In the dynamic world of financial markets, crypto CFD trading has emerged as a captivating frontier, offering traders a unique opportunity to capitalize on the volatility of digital assets. This comprehensive guide explores the intricacies of navigating the crypto CFD trading landscape, equipping readers with the knowledge and strategies to navigate this exciting and rapidly evolving market.

Understanding The Crypto Cfd Landscape

Crypto CFDs, or Contracts for Difference, are derivative financial instruments that allow traders to speculate on the price movements of cryptocurrencies without the need to own the underlying digital assets. By trading crypto CFDs, individuals can profit from the fluctuations in the prices of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Trading Bitcoin

Trading Bitcoin

One of the key advantages of crypto CFD trading is the ability to utilize leverage, which can amplify both potential profits and losses. Traders can open positions with a fraction of the full value of the trade, granting them broader exposure to the crypto market with a smaller initial investment. However, it’s crucial to recognize that the use of leverage also heightens the risk of significant losses, particularly in the highly volatile cryptocurrency market.

Selecting A Crypto Cfd Trading Platform

When venturing into the realm of crypto CFD trading, the choice of trading platform is of paramount importance. Traders should seek out brokers that offer a comprehensive range of cryptocurrency CFDs, competitive spreads, and robust risk management tools. Additionally, ensuring the broker’s regulatory status and reputation within the industry is essential for maintaining a secure and reliable trading experience.

Cover

Cover

Key factors to consider when selecting a crypto CFD trading platform include:

- Variety of cryptocurrencies available for trading

- Leverage options and margin requirements

- Spreads and trading costs

- Execution speed and liquidity

- Regulatory oversight and customer protection measures

- Trading platforms and analytical tools provided

As the crypto CFD trading landscape continues to evolve, with an increasing number of reputable and well-regulated brokers entering the market, traders should carefully evaluate the offerings of various platforms to identify the one that best aligns with their trading objectives and risk tolerance.

