As an avid observer and occasional participant in the ever-evolving world of cryptocurrency trading, I’ve witnessed the remarkable growth and transformative potential of this dynamic market. In this in-depth exploration, I’ll share my personal insights and experiences, guiding you through the complexities of crypto currency trading while offering an analytical and thought-provoking perspective.

Understanding The Crypto Trading Ecosystem

Cryptocurrency trading has become an increasingly accessible investment avenue, attracting a diverse array of players — from seasoned investors seeking portfolio diversification to newcomers intrigued by the promise of digital asset growth. As someone who has closely followed the industry’s development, I can attest to the captivating nature of this decentralized financial landscape.

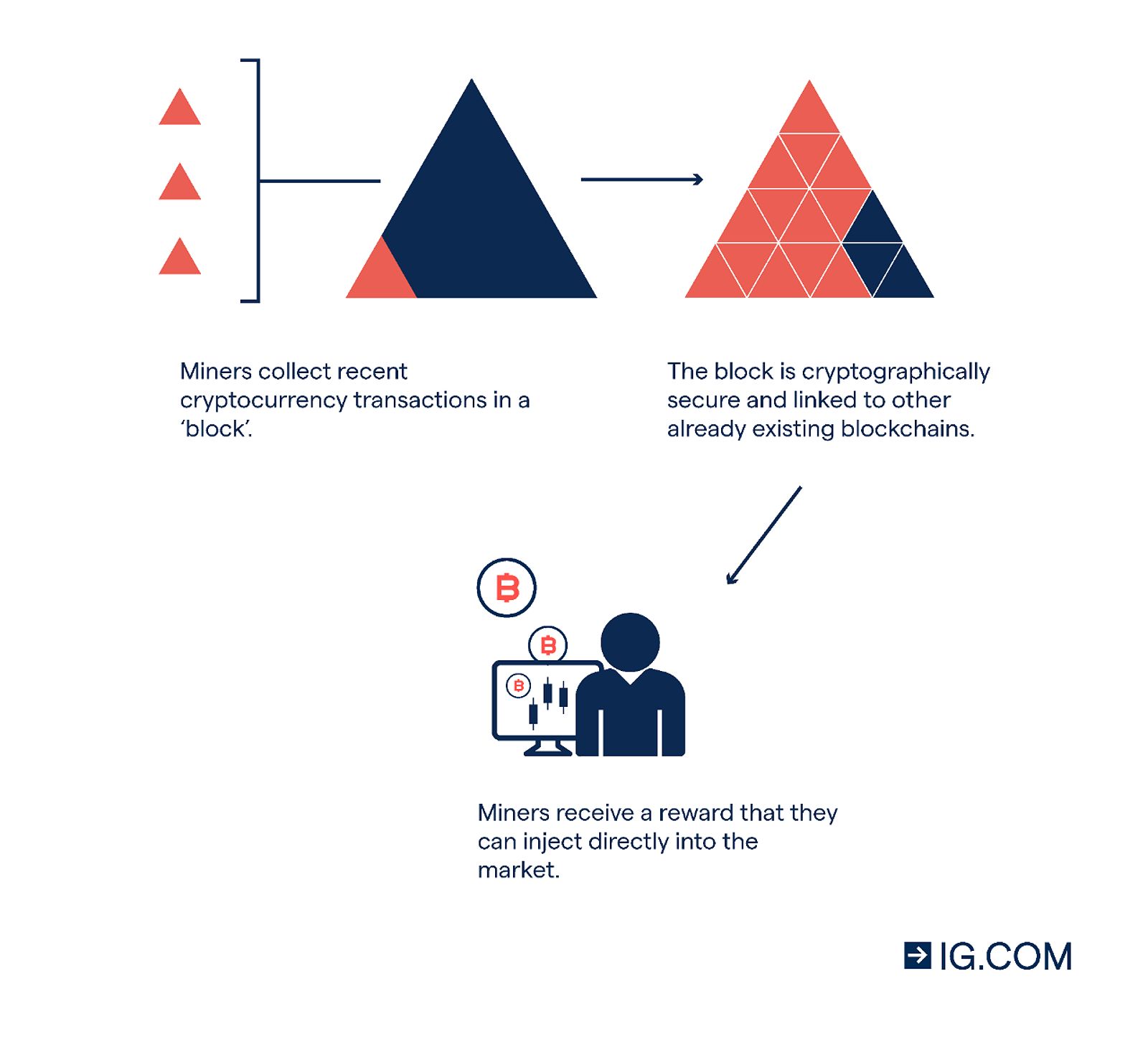

At its core, cryptocurrency trading involves the exchange of digital currencies, such as Bitcoin and Ethereum, on specialized platforms known as exchanges. These peer-to-peer networks operate on the blockchain, a shared digital ledger that records all transactions. Factors like supply and demand, market capitalization, media coverage, and industry-defining events can significantly influence the prices of these digital assets.

