategies and risk profiles. By carefully evaluating the pros and cons of each option, we can make informed decisions and position ourselves for success in this dynamic market.

Choosing The Right Crypto Futures Trading Platform

As we venture into the crypto futures space, the selection of a reliable and reputable trading platform is paramount. This is where we must exercise diligence, scrutinizing factors such as trading fees, liquidity, security measures, and the availability of advanced trading tools.

Top 5 Crypto Futures Trading Apps 1

Top 5 Crypto Futures Trading Apps 1

The platform we choose can make or break our crypto futures trading experience. A well-designed platform with a user-friendly interface and robust risk management features can mean the difference between navigating the market with confidence or succumbing to the perils of poor execution and unexpected losses.

Strategies For Navigating The Crypto Futures Market

In this unpredictable landscape, employing well-crafted strategies is essential for weathering the storms and potentially emerging victorious. Strategies such as trend following, scalping, arbitrage, and hedging can provide a solid foundation for our trading approach.

Crypto futures trading strategies

Crypto futures trading strategies

However, the true mastery lies in adapting these strategies to the unique characteristics of the crypto futures market, constantly refining and evolving our tactics to stay ahead of the curve. It’s a continuous learning process, where we must be willing to experiment, analyze our results, and make adjustments to optimize our performance.

Prioritizing Risk Management

As we delve deeper into the world of crypto futures trading, it’s crucial to maintain a relentless focus on risk management. Leveraged trading amplifies both our gains and losses, and a single misstep can have devastating consequences.

Utilizing stop-loss orders, proper position sizing, and a disciplined approach to risk-taking are the cornerstones of successful crypto futures trading. It’s a delicate balance that requires us to constantly monitor the market, stay informed, and make unemotional decisions based on objective analysis.

The Future Of Crypto Futures Trading

As I gaze into the crystal ball of the crypto futures market, I see a future that is both captivating and fraught with challenges. The rapid advancements in blockchain technology, the increasing institutional involvement, and the relentless innovation within the cryptocurrency ecosystem all point to a future where crypto futures trading will play an ever-more prominent role.

However, with this evolution comes the need for greater regulatory scrutiny, enhanced market surveillance, and a deeper understanding of the underlying risks. It’s a future where the successful traders will be those who can navigate the complexities, adapt to the changing landscape, and remain steadfast in their commitment to prudent risk management.

Faq

What is the minimum investment required for crypto futures trading? The minimum investment required for crypto futures trading can vary significantly across different exchanges and contract sizes. Many platforms now offer micro-contracts with smaller contract sizes, allowing traders with more modest capital to participate in this market.

Can I trade crypto futures with leverage? Yes, leveraged trading is a hallmark of the crypto futures landscape. However, it’s crucial to exercise caution when using leverage, as it can amplify both your gains and losses. Understand the risks associated with leveraged trading and be sure to use it within the confines of your risk tolerance.

How do I calculate profit and loss in crypto futures trading? Calculating the profit or loss in a crypto futures trade is relatively straightforward. You simply need to multiply the contract size by the difference between your entry and exit prices. For example, if you buy a Bitcoin futures contract with a size of 0.1 BTC and the price increases by $100, your profit would be $10 (0.1 BTC x $100).

Conclusion

As I reflect on my personal journey through the crypto futures landscape, I can’t help but feel a sense of excitement and caution. This market is a true test of our trading mettle, where the rewards can be immense, but the risks can be equally daunting.

Yet, it is precisely this challenge that draws me in, fueling my desire to constantly expand my knowledge, refine my strategies, and navigate the ever-shifting tides of the crypto futures market. It’s a journey that requires unwavering discipline, a keen eye for risk, and a willingness to adapt in the face of the unknown.

So, if you’re ready to embark on this thrilling adventure, I encourage you to approach it with caution, vigilance, and an unquenchable thirst for knowledge. The crypto futures market may be a wild frontier, but for those willing to embrace the challenge, the potential rewards are truly boundless.