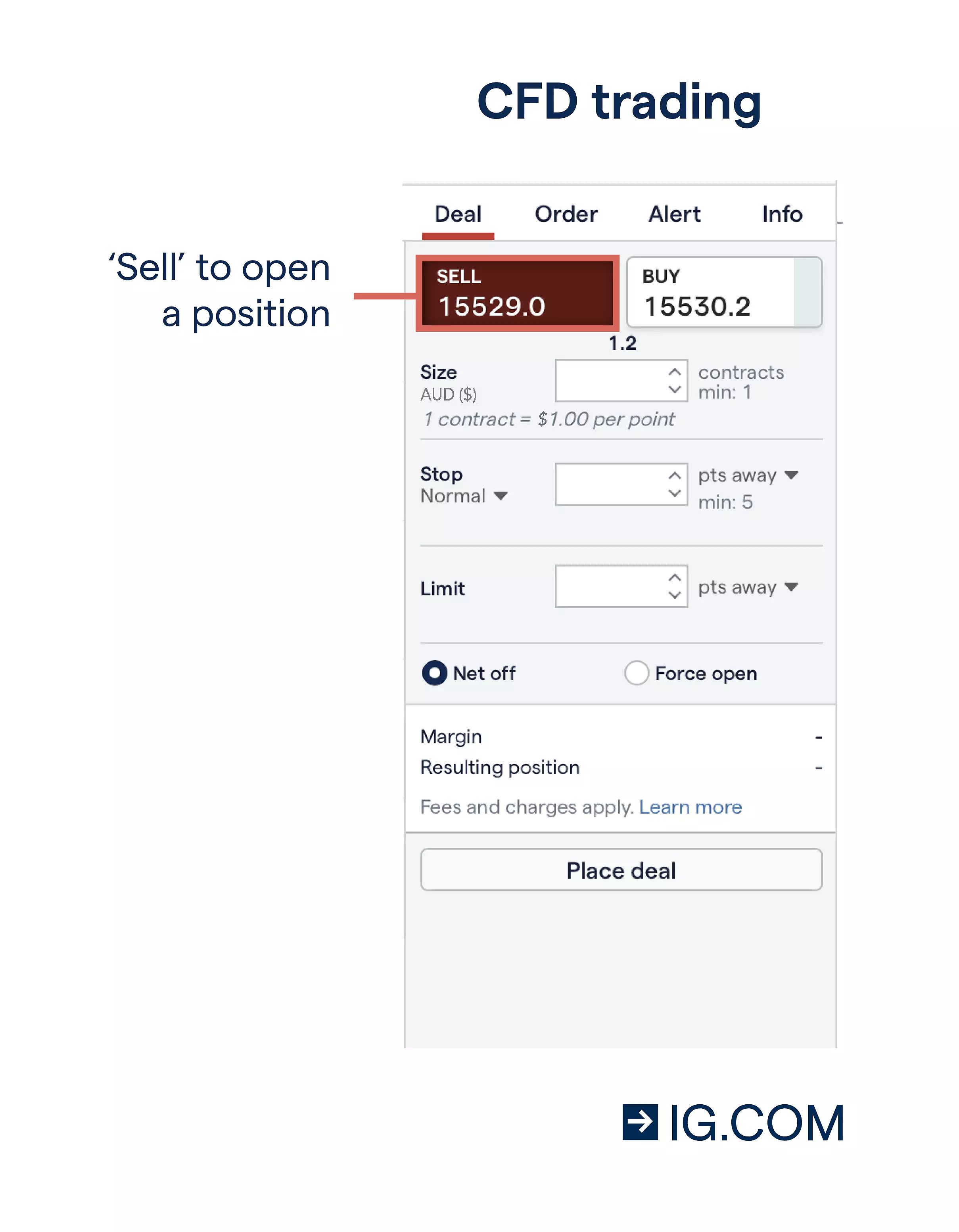

Navigating The Crypto Cfd Trading Process

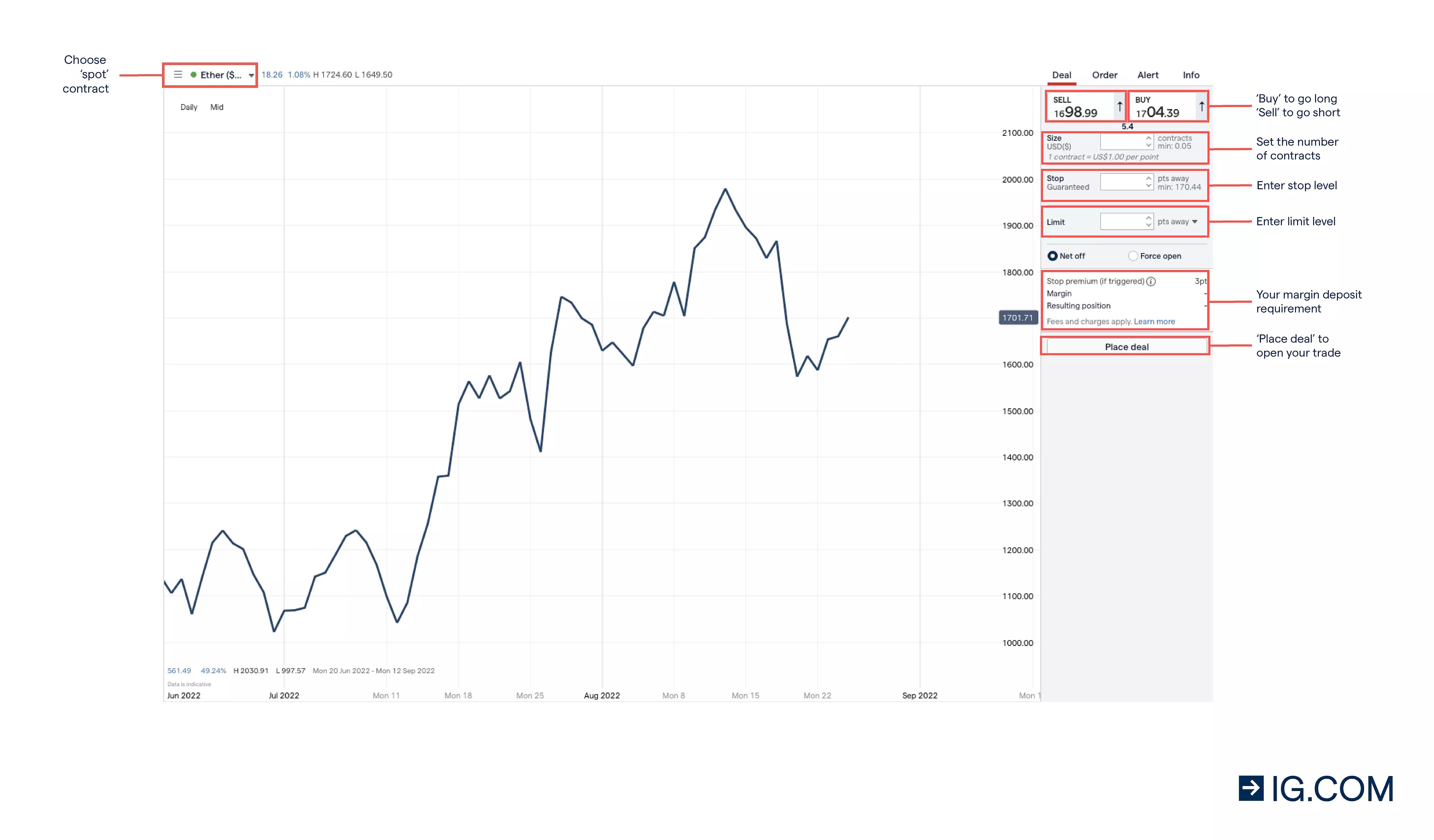

Establishing a crypto CFD trading account typically involves a straightforward process. Traders will need to provide personal and financial information, as well as undergo any necessary verification procedures. Once the account is set up, individuals can begin placing trades using the broker’s trading platform.

