As an experienced stock trader making the transition to the dynamic world of crypto, I know firsthand the power of a well-crafted trading journal. However, the unique challenges of the crypto market require a specialized approach. That’s why I’ve spent countless hours researching and testing the best crypto trading journals to help you maximize your gains and refine your strategies in 2024.

Why a Crypto-Focused Trading Journal is Essential

Crypto markets operate quite differently from traditional stock exchanges. The 24/7 trading, extreme volatility, and distinctive trading dynamics demand a more comprehensive record-keeping and analysis system. A dedicated crypto trading journal can provide the insights you need to identify winning strategies, manage risk, and avoid the emotional pitfalls that can derail your portfolio.

By tracking crypto-specific performance metrics, such as trading fees and slippage, you’ll gain invaluable data-driven perspectives on your trading habits and patterns. This deep-dive approach will empower you to make more informed decisions, continuously optimize your strategies, and ultimately, thrive in the ever-evolving crypto landscape.

Indispensable Features of a Robust Crypto Trading Journal

To truly serve the needs of experienced traders like yourself, a crypto trading journal must offer a comprehensive suite of features tailored to the unique dynamics of the crypto market. Let’s explore the key elements you should look for:

Seamless Trade Tracking and Logging

The foundation of any effective crypto trading journal is its ability to effortlessly track and log your trades. Look for platforms that provide:

- Multi-exchange Integration: The capacity to sync with a wide range of popular crypto exchanges, ensuring your entire trading activity is captured in one centralized location.

- Automated Trade Import: Seamless API integrations that allow you to automatically import your trade data, eliminating the need for manual data entry.

- Detailed Trade Details: Comprehensive tracking of critical information, such as entry/exit prices, trade quantities, fees, and other crucial data points for in-depth analysis.

- Customizable Trade Categorization: The flexibility to tag your trades and add personalized notes for future reference and insights.

Robust Performance Analysis

Dive deep into your trading performance with advanced analytics and reporting features, including:

- Profit/Loss Tracking: Detailed monitoring of your gains and losses, both in fiat and cryptocurrency, for a clear understanding of your overall profitability.

- Return on Investment (ROI) Calculations: Sophisticated metrics to measure the effectiveness of your trading strategies.

- Risk Management Insights: Valuable data points on your win/loss ratio, drawdown, and other key risk-related indicators.

- Visually Compelling Reporting: The ability to generate insightful reports and charts that help you identify trends and patterns in your trading activities.

Powerful Strategy Optimization Tools

Take your trading to new heights with features that enable you to refine and optimize your strategies:

- Backtesting Capabilities: The power to test your trading strategies against historical market data, allowing you to evaluate their performance and make data-driven adjustments.

- Advanced Analytics: Sophisticated algorithms that uncover hidden patterns, correlations, and insights to help you identify your most successful approaches.

- Technical Analysis Integration: Seamless integration of technical indicators and charting tools to supplement your strategy development and decision-making.

- Multivariate Strategy Comparison: The opportunity to track and compare the performance of multiple trading strategies simultaneously, empowering you to make informed decisions.

Additional Noteworthy Features

Look for platforms that offer additional functionality to enhance your overall crypto trading experience:

- Portfolio Management: Comprehensive tools to track your cryptocurrency holdings, market values, and overall portfolio performance.

- Alert Notifications: Receive timely notifications for price movements, trading opportunities, or other events that may impact your trading decisions.

- Community Features: The ability to share your trades, insights, and strategies with a community of fellow traders, fostering collaboration and learning.

Exploring the Best Crypto Trading Journals for Experienced Traders

Now that you understand the key features to look for, let’s dive into some of the top crypto trading journal platforms that cater to the needs of seasoned traders like yourself:

Tradiry

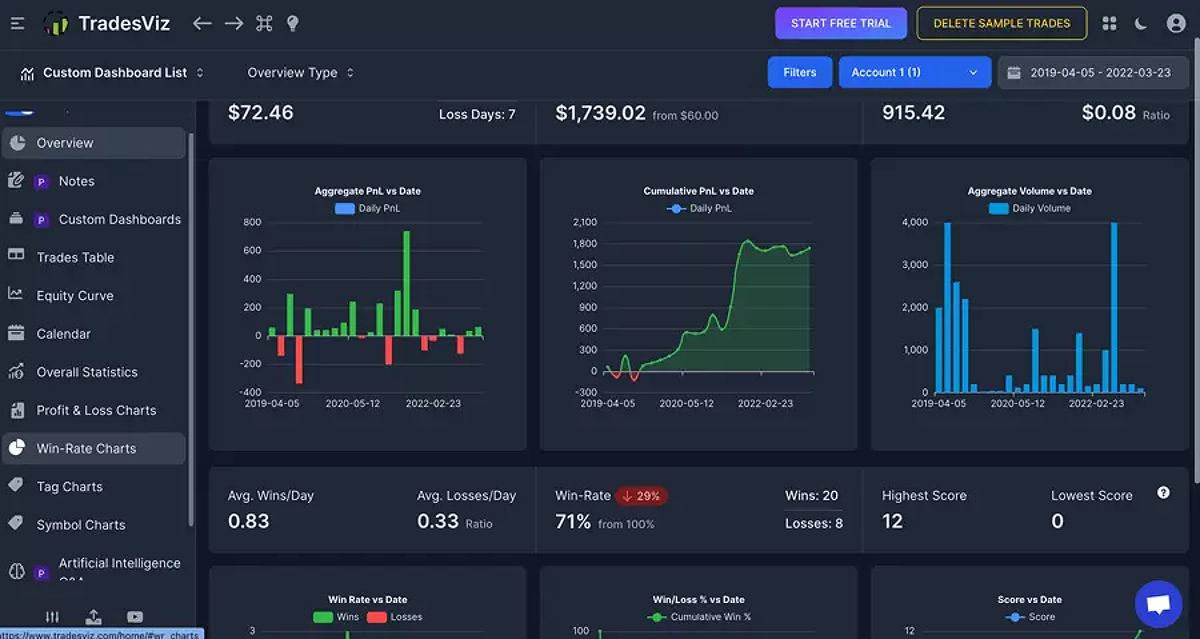

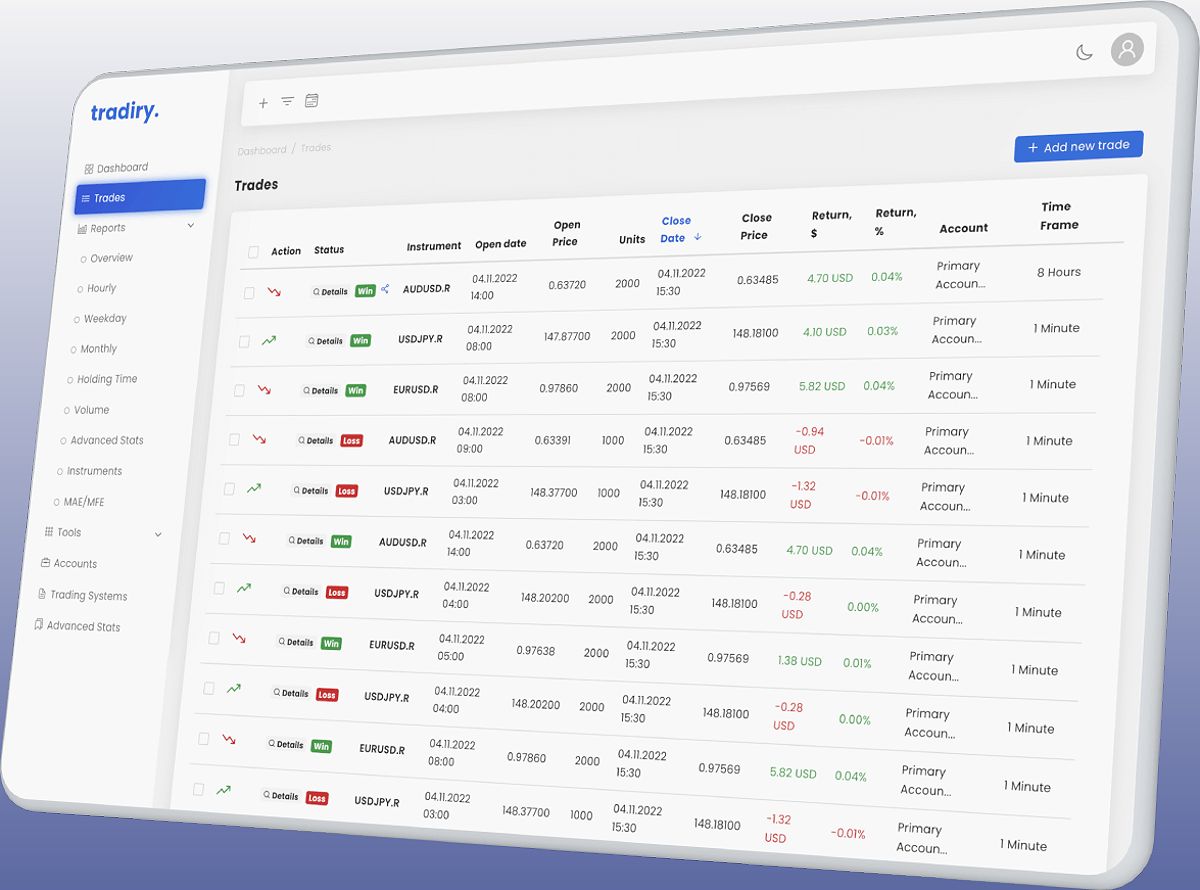

Tradiry stands out as a comprehensive crypto trading journal solution that truly understands the requirements of experienced traders. Its advanced analytics, multi-exchange support, and powerful backtesting tools make it an excellent choice for optimizing your trading strategies. While it may come with a slightly higher price tag compared to some alternatives, Tradiry’s feature-rich platform and intuitive user experience have earned it a loyal following among crypto traders.

