In the ever-evolving landscape of cryptocurrency trading, Crypto.com has emerged as a prominent player, offering traders a robust platform to navigate the dynamic and often volatile digital asset ecosystem. With its diverse suite of trading tools and features, Crypto.com has positioned itself as a go-to destination for both seasoned veterans and those embarking on their crypto trading journey.

This comprehensive guide aims to equip you with the knowledge and insights necessary to thrive in the ever-changing crypto market by exploring the intricacies of Crypto.com trading, from the fundamentals of order types to the advanced realm of automated trading.

Mastering The Crypto-com Trading Essentials

The first step in your Crypto.com trading odyssey is to familiarize yourself with the platform’s user-friendly interface and the various features at your disposal. Whether you’re accessing the platform through the website or the mobile app, the onboarding process is straightforward, allowing you to create an account, fund your balance, and begin exploring the extensive range of cryptocurrencies available.

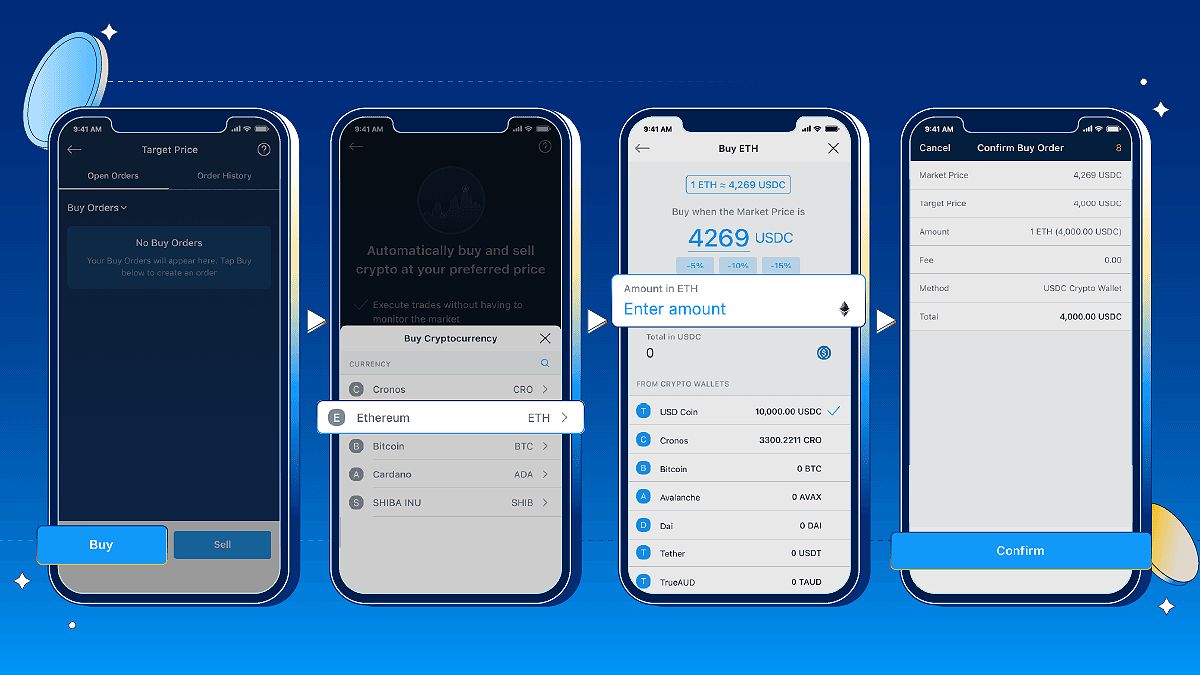

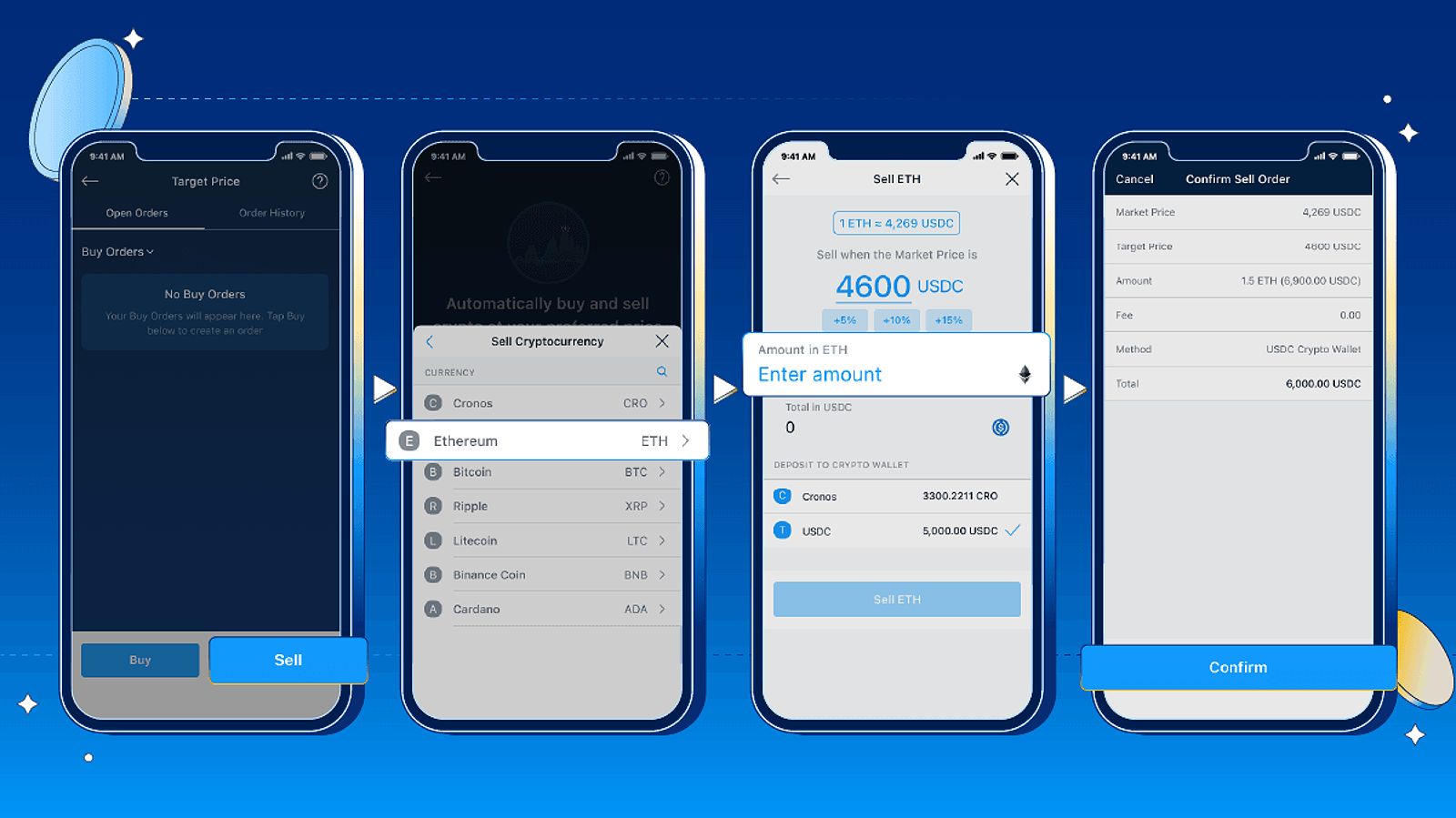

One of the key aspects to master is the understanding of the different order types offered by Crypto.com. From market orders, which execute trades at the current market price, to limit orders, which allow you to set specific buy or sell prices, and stop-loss orders, which can help mitigate potential losses — each option presents unique advantages and considerations. Developing a deep comprehension of these order types will empower you to make more informed and strategic trading decisions.

Market order

Market order  Limit order

Limit order

Navigating The Order Book: Unlocking Market Insights

As you delve deeper into the Crypto.com trading ecosystem, the order book becomes an invaluable tool for gaining a comprehensive understanding of the market dynamics. This real-time visual representation of buy and sell orders provides crucial insights into the sentiment and potential price movements of a particular cryptocurrency.

By learning to interpret the order book effectively, you can identify key support and resistance levels, anticipate potential market trends, and make more informed trading decisions. Crypto.com’s intuitive interface simplifies the process of accessing and analyzing the order book, equipping you with the data-driven insights necessary to navigate the volatile crypto markets.

Order book

Order book

Automating Your Trading With Crypto-com Bots

One of the standout features offered by Crypto.com is the availability of automated trading bots. These powerful tools can be programmed to execute trades based on pre-defined rules and strategies, enabling you to take a more hands-off approach to your trading activities while potentially enhancing your overall performance.