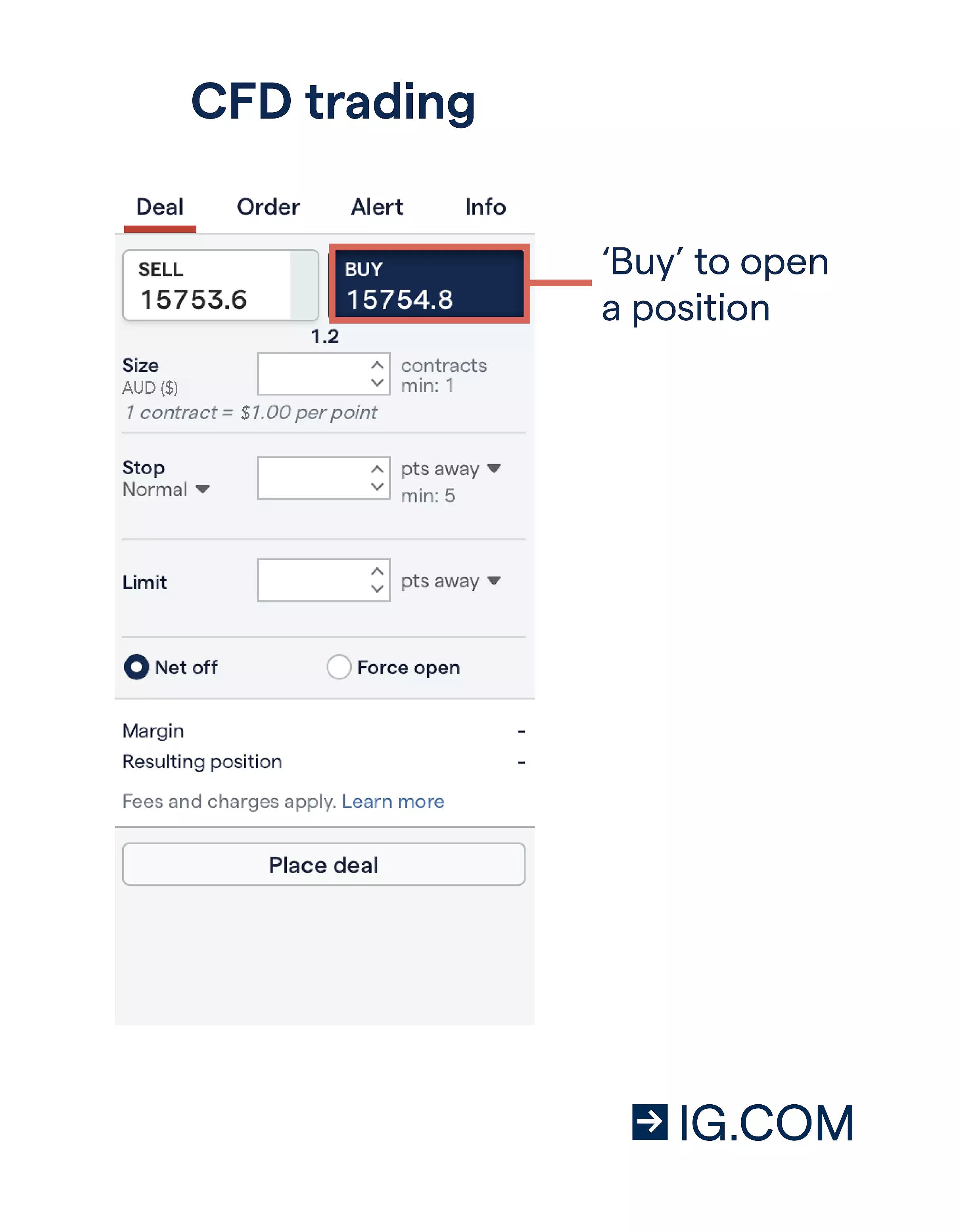

Going long

Going long

When engaging in crypto CFD trading, a sound risk management strategy is of utmost importance. This includes setting appropriate stop-loss and take-profit levels, as well as carefully managing the size of each position. Traders should also be cognizant of the potential for increased volatility in the crypto market, which can lead to rapid price movements and heightened risk.

Going short

Going short

As the crypto CFD trading industry continues to attract new traders, the importance of robust risk management practices has become even more pronounced. Navigating the market’s inherent challenges requires heightened diligence and discipline from traders.

Technical Analysis In The Crypto Cfd Market

Effective crypto CFD trading often relies on the strategic application of technical analysis. By studying historical price data and identifying patterns and trends, traders can make more informed decisions about the optimal entry and exit points for their trades. Some of the most commonly utilized technical indicators in the crypto market include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