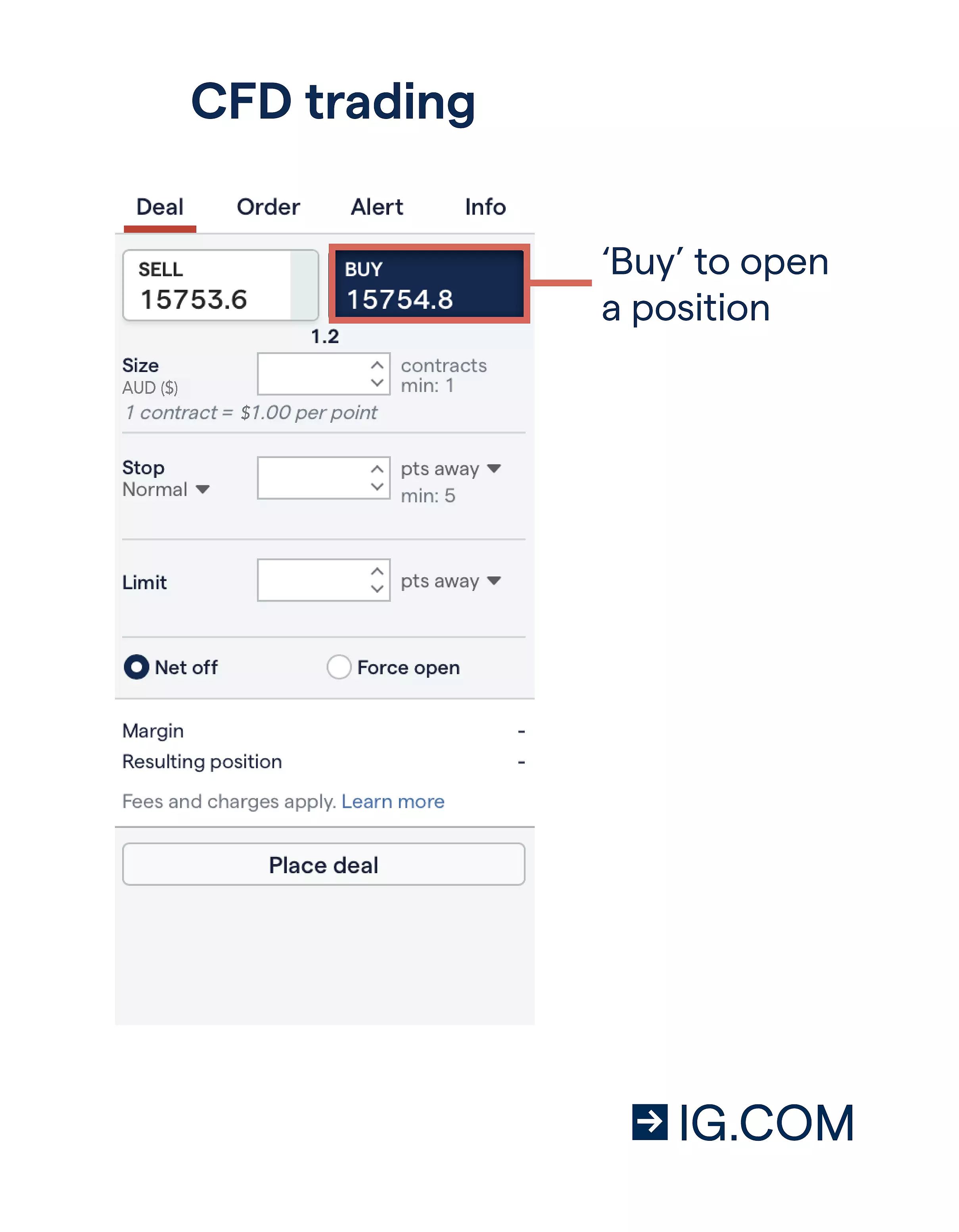

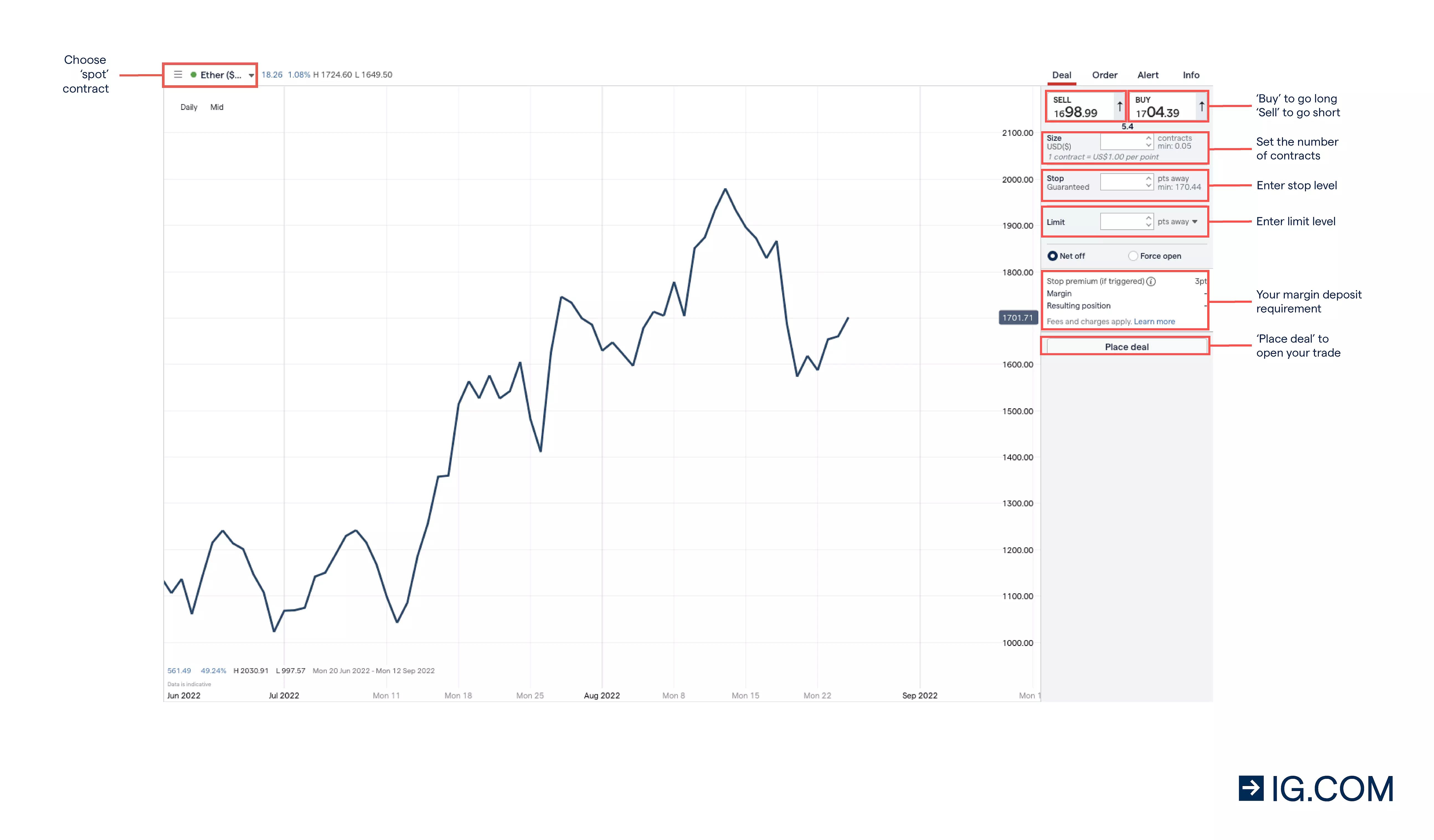

Traders can engage in a variety of strategies, including spot trading (immediate exchange), futures trading (speculating on future prices), and margin trading (leveraging borrowed funds). Each approach carries its own risks and rewards, requiring a nuanced understanding of the market dynamics and the trader’s own risk tolerance.

