Crypto Bot Trading Strategies: Revolutionizing the Digital Asset Markets

In the rapidly evolving landscape of cryptocurrency, traders are continuously seeking innovative tools to gain a competitive edge and maximize their returns. One remarkable solution that has garnered significant attention is the crypto trading bot – an automated system designed to revolutionize the way you approach the digital asset markets.

Crypto trading bots are sophisticated computer programs that analyze market data, identify profitable trading opportunities, and execute trades automatically based on predefined algorithms and strategies. By leveraging the speed, precision, and 24/7 market participation of these intelligent systems, traders can streamline their decision-making process, mitigate the impact of human emotions, and potentially achieve higher returns compared to manual trading.

Crypto trading bots are sophisticated computer programs that analyze market data, identify profitable trading opportunities, and execute trades automatically based on predefined algorithms and strategies. By leveraging the speed, precision, and 24/7 market participation of these intelligent systems, traders can streamline their decision-making process, mitigate the impact of human emotions, and potentially achieve higher returns compared to manual trading.

Unveiling The Versatility Of Crypto Bot Trading Strategies

Crypto trading bots come in various forms, each tailored to tackle specific market conditions and trading approaches. From trend-following bots that capitalize on market momentum to arbitrage bots that exploit price discrepancies across exchanges, the array of options allows traders to customize their strategies to their unique goals and risk profiles.

Mastering The Art Of Trend Following

Trend-following bots are programmed to identify and capitalize on the prevailing market direction. By analyzing a multitude of technical indicators, such as moving averages and momentum oscillators, these bots can detect emerging trends and execute trades accordingly. The objective is to ride the wave of the market’s momentum, generating profits as prices move in a consistent direction.  Trend following bot interface

Trend following bot interface

Exploiting Arbitrage Opportunities

Arbitrage bots, on the other hand, focus on taking advantage of price differences between various cryptocurrency exchanges. These intelligent systems constantly monitor market prices, quickly executing trades to buy low on one exchange and sell high on another. By leveraging the speed and efficiency of these bots, traders can capture small yet consistent profits from these price discrepancies.  Arbitrage trading