Crypto.com’s suite of trading bots caters to a diverse range of trading styles and risk profiles. From the popular Dollar Cost Averaging (DCA) bot, which automates regular cryptocurrency purchases, to the Grid Trading Bot, which sets multiple predetermined price levels for buy and sell orders — these automated solutions can help you streamline your trading operations and potentially reduce the impact of market volatility.

Automated trading bots

Automated trading bots

However, it’s crucial to thoroughly understand the risks and limitations associated with automated trading before incorporating these bots into your strategy. Striking the right balance between manual and automated trading can be a game-changer in your Crypto.com trading journey.

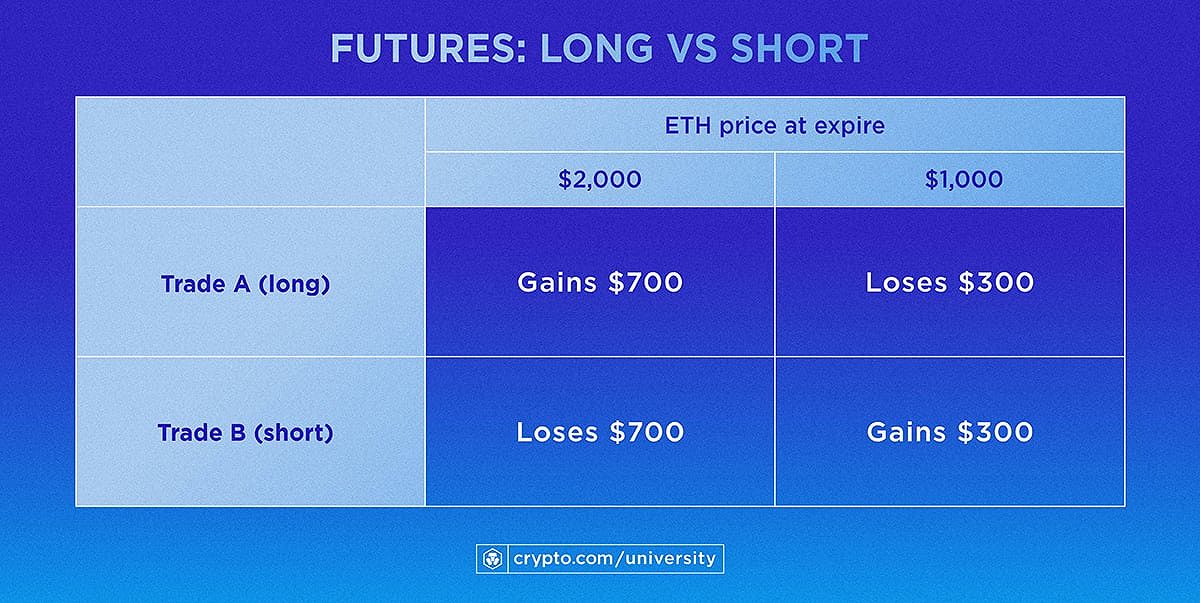

Exploring The Crypto Options Frontier

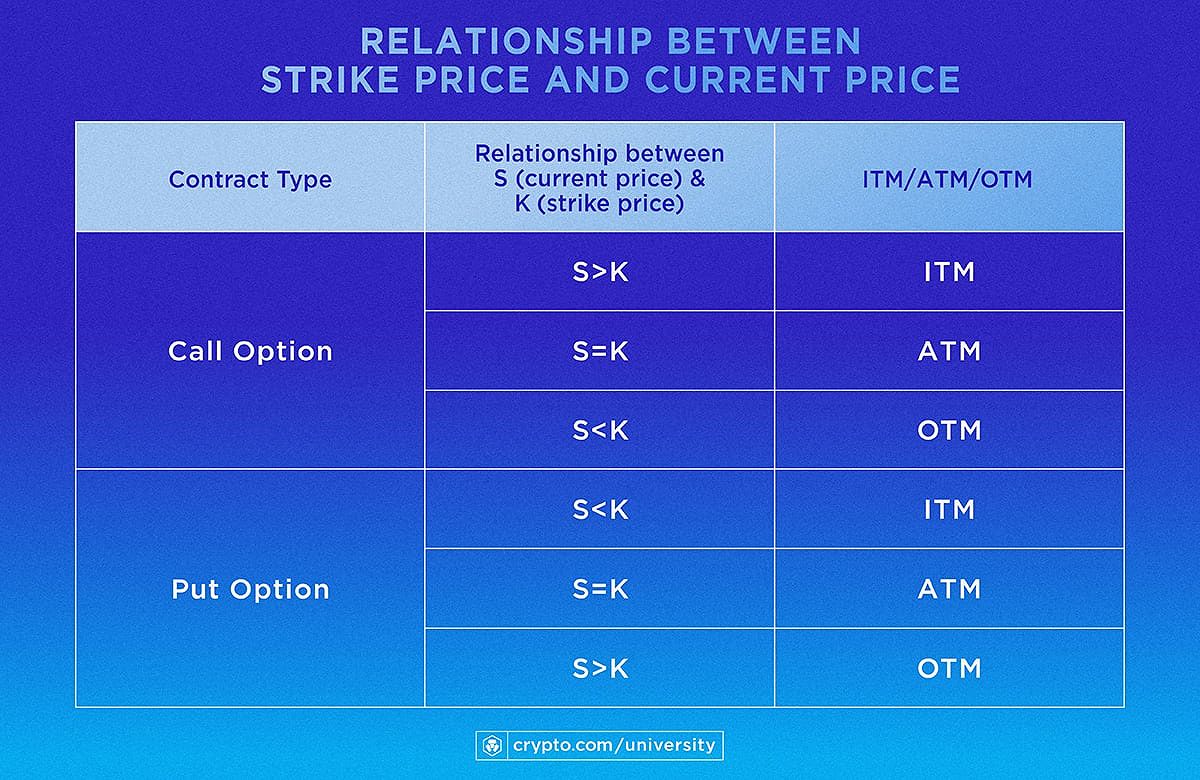

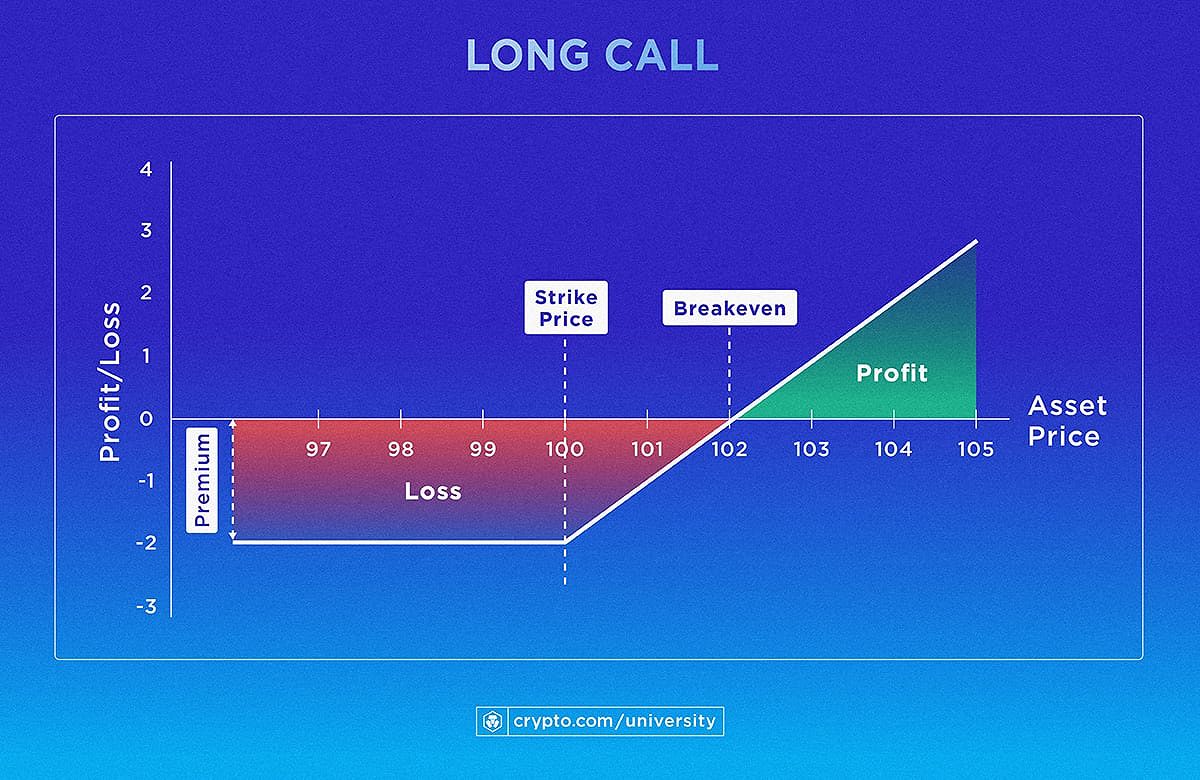

In addition to the traditional spot trading options, Crypto.com also offers the ability to engage in options trading — a powerful derivative instrument that can be leveraged for both hedging and speculative purposes. Options contracts provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time.

