As someone who has been fascinated by the world of cryptocurrency since its early days, I’m excited to share with you my personal journey in learning the best way to navigate the crypto trading landscape. The crypto market can seem daunting, especially for beginners, but with the right approach and a solid understanding of the fundamentals, you too can confidently join this exciting and potentially lucrative realm.

In this article, I’ll take you through the steps I’ve taken to become a successful crypto trader, from comprehending the basics of crypto trading to selecting the right exchange and developing a winning strategy. By the end of this guide, you’ll have a clear roadmap to kickstart your own crypto trading journey and pave the way towards financial independence.

The Best Way to Learn Crypto Trading: Grasping the Fundamentals

Unraveling the Crypto Trading Enigma

When I first started exploring the world of cryptocurrency trading, I was overwhelmed by the sheer complexity of the market. What exactly is cryptocurrency trading, and how does it differ from traditional investing? Essentially, crypto trading involves the buying and selling of digital currencies, such as Bitcoin and Ethereum, with the goal of profiting from the price movements of these assets.

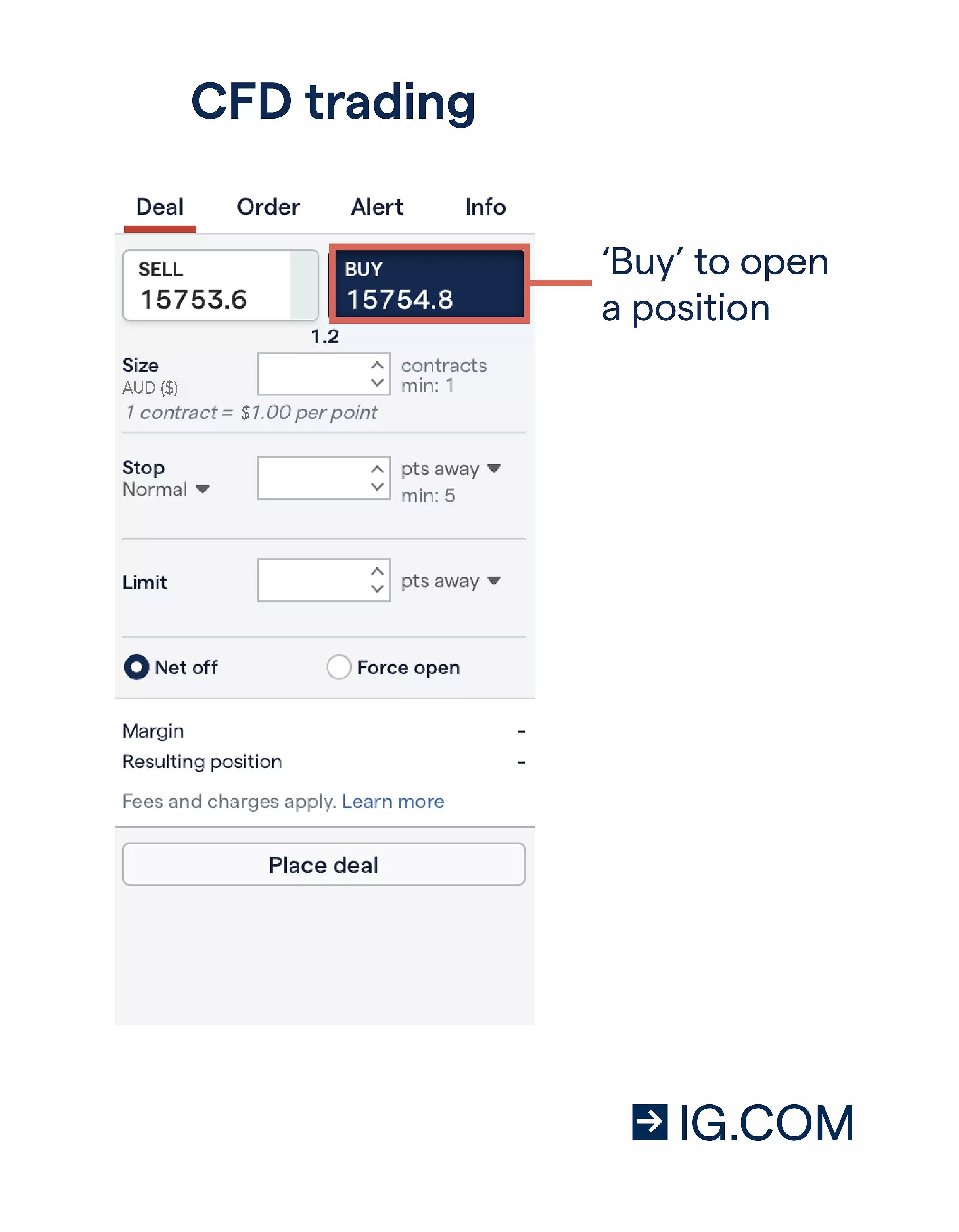

CFD trading deal ticket – going long

CFD trading deal ticket – going long

Unlike traditional investments, where you purchase the underlying asset, crypto trading is all about speculating on the price fluctuations of these digital currencies. You can potentially make money whether the market is rising or falling by going long (buying) or short (selling) on the cryptocurrencies of your choice.

