Navigating the Complex World of Crypto Day Trading: Essential Rules to Consider

In the ever-evolving landscape of cryptocurrency, the allure of day trading has captivated the minds of many aspiring investors. While the prospect of capitalizing on the market”s volatility may seem enticing, the reality is far more complex and treacherous than it appears on the surface. This article explores the essential crypto day trading rules, challenging the conventional wisdom and offering a contrarian perspective that may reshape your approach to this high-stakes game.

The Illusion Of Mastering Crypto Day Trading Rules

Cryptocurrency trading has undoubtedly gained significant traction in recent years, with day trading emerging as a strategy that promises quick profits. However, the notion of “mastering” the crypto day trading market is nothing more than a mirage, a seductive illusion that lures in the unsuspecting. The reality is that the crypto market is a chaotic and unpredictable beast, where even the most seasoned traders can find themselves on the wrong side of the trade.

Day trading price chart

Day trading price chart

Proponents of crypto day trading often tout the market’s inherent volatility as the key to their success. They argue that by capitalizing on the rapid price movements, traders can generate substantial gains. However, this mindset is a double-edged sword. While volatility can indeed present opportunities, it also carries a risk of catastrophic losses that can quickly erode one’s trading capital. The allure of quick profits blinds many traders to the underlying dangers, leading them down a path of financial ruin.

The crypto market is a constantly evolving, chaotic system that defies simple rule-based strategies. Despite the claims of self-proclaimed “experts,” there is no universal, foolproof approach to day trading cryptocurrencies. Each market condition, each asset, and each trading session presents a unique set of challenges that require nimble adaptation and a deep understanding of the underlying fundamentals.

Embracing The Uncertainty Of Crypto Day Trading

Successful crypto day trading is not about mastery, but rather, about embracing the inherent uncertainty of the market. Traders who can navigate this reality with a flexible and adaptable mindset, coupled with a strong risk management framework, are the ones who stand the best chance of weathering the storms and emerging victorious.

Sentiment-Based Trading Example

Sentiment-Based Trading Example

At the heart of any successful crypto day trading approach lies a well-crafted risk management strategy. This includes the judicious use of stop-loss orders, diversification across multiple assets, and a disciplined approach to position sizing. Traders who fail to prioritize risk management are like sailors navigating treacherous waters without a lifejacket — a reckless and ultimately foolhardy endeavor.

In the ever-evolving world of cryptocurrency, the notion of a static, one-size-fits-all trading strategy is a fallacy. Successful crypto day traders understand the importance of continuous learning and adaptation. They constantly seek to expand their knowledge, refine their techniques, and stay ahead of the curve, recognizing that the market is in a perpetual state of flux.

The Myth Of The Cryptocurrency Day Trading Guru

The crypto trading landscape is rife with self-proclaimed “gurus” and “experts” who promise guaranteed profits and foolproof strategies. However, these individuals are often nothing more than charlatan snake oil salesmen, peddling false promises and unproven methods. Savvy traders must approach such claims with a healthy dose of skepticism, recognizing that true mastery in this domain is an elusive and ever-shifting target.

What-is-Crypto-Day-Trading-Beginners-Guide

What-is-Crypto-Day-Trading-Beginners-Guide

One of the most common misconceptions in the crypto day trading realm is the idea of “mastering” the market. Proponents of this notion often tout their ability to predict price movements, identify patterns, and execute trades with near-flawless precision. However, the reality is that the crypto market is a complex, dynamic system that defies simple rule-based strategies. Even the most seasoned traders can find themselves on the wrong side of a trade, as the market’s inherent volatility can quickly turn their carefully crafted plans into a house of cards.

Another prevalent fallacy in the crypto day trading landscape is the belief that volatility is the key to success. While it’s true that the crypto market’s inherent volatility can present opportunities for traders, it also carries a significant risk of catastrophic losses. Traders who become overly enamored with the prospect of quick profits often fail to account for the potential downside, leading them to make impulsive decisions that can quickly erode their trading capital.

Developing A Robust Risk Management Strategy

At the heart of any successful crypto day trading approach lies a well-crafted risk management strategy. This includes the judicious use of stop-loss orders, diversification across multiple assets, and a disciplined approach to position sizing. Traders who fail to prioritize risk management are like sailors navigating treacherous waters without a lifejacket — a reckless and ultimately foolhardy endeavor.

