As a seasoned financial journalist specializing in the dynamic cryptocurrency market, I”ve had the privilege of witnessing firsthand the transformative impact of copycat crypto trading. This innovative approach has emerged as a game-changer, empowering both newcomers and seasoned investors to navigate the ever-evolving crypto landscape with increased confidence and potential for success.

Understanding Copycat Crypto Trading

At its core, copycat crypto trading, also known as social or mirror trading, allows investors to replicate the trading decisions of successful cryptocurrency traders. By linking your portfolio to that of a proven trader, you can automatically execute the same trades, proportionally adjusting for factors like your available funds and risk tolerance.

This strategy offers a unique opportunity for individuals who may lack the time, resources, or expertise to independently navigate the complex crypto market. By tapping into the knowledge and strategies of seasoned traders, copycat crypto trading provides a streamlined path to participating in the growth of the cryptocurrency ecosystem.

When selecting a platform for copycat crypto trading, I place a strong emphasis on transparency. The ability to access clear and detailed performance metrics for the traders you may consider following is crucial, as it will enable you to make informed decisions and ensure that the trading strategies you’re replicating match your own risk tolerance and investment objectives.

How copy trading works

How copy trading works

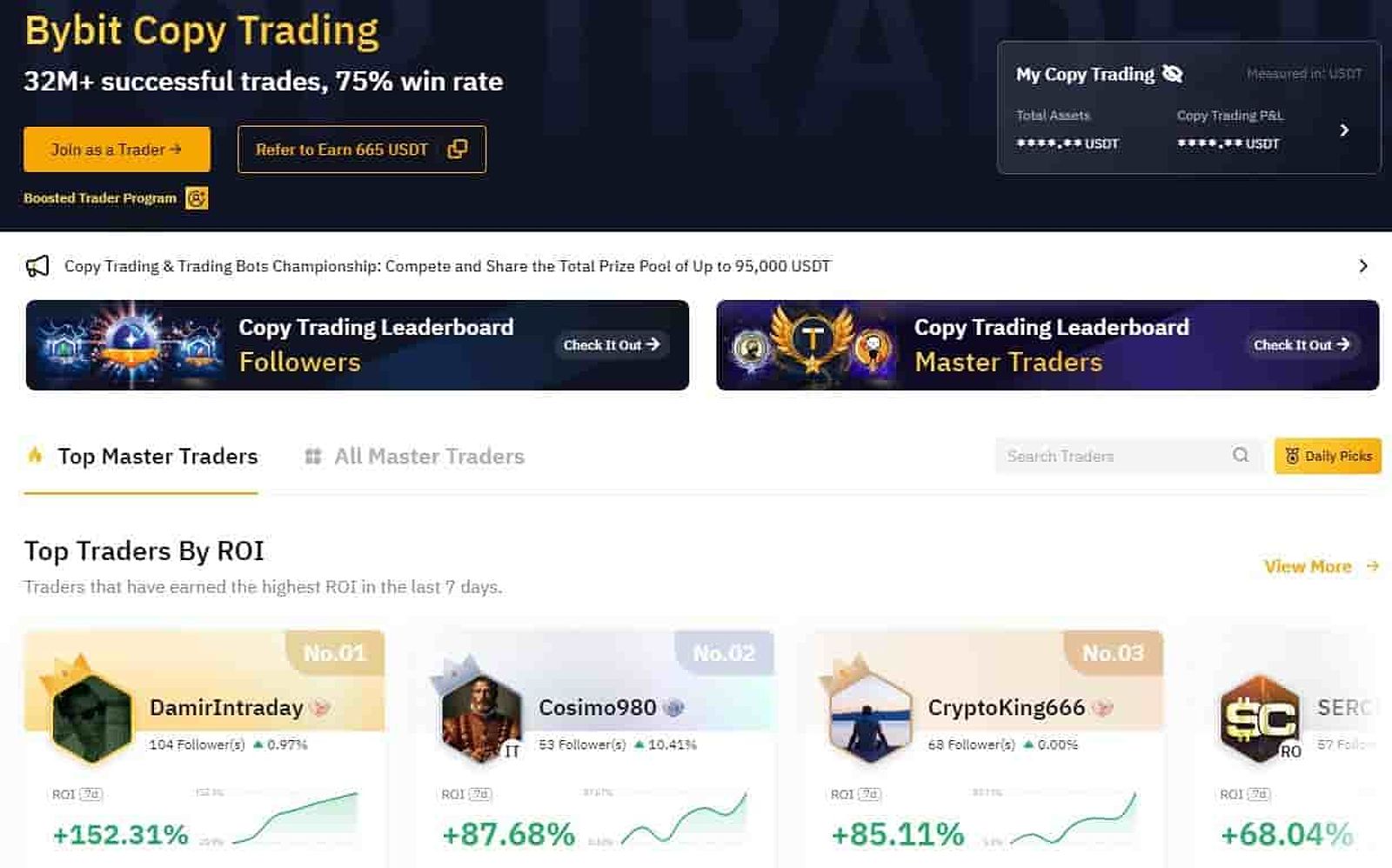

Leading Platforms For Copycat Crypto Trading

eToro

One of the leading platforms in the copycat crypto trading space is eToro, which has gained popularity for its user-friendly interface and diverse pool of experienced traders. The platform provides comprehensive performance data, allowing you to thoroughly vet potential traders before deciding to follow them. Additionally, eToro offers various risk management tools, such as stop-loss orders and portfolio diversification features, to help you manage your exposure and protect your capital.

EToro crypto copy trading

EToro crypto copy trading

Zulutrade

Another prominent platform in the copycat crypto trading landscape is Zulutrade, which boasts a wide range of successful traders across different trading styles and risk profiles. The platform’s robust analytical tools and detailed trader profiles make it easier for investors to identify and evaluate potential candidates to follow. Zulutrade also offers a social community aspect, enabling investors to engage with and learn from their peers.