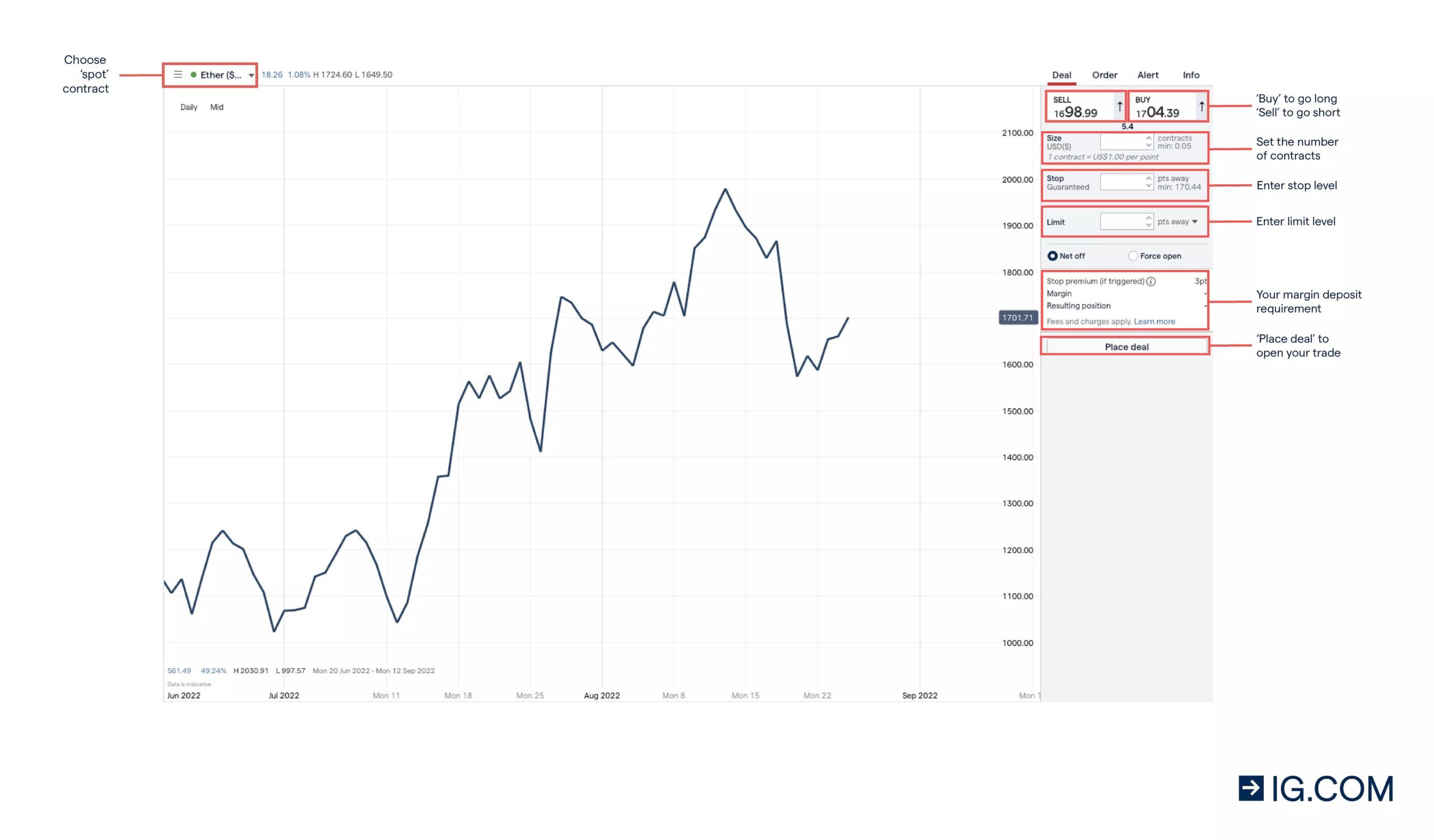

Ether deal ticket

Ether deal ticket

Additionally, traders should be familiar with commonly observed chart patterns, such as head and shoulders, triangles, and flags, as these can provide valuable insights into the prevailing market sentiment and the potential direction of price movements.

As the crypto CFD market continues to evolve, the importance of technical analysis has only grown. Traders who can effectively leverage these analytical tools and techniques have a distinct advantage in navigating the dynamic and often unpredictable nature of the cryptocurrency landscape.

The Psychological Aspect Of Crypto Cfd Trading

Emotional and psychological factors can have a significant impact on a trader’s success in the crypto CFD market. Overconfidence, fear, and greed can all lead to poor decision-making and ultimately, losses. To mitigate these risks, traders should develop a solid understanding of their own biases and emotions, and implement strategies to manage them effectively.

This may involve the creation of a structured trading plan, the practice of self-discipline, and the seeking of support from experienced traders or trading communities. By recognizing and addressing the psychological challenges inherent in crypto CFD trading, traders can better position themselves to make rational, informed decisions in the face of market volatility.

As the crypto CFD trading environment continues to evolve, the ability to effectively manage one’s emotions and psychological responses has become increasingly crucial. Traders who can maintain a disciplined and level-headed approach are more likely to navigate the market’s complexities and capitalize on potential opportunities.

Faqs

What is the difference between crypto CFDs and spot crypto trading? The primary distinction lies in the underlying asset. With crypto CFDs, traders speculate on the price movements of cryptocurrencies without actually owning the digital coins. In contrast, spot crypto trading involves the direct purchase and holding of the underlying digital assets.

How do I calculate my profit or loss on a crypto CFD trade? The calculation of profit or loss on a crypto CFD trade is determined by the difference between the opening and closing prices of the CFD contract, multiplied by the size of the position and the value per point (pip) of the contract.

What are the tax implications of crypto CFD trading? The tax implications of crypto CFD trading can vary depending on the trader’s location and tax jurisdiction. It is recommended to consult with a tax professional to ensure compliance with all relevant laws and regulations.

Conclusion

In the ever-evolving world of finance, the rise of cryptocurrencies has ushered in a new era of trading opportunities, with crypto CFD trading emerging as a popular choice among market participants. By understanding the mechanics of crypto CFDs, selecting a reputable and well-regulated trading platform, and developing a comprehensive trading strategy, traders can potentially capitalize on the price movements of digital assets.

However, it’s crucial to acknowledge the inherent risks associated with crypto CFD trading, particularly the heightened volatility of the cryptocurrency market and the amplifying effects of leverage. Prudent risk management, disciplined trading practices, and a solid understanding of both technical and psychological factors are essential for navigating the crypto CFD trading landscape successfully.

By embracing the depth of technical analysis, cultivating a keen awareness of their own biases and emotions, and partnering with a reliable crypto CFD trading platform, traders can position themselves to navigate the dynamic and ever-changing crypto landscape with greater confidence and potential for success. As the crypto CFD market continues to evolve, those who can adapt and capitalize on the unique opportunities it presents will be well-positioned to thrive in this exciting and rapidly-evolving financial frontier.