Arbitrage trading

Navigating Range-bound Markets

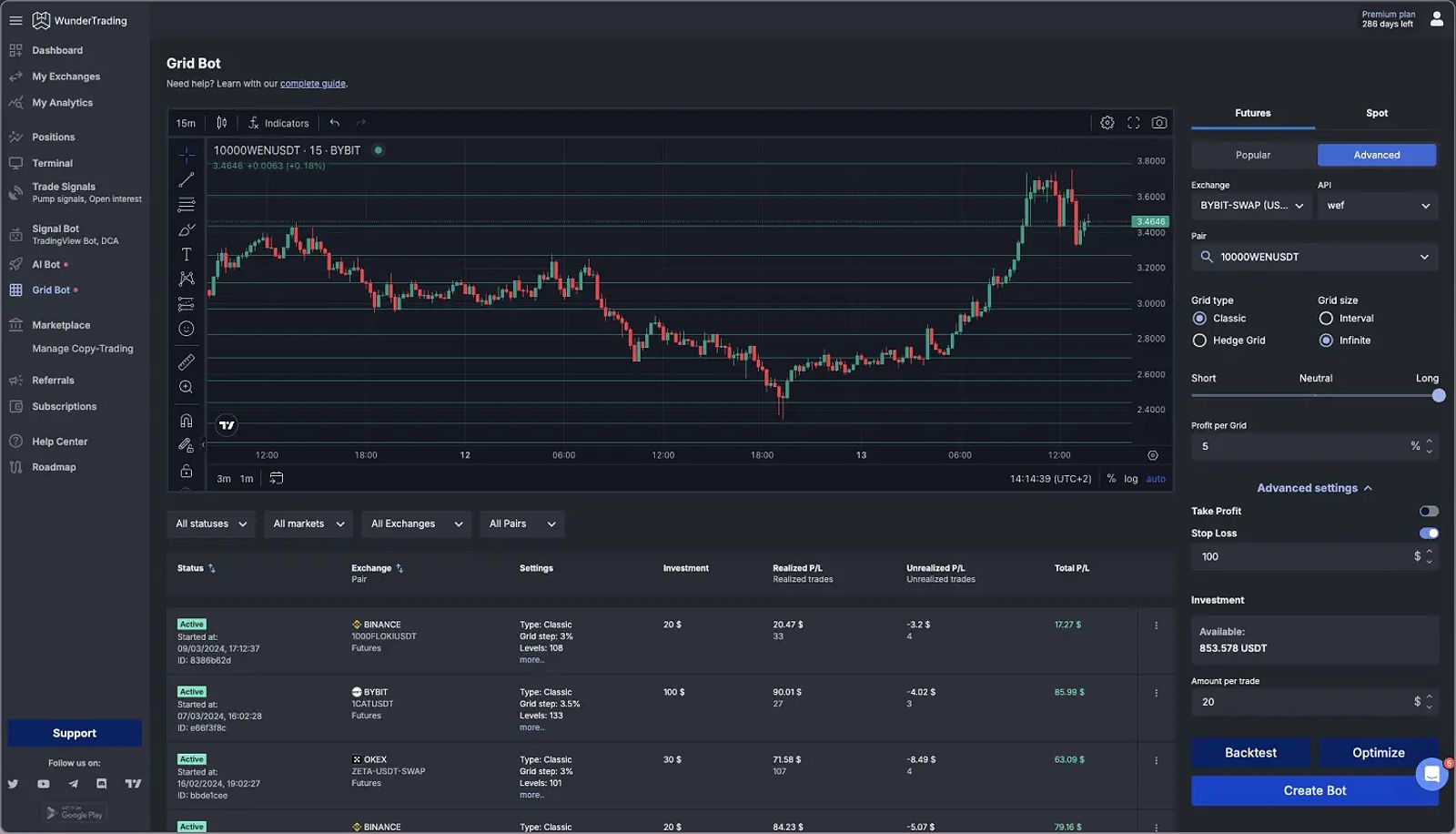

For traders seeking to profit from range-bound markets, grid trading bots offer a promising solution. These bots establish a grid of buy and sell orders at predefined price levels, allowing them to capitalize on the oscillations within a specific price range. As the market fluctuates, the bot automatically executes trades, aiming to generate consistent returns from the price movements.  Grid trading bot interface

Grid trading bot interface

Harnessing The Power Of Ai And Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies has taken crypto trading bots to new heights. By leveraging advanced algorithms, these bots can analyze vast amounts of market data, identify complex patterns, and make informed trading decisions with a level of precision that surpasses human capabilities.