Top Crypto Copy Trading Platforms

Top Crypto Copy Trading Platforms

Identifying Successful Traders To Follow

One of the most critical aspects of copycat crypto trading is the selection of the right traders to mirror. Through my extensive research and interviews with industry experts, I’ve come to understand the importance of seeking out individuals with a proven track record of consistent and sustainable performance, rather than those who have experienced short-term spikes in returns.

In my analysis, I examine factors such as the trader’s trading strategy, risk management approach, and overall market understanding. I also consider the diversification of their portfolio and the types of cryptocurrencies they typically trade. This meticulous due diligence helps me identify traders whose style and risk profile align with the investment goals of my readers.

Case Studies: Successful Traders To Consider

Michael

One such trader that has caught my attention is Michael, who has consistently delivered impressive returns over the past three years. His trading strategy focuses on identifying undervalued cryptocurrencies with strong fundamental potential, coupled with a disciplined risk management approach. Michael’s portfolio is well-diversified across various sectors within the crypto ecosystem, mitigating the impact of market volatility.

Sarah

Another trader I’ve closely followed is Sarah, who has demonstrated an exceptional ability to navigate the crypto market’s ups and downs. Her trading style emphasizes a combination of technical analysis and macroeconomic trends, allowing her to identify profitable opportunities across a wide range of digital assets. Sarah’s risk management practices, including the use of stop-loss orders and position sizing, have been instrumental in preserving her clients’ capital during periods of market turmoil.

Navigating Risks And Maximizing Rewards

While copycat crypto trading can provide a streamlined path to participating in the crypto market, it’s essential to remain vigilant about the inherent risks. I emphasize the importance of diversifying your portfolio by following multiple traders, each with their own unique strategies and risk profiles. This can help mitigate the impact of potential losses from any single trader.

Additionally, I encourage my readers to familiarize themselves with the risk management tools offered by their chosen platform, such as stop-loss orders and drawdown limits. Leveraging these features can help you proactively manage your exposure and protect your capital during periods of market volatility.