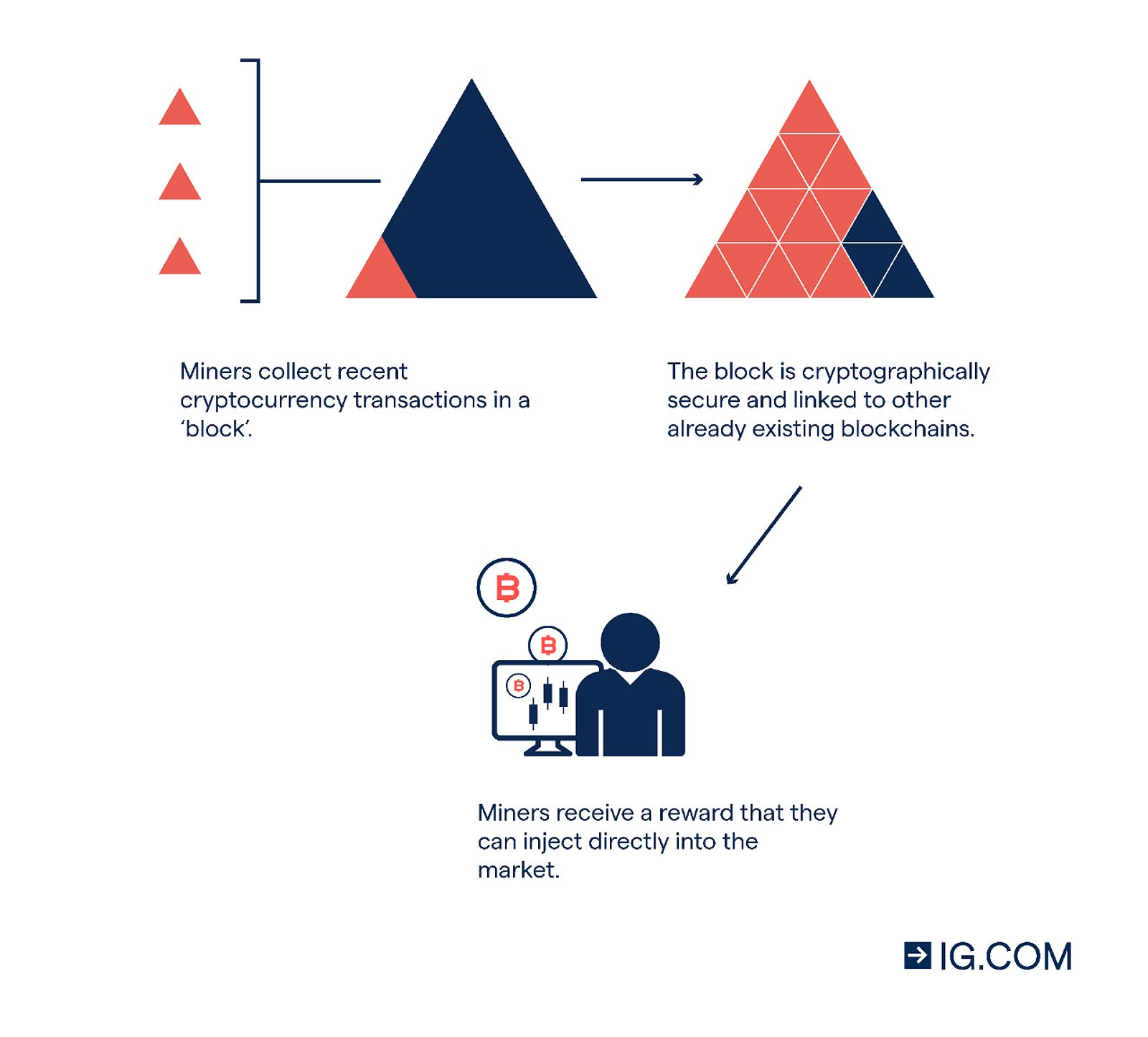

One of the unique aspects of the crypto market is its decentralized nature, where transactions are facilitated through a peer-to-peer network rather than a central authority. This structure can offer traders opportunities for diversification and potentially higher returns, but it also comes with increased volatility and risk.