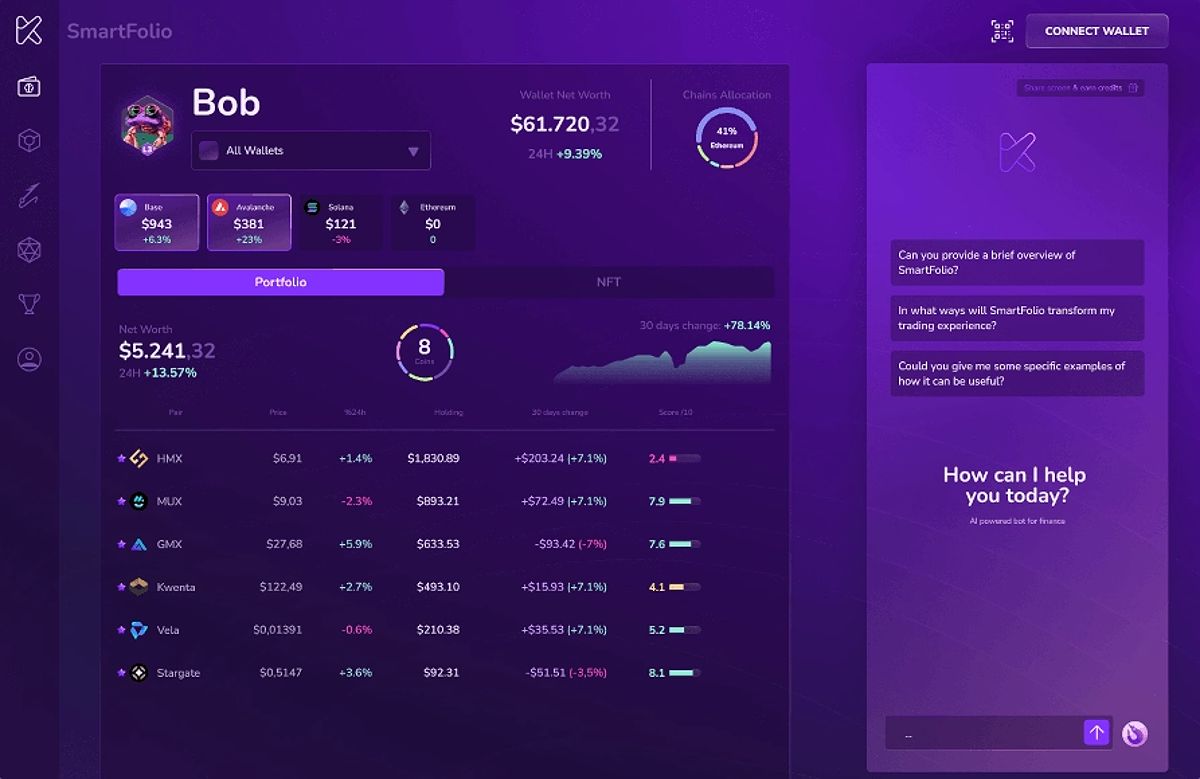

Enhancing Decision-making With Ai

AI-powered crypto trading bots can utilize a wide range of data sources, including on-chain metrics, sentiment analysis, and macroeconomic indicators, to gain a comprehensive understanding of market dynamics. This holistic approach allows the bots to make more informed trading decisions, potentially identifying opportunities that may have been overlooked by manual traders.  AI-powered crypto trading

AI-powered crypto trading

Optimizing Strategies Through Machine Learning

Machine learning models can be employed to continuously refine and optimize the trading strategies used by crypto bots. By backtesting various approaches, the bots can identify the most effective techniques and adapt them over time, ensuring that the trading strategies remain relevant and effective in the ever-changing crypto landscape.  Machine learning optimization

Machine learning optimization

Mitigating Risks With Comprehensive Risk Management

While the potential rewards of crypto trading bots are enticing, it is essential to recognize and manage the inherent risks associated with their use. Responsible traders must implement robust risk management strategies to protect their capital and ensure the long-term sustainability of their trading operations.

Leveraging Stop-loss Orders

One of the fundamental risk management tools for crypto trading bots is the implementation of stop-loss orders. These orders automatically sell an asset when it reaches a predetermined price level, limiting the potential downside and protecting traders from significant losses.  Stop-loss order