Navigating the options market can be a complex endeavor, but Crypto.com has made significant strides in simplifying the process. The platform provides a wealth of educational resources and tools to help you understand the intricacies of options trading, including the different contract types, the factors that influence option pricing, and the potential risks involved.

Options trading

Options trading

By incorporating options into your Crypto.com trading strategy, you can explore a range of advanced techniques, such as protective put strategies to hedge your spot positions or covered call strategies to generate additional income. However, it’s essential to approach options trading with caution and a thorough understanding of the associated risks.

Unlocking Advanced Trading Strategies

As you progress in your Crypto.com trading journey, the platform offers a range of advanced tools and strategies to help you refine your approach and potentially improve your trading performance. One such tool is technical analysis, which involves the study of historical market data to identify patterns and make informed trading decisions.

Crypto.com supports a variety of technical analysis indicators, including candlestick charts, moving averages, and Fibonacci retracements, among others. By mastering these technical analysis techniques, you can develop a more sophisticated understanding of market dynamics and identify potential trading opportunities.

Technical analysis

Technical analysis

Additionally, Crypto.com enables traders to explore a range of advanced trading strategies, such as arbitrage, scalping, and swing trading. Each of these strategies presents unique advantages and risks, and it’s crucial to thoroughly understand the underlying principles before implementing them in your Crypto.com trading arsenal.

Advanced trading strategies

Advanced trading strategies

Staying Informed And Managing Risks

In the ever-evolving cryptocurrency market, staying informed and managing risks are paramount to long-term trading success. Crypto.com recognizes this and provides a wealth of educational resources, including articles, tutorials, and market analyses, to help you stay up-to-date on the latest trends and best practices.

One of the key aspects of successful Crypto.com trading is the ability to diversify your portfolio and manage your risk exposure. This may involve implementing stop-loss orders, leveraging the platform’s risk management tools, and regularly reviewing your trading strategy to ensure it aligns with your risk tolerance and investment objectives.

By staying informed, disciplined, and adaptable, you can navigate the dynamic Crypto.com trading landscape and maximize your chances of success in the exciting world of cryptocurrency trading.

Fees And Deposits

Crypto.com charges a maker fee of 0.04% and a taker fee of 0.06% for most trades. The minimum deposit amount on the platform is $20, allowing traders to get started with a relatively low initial investment.

Faq

What are the fees for trading on Crypto.com? Crypto.com charges a maker fee of 0.04% and a taker fee of 0.06% for most trades.

What is the minimum deposit amount on Crypto.com? The minimum deposit amount on Crypto.com is $20.

Can I trade cryptocurrencies on Crypto.com using a mobile device? Yes, Crypto.com offers a user-friendly mobile app that allows you to access your account and execute trades on the go.

Conclusion

As the cryptocurrency market continues to evolve, Crypto.com has solidified its position as a premier trading platform, offering traders a comprehensive suite of tools and features to navigate the dynamic digital asset landscape. From mastering the fundamentals of order types and order book analysis to leveraging the power of automated trading bots and exploring the world of options, Crypto.com has positioned itself as a one-stop-shop for traders seeking to capitalize on the exciting opportunities in the cryptocurrency space.

By staying informed, disciplined, and adaptable, traders can unlock the full potential of the Crypto.com trading ecosystem and potentially enhance their chances of success in the thrilling world of cryptocurrency trading. Remember, investing in digital assets carries inherent risks, and it’s crucial to do your own research, diversify your portfolio, and manage your risk accordingly.

With its innovative features, user-friendly interface, and commitment to empowering traders, Crypto.com is poised to continue its rise as a leading force in the cryptocurrency trading arena. By embracing the platform’s capabilities and leveraging the strategies outlined in this comprehensive guide, traders can position themselves for success in the ever-evolving crypto market.