Choosing A Reliable Crypto Currency Trading Platform

As an investigative journalist closely following the cryptocurrency industry, I’ve observed the importance of selecting a reputable and secure trading platform. Factors such as regulatory oversight, security measures (e.g., two-factor authentication, cold storage), fee structures, and user experience are crucial considerations.

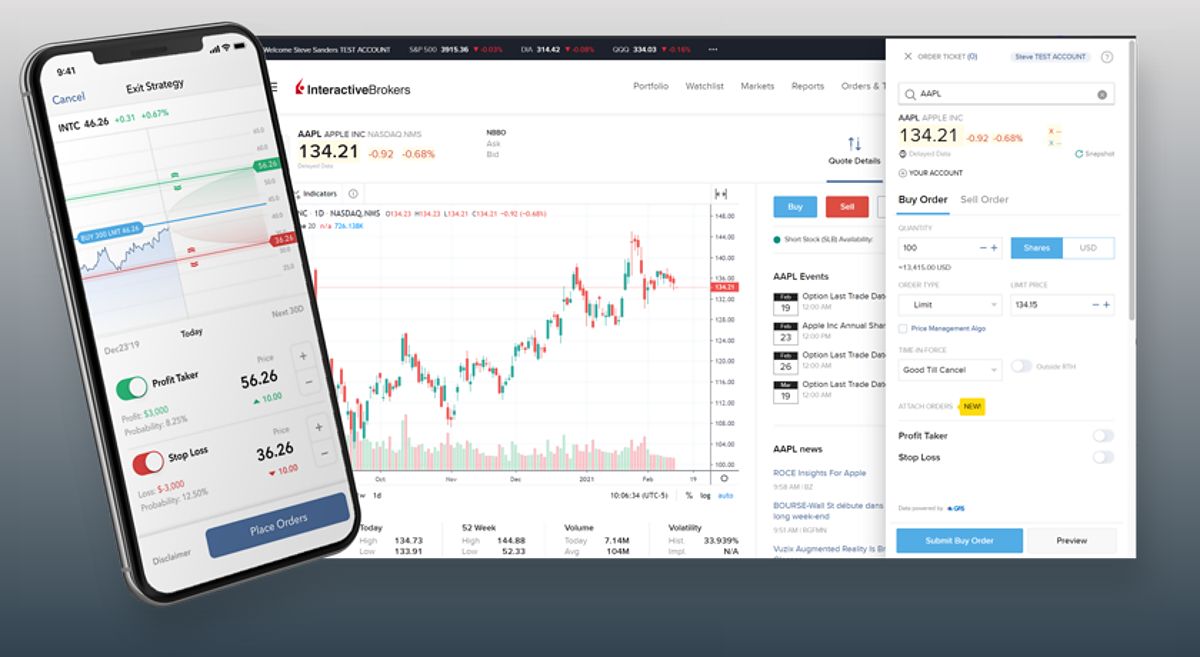

In my research, I’ve encountered prominent platforms like Binance, Coinbase, Kraken, and Interactive Brokers, each with its own unique features and target audience. Before committing real funds, I recommend exploring demo accounts to familiarize yourself with the platform’s functionalities and user interface.

Cryptocurrency Trading Strategies For Beginners

When it comes to navigating the crypto trading landscape as a beginner, I’ve found that a diverse range of strategies can be employed, each with its own merits and risks. One approach that has gained popularity is dollar-cost averaging (DCA), which involves investing a fixed amount at regular intervals, regardless of market fluctuations. This strategy can help mitigate the impact of volatility and smooth out your purchase prices over time.

Another strategy worth considering is day trading, which involves the rapid buying and selling of cryptocurrencies within a single trading day. This approach requires a deep understanding of technical analysis and market trends, as well as a robust risk management plan to manage potential losses.

