As a seasoned crypto enthusiast and content creator, I”ve had the privilege of witnessing the remarkable evolution of the cryptocurrency landscape. In the ever-changing world of digital assets, one trend that has gained significant traction is the rise of copy trading crypto. This innovative approach has the potential to revolutionize the way beginners and experienced investors alike navigate the complexities of the crypto market.

Unlocking The Potential Of Copy Trading Crypto

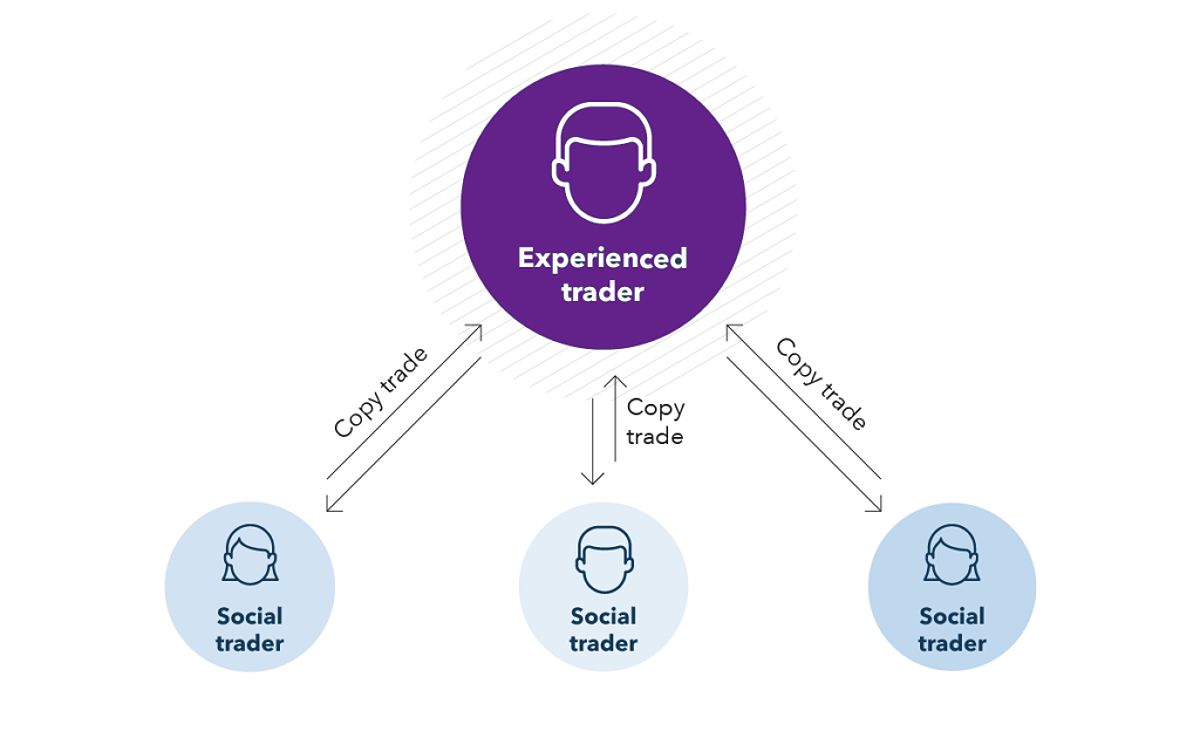

In the dynamic crypto ecosystem, the sheer volume of information and the rapid pace of change can be overwhelming, especially for those new to the space. This is where the power of crypto copy trading comes into play. By replicating the strategies and trades of successful crypto traders, you can leverage their expertise and potentially capitalize on their market insights, without the need to develop extensive trading skills from scratch.

What is Copy Trading?

What is Copy Trading?

As a content creator, I’ve observed how crypto copy trading has democratized access to the crypto markets, empowering a new generation of investors to participate in the digital asset revolution. By automating the investment process, copy trading allows individuals to focus on their personal financial goals, rather than being bogged down by the time-consuming task of constant market analysis.