Navigating the Crypto Trading Landscape

As I delved deeper into the world of crypto trading, I quickly realized that there are several different approaches one can take. From spot trading, where you directly purchase and sell cryptocurrencies, to margin trading, where you use borrowed funds to amplify your potential profits (and losses), each method comes with its own set of risks and benefits.

I also learned about the intricacies of futures trading, which allows you to buy or sell a specific cryptocurrency at a predetermined price and date in the future, and options trading, which provides the right, but not the obligation, to buy or sell a digital currency at a specific price within a certain time frame.

Understanding these various trading techniques and the factors that influence cryptocurrency prices, such as supply and demand, news and events, market capitalization, and adoption, has been crucial to my success in the crypto market.

Choosing the Right Cryptocurrency Exchange

One of the most important decisions I made in my crypto trading journey was selecting the right cryptocurrency exchange. With so many options available, it’s essential to carefully evaluate factors such as security, fees, trading volume, user interface, customer support, and the variety of cryptocurrencies offered.

I took the time to research and compare several reputable exchanges, including Coinbase, Binance, Kraken, and Gemini, before ultimately settling on the platform that best suited my needs. Security was a top priority for me, so I looked for exchanges with robust measures in place, such as two-factor authentication and secure storage of digital assets.

Image: Binance

Image: Binance

Additionally, I compared the trading fees, deposit fees, and withdrawal fees across different platforms to ensure I was getting the best value for my money. High trading volume was also a crucial factor, as it provided better liquidity and execution for my trades.

The user-friendly interface and responsive customer support of the exchange I chose have been invaluable in my learning process, as I’ve been able to navigate the platform with ease and receive prompt assistance whenever I’ve encountered any issues.

Mastering the Art of Placing Trades and Reading Charts

As I continued to expand my knowledge of crypto trading, I realized that understanding the different order types and how to read technical charts were essential skills to develop.

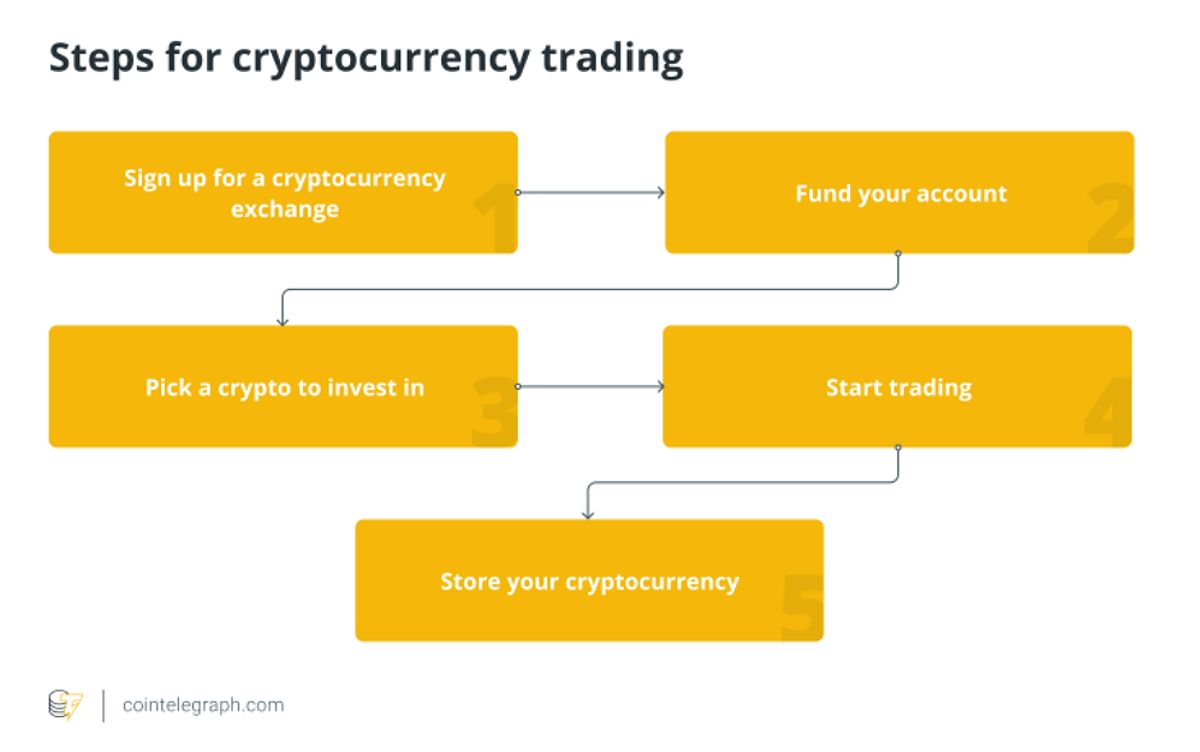

Steps for cryptocurrency trading

Steps for cryptocurrency trading

I spent a significant amount of time familiarizing myself with market orders, limit orders, stop-loss orders, and take-profit orders, and how to effectively use each one to manage my trades and mitigate risk. Recognizing the nuances of these order types has been instrumental in my ability to execute trades with precision and confidence.