How to copy trade

How to copy trade

Effective Risk Management Strategies

One effective risk management strategy I’ve observed among successful copycat crypto traders is the adoption of a layered approach. By allocating a portion of their portfolio to following multiple traders, they can benefit from the diversification of trading styles and risk profiles, while also maintaining a degree of control over their overall exposure.

For instance, an investor might dedicate 20% of their portfolio to following a trader with a conservative, low-risk approach, 30% to a trader with a moderate risk profile, and the remaining 50% to a trader who employs a more aggressive, high-return strategy. This balanced allocation can help investors navigate the inherent volatility of the crypto market while potentially maximizing their long-term returns.

Continuous Learning And Adaptation

Engaging in copycat crypto trading should not be seen as a passive endeavor. As an industry expert, I firmly believe that investors must strive to develop a deeper understanding of the underlying cryptocurrency market, trading strategies, and risk management principles.

Regularly reviewing the performance of the traders you’re following and being prepared to adjust your portfolio or even switch to new traders as market conditions and your own investment goals evolve is crucial. By continually educating yourself and adapting your approach, you can maximize the benefits of copycat crypto trading and position yourself for long-term success in the dynamic crypto arena.

Resources For Continuous Learning

One effective way for investors to enhance their knowledge and stay up-to-date with the latest trends in the crypto market is by actively participating in online forums, webinars, and educational resources. These platforms provide valuable insights from industry experts, as well as the opportunity to engage with a community of fellow copycat crypto traders.

Additionally, I recommend that my readers periodically review their investment objectives and risk tolerance to ensure that the traders they’re following continue to align with their financial goals. As the crypto market evolves, it’s essential to be agile and willing to make adjustments to your portfolio to maintain optimal performance and risk management.

Faqs

What is the difference between copycat crypto trading and mirror trading? Copycat crypto trading and mirror trading are similar in that they both involve replicating the trades of experienced traders. The key difference lies in the level of control and customization available to the investor. In copycat trading, you can adjust factors like trade size and risk level, while mirror trading typically involves directly mirroring the trader’s positions without the ability to modify them.

How do I find a good trader to follow? When searching for a trader to follow, look for individuals with a consistent track record of positive returns, a well-defined trading strategy, and a risk management approach that aligns with your own preferences. Review their performance metrics, including drawdowns and risk-adjusted returns, to assess their suitability.

What are the risks of copycat crypto trading? Copycat crypto trading, like any investment strategy, carries inherent risks. The cryptocurrency market is known for its volatility, and even the most successful traders can experience periods of losses. Additionally, you are relying on the decision-making of others, which introduces the risk of dependency and potential mistakes.

How can I minimize my risk? To minimize risk in copycat crypto trading, diversify your portfolio by following multiple traders with different trading styles and risk profiles. Utilize the risk management tools provided by your chosen platform, such as stop-loss orders and drawdown limits, to proactively manage your exposure. Additionally, maintain a long-term perspective and be prepared to adjust your approach as market conditions and your own investment goals evolve.

Conclusion

As the cryptocurrency market continues to evolve, the rise of copycat crypto trading has emerged as a compelling opportunity for both novice and experienced investors. By leveraging the expertise of successful traders, individuals can potentially unlock lucrative returns while minimizing their own time and effort.

However, as an investigative journalist, I emphasize the importance of approaching this strategy with due diligence, a clear understanding of the risks involved, and a commitment to continuous learning and adaptation. By following the guidance outlined in this comprehensive article, my readers can confidently embark on their copycat crypto trading journey and position themselves for success in the ever-evolving world of digital assets.

In the ever-changing landscape of the cryptocurrency market, the demand for reliable and user-friendly platforms that cater to the needs of copycat traders continues to grow. Through my in-depth reporting, I’ve witnessed the industry’s response, with leading platforms like eToro and Zulutrade enhancing their offerings, prioritizing transparency, and providing a diverse pool of successful traders for investors to consider.

Ultimately, the rise of copycat crypto trading has democratized access to the cryptocurrency market, empowering both novice and experienced investors to leverage the expertise of seasoned traders and potentially achieve their financial objectives in the dynamic and ever-evolving world of digital assets.