The world of cryptocurrency trading has seen a remarkable transformation in recent years, with the rise of algorithmic trading strategies emerging as a game-changer for traders seeking to automate their processes and potentially enhance their profitability. As we venture into 2024, this comprehensive guide aims to equip cryptocurrency traders with a deep understanding of the intricacies of crypto algo trading, including the various trading algorithms, the leading crypto trading bots, and essential risk management techniques.

Unlocking The Potential Of Crypto Trading Algorithms

The cryptocurrency trading landscape has witnessed a proliferation of algorithmic strategies, each offering its own unique advantages and challenges. Trend-following algorithms, for instance, leverage market momentum to identify and capitalize on emerging price trends, while arbitrage strategies exploit price discrepancies across multiple exchanges, seeking to capture small but consistent profits. The technical complexity of these algorithms requires a deep understanding of market dynamics, order execution, and risk management principles.

Moving Average Crossover Crypto

Moving Average Crossover Crypto

Navigating The Crypto Trading Bot Landscape

The crypto trading bot market has witnessed a proliferation of platforms, each offering a unique set of features and capabilities. Selecting the right bot for one’s trading needs requires a comprehensive evaluation of various factors, including the bot’s functionality, the exchange integrations, security measures, and the level of customization available.

Conducting thorough research and analyzing the strengths and weaknesses of different crypto trading bot offerings can empower traders to make informed decisions that align with their individual trading strategies and risk profiles. This guide will provide a curated overview of the top crypto trading bot platforms, equipping traders with the knowledge to choose the solution that best fits their specific requirements.

Leading crypto trading bot platforms, such as Bitsgap, 3Commas, and Cryptohopper, have emerged as popular choices among cryptocurrency traders. These platforms offer a range of features, including automated order execution, portfolio management, and performance tracking, catering to traders with varying levels of experience and risk tolerance. By carefully evaluating the capabilities, security measures, and customer support provided by these platforms, traders can make an informed decision that aligns with their trading objectives.

Gainium GUI

Gainium GUI

Implementing Crypto Trading Bots: A Methodical Approach

Integrating a crypto trading bot into one’s trading workflow demands a well-structured approach. This guide will walk traders through the process of setting up and configuring their chosen bot, from connecting to the exchange’s API to fine-tuning the trading parameters and monitoring the bot’s performance.

By understanding the intricacies of this implementation process, traders can ensure that their automated trading strategies are executed seamlessly and in accordance with their risk management protocols. This level of control and oversight is crucial for maintaining a profitable and sustainable trading approach in the volatile crypto markets.

Successful implementation of a crypto trading bot requires a meticulous approach. Traders must first establish secure API connections with their preferred cryptocurrency exchanges, ensuring that the bot can seamlessly execute trades on their behalf. Configuring the trading parameters, such as entry and exit conditions, position sizing, and risk management settings, is a crucial step in tailoring the bot’s behavior to the trader’s specific strategy and risk tolerance.