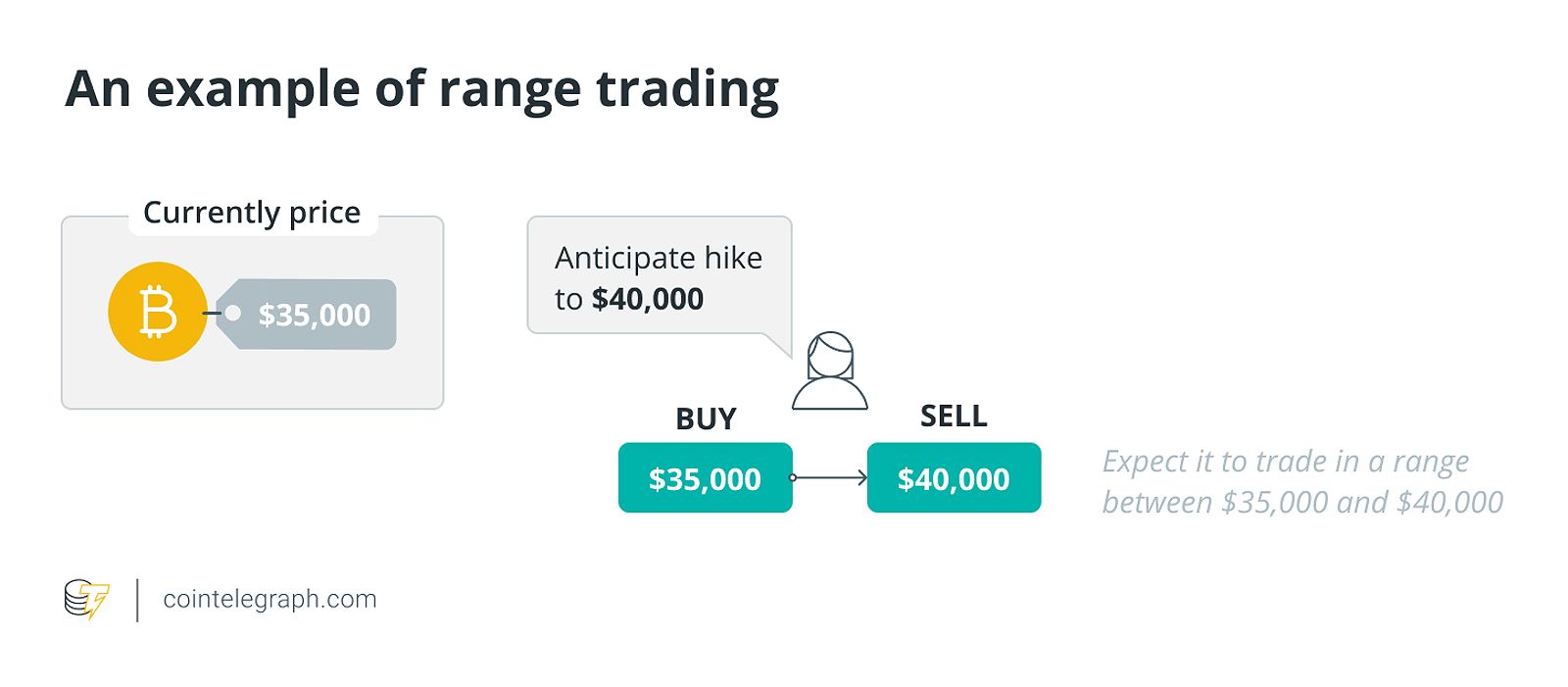

An example of range trading

An example of range trading

Successful crypto day traders understand that the key to navigating the market’s volatility is not to chase the latest trends or follow the herd, but rather, to develop a robust risk management framework that can weather the storms. This may mean sacrificing the potential for outsized gains in favor of more consistent, risk-adjusted returns. But in the long run, this disciplined approach is more likely to lead to sustainable success in the ever-changing world of cryptocurrency trading.

The Importance Of Continuous Learning And Adaptation

In the ever-evolving world of cryptocurrency, the notion of a static, one-size-fits-all trading strategy is a fallacy. Successful crypto day traders understand the importance of continuous learning and adaptation. They constantly seek to expand their knowledge, refine their techniques, and stay ahead of the curve, recognizing that the market is in a perpetual state of flux.

The crypto trading landscape is rife with self-proclaimed “gurus” and “experts” who promise guaranteed profits and foolproof strategies. However, these individuals are often nothing more than charlatan snake oil salesmen, peddling false promises and unproven methods. Savvy traders must approach such claims with a healthy dose of skepticism, recognizing that true mastery in this domain is an elusive and ever-shifting target.

Conclusion: Embracing The Challenges, Reaping The Rewards

Navigating the treacherous waters of crypto day trading requires a mindset that is both adaptable and disciplined. It demands a recognition of the inherent uncertainty and volatility of the market, coupled with a robust risk management strategy and a commitment to continuous learning. By embracing these principles, traders may just find themselves well-positioned to weather the storms and reap the potential rewards that the crypto market has to offer.

Faq

What Is The Best Crypto Day Trading Strategy?

There is no single “best” crypto day trading strategy, as the most suitable approach will depend on your personal trading goals, risk tolerance, and the ever-changing market conditions. Successful traders understand the importance of adapting their strategies to the current landscape, rather than relying on a static, one-size-fits-all approach.

How Much Money Do I Need To Start Crypto Day Trading?

The amount of capital required to start crypto day trading can vary, but it’s generally recommended to start with a relatively small amount, such as $1,000 or less. This allows you to gain experience and refine your strategies without risking a significant portion of your overall investment portfolio. Remember, the crypto market is highly volatile, and it’s crucial to approach day trading with caution and a well-defined risk management plan.

What Are The Risks Of Crypto Day Trading?

Crypto day trading carries inherent risks, including the potential for substantial losses due to the market’s high volatility. Factors such as sudden price swings, liquidity issues, and exchange outages can all contribute to the risks involved. Successful traders understand the importance of prioritizing risk management and being prepared for unexpected market events.

How Can I Minimize My Losses In Crypto Day Trading?

To minimize losses in crypto day trading, it’s essential to implement effective risk management strategies. This includes setting stop-loss orders, diversifying your portfolio, and practicing disciplined position sizing. Additionally, continuously educating yourself, staying up-to-date with market trends, and avoiding emotional decision-making can help mitigate the risks involved.

What Are Some Tips For Successful Crypto Day Trading?

Some key tips for successful crypto day trading include developing a well-defined trading plan that accounts for the inherent uncertainty of the market, utilizing stop-loss and take-profit orders, starting with a small amount of capital, taking regular breaks to avoid emotional decision-making, and continuously learning and adapting your strategies based on the ever-changing market conditions.