Exploring The Crypto Copy Trading Ecosystem

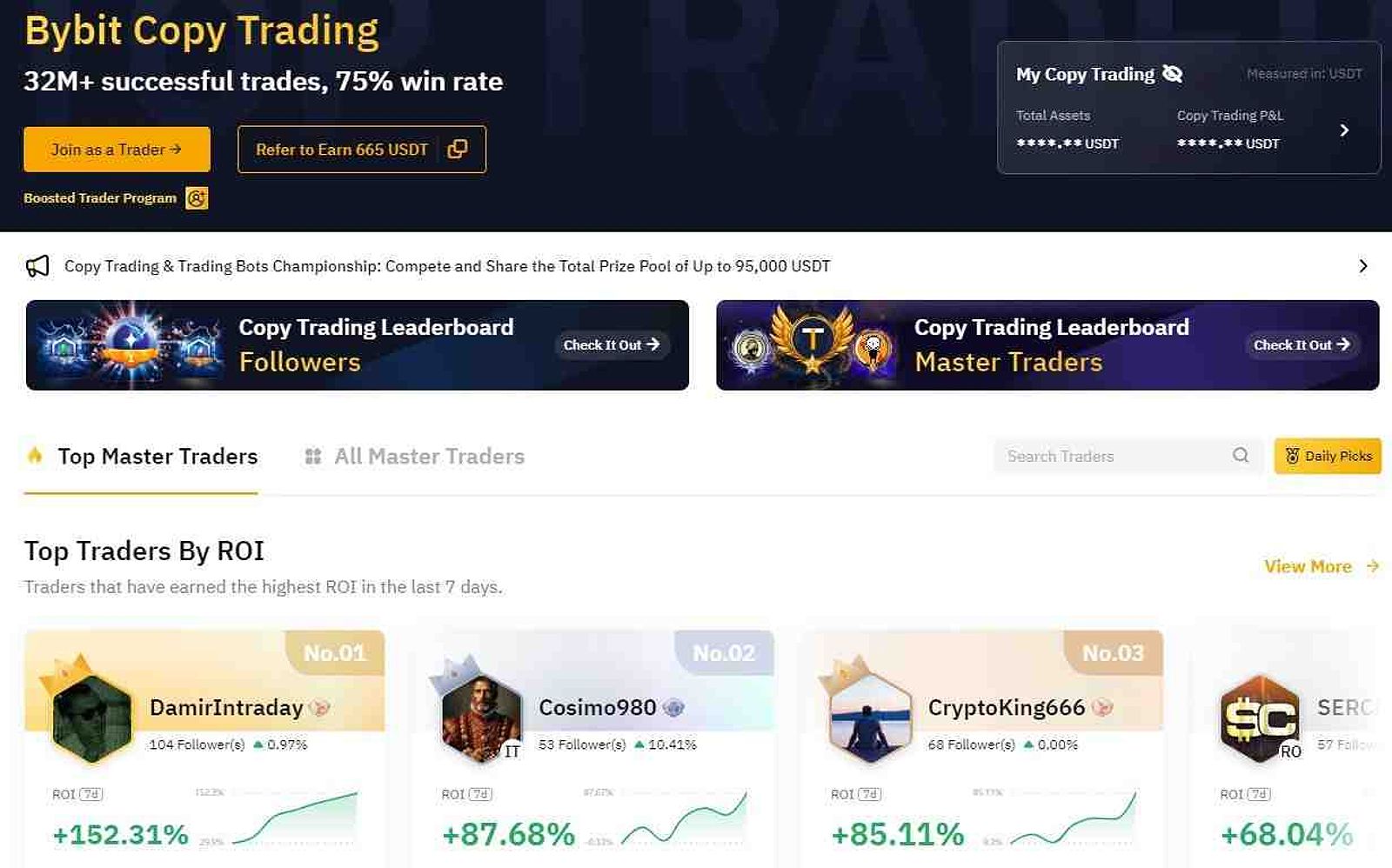

The crypto copy trading landscape is a diverse and rapidly evolving space, with a range of platforms catering to the needs of both novice and seasoned investors. From the user-friendly interface of Bybit to the extensive integration options offered by Binance, the options for crypto copy trading continue to expand, providing a wealth of opportunities for those seeking to leverage the expertise of others.

