Optimizing Cryptocurrency Trading: Mastering the Best Time Frame

As an avid cryptocurrency trader, I”ve been on a captivating journey of exploring the ever-evolving landscape of this dynamic market. One crucial factor that has consistently proven to be the key to unlocking my full profit potential is understanding the best time frame for crypto trading. Whether you”re a beginner seeking short-term gains or a seasoned trader building a long-term investment strategy, mastering the art of time frame selection can be the difference between success and frustration.

In this article, I’ll share my personal experiences and insights to help you navigate the time frame spectrum and identify the one that aligns perfectly with your unique trading style and goals. From the lightning-fast 1-minute charts to the more stable daily and weekly time frames, each option offers its own distinct advantages and challenges.

Embracing The Volatility Of Crypto Trading

Cryptocurrency trading is a realm defined by its ceaseless nature and constant fluctuations. As a beginner, I was naturally drawn to the allure of the smaller time frames, hoping to capitalize on the market’s rapid price movements. However, this proved to be a double-edged sword, as these shorter time frames were typically more volatile and prone to noise, making it challenging for me to develop a consistently profitable strategy.

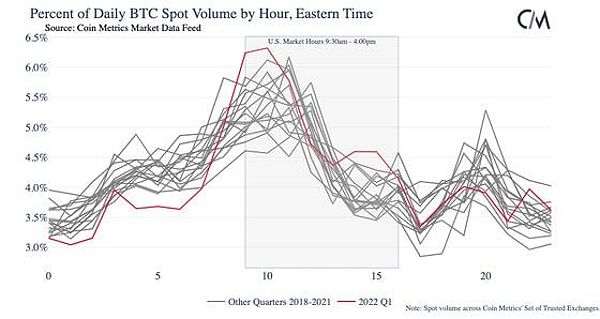

Bitcoin’s spot volume over three years

Bitcoin’s spot volume over three years

It wasn’t until I shifted my focus to the daily and weekly time frames that I truly began to understand the underlying factors driving the cryptocurrency markets. By mastering these longer-term charts, I gained a deeper understanding of the market’s overall trends and momentum, allowing me to make more informed decisions and minimize the impact of short-term volatility.

Aligning Time Frames With Your Trading Style And The Best Time Frame For Crypto Trading

One of the key lessons I’ve learned on my crypto trading journey is the importance of selecting the optimal time frame that aligns with your risk tolerance, trading goals, and available capital. As a beginner, I found that the daily time frame provided the perfect balance between noise reduction and valuable insights into the market’s behavior.

Focusing on the daily time frame allowed me to identify broader trends, support and resistance levels, and develop a solid foundation for my trading strategy. By honing my skills on this time frame, I built the confidence and expertise needed to tackle more complex, shorter-term time frames as my experience and account size grew.

Daily Charts for crypto trading

Daily Charts for crypto trading

As I progressed, I explored intermediate time frames such as the 4-hour and 1-hour charts. These offered a more granular view of the market’s movements, enabling me to capitalize on shorter-term swings and momentum-driven opportunities. However, I quickly learned that smaller time frames also come with increased volatility and noise, which can be more challenging to navigate, especially for those new to the crypto trading landscape.

Navigating The Rhythms Of The Crypto Markets

Regardless of the time frame I choose, I’ve found it crucial to be aware of the market’s typical trading patterns and volatility fluctuations. Cryptocurrency trading activity often aligns with the traditional market hours in the U.S., with the morning and late afternoon sessions typically displaying the highest levels of volatility and trading volume.

By understanding these peak activity periods, I’ve been able to strategically plan my trading sessions to maximize my chances of success. Focusing my efforts during the most volatile and liquid market hours has increased my odds of capturing profitable trends and minimizing the impact of market manipulation or thin trading conditions.

Best Trading Times and Volatile Sessions for Crypto Day Traders

Best Trading Times and Volatile Sessions for Crypto Day Traders

Mastering The Art Of Time Frame Selection

As I continue on my crypto trading journey, I’ve come to realize that the key to success lies in finding the right balance between time frame, risk, and trading style. Here are some tips that have proven invaluable to me:

- Start with Daily Charts: For beginners, the daily time frame is an excellent starting point, as it provides a solid foundation for understanding market trends and developing a profitable trading strategy.

- Experiment with Intermediate Time Frames: As your skills and account size grow, consider exploring the 4-hour or 1-hour charts. These intermediate time frames can offer more granular insights and opportunities, but be mindful of the increased volatility and noise.

- Manage Risk Effectively: Regardless of the time frame you choose, ensure that your position sizes and risk-per-trade are aligned with your overall trading plan and account size. Overexposure can quickly lead to significant losses.

- Develop a Consistent Routine: Establish a routine for monitoring your chosen time frame and executing trades. Consistency and discipline are key to building a successful trading strategy.

- Stay Adaptable: The cryptocurrency market is constantly evolving, so be prepared to adjust your time frame selection and trading approach as market conditions change.

Frequently Asked Questions

Q: What is the best time frame for beginners in crypto trading? A: For beginners, the daily time frame is generally considered the most suitable starting point. Daily charts provide a good balance between noise reduction and valuable insights into the market’s overall trends, allowing you to develop a solid understanding of the market’s behavior.

Q: How often should I check my charts when trading on different time frames? A: The frequency of chart monitoring will depend on the time frame you’re trading. For smaller time frames, such as 1-minute or 5-minute charts, you’ll need to check your charts more frequently to identify potential trading opportunities. Conversely, when trading on daily or weekly charts, you may only need to check your charts once or twice a day.

Q: What are some common mistakes beginners make when choosing a time frame? A: Some common mistakes include choosing a time frame that is too short for their trading style and risk tolerance, as well as not considering the market’s overall volatility and liquidity. Beginners may also struggle to find the right balance between noise and valuable information when selecting a time frame.

Conclusion

As I look back on my crypto trading journey, I’m amazed at how much I’ve learned about the importance of time frame selection. Unlocking the optimal time frame for your success is not just a crucial step, but a transformative experience that can propel you towards consistent profitability in the ever-evolving cryptocurrency markets.

Remember, the path to mastering time frame selection is not a one-size-fits-all approach. It requires experimentation, adaptability, and a deep understanding of your own risk tolerance and trading preferences. Embrace the process, stay disciplined, and let your trading prowess shine as you navigate the rhythms of the crypto world.