Stop-loss order

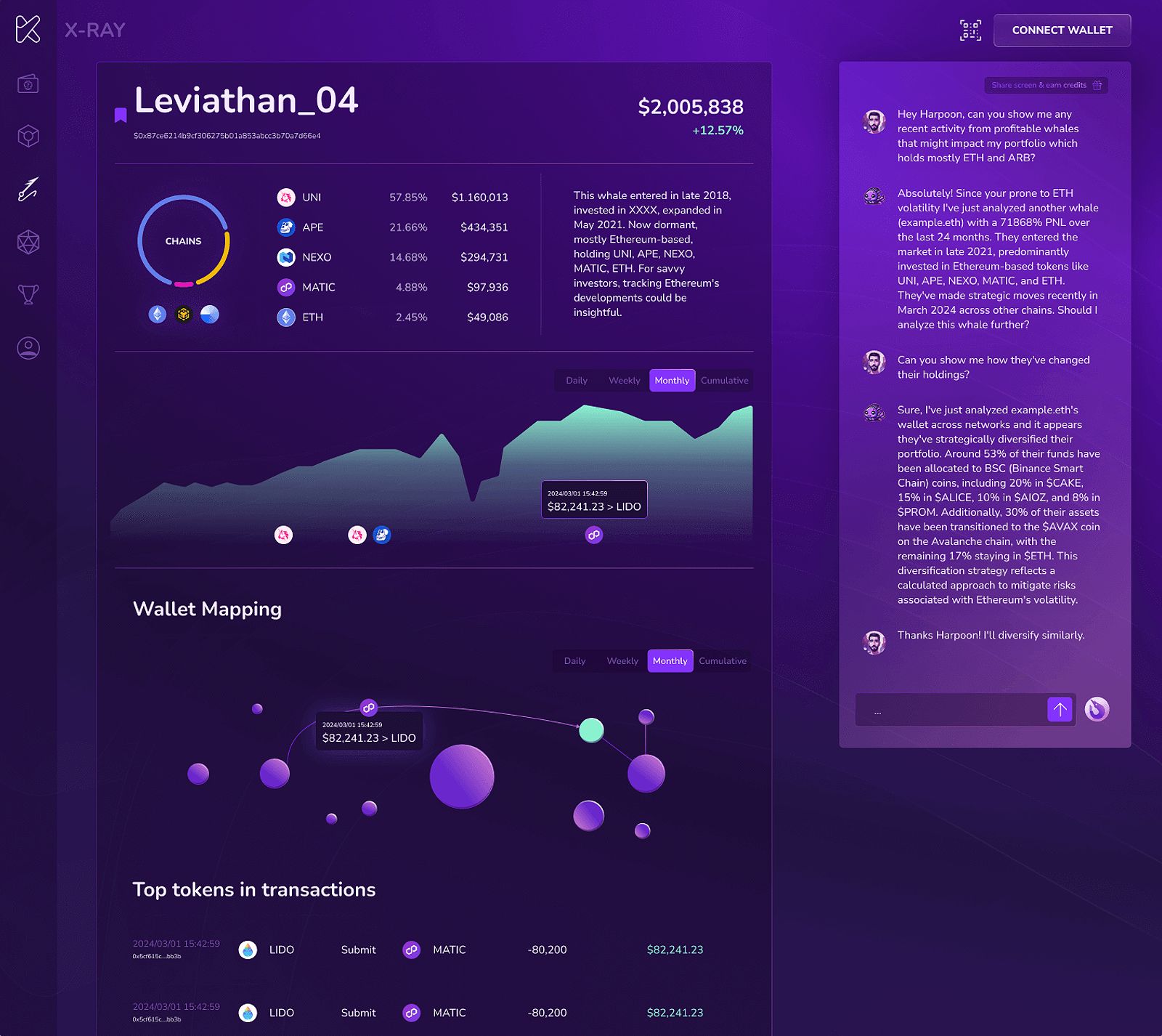

Diversifying Portfolio Exposure

Another crucial aspect of risk management is portfolio diversification. Crypto trading bots can be programmed to allocate trading capital across multiple assets, reducing the concentration risk and mitigating the impact of market fluctuations on the overall portfolio.  Portfolio diversification

Portfolio diversification

Maximizing The Potential Of Crypto Trading Bots

As the cryptocurrency market continues to evolve, the role of crypto trading bots in enhancing trading performance becomes increasingly compelling. By understanding the various strategies and techniques employed by these intelligent systems, traders can unlock new opportunities, improve their decision-making, and potentially achieve greater success in the dynamic world of digital assets.

Streamlining The Trading Process

One of the primary benefits of using crypto trading bots is the ability to automate the trading process. These bots can execute trades 24/7, without the limitations imposed by human traders. This constant market participation allows bots to capitalize on opportunities that may arise during times when manual traders are unable to monitor the market actively.

Eliminating The Impact Of Emotions

Emotions can be a significant obstacle for human traders, leading to impulsive decisions and suboptimal trade execution. Crypto trading bots, on the other hand, are programmed to make trading decisions based solely on market data and predefined algorithms, effectively eliminating the influence of emotions and maintaining a disciplined, systematic approach.

Optimizing Strategies Through Backtesting

Crypto trading bots offer the advantage of backtesting, which allows traders to simulate the performance of their trading strategies using historical market data. This process enables the fine-tuning and optimization of trading parameters, helping traders identify the most effective approaches before deploying their bots in live market conditions.  Backtesting

Backtesting

Frequently Asked Questions

How Can I Ensure The Reliability And Performance Of My Crypto Trading Bot?

Ensuring the reliability and performance of your crypto trading bot is crucial. Thoroughly test your bot’s strategies through extensive backtesting, monitor its performance in live market conditions, and regularly review and update its parameters to adapt to changing market dynamics. Additionally, consider incorporating comprehensive risk management measures, such as stop-loss orders and portfolio diversification, to mitigate potential losses.

What Are The Key Factors To Consider When Choosing A Crypto Trading Bot?

When selecting a crypto trading bot, consider factors such as its trading strategies, customization options, ease of use, and track record of performance. Evaluate the bot’s ability to integrate with your preferred cryptocurrency exchanges, and ensure it aligns with your trading goals and risk tolerance. Additionally, review the bot’s security measures and the provider’s reputation to ensure the safety of your trading activities.

Conclusion

As the crypto landscape continues to evolve, the role of crypto trading bots in enhancing trading performance becomes increasingly compelling. By harnessing the power of these intelligent systems, traders can streamline their decision-making, improve their risk management, and potentially achieve greater success in the dynamic world of digital assets.

Whether you’re a seasoned trader or just starting your journey in the crypto markets, understanding and leveraging the capabilities of crypto trading bots can be a transformative experience. By embracing the efficiency, precision, and data-driven insights these bots provide, you can unlock new opportunities and take your trading to new heights.

So, embark on your crypto trading journey with confidence, and let the power of crypto bots be your guide to unlocking the full potential of the digital asset ecosystem.