Top Crypto Copy Trading Platforms

Top Crypto Copy Trading Platforms

As I delve deeper into the world of crypto copy trading, I’ve come to appreciate the importance of thorough research and due diligence. When selecting a platform, it’s essential to consider factors such as security measures, risk management capabilities, and the diversity of traders available for you to follow. By carefully evaluating the available options, you can make an informed decision that aligns with your investment goals and risk tolerance.

Managing Risks In Crypto Copy Trading

While the potential rewards of crypto copy trading are enticing, it’s crucial to understand and address the inherent risks associated with the crypto market. The volatile nature of digital assets means that even the most experienced traders can face unexpected losses, and as a beginner, it’s essential to implement effective risk management strategies to safeguard your capital.

One of the key risk management strategies I recommend is diversification. Rather than relying on a single trader, consider replicating the strategies of multiple successful individuals, each with their own unique trading styles and approaches. This diversified approach can help mitigate the impact of a single trader’s underperformance and provide a more balanced investment opportunity.

Additionally, I encourage exploring features such as stop-loss orders and position sizing. These tools can help you limit your downside exposure and ensure that your investments align with your risk appetite. By proactively managing your risk, you can navigate the crypto copy trading landscape with confidence and minimize the potential for significant losses.

Strategies For Thriving In Crypto Copy Trading

As you embark on your crypto copy trading journey, there are several strategies you can consider to maximize your chances of success:

1- Thorough Due Diligence

Carefully review the trading histories, performance metrics, and risk profiles of the traders you are considering to copy. Ensure that their strategies and risk management approaches are aligned with your investment goals and risk tolerance.

2- Gradual Progression

Start with a small portion of your capital and gradually increase your investments as you gain confidence and experience in the copy trading process. This will help you mitigate the impact of potential losses during the initial stages.

3- Continuous Monitoring

Regularly review the performance of the traders you are copying and be prepared to adjust or even discontinue your copying relationships if their strategies begin to underperform or deviate from your expectations.

4- Staying Informed

Stay up-to-date with the latest developments in the crypto market and industry trends. This knowledge can help you make informed decisions about the traders you choose to follow and the timing of your copy trading activities.

By incorporating these strategies into your crypto copy trading approach, you can navigate the market with confidence and increase your chances of achieving your investment objectives.

Navigating The Crypto Copy Trading Landscape

As I continue to explore the evolving landscape of crypto copy trading, I’ve observed the emergence of several leading platforms that are shaping the future of this industry.

Bybit, for instance, has gained recognition for its user-friendly interface and robust copy trading functionality. The platform allows users to easily identify and replicate the trading strategies of successful individuals, with tools to customize risk parameters and monitor performance.