Equally important has been my journey in mastering the art of reading technical charts. I’ve studied candlestick patterns, moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) indicator, among other technical analysis tools. By identifying these patterns and indicators, I’ve been able to gain valuable insights into market trends and potential trading opportunities.

To hone these skills, I initially opened a demo account on a cryptocurrency exchange, where I could practice placing trades and analyzing charts without risking my own capital. This hands-on experience has been invaluable in building my confidence and refining my trading strategies.

Developing a Winning Trading Plan and Managing Risk

Perhaps the most crucial aspect of my crypto trading journey has been the development of a well-structured trading plan and a disciplined approach to risk management.

I began by clearly defining my investment goals and risk tolerance level, which helped me select the cryptocurrencies and trading techniques that aligned with my overall objectives. Whether it was generating consistent returns or capitalizing on market volatility, having a clear sense of purpose has been essential in guiding my decision-making process.

Effective risk management has been a cornerstone of my trading strategy. I’ve learned to diversify my investments across multiple cryptocurrencies, use stop-loss orders to limit my potential losses, and carefully manage the size of my positions based on my risk tolerance. Maintaining emotional control and avoiding impulsive trading decisions based on fear or greed has also been crucial to my success.

As I’ve progressed in my crypto trading journey, I’ve also kept a detailed trading journal to track my performance and identify areas for improvement. This ongoing reflection and learning process has been instrumental in refining my strategies and enhancing my overall trading skills.

Navigating the Crypto Landscape in 2024

As I look ahead to the future of crypto trading in 2024, I’m excited about the continued evolution and growth of the market. The increasing adoption of digital currencies by both individuals and institutions, along with advancements in blockchain technology, are poised to drive further innovation and opportunities for savvy traders.

One area that I’ve been particularly intrigued by is the rise of decentralized finance (DeFi) applications, which are leveraging blockchain technology to create new financial products and services. As the DeFi ecosystem expands, I anticipate seeing more traders exploring the potential of these decentralized platforms for generating yield and diversifying their portfolios.

Additionally, the continued development of institutional-grade crypto trading platforms and the growing involvement of large financial players in the space are likely to bring increased liquidity, stability, and legitimacy to the market. This could open the doors for more mainstream adoption and potentially attract a new wave of investors seeking exposure to the crypto asset class.

As I navigate this evolving landscape, I remain committed to staying up-to-date on the latest trends, regulations, and technological advancements in the crypto world. By continuously learning and adapting my strategies, I believe I’ll be well-positioned to capitalize on the exciting opportunities that lie ahead in the years to come.

FQAs

What are the best resources for learning more about crypto trading?

In addition to the information provided in this article, I highly recommend checking out Coinbase’s educational resources, online courses on platforms like Udemy, and books like “The Crypto Trader” by Glen Goodman. These are all excellent starting points for further learning and skill development.

How much money do I need to start crypto trading?

There is no minimum amount required to start crypto trading, but I would advise beginning with a small investment and gradually increasing your capital as you gain experience and confidence. It’s important to only invest what you can afford to lose, as the crypto market can be highly volatile.

Is crypto trading legal?

The legal status of cryptocurrency trading can vary by jurisdiction, so it’s essential to research and understand the regulations in your specific region before engaging in any crypto trading activities. While crypto trading is generally legal in many countries, it’s always best to stay informed about the latest developments in your area.

How do I protect my crypto assets from theft?

Securing your crypto assets is of utmost importance. I recommend using a reputable cryptocurrency wallet, enabling two-factor authentication, and following best practices for online security, such as using strong passwords and being cautious of phishing attempts.

Conclusion

As I reflect on my personal journey in the world of crypto trading, I’m grateful for the knowledge and experience I’ve gained along the way. What once seemed like a daunting and complex landscape has transformed into an exciting and potentially lucrative realm that I’m proud to be a part of.

Through my exploration of the fundamentals, selection of the right exchange, mastery of trading techniques, and development of a winning strategy, I’ve been able to navigate the crypto market with confidence and achieve meaningful financial success.

If you’re a beginner looking to embark on your own crypto trading journey, I encourage you to take the time to understand the basics, choose a reputable exchange, and develop a well-structured trading plan. Remember, this is a marathon, not a sprint, so be patient, persistent, and always prioritize risk management.

The crypto market is filled with incredible potential, and I believe that with the right approach, you too can unlock the path to financial freedom and prosperity. Embrace the challenge, stay committed to continuous learning, and let your crypto trading journey begin.