For those with a longer-term investment horizon, the “hodling” (holding) strategy may be suitable. This involves buying and holding cryptocurrencies for an extended period, often years, in the belief that the markets will experience long-term growth. When selecting cryptocurrencies for a long-term portfolio, it’s essential to conduct thorough research on the underlying technology, use cases, and future potential of the assets.

Effective Risk Management And Avoiding Common Pitfalls

As an objective and unbiased observer, I’ve recognized that effective risk management is a crucial aspect of successful cryptocurrency trading. The use of stop-loss orders, which automatically close positions when the market moves against you, can help limit potential losses. Diversification, the practice of spreading your investments across multiple cryptocurrencies, is another essential strategy to mitigate the impact of individual asset volatility.

It’s also crucial to avoid common pitfalls that can derail even the most well-intentioned traders. Succumbing to the fear of missing out (FOMO), overtrading, and allowing emotions to drive decision-making are all traps that I’ve witnessed trap even seasoned investors. Maintaining a disciplined approach and adhering to a well-defined trading plan can help you navigate the volatility of the crypto markets with more clarity and composure.

Leveraging Technical Analysis And Market Trends

In my in-depth reporting on the cryptocurrency industry, I’ve observed that while fundamental analysis of the underlying assets is crucial, understanding technical analysis can also provide valuable insights. By studying historical price patterns, chart formations, and various technical indicators, traders can identify potential entry and exit points, as well as recognize emerging market trends.

Familiarizing oneself with concepts like support and resistance levels, moving averages, and oscillators can give traders an analytical edge in the dynamic crypto trading landscape. Incorporating these technical tools into your investment decision-making process can help you make more informed and strategic trades.

Diversifying Your Cryptocurrency Portfolio

As an experienced observer of the crypto markets, I’ve come to appreciate the importance of portfolio diversification. By allocating your funds across a range of digital assets, you can mitigate the impact of individual asset volatility and potentially enhance the overall performance of your investments.

When building a diversified crypto portfolio, consider including a mix of established cryptocurrencies, such as Bitcoin and Ethereum, as well as promising altcoins with unique use cases and growth potential. This balanced approach can help you navigate the ever-changing landscape of the crypto industry and potentially capitalize on emerging opportunities.

Staying Informed And Continuously Learning

As the cryptocurrency market continues to evolve at a rapid pace, I’ve found that staying informed and continuously learning is essential for any trader or investor. Regularly consuming industry publications, following influential crypto experts, and participating in online communities can help you stay ahead of the curve and make more informed trading decisions.

Additionally, exploring educational resources, such as online courses, webinars, and workshops, can deepen your understanding of cryptocurrency trading strategies, risk management, and market analysis. Consistent learning and adaptation are key to becoming a successful crypto trader and navigating the dynamic nature of this rapidly evolving space.

Frequently Asked Questions

How much money do I need to start cryptocurrency trading? There is no fixed amount required to start crypto trading. Begin with an amount you’re comfortable with and gradually increase your investment as you gain experience and confidence.

Is cryptocurrency trading legal? Cryptocurrency trading is legal in many countries, but regulations can vary. It’s essential to research the applicable laws in your jurisdiction before engaging in any crypto-related activities.

What are the risks associated with cryptocurrency trading? Cryptocurrency markets are highly volatile, and you can potentially lose your entire investment. Other risks include security breaches, scams, and regulatory uncertainty surrounding the industry.

How can I learn more about cryptocurrency trading? Explore online resources, educational platforms, and dedicated cryptocurrency communities to deepen your understanding of the market, trading strategies, and industry developments.

Conclusion

As an investigative journalist closely following the cryptocurrency industry, I’ve found the trading landscape to be both captivating and complex. By understanding the fundamentals of the crypto ecosystem, choosing a reputable trading platform, and implementing effective strategies while managing risk, you can navigate this dynamic market with a more analytical and thoughtful approach.

Remember, cryptocurrency trading carries inherent risks, and it’s crucial to conduct thorough research, start with small investments, and continuously educate yourself to become a successful trader. With the right mindset and a well-defined plan, you can potentially unlock the growth potential of digital assets and diversify your investment portfolio. Stay vigilant, remain objective, and embrace the continuous learning process — the crypto trading world is a constantly evolving playground that demands our utmost attention and adaptability.