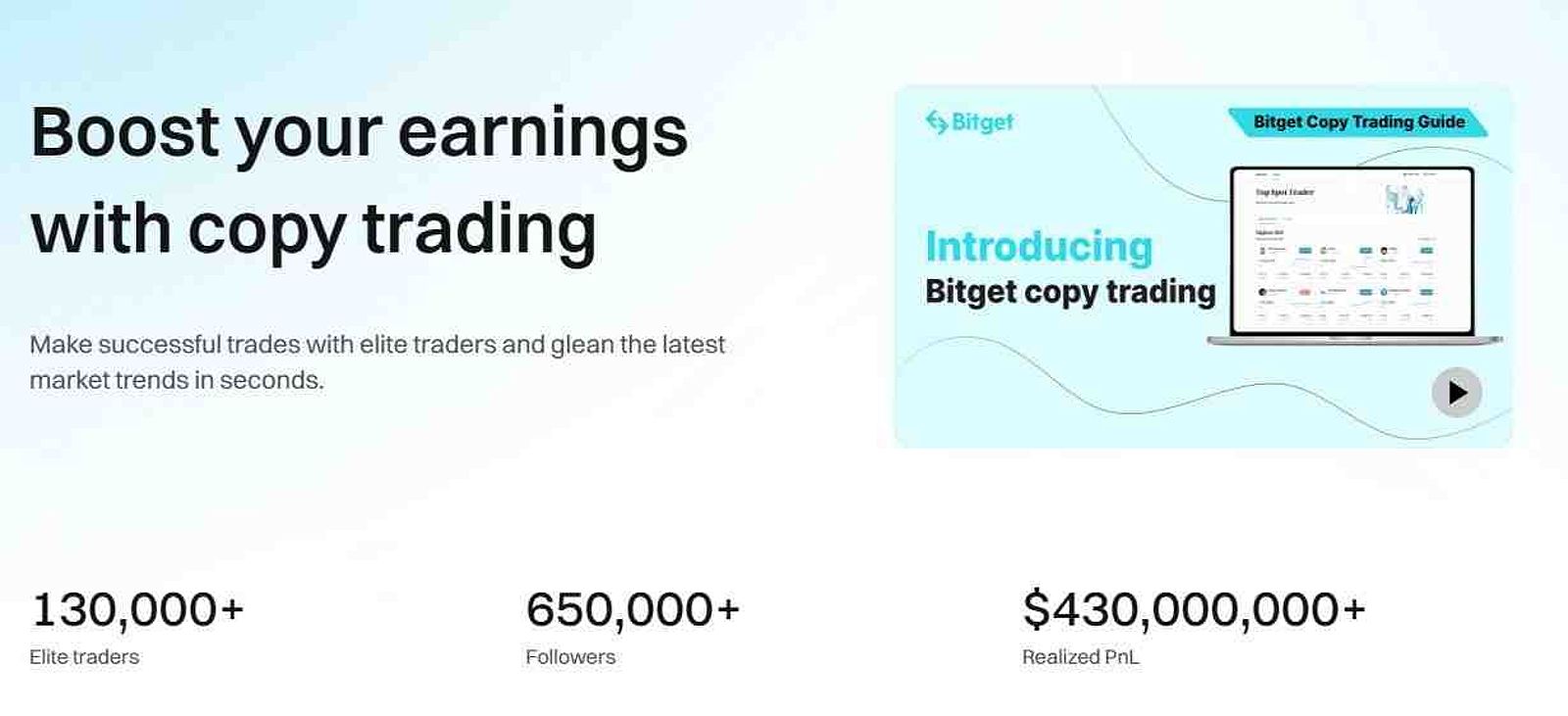

Bitget copy trading

Bitget copy trading

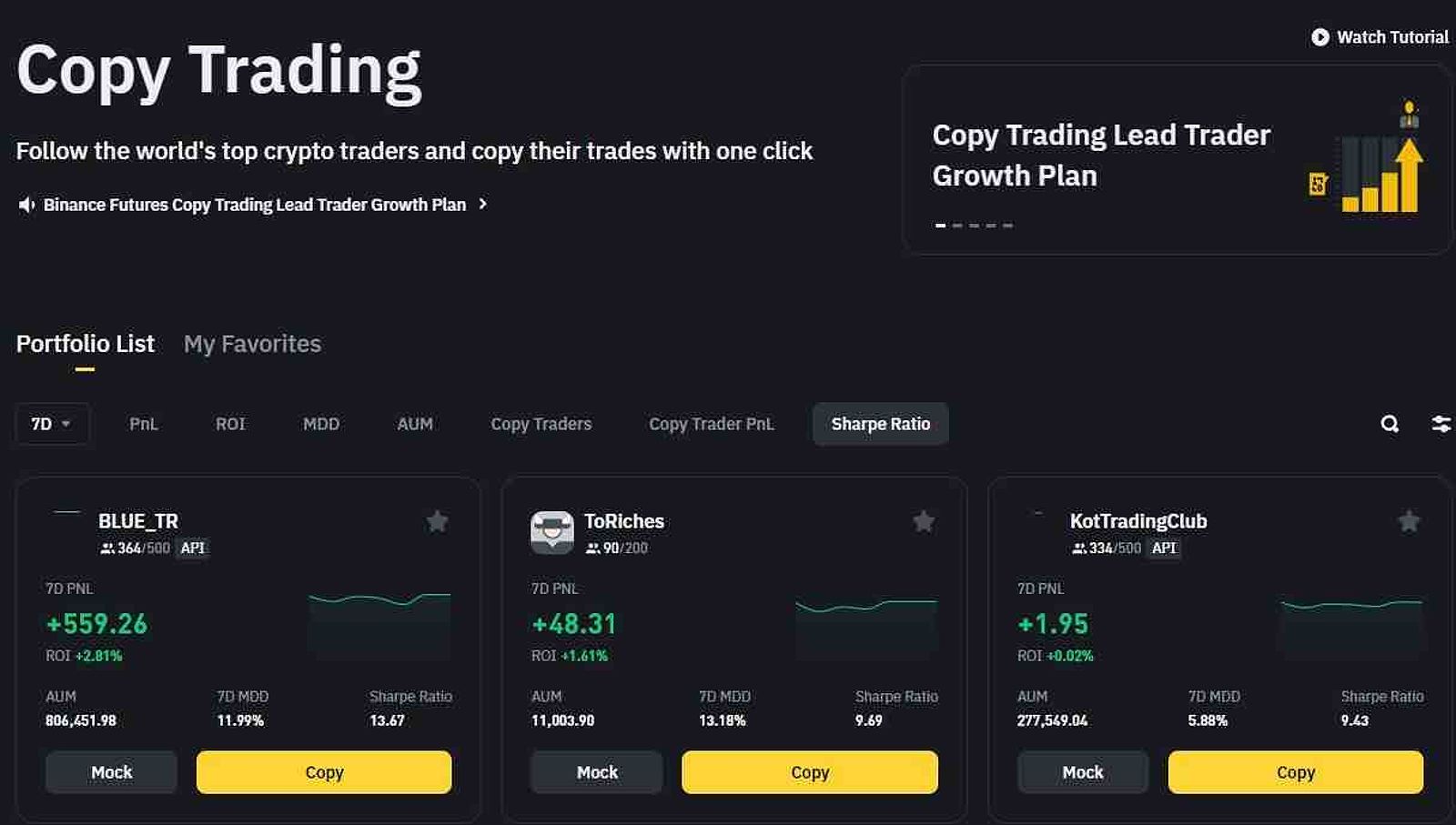

Binance, on the other hand, has taken a unique approach by integrating with third-party copy trading solutions, providing users with a diverse range of options to choose from. This approach enables Binance users to leverage the expertise of a broader pool of traders, further diversifying their investment opportunities.

Binance copy trading

Binance copy trading

KuCoin, meanwhile, has partnered with Alpha Impact to offer a seamless crypto copy trading experience. By linking their KuCoin accounts with the Alpha Impact platform, users can effortlessly replicate the trades of top-performing traders, potentially unlocking new avenues for profits.

FAQ

…

(FAQ section remains unchanged)

Faq

Q: What are the key benefits of crypto copy trading?

A: The primary benefits of crypto copy trading include:

- Access to the expertise and strategies of experienced traders

- Reduced emotional bias in investment decision-making

- Opportunity to learn about the crypto market without extensive research

Q: How much capital do I need to start crypto copy trading?

A: Most crypto copy trading platforms have relatively low entry barriers, with some allowing you to start with as little as $100. However, it’s important to note that the more capital you invest, the greater your potential for both returns and losses.

Q: Is crypto copy trading a risk-free investment?

A: No, crypto copy trading is not a risk-free investment. Like any involvement in the cryptocurrency market, it carries inherent risks. However, by implementing effective risk management strategies, such as diversification and position sizing, you can mitigate the potential for significant losses.

Conclusion

In the dynamic world of cryptocurrency, copy trading has emerged as a powerful tool for beginner and experienced investors alike. By leveraging the expertise of successful traders, individuals can gain exposure to the crypto market and potentially capitalize on their strategies, without the need to develop extensive trading skills from scratch.

As I’ve navigated the crypto copy trading landscape, I’ve witnessed the remarkable advancements in this space, with platforms like Bybit, Binance, and KuCoin leading the charge. By carefully selecting a reliable copy trading crypto platform, managing your risk, and incorporating proven strategies, you can embark on a journey of crypto investment with confidence and a path toward achieving your financial goals.