CoinTracking

CoinTracking is a popular choice among crypto traders, offering a user-friendly interface and a comprehensive suite of portfolio tracking features. Its strength lies in its advanced tax reporting capabilities, making it a valuable tool for managing your crypto investments from a tax planning perspective. While its backtesting functionality may not be as robust as some competitors, CoinTracking remains a reliable choice for those seeking a well-rounded crypto trading journal solution.

Cryptohopper

For traders seeking automation and technical analysis tools, Cryptohopper could be a compelling option. Its ability to create and deploy trading bots, combined with its advanced charting and indicator features, makes it a powerful platform for refining and executing your trading strategies. However, the learning curve may be steeper than some other alternatives, and the subscription-based model with varying tiers requires careful consideration.

Cointracking

If you’re on a tighter budget or just starting your crypto trading journey, Cointracking’s free tier could be a great entry point. While it may lack some of the more advanced analytics and features found in premium platforms, Cointracking still provides a solid foundation for tracking your trades and analyzing your portfolio performance. As your trading expertise grows, you can explore upgrading to their paid plans for additional functionality.

TradingView

Although not a dedicated crypto trading journal, TradingView is a widely used platform that offers extensive charting and technical analysis tools. While it requires manual trade logging, you can leverage TradingView’s powerful features to supplement your crypto trading journal, providing a more comprehensive view of your trading activities and market insights.

Choosing the Right Crypto Trading Journal for You

When selecting the best crypto trading journal for your needs, I recommend considering the following factors:

Trading Style: Evaluate whether you’re primarily a day trader or a long-term investor, as this will influence the features and functionality you require in a trading journal.

Exchange Usage: Determine the number of crypto exchanges you utilize, as platforms with broader multi-exchange support may better suit your needs.

Automation vs. Manual Logging: Assess your preference for automated trade import versus the flexibility of manual trade logging, and choose a platform that aligns with your workflow.

Budget: Weigh the cost of premium features against your trading volume and the value they provide, balancing your budget with the functionality you need.

Technical Expertise: Consider your comfort level with advanced analytics, backtesting, and other technical features, as this will impact the ease of use and learning curve for different platforms.

Community Engagement: Decide how much importance you place on sharing trades, insights, and collaborating with other traders, as some platforms offer dedicated community features.

By carefully evaluating these factors, you can select the crypto trading journal that best fits your trading style, budget, and long-term goals, empowering you to maximize your gains and refine your strategies in the dynamic crypto landscape.

FAQ

Q: Can I use a traditional trading journal for crypto? A: While it’s possible, a dedicated crypto trading journal offers features specifically designed for the unique aspects of crypto markets, such as 24/7 trading, high volatility, and crypto-specific performance metrics. These specialized tools can provide more valuable insights to help you navigate the crypto landscape effectively.

Q: How often should I update my crypto trading journal? A: Aim to log every trade and update your journal regularly, ideally after each trading session. This ensures you capture all relevant details and can conduct thorough post-trade analysis to refine your strategies.

Q: What are some common mistakes to avoid when using a crypto trading journal? A: Some common mistakes include neglecting to update your journal, skipping important details, and relying solely on automated features without manual review. Ensure you maintain a consistent habit of logging your trades and regularly analyzing the data to derive meaningful insights.

Conclusion

As an experienced trader, I know the importance of having the right tools and resources to maximize your gains in the dynamic crypto market. By exploring the best crypto trading journals for 2024, you can find the platform that aligns with your trading style, budget, and technical expertise, empowering you to make data-driven decisions and achieve lasting success.

Whether you’re a seasoned trader or just starting your crypto journey, investing in a comprehensive crypto trading journal can be a game-changer. By leveraging advanced analytics, backtesting capabilities, and powerful portfolio management tools, you’ll gain the insights necessary to refine your strategies, manage your risk, and ultimately, thrive in the ever-evolving crypto landscape.

So, take the time to carefully evaluate the options presented in this article, and choose the crypto trading journal that will elevate your trading game and propel you towards your financial goals. Remember, the key to long-term success in crypto trading lies in disciplined record-keeping, data-driven analysis, and a relentless pursuit of continuous improvement. Embrace the power of a specialized crypto trading journal, and watch your gains soar to new heights.