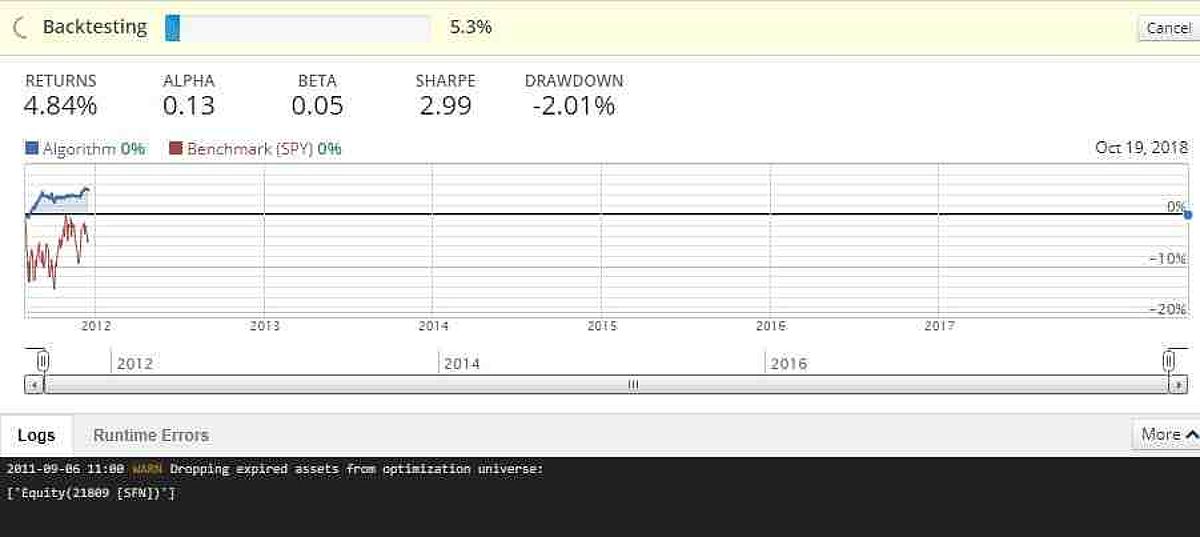

Backtesting an Algorithm

Backtesting an Algorithm

Mastering Risk Management In Crypto Algo Trading

Navigating the inherent volatility of the cryptocurrency markets requires a robust risk management framework. Crypto algo trading, while potentially lucrative, carries its own unique set of risks that must be addressed proactively.

This guide will delve into the essential risk mitigation strategies, such as stop-loss orders, position sizing, and diversification. By understanding and applying these principles, traders can protect their portfolio from the unexpected fluctuations that often characterize the crypto landscape.

Effective risk management is paramount in the realm of crypto algo trading. Traders must implement a comprehensive framework that addresses the unique challenges posed by the digital asset markets. This includes the strategic use of stop-loss orders to limit potential losses, as well as position sizing techniques that ensure appropriate allocation of capital across multiple trades. Additionally, diversifying one’s trading strategies and portfolios can help mitigate the impact of market volatility and reduce overall risk exposure.

Reversion to Mean Crypto

Reversion to Mean Crypto

Faq

- Q: What is the difference between a trend-following algorithm and an arbitrage strategy? A: A trend-following algorithm seeks to capitalize on market momentum by identifying and following emerging price trends, while an arbitrage strategy exploits pricing discrepancies across multiple exchanges to capture small but consistent profits.

- Q: How can I choose the right crypto trading bot for my needs? A: To choose the right crypto trading bot, evaluate the bot’s functionality, exchange integrations, security measures, and customization options. Consider your individual trading strategy and risk profile when making a decision.

- Q: What are some essential risk management strategies for crypto algo trading? A: Some essential risk management strategies include the use of stop-loss orders, position sizing techniques, and diversification of trading strategies and portfolios.

- Q: How can I backtest a crypto trading algorithm? A: Backtesting a crypto trading algorithm involves simulating the strategy against historical market data to evaluate its performance and fine-tune its parameters. This process helps traders optimize their algorithms for maximum performance and minimal risk.

- Q: What is the importance of securing API connections when implementing a crypto trading bot? A: Securing API connections is crucial for ensuring that the trading bot can execute trades seamlessly and in accordance with the trader’s risk management protocols. This level of control and oversight is essential for maintaining a profitable and sustainable trading approach in the volatile crypto markets.

Optimizing Crypto Algo Trading For Success

As traders embark on their crypto algo trading journey, it’s essential to incorporate best practices and continuously refine their strategies. This guide will provide practical tips and insights to help traders maximize the performance of their automated trading systems.

From backtesting and optimization techniques to ongoing monitoring and adjustment, this section will equip traders with the knowledge and tools needed to achieve sustainable success in the dynamic world of crypto algo trading.

Optimizing crypto algo trading performance requires a multifaceted approach. Traders must diligently backtest their strategies, using historical market data to fine-tune their algorithms and identify the most promising trading patterns. Ongoing monitoring and adjustment of trading parameters, based on market conditions and performance feedback, are crucial to maintaining the effectiveness of the automated systems.

Additionally, traders should stay abreast of the latest developments in the crypto industry, adapting their strategies to capitalize on emerging trends and technologies. By continuously refining their approach and embracing a culture of learning and adaptation, traders can navigate the ever-evolving crypto algo trading landscape with confidence and increase their chances of long-term success.

Conclusion

As the cryptocurrency markets continue to evolve, the role of algorithmic trading in the trading landscape has become increasingly prominent. This comprehensive guide has equipped cryptocurrency traders with a deep understanding of the various crypto trading algorithms, the leading crypto trading bots, and essential risk management strategies.

By leveraging the power of automated trading systems and incorporating robust risk management practices, traders can navigate the dynamic crypto markets with greater confidence and the potential to achieve sustainable trading success. As the industry continues to mature, staying informed and adaptable will be the key to unlocking the full potential of the crypto algo trading revolution in 2024 and beyond.